Fuel Cell Market Size

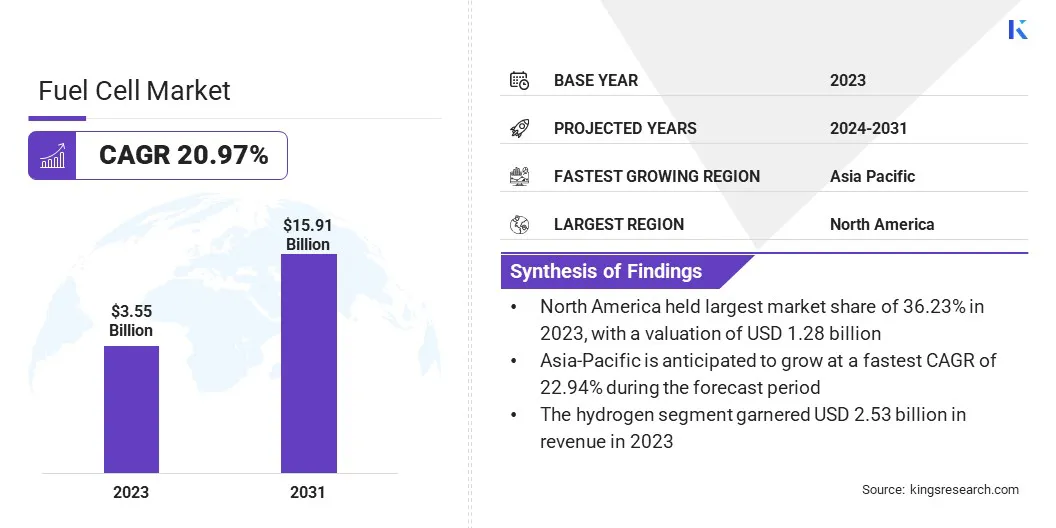

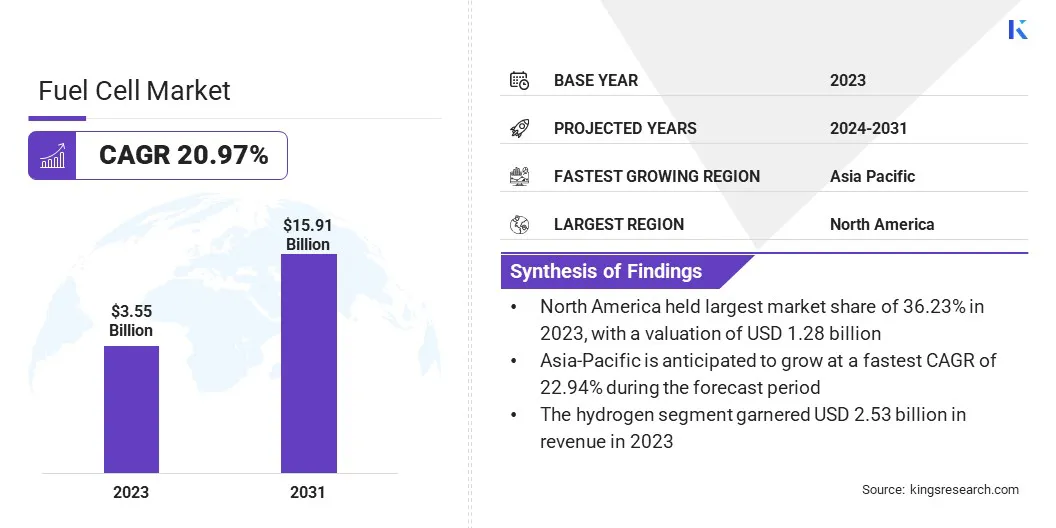

The global fuel cell market size was valued at USD 3.55 billion in 2023 and is projected to grow from USD 4.20 billion in 2024 to USD 15.91 billion by 2031, exhibiting a CAGR of 20.97% during the forecast period.

The market is registering steady growth, due to the increasing demand for these cells on account of the rising adoption of electric vehicles (EVs). Supportive regulatory policies to facilitate product deployment are driving the market.

In the scope of work, the report includes products offered by companies such Ballard Power Systems, Bloom Energy, Ceres Power Holdings Plc, Doosan Fuel Cell Co., Ltd., FuelCell Energy, Inc., Horizon Fuel Cell Technologies, Nexceris LLC, NUVERA FUEL CELLS, LLC, Proton Motor Fuel Cell GmbH, SFS Energy AG, and others.

Continuous R&D activities performed by key players are fostering the market growth. Companies are conducting extensive research and development (R&D) efforts to foster innovations aimed at improving performance, durability, and cost-efficiency. The unveiling of advanced modeling and simulation tools to enhance core processes and optimize designs is also fostering the market growth.

Manufacturers are utilizing computational fluid dynamics (CFD) modeling, multi-physics simulations, and advanced control strategies to ensure efficient and dependable operations. Key players are signing numerous agreements to launch advanced technologies in the market.

