Market Definition

Solar energy is a renewable, clean, and sustainable source of energy that powers homes, industries, and devices while reducing greenhouse gas emissions. The market encompasses the development, manufacturing, installation, and maintenance of solar panels, inverters, and energy storage systems.

Solar Energy Market Overview

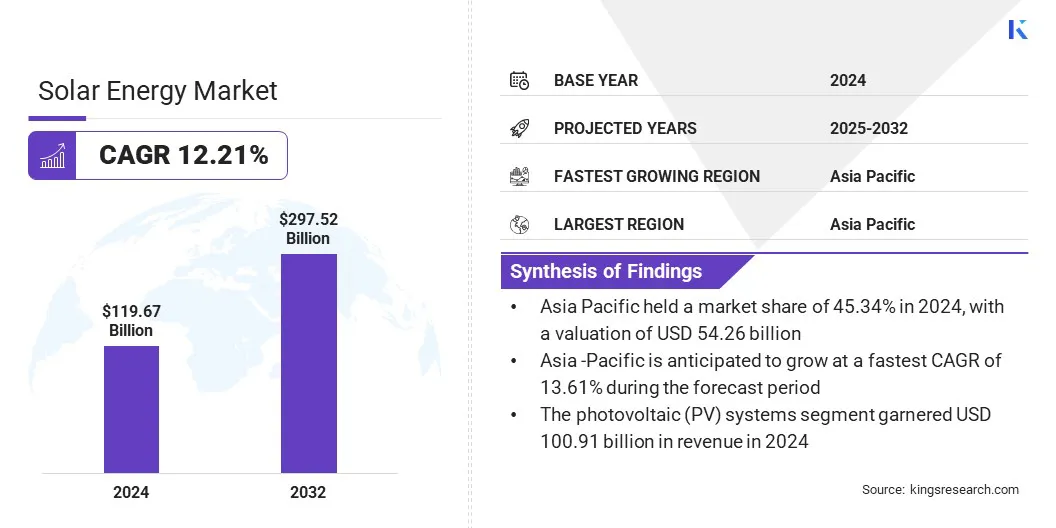

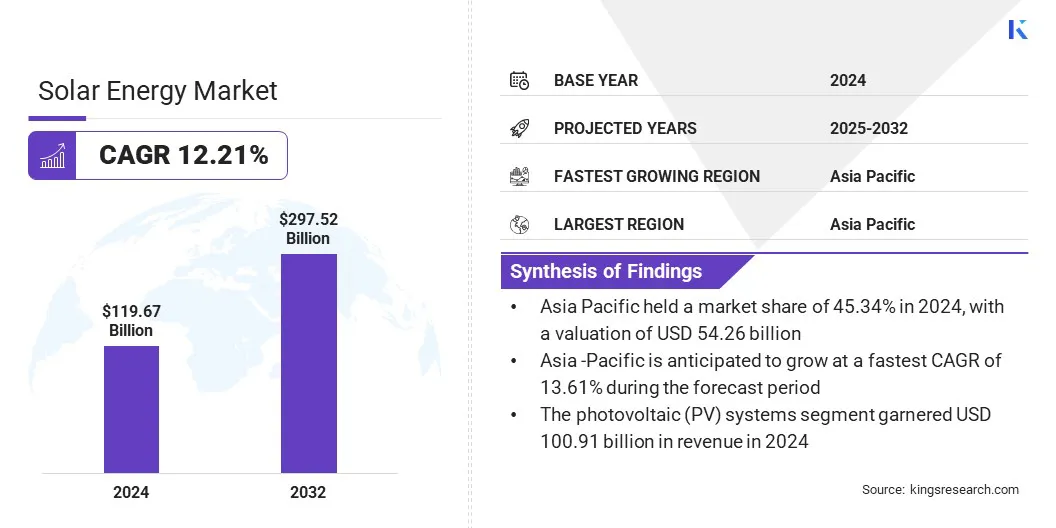

The global solar energy market size was valued at USD 119.67 billion in 2024 and is projected to grow from USD 132.86 billion in 2025 to USD 297.52 billion by 2032, exhibiting a CAGR of 12.21% over the forecast period.

This growth is attributed to the rising demand for clean and sustainable energy to reduce dependence on fossil fuels and lower greenhouse gas emissions. The expansion of government policies, incentives, and subsidies for solar adoption, along with growing corporate and residential efforts toward renewable energy adoption is driving market growth.

Key Highlights:

- The solar energy industry size was valued at USD 119.67 billion in 2024.

- The market is projected to grow at a CAGR of 12.21% from 2025 to 2032.

