Market Definition

Remote sensing technology involves collecting and interpreting data about objects, areas, or phenomena on the Earth’s surface without direct contact. It leverages satellite-based systems, aerial platforms, and ground-based sensors to capture electromagnetic radiation, radar, or thermal signals.

These data are processed to generate images, maps, and analytical datasets that support decision-making across industries such as agriculture, forestry, urban planning, energy, defense, and environmental monitoring. The technology delivers insights into spatial patterns, resource management, and temporal changes, making it essential for both commercial and government applications.

Remote Sensing Technology Market Overview

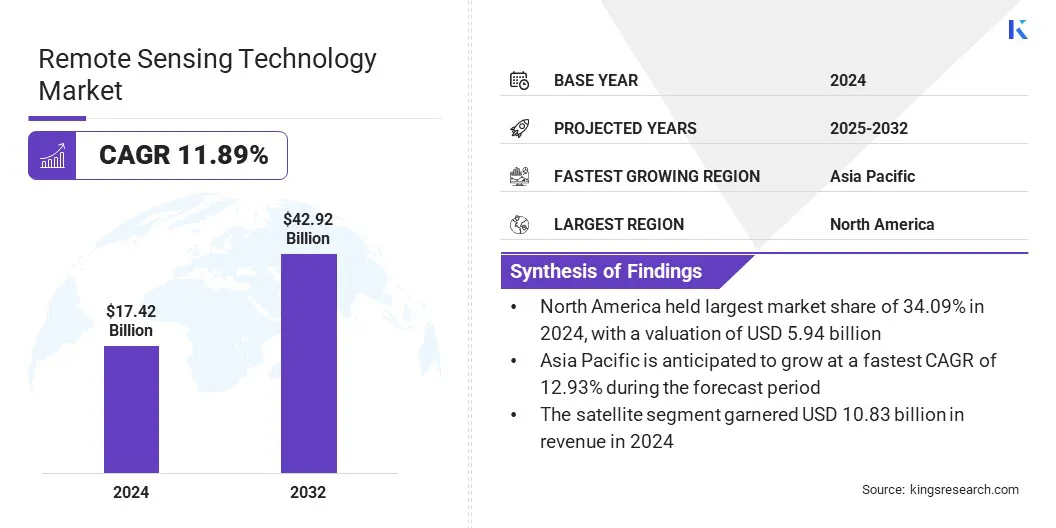

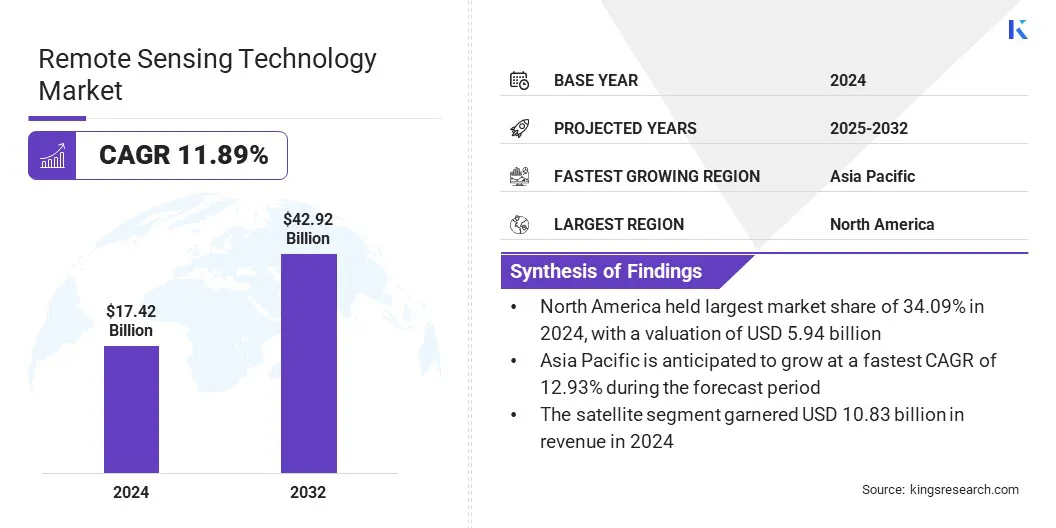

The global remote sensing technology market size was valued at USD 17.42 billion in 2024 and is projected to grow from USD 19.46 billion in 2025 to USD 42.92 billion by 2032, exhibiting a CAGR of 11.89% during the forecast period.

This growth is driven by increasing adoption of hyperspectral and multispectral imaging in precision applications such as agriculture, mining, and environmental monitoring. These imaging techniques enable detailed material identification and condition assessment with high accuracy, fostering innovation and market expansion.

