Market Definition

Aircraft electrification is the process of replacing or supplementing traditional aircraft propulsion and systems that rely on fossil fuels and hydraulics with electric power sources. This includes using electric motors, batteries, fuel cells, and hybrid electric systems to power aircraft propulsion, onboard systems, and auxiliary functions to improve efficiency, reduce emissions, and enhance sustainability in aviation.

The market encompasses the design, development, and manufacturing of electric propulsion systems, power electronics, energy storage solutions, electric motors, and charging infrastructure.

Aircraft Electrification Market Overview

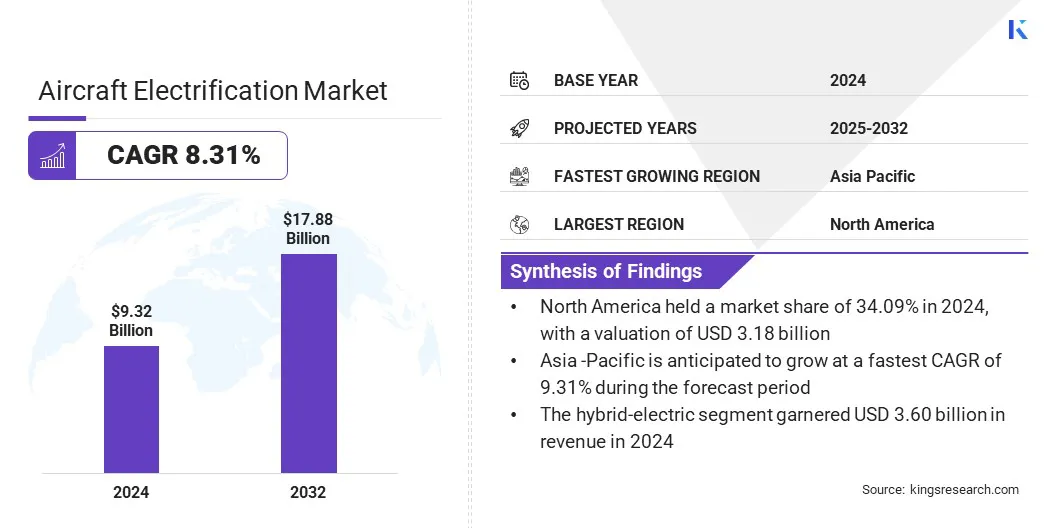

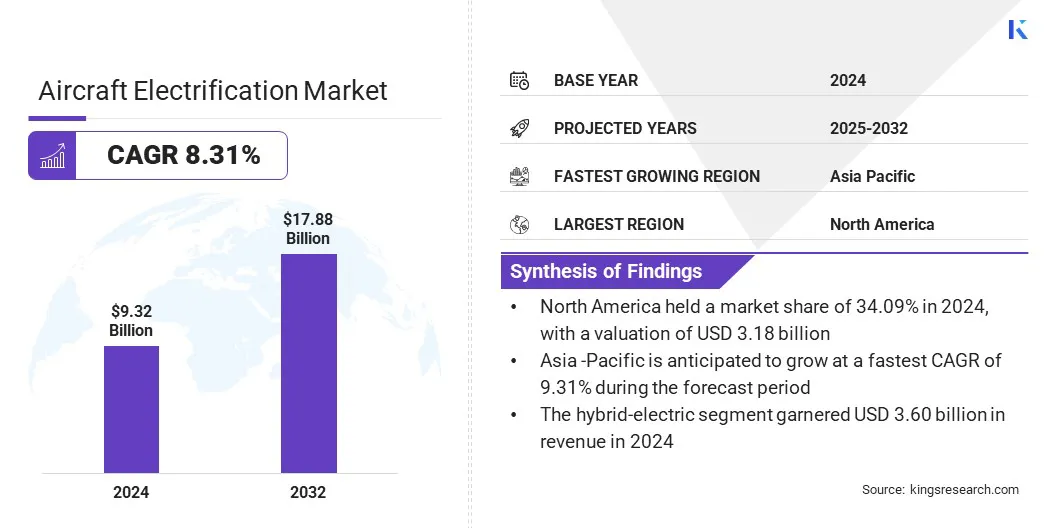

The global aircraft electrification market size was valued at USD 9.32 billion in 2024 and is projected to grow from USD 10.03 billion in 2025 to USD 17.88 billion by 2032, exhibiting a CAGR of 8.31% over the forecast period.

Market growth is driven by technological advancements in energy storage that enhance efficiency and performance in electrified aircraft. The growing demand for urban air mobility is further fueling adoption by promoting zero-emission, low-noise, and flexible air transport solutions.

Key Highlights:

- The aircraft electrification industry size was recorded at USD 9.32 billion in 2024.