- For instance, on July 7, 2023, Bloom Energy entered into an agreement with Perenco to deploy 2.5 megawatts (MW) of its solid oxide fuel cells at a location in England. Perenco, a prominent independent hydrocarbon company, produces 500,000 barrels of oil equivalent (BOE) daily across operations in 14 partner nations.

These strategic advancements are significantly contributing to the growth of the fuel cell market.

Fuel cells are devices that generate electricity through electrochemical reactions, offering a cleaner and more efficient alternative to traditional combustion-based power generation. They have a wide range of applications, including transportation, industrial processes, commercial use, residential buildings, and potentially large-scale energy storage solutions in the future.

Fuel cells deliver efficiency levels above 60%, significantly outperforming conventional combustion engines. Unlike batteries, fuel cells do not deplete or require recharging, continuously producing electricity and heat as long as fuel is provided.

The core components of a fuel cell include two electrodes the anode, which receives the fuel (such as hydrogen), and the cathode, which takes in air—separated by an electrolyte. This system ensures a sustainable and reliable energy source.

Analyst’s Review

Manufacturers in the market are focusing on advancing fuel cell technology to increase the adoption of clean energy solutions. They are developing proton exchange membrane cells to offer sustainable and efficient power for numerous applications.

M&A activities are also driving consolidation, allowing key players to expand their global footprint and improve operational efficiency. Governments are launching initiatives to promote fuel cell EVs.

- For instance, in March 2022, Government of India’s Ministry of Road Transport & Highways developed a Green Hydrogen Fuel Cell Electric Vehicle (FCEV) project, The Toyota Mirai, to establish a green hydrogen-based ecosystem.

The increasing utilization of these cells in automotive, residential, and transportation is pushing manufacturers for continuous advancements.

Fuel Cell Market Growth Factors

The rising demand for clean energy sources is bolstering the growth of the market. These cells offer a clean energy conversion technology that produces low or zero emissions by generating electricity through electrochemical reactions instead of combustion. This technology is increasingly utilized in various products, as it aids in the integration of intermittent renewable energy sources into the grid.

Fuel cells contribute to a favorable market outlook by efficiently converting stored hydrogen or other renewable fuels into electricity. Additionally, the adoption of supportive policies and initiatives is driving the widespread adoption of clean energy technologies. Additionally, companies in the market are focusing on manufacturing products that assist in lowering carbon emissions and promoting sustainability.

- For instance, in November 2023, Kohler Energy launched a new hydrogen KDI engine, along with its inaugural hydrogen fuel cell power system, expanding its range of clean energy solutions. This announcement accelerates Kohler Energy's strategy to provide a diverse range of clean energy and hydrogen-compatible products for off-highway machinery, as well as standby and prime power solutions for residential and industrial applications, with capacities ranging from 20kW to more than 5MW.

The market faces challenges related to the high cost of fuel cells. These cells, which generate electricity through chemical reactions, typically involve expensive materials such as platinum for catalysts and other specialized components, leading to higher production costs.

This cost barrier can hinder the scalability of fuel cell technologies, making them less competitive compared to traditional energy solutions, such as gasoline or electric batteries. R&D efforts are focused on discovering alternative, less expensive materials to replace platinum, such as nickel or non-precious metals, without compromising performance.

Additionally, advancements in manufacturing processes and economies of scale could assist in lowering production costs. Moreover, increasing investments in fuel cell infrastructure, such as refueling stations, could contribute to the overall cost reduction.

Fuel Cell Market Trends

The rapid surge in the production of green hydrogen is fostered by the rising demand for sustainable energy solutions. Green hydrogen can be produced by minimizing the expense and environmental impact of imports. Additionally, producing green hydrogen from waste biomass creates a new source of income for farmers and local communities.

Governments worldwide are implementing policies, launching initiatives, and infrastructure investments to accelerate production. Advancements in electrolyzer technology have reduced costs and improved efficiency, making large-scale deployment more feasible.

- In January 2023, the Government of India initiated the National Green Hydrogen Mission, aiming to achieve an annual production capacity of 5 billion metric tons (MMT) of green hydrogen.

The growing popularity of microbial fuel cells is driving the fuel cell market. A Microbial Fuel Cell (MFC) is a device that transforms chemical energy into electrical power through the use of microorganisms. Operating as a bio-electrochemical system, MFCs harness bacteria to break down organic and inorganic substances, producing electricity.

This technology has diverse applications, including energy generation, resource recovery, and wastewater treatment. Particularly effective in low-power environments, MFCs present a sustainable alternative to traditional batteries, making them ideal for applications such as powering wireless sensor networks for remote monitoring and data collection.

Segmentation Analysis

The global market has been segmented based on type, fuel, end use industry, application, and geography.

By Type

Based on type, the market has been segmented into proton exchange membrane fuel cell (PEMFC), solid oxide fuel cell (SOFC), phosphoric acid fuel cell, alkaline fuel cell, and others. The proton exchange membrane fuel cell (PEMFC) segment led the fuel cell market in 2023, reaching a valuation of USD 2.21 billion.

These cells are utilized in high numbers, owing to their efficiency and versatility in numerous applications. They are extensively used in portable power systems, transportation, and stationary power generation. They operate efficiently at low temperatures, enabling faster start-up times and making them ideal for automotive and consumer applications.