Key Highlights:

- The remote sensing technology industry was valued at USD 17.42 billion in 2024.

- The market is projected to grow at a CAGR of 11.89% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 5.94 billion.

- The passive sensing segment garnered USD 10.44 billion in revenue in 2024.

- The satellite segment is expected to reach USD 26.41 billion by 2032.

- The weather segment is anticipated to witness the fastest CAGR of 12.21% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 12.93% through the projection period.

Major companies operating in the remote sensing technology market are Airbus SAS, Maxar Technologies, BlackSky, Planet Labs PBC, L3Harris Technologies, Inc., ICEYE, Capella Space, Imagesat International (I.S.I) Ltd., Northrop Grumman Corporation, Thales, The Boeing Company, and Rocket Lab USA.

Remote sensing technology is increasingly critical to modern urban planning and smart city development, contributing significantly to market progress. High-resolution satellite imagery and advanced analytics enable city planners to monitor land use, assess infrastructure performance, and manage rapid urbanization.

It supports traffic management, utility monitoring, green space allocation, and disaster risk reduction, allowing cities to optimize resources and enhance sustainability. Rising global urban populations are creating a strong demand for data-driven solutions that improve livability, resilience, and operational efficiency. Its integration into smart city frameworks supports informed decision-making and effective governance for sustainable urban growth.

- In September 2025, Tata Consultancy Services partnered with IIT Kanpur’s AIRAWAT Research Foundation, established with support from the Ministry of Education and the Ministry of Housing and Urban Affairs. The collaboration aims to leverage TCS’s expertise in AI, remote sensing, digital twin, and data engineering to advance sustainable urban transformation.

Market Driver

Rising Demand for Earth Observation Data

Rising challenges from climate change, deforestation, and environmental degradation are fueling demand for Earth observation data, highlighting the need for remote sensing technology. It delivers critical insights into land cover changes, atmospheric conditions, water cycles, and biodiversity.

Governments and organizations rely on such data to track emissions, monitor natural resources, and comply with international sustainability regulations. The ability to generate near real-time insights allows policymakers and industries to design adaptive strategies for mitigation and resilience. This underscores the growing importance of remote sensing in promoting environmental stewardship, aiding market progress.

- In September 2024, BAE Systems announced plans to utilize ArgUS to test advanced hardware and software for Earth observation and weather monitoring. The payload features a next-generation RF receiver, a short-wavelength infrared camera, and Linux-based software supporting in-orbit data processing and containerized applications, providing insights into climate change, natural disasters, and environmental challenges.

Market Challenge

High Capital Investment and Maintenance Costs of Satellites

The deployment of advanced remote sensing systems, particularly satellite constellations and hyperspectral payloads, demands substantial upfront capital investment and recurring operational expenses. The costs associated with launch services, ground stations, and data processing infrastructure often restrict adoption by new entrants and small enterprises, particularly in emerging economies.

These cost barriers limit scalability and slow innovation, even as demand across industries continues to grow. To overcome this challenge, stakeholders are increasingly adopting collaborative business models, leveraging shared platforms, and exploring public-private partnerships to reduce financial risks and improve affordability.

Market Trend

Growing Integration of Artificial Intelligence and Machine Learning in Remote Sensing Analytics

The rising integration of artificial intelligence and machine learning is influencing the remote sensing technology market. These technologies enhance the accuracy and speed of image classification, object detection, and predictive modeling, enabling stakeholders to extract actionable insights from massive volumes of geospatial data.

AI-driven analytics allows users to detect subtle patterns, forecast environmental changes, and automate monitoring processes, creating significant value for sectors such as defense, agriculture, and urban development. This trend underscores a notable shift toward intelligent, automated, and scalable solutions that improve efficiency.

- In December 2023, ISRO adopted artificial intelligence and machine learning in the space industry, aligning with rapid technological advancements. The agency has applied these technologies in spacecraft health monitoring, predictive maintenance of critical systems, autonomous navigation, and satellite image analysis.

Remote Sensing Technology Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Active sensing, Passive sensing

|

|

By Platform

|

Satellite, Aerial systems

|

|

By Application

|

Agriculture & Living Resources, Military & Intelligence, Disaster Management, Infrastructure, Weather, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Active sensing and Passive sensing): The passive sensing segment captured a share of 59.94% in 2024, primarily due to its cost efficiency, wide availability of optical data, and suitability for agriculture, forestry, and environmental monitoring applications.

- By Platform (Satellite and Aerial systems): The aerial systems segment is set to grow at a CAGR of 12.11%, owing to rising adoption of UAVs, flexibility in deployment, high-resolution imaging capabilities, and cost-effective data collection for diverse applications.

