Market Definition

The market involves the production and utilization of chromium(III) oxide, an inorganic compound valued for its exceptional hardness, thermal stability, and resistance to corrosion. It is widely used as a pigment and functional material across multiple industrial sectors due to its durability and long-lasting color performance.

The report includes segmentation based on type, application, and region. Key end-use industries such as automotive, construction, electronics, and chemicals depend on chromium oxide to enhance surface protection, improve material strength, and deliver superior structural and visual finishes.

Chromium Oxide Market Overview

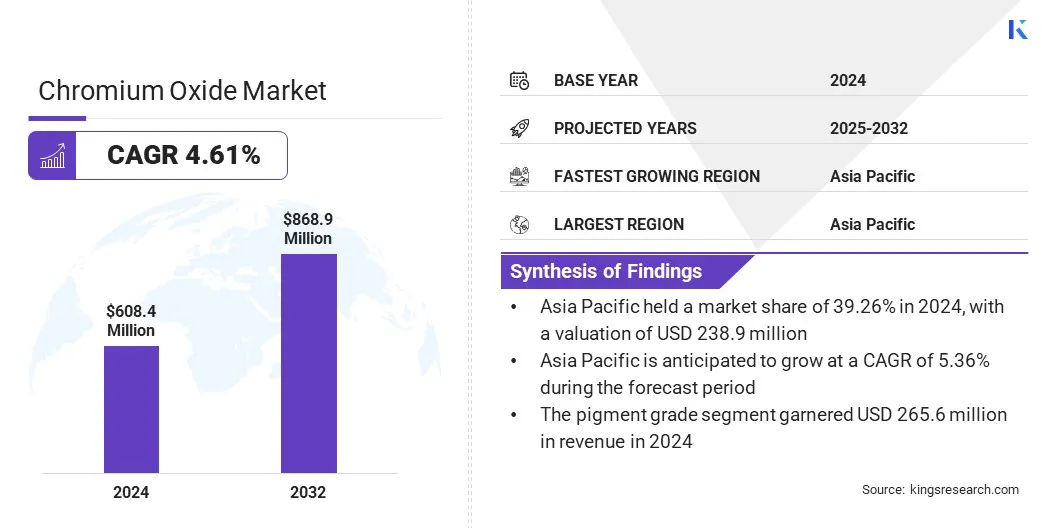

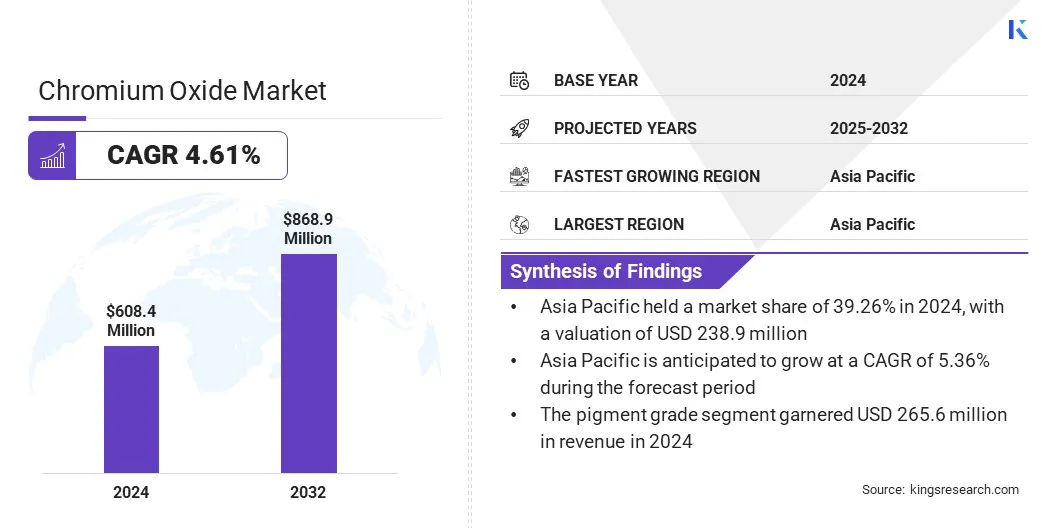

According to Kings Research, the global chromium oxide market size was valued at USD 608.40 million in 2024 and is projected to grow from USD 633.74 million in 2025 to USD 868.93 million by 2032, exhibiting a CAGR of 4.61% over the forecast period. The market is driven by expanding construction and infrastructure activities, which increase demand for durable coatings, tiles, and ceramics.

Additionally, the development of nano-grade particles enhances material performance, offering higher hardness, improved wear resistance, and better dispersion, supporting applications in electronics, coatings, and advanced industrial sectors.

Key Market Highlights:

- The chromium oxide industry size was valued at USD 608.40 million in 2024.

- The market is projected to grow at a CAGR of 4.61% from 2025 to 2032.

- Asia Pacific held a market share of 39.26% in 2024, with a valuation of USD 238.86 million.

- The pigment grade segment garnered USD 265.57 million in revenue in 2024.

