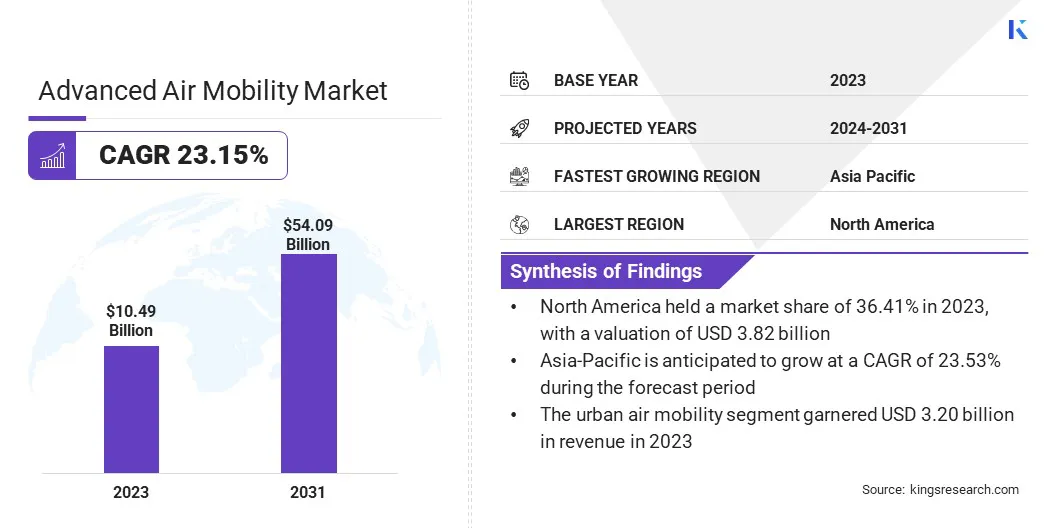

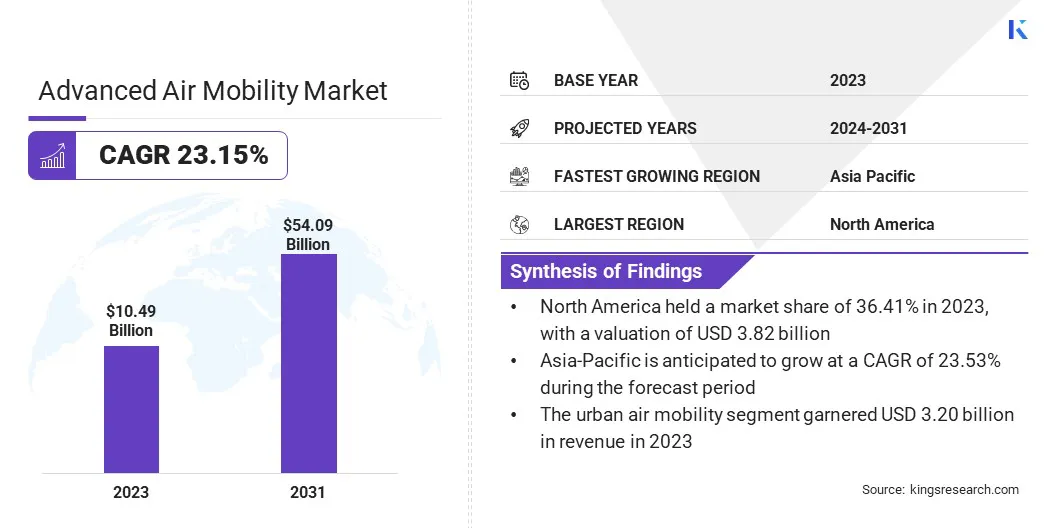

Advanced Air Mobility Market Size

The global Advanced Air Mobility Market size was valued at USD 10.49 billion in 2023 and is projected to grow from USD 12.59 billion in 2024 to USD 54.09 billion by 2031, exhibiting a CAGR of 23.15% during the forecast period. The market is expanding due to increasing demand for faster urban transportation, rising investments in autonomous aircraft, and the shift toward sustainable, low-emission solutions.

Innovations in electric vertical take-off and landing (eVTOL) aircraft, along with government initiatives promoting urban air mobility, are key factors supporting market growth. Additionally, advancements in drone technology for commercial and cargo applications are boosting the development of AAM solutions across industries.

In the scope of work, the report includes solutions offered by companies such as Airbus, Aurora Flight Sciences, Bell Textron Inc., Boeing, EHang, Embraer, Joby Aviation, Lilium GmbH, Vertical Aerospace, Volocopter GmbH, and others.

The advanced air mobility market is experiencing significant growth, mainly due to the growing need for faster, more efficient transportation solutions in urban environments. With rapid urbanization, traditional infrastructure is struggling to manage congestion.

- According to the United Nations by 2050, 68% of the global population are likely to reside in urban areas, increasing the demand for alternative transportation options such as air taxis and drones.

- Additionally, as per the International Air Transport Association (IATA) by 2037, 8.4 billion people are anticipated to use aircraft, underscoring the need for innovative air mobility solutions.