- By Application (Agriculture & Living Resources, Military & Intelligence, Disaster Management, Infrastructure, Weather, and Others): The military & intelligence segment held a share of 29.90% in 2024, propelled by increasing defense investments, rising demand for surveillance, reconnaissance, and strategic decision-making enabled by advanced satellite and sensor technologies.

Remote Sensing Technology Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America remote sensing technology market share stood at 34.09% in 2024, valued at USD 5.94 billion. This dominance is supported by strong government funding, advanced defense programs, and a mature commercial ecosystem for Earth observation services.

The growing involvement of private sector companies in satellite constellations, hyperspectral imaging, and data analytics strengthens regional competitiveness. Additionally, robust infrastructure, early adoption of AI-driven analytics, and strong collaborations between government, defense, and private enterprises position North America as a major hub for remote sensing innovation and commercialization.

The Asia-Pacific remote sensing technology industry is set to grow at a robust CAGR of 12.93% over the forecast period. Rising demand for geospatial intelligence in agriculture, natural resource management, and infrastructure development is fueling adoption across emerging economies.

Governments in the region are investing heavily in space programs such as Earth Observing System (EOS) and the NASA-ISRO Synthetic Aperture Radar (NISAR) mission, satellite launches, and domestic manufacturing capabilities to reduce dependency on foreign providers.

Rapid urbanization, coupled with the need for climate resilience and disaster preparedness, is further stimulating market growth. The proliferation of low-cost satellites and UAVs provides local players with opportunities to compete globally.

Regulatory Frameworks

- In the U.S., the Land Remote Sensing Policy Act regulates commercial satellite imaging activities. It establishes licensing requirements, ensures national security compliance, and promotes responsible commercial participation in the remote sensing market.

- In the EU, the EU Space Regulation regulates space-based Earth observation activities. It harmonizes data policies, strengthens Copernicus program operations, and enhances accessibility of geospatial information to support environmental monitoring and economic growth.

- In India, the Remote Sensing Data Policy (RSDP) regulates the acquisition and distribution of high-resolution satellite imagery. It ensures national security while facilitating commercial access and influencing the growth of domestic and international remote sensing services.

- In China, the Measures for the Administration of Remote Sensing Satellite Ground Receiving Stations regulate the reception and dissemination of satellite data. They ensure state control over geospatial information flow and support the development of domestic remote sensing industries.

- In Canada, the Remote Sensing Space Systems Act regulates the operation of space-based remote sensing systems. It addresses licensing, data distribution, and safeguards national security while enabling private sector participation in the space economy.

- In Australia, the Space (Launches and Returns) Act regulates commercial satellite launches and data operations. It governs licensing, insurance, and safety compliance, ensuring responsible use of remote sensing technologies within national and international frameworks.

Competitive Landscape

Leading companies in the remote sensing technology industry are placing a greater emphasis on innovation, vertical integration, and customer-centric offerings. Firms are investing in AI-powered analytics, hyperspectral imaging, and low-cost satellite constellations to differentiate their portfolios. Expansion into value-added services such as predictive modeling, change detection, and real-time monitoring supports recurring revenue streams.

Strategic collaborations with government agencies and defense organizations are enhancing credibility and ensuring long-term contracts. Companies are also scaling international partnerships and adopting mergers to expand global reach. They are also focusing on R&D, faster deployment cycles, and adapting solutions to address climate resilience, urban planning, and defense modernization needs to maintain a competitive edge.

- In June 2025, Maxar Intelligence partnered with Array Labs to secure dedicated capacity from its upcoming 3D radar imaging constellation, scheduled for launch in 2026. The collaboration integrates electro-optical and radar-based 3D terrain data, strengthening Maxar’s real-time global 3D mapping capabilities, supporting validation, and advancing integration into its product portfolio.

Key Companies in Remote Sensing Technology Market:

- Airbus SAS

- Maxar Technologies

- BlackSky

- Planet Labs PBC

- L3Harris Technologies, Inc.

- ICEYE

- Capella Space

- Imagesat International (I.S.I) Ltd.

- Northrop Grumman Corporation

- Thales

- The Boeing Company

- Rocket Lab USA

Recent Developments (Collaboration/New Product Launch)

- In June 2025, Airbus, in collaboration with CNES, developed four next-generation CO3D optical satellites aboard Arianespace’s Vega-C rocket. These dual-use satellites will provide high-resolution stereo and 2D imagery, supporting enhanced global digital surface modeling for government and commercial applications.

- In February 2025, Esri introduced Content Store for ArcGIS, a web application developed with SkyWatch. The platform simplifies access to high-quality commercial satellite imagery from Maxar and other providers, eliminating the need to manage multiple sources and enabling seamless integration for organizations.