- The market is projected to grow at a CAGR of 8.31% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 3.18 billion.

- The batteries segment garnered USD 2.16 billion in revenue in 2024.

- The hybrid-electric segment is expected to reach USD 6.83 billion by 2032.

- The power distribution segment is anticipated to witness the fastest CAGR of 8.61% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.31% over the forecast period.

Major companies operating in the aircraft electrification market are Airbus SE, General Electric Company, RTX Corporation, Safran Group, Honeywell International Inc, Rolls-Royce plc, BAE Systems, Thales Group, Textron Inc, Leonardo S.p.A, Joby Aviation, Archer Aviation Inc, Astronics Corporation, BETA Technologies, Inc, and MagniX, Inc.

The growing focus of aerospace companies on expanding electric air transport services is accelerating growth in the market. Increasing adoption of electric vertical takeoff and landing (eVTOL) aircraft is promoting zero-emission and low-noise operations. This shift is prompting investments in electric propulsion systems and battery technologies, advancing the transition toward sustainable air transportation solutions.

- In November 2024, Archer partnered with Japan Airlines and Sumitomo’s air mobility-focused joint venture Soracle to purchase up to 100 electric eVTOL aircraft worth approximately USD 500 million. The partnership aims to establish advanced air mobility services in Japan, advancing aircraft electrification by promoting zero-emission and low-noise air transport.

Market Driver

Growing Demand for Sustainable Aviation Solutions

A major driver in the aircraft electrification market is the growing demand for sustainable aviation solutions. Airlines and aircraft manufacturers are increasingly prioritizing electrified technologies to reduce carbon emissions, improve fuel efficiency, and meet climate goals.

Electric propulsion and advanced battery systems are enabling cleaner alternatives to conventional aircraft engines, aligning with net-zero goals. This shift toward greener aviation is prompting investments in electrification technologies and supporting regulatory compliance for sustainability goals.

- According to the International Energy Agency (IEA), aviation accounted for 2.5% of global energy-related CO₂ emissions in 2023.

Market Challenge

High Development Costs

A key challenge in the aircraft electrification market is the high development costs associated with advanced aircraft electrification technologies. Designing and manufacturing electric propulsion systems, high-performance batteries, and power management components requires substantial investment in research, specialized materials, and testing facilities.

To address this, market players are actively investing in research and development and forming strategic partnerships to share resources and expertise in electric propulsion and battery technologies. Additionally, they are employing advanced simulation and testing methods to streamline development cycles and minimize prototyping expenses.

Market Trend

Development of Hybrid-Electric Propulsion Systems

A key trend in the aircraft electrification market is the development of hybrid-electric propulsion systems. Aerospace companies are combining electric power with conventional engines to extend flight range, improve fuel efficiency, and reduce emissions.

Manufacturers are deploying advanced electric motors, power electronics, and energy storage solutions to enhance system performance and adaptability. This is enabling more sustainable operations while overcoming range limitations of fully electric aircraft.

- In March 2024, Ampaire Inc. acquired Magpie Aviation Inc. to expand its hybrid-electric propulsion capabilities. The acquisition broadens Ampaire’s technology portfolio, intellectual property, and market reach in both commercial and defense aviation electrification.

Aircraft Electrification Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Batteries, Fuel Cells, Electric Actuators, Generators, Motors, Power Electronics, Distribution Devices, Others

|

|

By Technology

|

More-Electric, Hybrid-Electric, Fully Electric

|

|

By Application

|

Power generation, Power distribution, Power conversion, Energy storage

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Batteries, Fuel Cells, Electric Actuators, Generators, Motors, Power Electronics, Distribution Devices, and Others): The batteries segment earned USD 2.16 billion in 2024 due to growing demand for high-energy-density storage solutions in electrified aircraft.

- By Technology (More-Electric, Hybrid-Electric, and Fully Electric): The hybrid-electric segment held 38.61% of the market in 2024, due to its ability to extend flight range while reducing emissions and fuel consumption.

- By Application (Power generation, Power distribution, Power conversion, and Energy storage): The power generation segment is projected to reach USD 5.89 billion by 2032, owing to the rising adoption of electric propulsion and renewable energy integration in aviation.

Aircraft Electrification Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aircraft electrification market share stood at 34.09% in 2024, valued at USD 3.18 billion. This dominance is attributed to the rising demand for sustainable and low-emission aviation solutions in the region.

Moreover, favorable government regulations and initiatives aimed at reducing carbon footprints are driving market growth across the region. The presence of leading aerospace companies actively investing in electrification technologies is further accelerating innovation and commercialization within the sector.