Government initiatives supporting sustainable transportation and advancements in electric and autonomous aircraft are accelerating the development and adoption of advanced air mobility globally.

Advanced air mobility (AAM) refers to the emerging aviation sector that focuses on the development and deployment of air transportation systems using innovative aircraft technologies such as electric vertical take-off and landing (eVTOL) vehicles. AAM aims to revolutionize urban and regional air travel by providing faster, more efficient, and sustainable transportation solutions.

It includes passenger transport, cargo delivery, and emergency services, primarily targeting congested urban areas and remote regions. AAM seeks to enhance mobility, reduce emissions, and ease traffic congestion through advancements in autonomy, electrification, and infrastructure development, improving connectivity in both urban and rural environments.

Analyst’s Review

Key collaborations among major industry players are contributing significantly to the growth of the advanced air mobility market. These partnerships are crucial for developing innovative ecosystems and business models that enhance operational efficiency and expand market reach.

- For instance, in February 2024, Airbus and LCI announced a collaboration to develop AAM ecosystems, focusing on strategy, commercialization, and financing through partnership models.

- Additionally, in June 2024, Airbus and Avincis signed a Memorandum of Understanding (MoU) to explore opportunities for operating electric vertical take-off and landing (eVTOL) aircraft throughout Europe.

Such strategic alliances enable companies to pool resources, share expertise, and accelerate technological advancements. By collaborating on regulatory frameworks, infrastructure development, and market integration, key players are effectively positioning themselves to meet the growing demand for AAM solutions.

This collective effort fosters innovation and supports a more sustainable and efficient future in urban and regional air transportation, which is expected to boost market growth in coming years.

Advanced Air Mobility Market Growth Factors

Governments and regulatory bodies are increasingly recognizing the potential of advanced air mobility to revolutionize transportation and address environmental concerns. To support industry expansion, numerous countries are introducing grants, funding initiatives, and developing regulatory frameworks to facilitate the safe integration of eVTOL (electric vertical take-off and landing) aircraft into urban airspace.

Governments are developing air traffic management systems tailored for advanced air mobility to ensure safe and efficient operations. This governmental backing is prompting private-sector investment and accelerating research and development. These initiatives are contributing significantly to market growth by creating a conducive environment for the deployment of advanced air mobility technologies.

The advanced air mobility market faces regulatory challenges and public acceptance issues regarding new technologies. Strict aviation regulations and safety standards often impede the development and deployment of electric vertical take-off and landing (eVTOL) aircraft, while noise pollution and safety concerns may dampen public enthusiasm.

To address these challenges, key players are actively engaging with regulators to ensure compliance with safety standards while advocating for updated policies that support innovation. Furthermore, public outreach initiatives are being implemented to educate communities on the benefits of AAM, fostering acceptance. Additionally, partnerships with established aviation firms enhance credibility and provide the necessary expertise for navigating regulatory landscapes effectively.

Advanced Air Mobility Industry Trends

The development of electric vertical take-off and landing (eVTOL) aircraft is revolutionizing urban air mobility. These aircraft, powered by electricity, offer a cleaner and more sustainable alternative to conventional helicopters or small planes.

- In January 2024, Joby Aviation, Inc. collaborated with Atlantic Aviation to electrify existing aviation infrastructure in New York and Southern California. This partnership aims to support the upcoming launch of Joby’s revolutionary air taxi service, facilitating the integration of electric vertical take-off and landing (eVTOL) aircraft into commercial passenger transportation.

Autonomous capabilities further enhance the appeal of eVTOLs by reducing the need for skilled pilots and making air mobility more accessible. These technological advancements are contributing to lower operational costs and reducing carbon emissions, which aligns with global sustainability goals.

As these technologies mature, they are becoming commercially viable, driving the growth of the advanced air mobility market and facilitating large-scale adoption in the near future.

The advanced air mobility ecosystem is witnessing an increasing number of collaborations between aircraft manufacturers, software developers, and transportation service providers. Companies are collaborating to integrate hardware and software solutions for seamless urban air mobility services. Infrastructure development, such as vertiports for takeoff and landing, is also benefiting from these partnerships.

- In July 2024, Skyports Infrastructure, Lilium N.V., and SEA Milan Airports signed an MoU to develop an eVTOL passenger network in Italy's Lombardy region. The partnership aims to build infrastructure for Regional Air Mobility, promoting sustainable aviation and eVTOL services in Europe.

Collaborations faclitate the exchange of expertise and resources, accelerating the research, development, and commercialization of advanced air mobility technologies. These partnerships are essential for establishing a cohesive and scalable AAM ecosystem that fosters rapid innovation and stimulates market expansion.

Segmentation Analysis

The global market has been segmented based on application, propulsion system, component, and geography.

By Application

Based on application, the market has been categorized into urban air mobility, regional air mobility, emergency medical services, cargo and logistics, and tourism and recreation. The urban air mobility segment led the advanced air mobility market in 2023, reaching a valuation of USD 3.20 billion, mainly fueled by rapid urbanization and the surging need for efficient, eco-friendly transportation solutions.