- The paints & coatings segment is expected to reach USD 349.54 million by 2032.

- North America is anticipated to grow at a CAGR of 4.34% over the forecast period.

Major companies operating in the chromium oxide market are LANXESS AG, Shanghai Greenearth Chemicals Co., Ltd., Nanorh Materials Co., Ltd., Kurt J. Lesker Company, TNJ Chemical, SONUCHEM, Changzhou Konada New Materials Technology Co., Ltd., HI‑TECH MATERIALS Corp., Ereztech, MidUral Group, Venator Materials plc, Vishnu Chemicals, Hebei Chromate Chemical Co., Ltd., Nippon Chemical Industrial Co., Ltd., and Hunter Chemical LLC.

Rising demand from the coatings and pigments industry is driving the growth of the chromium oxide market. The compound’s superior thermal stability, opacity, and corrosion resistance make it ideal for producing durable pigments used in paints, ceramics, and protective coatings.

Growing infrastructure development and industrial activities are increasing the need for coatings that can withstand extreme environmental and mechanical stress.

- In August 2025, TRUNNANO launched its High-Purity Chromium Oxide Powder (Cr₂O₃), engineered for applications in aerospace, coatings, ceramics, and energy storage. The product boasts over 99.9% purity and is designed to deliver superior thermal stability, corrosion resistance, and catalytic performance.

In construction and automotive sectors, manufacturers are using chromium oxide pigments to improve both surface protection and color retention in harsh operating conditions. The expanding use of ceramic coatings in aerospace and heavy machinery applications is further creating consistent demand for high-performance pigments.

What drives growth in the chromium oxide market?

Expanding construction and infrastructure activities are driving the growth of the market. The material’s durability, color stability, and resistance to heat and chemicals make it valuable in architectural coatings, flooring tiles, and decorative concrete. Rapid urbanization in emerging economies is increasing demand for aesthetically appealing and long-lasting building materials.

- In January 2024, the Connecticut Housing Finance Authority (CHFA) specified the use of natural and synthetic iron oxide and chromium oxide pigments in masonry mortars for multifamily construction projects.

Construction companies are using chromium oxide pigments in paints, façade coatings, and roofing materials to ensure weather resistance and color retention. Growth in commercial and residential projects is also contributing to higher consumption of ceramic tiles and pavers containing chromium oxide for their wear resistance and visual appeal.

What impact do chromite ore and energy price fluctuations have on the market?

A key challenge in the market is the fluctuation in the prices of chromite ore and energy inputs, which significantly impacts production economics.

The dependency on mining operations and energy-intensive manufacturing processes exposes producers to frequent cost variations. Price instability disrupts procurement planning and reduces profitability, particularly for smaller manufacturers with limited cost flexibility.

To address this challenge, market players are engaging in long-term supply contracts, adopting energy-efficient production methods, and exploring alternative raw material sources. These measures are improving cost stability and ensuring a consistent supply in the chromium oxide market.

- In August 2024, LANXESS announced the production of chromium oxide pigments at its Krefeld-Uerdingen site. The expansion aims to strengthen its position in the global pigments sector by meeting the rising demand from the coatings, construction, and plastics industries.

What trends are shaping the chromium oxide market?

A key trend in the chromium oxide market is the development of nano-structured Cr₂O₃ to enhance material performance. Nano-grade particles are providing higher hardness and improved wear resistance compared to conventional powders. Enhanced catalytic efficiency is enabling more effective chemical reactions in industrial applications.

Improved dispersion properties support uniform coatings and advanced electronic formulations. Manufacturers are leveraging these characteristics to expand the use of chromium oxide in high-performance coatings, electronics, and specialty ceramics.

- In 2024, researchers at the University of Nebraska-Lincoln discovered that chromium oxide, when doped with boron, exhibits antiferromagnetic properties. This material could pave the way for digital memory and processors that consume less power and operate faster than current technologies. The study highlights the potential of chromium oxide in advanced electronic applications.

Chromium Oxide Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Pigment Grade, Metallurgical Grade, Refractory Grade, Chemical Grade

|

|

By Application

|

Paints & Coatings, Ceramic, Metallurgy, Rubber, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Pigment Grade, Metallurgical Grade, Refractory Grade, and Chemical Grade): The Pigment Grade segment earned USD 265.57 million in 2024 due to its extensive use in coatings, paints, ceramics, and plastics.

- By Application (Paints & Coatings, Ceramic, Metallurgy, Rubber, and Others): The Paints & Coatings segment held 38.25% of the market in 2024, due to its wide application in industrial and architectural coatings, offering superior corrosion resistance, long-lasting color, and enhanced durability.

Chromium Oxide Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific chromium oxide market share stood around 39.26% in 2024 in the global market, with a valuation of USD 238.86 million, due to extensive construction and infrastructure development in the region. Urban areas are experiencing significant expansion, leading to higher consumption of decorative and functional coatings containing chromium oxide.