- In February 2025, ZeroAvia announced its first sale of a standalone 600kW electric propulsion system (EPS) to Jetcruzer International for integration into the Jetcruzer 500E hydrogen-electric aircraft. The agreement advances the development and testing of electric propulsion systems for sustainable aviation.

Asia Pacific is set to grow at a CAGR of 9.31% over the forecast period. This growth is driven driven by rising air traffic volumes, rapid fleet modernization, and the growing need to reduce operational emissions across commercial and regional aviation segments.

Airlines and OEMs are increasingly investing in hybrid and electric propulsion technologies to address fuel efficiency challenges and comply with tightening environmental regulations. The strong presence of advanced battery and power electronics manufacturing industries in countries such as China, Japan, and South Korea provides a critical supply advantage, supporting localized production and cost optimization.

Expanding collaborations between aerospace manufacturers and technology suppliers are accelerating the development of high-performance energy storage systems and lightweight components.

- In January 2025, Tata Elxsi and CSIR-National Aerospace Laboratories (CSIR-NAL) signed a Memorandum of Understanding to collaborate on advanced air mobility technologies, including UAVs, UAM, and eVTOL aircraft. The collaboration enables them to gain advanced electrification capabilities and strengthen their technology portfolio in India.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) oversees aircraft electrification by setting airworthiness certification, safety standards, and operational approvals for electric and hybrid-electric aircraft. It monitors compliance under Title 14 of the Code of Federal Regulations (14 CFR), addressing propulsion systems, energy storage, noise control, and environmental performance. The FAA’s guidelines ensure safe integration of electrified aircraft into the national airspace while supporting innovation in sustainable aviation.

- In the UK, the Civil Aviation Authority (CAA) supervises aircraft electrification by enforcing safety certification, environmental standards, and airspace integration requirements for electric aircraft. It governs technical norms for propulsion systems, energy storage, and noise performance. The CAA’s framework aligns with national net-zero targets and promotes innovations that advance sustainable aviation practices.

- In China, the Civil Aviation Administration of China (CAAC) governs the aircraft electrification sector by defining technical standards, certification procedures, and safety protocols for electric and hybrid-electric aircraft. It monitors the development and deployment of these technologies in alignment with national environmental goals. CAAC standards include noise limitations, emission control measures and energy efficiency requirements to boost greener aviation.

- In India, the Directorate General of Civil Aviation (DGCA) monitors aircraft electrification by establishing airworthiness certifications, safety protocols, and environmental compliance for electric aircraft. It oversees testing and approval processes for electric propulsion systems, including eVTOL designs. DGCA mandates emission norms, noise control measures, and adherence to India’s electric aviation roadmap to advance sustainable air transport.

Competitive Landscape

Major players in the aircraft electrification industry are intensifying research and development to enhance electric propulsion efficiency. They are expanding manufacturing capabilities and establishing specialized facilities to produce advanced components such as high-performance motors, power electronics, and battery systems.

Additionally, players are focusing on strategic partnerships and collaborations to accelerate innovation, integrate advanced electrification technologies, and improve safety standards of electric aircraft.

- In June 2025, Safran Electrical & Power and Saft announced a partnership to co-develop a high-voltage battery system for aviation. The system is designed to improve energy storage, scalability, and safety for electric and hybrid-electric aircraft.

Top Key Companies in Aircraft Electrification Market:

- Airbus SE

- General Electric Company

- RTX Corporation

- Safran Group

- Honeywell International Inc

- Rolls-Royce plc

- BAE Systems

- Thales Group

- Textron Inc

- Leonardo S.p.A

- Joby Aviation

- Archer Aviation Inc

- Astronics Corporation

- BETA Technologies, Inc

- MagniX, Inc.

Recent Developments

- In August 2025, Joby Aviation acquired Blade Air Mobility’s passenger business for approximately USD 125 million. This includes Blade’s urban air mobility infrastructure and customer base in the U.S. and Europe. The acquisition accelerates Joby’s deployment of electric vertical takeoff and landing (eVTOL) services.

- In July 2025, Safran completed the acquisition of Collins Aerospace’s flight control and actuation activities, adding technologies critical to commercial, military, and helicopter platforms. The acquisition strengthens Safran’s capabilities in electro-mechanical actuation.

- In June 2025, Collins Aerospace launched a new engineering centre of excellence in Wolverhampton, UK, and a dedicated production line in Colomiers, France, for its elecTRAS electric thrust reverser actuation systems. The development focuses on designing and producing electric systems to replace hydraulic actuation in aircraft nacelles.

- In January 2025, Sarla Aviation unveiled Shunya, India’s first electric vertical takeoff and landing (eVTOL) aircraft prototype. The prototype introduces advanced electric propulsion and autonomous capabilities to promote zero-emission urban air mobility in India.