As urban populations grow, UAM offers a solution to reduce traffic congestion and improve commuting efficiency. Technological advancements in electric vertical take-off and landing (eVTOL) aircraft and autonomous flight systems are propelling is innovation.

- In July 2023, the FAA granted Joby Aviation a unique airworthiness certificate for its first eVTOL aircraft, marking a significant milestone. As part of its Agility Prime contract with the U.S. Air Force, Joby is set to deliver this aircraft in 2024. The contract's extension, valued at up to USD 131 million, highlights the ongoing collaboration with Toyota, which has invested over USD 400 million.

These developments reflect the growing investment in UAM infrastructure, supporting the expansion of the segment.

By Propulsion System

Based on propulsion system, the market has been categorized into electric, hybrid, and fuel cell. The electric segment captured the largest share of 47.32% in 2023, largely due to the increasing demand for sustainable and eco-friendly transportation solutions. Electrification of aircraft reduces carbon emissions and operational costs, making it a highly attractive option for urban mobility solutions.

Governments and regulatory bodies are actively supporting the adoption of electric aircraft through incentives and policy frameworks. Innovations in battery technology, extended range, and reduced charging times are contributing to the expansion of the electric segment.

Key players such as Joby Aviation and EHang are focusing on electric vertical take-off and landing (eVTOL) aircraft, strengthening the position of the segment.

By Component

Based on component, the market has been categorized into hardware and software. The hardware segment is expected to garner the highest revenue of USD 30.22 billion by 2031. This segment includes propulsion systems, avionics, batteries, sensors, and airframes, all of which are critical for ensuring the safe and efficient operation of AAM vehicles.

Innovations in lightweight materials and high-performance batteries are significantly enhancing aircraft efficiency, range, and safety. Increased investments in R&D by key players such as Airbus, Boeing, and other industry leaders are aiding the growth of the hardware segment.

Additionally, the pressing need for reliable hardware systems to support autonomous operations is propelling demand, making the hardware segment pivotal in the future advanced air mobility solutions.

Advanced Air Mobility Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America advanced air mobility market accounted for the largest revenue share of 36.41% in 2023, with a valuation of USD 3.82 billion. This notable growth is fueled by ongoing technological advancements and a robust regulatory framework. The region is home to leading aerospace companies and innovative startups, fostering an ecosystem for developing electric vertical take-off and landing (eVTOL) aircraft.

- Recent collaborations, including the July 2024 Memorandum of Understanding between Eve Air Mobility and Siemens Smart Infrastructure, bolster regional market growth. This partnership focuses on evaluating the necessary electrical infrastructure and energy management services needed to support eVTOL operations, highlighting the increasing demand for scalable energy solutions across the United States as the AAM industry expands.

Furthermore, government support and funding initiatives are facilitating research and development, fostering the adoption of AAM technologies in urban environments.

Asia-Pacific market is anticipated to witness significant growth, recording a staggering CAGR of 23.53% over the forecast period. This growth is largely attributed to rapid urbanization and the pressing need for efficient transportation solutions.

Governments are actively exploring policies to support eVTOL operations, enhancing regulatory frameworks for urban air mobility. Significant investments in infrastructure development, including vertiports and charging stations, are leading to widespread adoption, thereby supporting regional market development.

- In July 2024, EHang Holdings Limited, a global leader in urban air mobility technology, signed a purchase and operation cooperation agreement with KC Smart Mobility Company Limited, a subsidiary of Kwoon Chung Bus Holdings. This partnership aims to promote the deployment of EHang’s EH216-S pilotless eVTOL aircraft in Hong Kong, Macau, and cities in China. KC Smart Mobility intends to purchase 30 units of the EH216-S, marking a significant advanecment toward the broader adoption of urban air mobility solutions in the region.

This partnership, involving the purchase of 30 units, signifies a critical milestone in integrating urban air mobility into the region’s transportation landscape, thereby stimulating the growth domestic market.

Competitive Landscape

The global advanced air mobility market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Advanced Air Mobility Market

- Airbus

- Aurora Flight Sciences

- Bell Textron Inc.

- Boeing

- EHang

- Embraer

- Joby Aviation

- Lilium GmbH

- Vertical Aerospace

- Volocopter GmbH

Key Industry Developments

- March 2024 (Product Launch): Electron Aerospace introduced designs for a five-passenger electric utility aircraft. The company plans to start manufacturing and testing these aircraft, with the goal of deployment by the end of 2030. Featuring advanced battery technology, the aircraft is anticipated to have an operational range of 500 kilometers.

- September 2024 (Product Launch): Boeing unveiled a land-based design for its MQ-25 autonomous tanker. The company focused on creating a larger, uncrewed version of the MQ-25 to support the U.S. Air Force's future refueling plans, including refueling Collaborative Combat Aircraft (CCA) in contested airspace.

The global advanced air mobility market is segmented as:

By Application

- Urban Air Mobility (UAM)

- Regional Air Mobility (RAM)

- Emergency Medical Services (EMS)

- Cargo and Logistics

- Tourism and Recreation

By Propulsion System

- Electric

- Hybrid

- Fuel Cell

By Component

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America