- Asia Pacific held a share of 45.34% in 2024, valued at USD 54.26 billion.

- The photovoltaic (PV) systems segment garnered USD 100.91 billion in revenue in 2024.

- The electricity generation segment is expected to reach USD 217.47 billion by 2032.

- The commercial & industrial segment is anticipated to witness the fastest CAGR of 14.14% over the forecast period.

- North America is anticipated to grow at a CAGR of 13.09% over the forecast period.

Major companies operating in the solar energy market are JinkoSolar Holding Co., Ltd, Canadian Solar Inc, LONGi Green Energy Technology Co., Ltd, Adani Group, Tata Power Company Limited, Waaree Energies Ltd, Trina Solar Co., Ltd, JA Solar Technology Co., Ltd, RenewSys Pvt Ltd, Sunrun Inc, Qcells, Goldi Solar Pvt. Ltd, NextEra Energy, Inc, Emmvee Group, and Azure Power.

The rapid urbanization is driving demand for reliable, sustainable, and decentralized power solutions to meet rising electricity needs and reduce dependence on conventional energy sources. Additionally, increasing global electricity demand is expanding the need for scalable renewable solutions such as solar energy to meet the surging electricity demand.

- The International Energy Agency (IEA) reported that global electricity demand increased by 4.3% in 2024, compared to the 2.5% growth recorded in 2023. The electricity consumption in buildings rose by more than 600 TWh (5%) in 2024, which accounted for nearly 60% of the total growth in global electricity use.

Market Driver

Energy Security and Independence

A key factor propelling the growth of the solar energy market is the rising need for energy security and independence that enables nations and businesses to maintain stable energy supplies. Increasing reliance on imported fossil fuels exposes countries and enterprises to price volatility, supply chain disruptions, and geopolitical risks.

Governments and businesses are investing in solar energy to harness abundant, locally available, and sustainable power for reducing dependence on imported fossil fuels. This energy resilience is supporting governments in achieving long-term stability and enabling businesses to maintain sustainable operations.

- In March 2025, the Solar Energy Industries Association (SEIA) reported that the US solar industry installed nearly 50 gigawatts of direct current (GWdc) capacity, a 21% increase from 2023.

Market Challenge

High Initial Capital Investment

A key challenge impeding the growth of the solar energy market is the high initial capital investment required for solar energy project development. Solar installations involve substantial upfront costs for purchasing photovoltaic panels, inverters, mounting structures, land acquisition, and grid connection infrastructure.

Additionally, ongoing expenses for operations and maintenance create barriers for small and medium-sized enterprises to adopt solar energy projects. These cost challenges slow project deployment and limit widespread adoption of solar energy projects.

To address this challenge, market players are increasingly adopting innovative financing models, including power purchase agreements (PPAs) and lease arrangements, to lower upfront costs for end-users. Governments and financial institutions are providing subsidies and tax incentives to support solar adoption.

Additionally, market players are focusing on scalable project designs and cost-efficient procurement to optimize capital expenditure and accelerate the deployment of solar energy solutions across the residential, commercial, and utility-scale sectors.

Market Trend

Technological Advancements in PV Efficiency

A key trend influencing the solar energy market is the ongoing advancement in photovoltaic (PV) efficiency. Manufacturers are developing high-performance solar cells and modules, including tandem cells and back-contact designs, to capture more sunlight and convert it into electricity more effectively.

This is enhancing energy output, reducing losses, and improving system reliability. Increasing focus of key players on energy efficiency is enabling cost-effective solar power generation and supporting large-scale deployments of solar energy solutions.

- In June 2025, LONGi introduced large-area crystalline silicon-perovskite tandem cells and back-contact solar modules, achieving record efficiencies of 33% and over 26%, respectively. These innovations improve sunlight-to-electricity conversion by optimizing cell architecture and reducing energy losses.

Solar Energy Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Photovoltaic (PV) Systems (Monocrystalline Silicon, Polycrystalline Silicon, Thin Film), Concentrated Solar Power (CSP) (Parabolic Trough, Solar Tower, Linear Fresnel, Dish Stirling)

|

|

By Application

|

Electricity Generation, Heating & Cooling, Others

|

|

By End-User

|

Residential, Commercial & Industrial, Utility-Scale

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Photovoltaic (PV) Systems, and Concentrated Solar Power (CSP)): The photovoltaic (PV) systems segment earned USD 100.91 billion in 2024 due to declining module costs, increased efficiency, and widespread adoption across residential, commercial, and utility-scale projects.

- By Application (Electricity Generation, Heating & Cooling, and Others): The electricity generation segment held 73.21% of the market in 2024, supported by rising demand for clean and reliable power, government incentives, and the expansion of large-scale solar farms.