It is widely used in tiles, ceramics, and exterior paints for its long-lasting color and stability. Governments’ investments in commercial and residential projects further drive material requirements. Commercial real estate (CRE) investment in the Asia Pacific region increased by 23% year-on-year in 2024, reaching USD 131.3 billion.

Moreover, the India Brand Equity Foundation reported that institutional investments in Indian real estate have amounted to USD 19 billion since FY21, with 40% allocated to office properties.

In the first three quarters of FY24, investment volumes reached USD 4.7 billion, representing 87% of the total inflows in FY23. The ongoing modernization of roads, bridges, and public buildings further increases the demand for durable coatings, thereby driving market growth.

The chromium oxide industry in North America is poised for a significant CAGR of 4.34% over the forecast period. This growth is due to the increasing application of chromium oxide in electronics and semiconductor manufacturing.

The strong focus of North American industries on high-performance computing, advanced displays, and semiconductor fabrication drives demand for materials that are thermally stable and highly durable. In June 2025, Texas Instruments announced that the company aims to invest more than USD 60 billion across seven U.S. semiconductor fabs.

Rising investments in semiconductor fabs and the expansion of tech hubs increase the consumption of this material. Manufacturers in the region prioritize precise and uniform production standards, which further elevates the need for high-quality chromium oxide.

- In December 2024, the U.S. Commerce Department awarded over USD 6 billion in CHIPS Act funding to Samsung and Texas Instruments to strengthen domestic semiconductor manufacturing. Samsung received USD 4.75 billion to support its USD 37 billion investment in Texas for two new leading-edge logic fabs and an expansion of its Austin facility. Texas Instruments secured USD 1.61 billion toward its USD 18 billion plan to build two wafer fabs in Texas and a third in Utah.

Regulatory Frameworks

- In the U.S., chromium oxide is regulated by the Food and Drug Administration (FDA) under 21 CFR § 73.2327, permitting its use as a color additive in externally applied cosmetics, including those intended for the eye area, provided they meet specified purity standards. The Occupational Safety and Health Administration (OSHA) sets a permissible exposure limit (PEL) for chromium compounds at 0.5 mg/m³ over an 8-hour workday.

- In European Union, chromium compounds are subject to the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) Regulation. Additionally, the Classification, Labelling and Packaging (CLP) Regulation (EC) No 1272/2008 classifies chromium(VI) compounds as carcinogenic (Carc. 1B) and mutagenic (Muta. 1B), necessitating stringent labeling and safety measures for their use.

- In China, chromium compounds are regulated under the Environmental Protection Law, which imposes strict regulations on the emission and disposal of hazardous substances to protect public health and the environment. The Occupational Disease Prevention Law includes provisions for the prevention of diseases caused by exposure to toxic substances like chromium, mandating protective measures in workplaces.

- In India, the Environment (Protection) Act, 1986, provides a framework for the protection and improvement of the environment, including the regulation of hazardous substances like chromium compounds. The Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016, classify chromium compounds as hazardous waste, requiring industries to obtain authorization for their disposal and to follow prescribed procedures to minimize environmental impact.

- Japan governs chromium compounds under the Industrial Safety and Health Act, which designates certain substances, including chromium compounds, as harmful substances. The Chemical Substances Control Law regulates the manufacture and import of chemical substances, including chromium compounds, to ensure their safe use and to prevent environmental pollution.

Competitive Landscape

Major players in the chromium oxide market are adopting research and development, strategic partnerships, and technological advancements to enhance production efficiency, reduce environmental impact, and remain competitive in the chromium and specialty metals industry.

These approaches allow companies to improve material performance, develop sustainable solutions, and meet the growing demand for high-quality chromium-based products in advanced manufacturing and clean energy applications.

- In September 2025, Finnish steelmaker Outokumpu signed a memorandum of understanding with U.S.-based Boston Metal to advance the production of carbon-free metals. The collaboration focuses on utilizing chromium materials from Outokumpu's Kemi mine in Finland in Boston Metal’s molten oxide electrolysis (MOE) technology.

List of Key Companies in Chromium Oxide Market:

- LANXESS AG

- Shanghai Greenearth Chemicals Co., Ltd.

- Nanorh Materials Co., Ltd.

- Kurt J. Lesker Company

- TNJ Chemical

- SONUCHEM

- Changzhou Konada New Materials Technology Co., Ltd.

- HI‑TECH MATERIALS Corp.

- Ereztech

- MidUral Group

- Venator Materials plc

- Vishnu Chemicals

- Hebei Chromate Chemical Co., Ltd.

- Nippon Chemical Industrial Co., Ltd.

- Hunter Chemical LLC

Recent Developments

- In July 2025, NIPPON KINZOKU CO., LTD. expanded the sales of its environmentally friendly product, L-DieL (Long Die Life) finish stainless steel, designed to reduce die wear. The L-DieL finish alters the passive oxide film on the surface of stainless steel, softening it. This passive oxide layer, which is primarily composed of chromium oxide, is responsible for the corrosion resistance of stainless steel and is naturally very hard.