By Fuel

Based on fuel, the market has been categorized into hydrogen, ammonia, methanol, ethanol, and hydrocarbon. The hydrogen segment captured the largest market share of 71.23% in 2023. Hydrogen fuel cells generate electricity through an electrochemical reaction between hydrogen and oxygen, with water being the sole byproduct.

These cells are exceptionally efficient and environmentally friendly, as they generate no harmful emissions. Their adaptability makes hydrogen an attractive energy source across multiple sectors. In transportation, fuel cell vehicles present a sustainable alternative to conventional combustion engines.

In stationary power generation, hydrogen fuel cells deliver dependable and clean energy solutions for residential, commercial, and industrial use, positioning them as a critical component in reducing environmental impact.

By End Use Industry

Based on end use industry, the market has been segmented into automotive and transportation, utilities and power generation, commercial & industrial, residential, and others. The automotive and transportation segment is expected to garner the highest revenue of USD 7.47 billion by 2031.

This technology is extensively adopted in vehicles such as buses, trucks, and passenger cars, owing to their ability to provide high energy efficiency, rapid refueling, and long-range capabilities. The rise of FCEVs is particularly prominent, with major automotive manufacturers launching hydrogen-powered models. Companies are unveiling several products for their customer needs.

- For instance, in February 2023, Weichai Power partnered with Ceres, launched stationary solid oxide fuel cells in China. The fuel cell achieved over 30,000 hours of combined operational time. Additionally, the system boasts a 60% efficiency rate and is capable of starting and stopping up to four times during the power generation process.

By Application

Based on application, the market has been categorized into transportation, stationary power generation, portable power, and others. The transportation segment is expected to garner the highest revenue of USD 8.04 billion by 2031. This technology is being incorporated into numerous transportation applications to lower carbon emissions and dependence on fossil fuels.

Hydrogen fuel cells, in particular, are seen as a viable alternative to traditional internal combustion engines, offering longer driving ranges and shorter refueling times. Government incentives for advancements in fuel cell infrastructure and clean energy adoption are boosting the adoption of fuel cell vehicles.

Fuel Cell Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for the largest fuel cell market share of 36.23% in 2023, with a valuation of USD 1.28 billion. The increasing demand for clean energy solutions and technological advancements are driving the market in he region. Several initiatives in the U.S. are aimed at promoting the adoption of fuel cell technologies in various sectors like power generation and transportation.

- For instance, on February 7, 2023, the California Air Resources Board (CARB) granted Nikola Corporation's request for its Tre hydrogen FCEV to be eligible for the CARB's hybrid and zero-emission truck and bus voucher incentive project (HVIP).

The fuel cell market in Asia Pacific is anticipated to register significant growth at a CAGR of 22.94% over the forecast period. Governmental support for the adoption of clean and sustainable energy solutions is fostering the growth of the market in region. Increasing adoption of EVs in countries such as China and Japan is boosting the market in the region.

Fuel cell manufacturers in these nations are focusing on investing in infrastructure development and R&D, which is propelling the market. Growing automotive industry in Japan, India, and China has increased the adoption of these cells.

- For instance, in December 2023, according to CEIC, India manufactured 5,851,507 motor vehicles.

Competitive Landscape

The global fuel cell market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in R&D, establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create opportunities for market growth.

List of Key Companies in Fuel Cell Market

- Ballard Power Systems

- Bloom Energy

- Ceres Power Holdings Plc

- Doosan Fuel Cell Co., Ltd.

- FuelCell Energy, Inc.

- Horizon Fuel Cell Technologies

- Nexceris LLC

- NUVERA FUEL CELLS, LLC

- Proton Motor Fuel Cell GmbH

- SFS Energy AG

Key Industry Developments

- January 2024 (Partnership): Hyzon, a leading producer of advanced hydrogen fuel cell technology and provider of zero-emission heavy-duty FCEVs, launched 19 FCEVs across three continents.

- February 2023 (Launch): SFC Energy and FCTecNrgy Pvt. Ltd. launched a combined hydrogen and methanol fuel cell manufacturing facility in India. This initiative assists the development of a sustainable economy while enhancing the accessibility of German technology in India. The facility will produce both stationary and mobile fuel cells, generating clean energy from hydrogen and methanol. Through this collaboration, the company aims to make a significant contribution to the local production of renewable energy across India.

- January 2023 (Partnership): Advent Technologies partnered with Alfa Laval to investigate the use of high-temperature proton exchange membrane fuel cells in marine applications.

The global fuel cell market is segmented as:

By Type

- Proton Exchange Membrane Fuel Cell (PEMFC)

- Solid Oxide Fuel Cell (SOFC)

- Phosphoric Acid Fuel Cell

- Alkaline Fuel Cell

- Others

By Fuel

- Hydrogen

- Ammonia

- Methanol

- Ethanol

- Hydrocarbon

By End Use Industry

- Automotive and Transportation

- Utilities and Power Generation

- Commercial & Industrial

- Residential

- Others

By Application

- Transportation

- Stationary Power Generation

- Portable Power

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America