- By End-User (Residential, Commercial & Industrial, and Utility-Scale): The residential segment is projected to reach USD 159.51 billion by 2032, owing to growing rooftop solar installations, favorable net-metering policies, and increasing consumer awareness of renewable energy benefits.

Solar Energy Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific solar energy market share stood at 45.34% in 2024 in the global market, valued at USD 54.26 billion. This dominance is driven by the rapid growth in electricity consumption and industrialization across the region.

Expanding investments by governments and regional players in solar energy generation are enabling large-scale and cost-effective power production. Government policies promoting renewable energy adoption, decarbonization, along with subsidies and tax incentives, are further accelerating market expansion.

Moreover, technological advancements such as high-efficiency bifacial and smart inverters by regional market players are improving the efficiency and scalability of solar power systems. Additionally, regional players are implementing large-scale solar power projects and acquiring solar portfolios to expand generation capacity and improve grid reliability, thereby supporting market expansion.

- In July 2024, Levanta Renewables acquired a 90% stake from Super Energy in a 139.4 MWp operating solar portfolio in Thailand. The acquisition enables Levanta’s entry into the Thai market and adds 24 solar farms under long-term Power Purchase Agreements (PPAs) with the Provincial Electricity Authority of Thailand.

North America is set to grow at a CAGR of 13.09% over the forecast period. This growth is propelled by increasing government policies, incentives, and subsidies that encourage the adoption of solar energy across residential, commercial, and industrial sectors.

Rising electricity demand and corporate efforts toward sustainability are driving market adoption of solar energy projects. Additionally, commercial solar project development by key players is enhancing regional capacity and accelerating the deployment of solar energy projects across the region.

- In January 2025, ContourGlobal acquired a 446 MWp solar PV portfolio from Qcells in Colorado and Virginia. The acquisition expands ContourGlobal’s U.S. renewable capacity to nearly 1.5 GW and enhances regional diversification while accelerating commercial operations.

Regulatory Frameworks

- In the U.S., the Federal Energy Regulatory Commission (FERC) regulates and oversees the market. It sets grid reliability standards, approves utility-scale solar interconnections and monitors market operations. It also ensures compliance with federal energy policies to support efficient and sustainable solar deployment.

- In China, the National Energy Administration (NEA) regulates solar energy development, project approvals, grid connections, and incentive distribution. It monitors industry standards, technology adoption, and market compliance to ensure sustainable growth and alignment with national renewable energy targets.

- In India, the Ministry of New and Renewable Energy (MNRE) governs solar project approvals, grid integration, incentive schemes, and renewable energy certificates. It monitors compliance with quality standards and facilitates large-scale deployment of utility, commercial, and rooftop solar projects.

Competitive Landscape

Companies operating in the solar energy industry are actively strengthening their competitive position through technological innovation and strategic acquisitions. They are investing in advanced photovoltaic (PV) modules, energy storage systems, and smart inverters to improve efficiency, reduce costs, and accelerate project deployment.

Additionally, market players are acquiring solar projects to enhance integrated energy offerings, secure long-term power purchase agreements, and expand their presence.

- In June 2025, TotalEnergies acquired a pipeline of eight solar projects totaling 350 MW and 2 battery storage projects totaling 85 MW from Low Carbon in the UK. This acquisition strengthens TotalEnergies’ integrated electricity portfolio in the UK.

Key Companies in Solar Energy Market:

- JinkoSolar Holding Co., Ltd

- Canadian Solar Inc

- LONGi Green Energy Technology Co., Ltd

- Adani Group

- Tata Power Company Limited

- Waaree Energies Ltd

- Trina Solar Co., Ltd

- JA Solar Technology Co., Ltd

- RenewSys Pvt Ltd

- Sunrun Inc

- Qcells

- Goldi Solar Pvt. Ltd

- NextEra Energy, Inc

- Emmvee Group

- Azure Power

Recent Developments

- In June 2025, Tata Power Renewable Energy Limited (TPREL) introduced solar solutions in Odisha, India under its ‘Ghar Ghar Solar’ campaign. It focuses on residential rooftop solar installations across the state.

- In September 2025, Nextracker acquired Origami Solar, Inc. for approximately USD 53 million to expand into the solar panel frame sector with roll-formed steel technology. The steel frames provide enhanced durability, lower carbon footprint, and compatibility.

- In April 2024, CESC Ltd acquired 100% stake in Bhadla Three SKP Green Ventures for approximately USD 460,800. The acquisition strengthens CESC’s renewable energy portfolio and adds a 300 MW solar project in Rajasthan, India.