Digital Twin Market Size

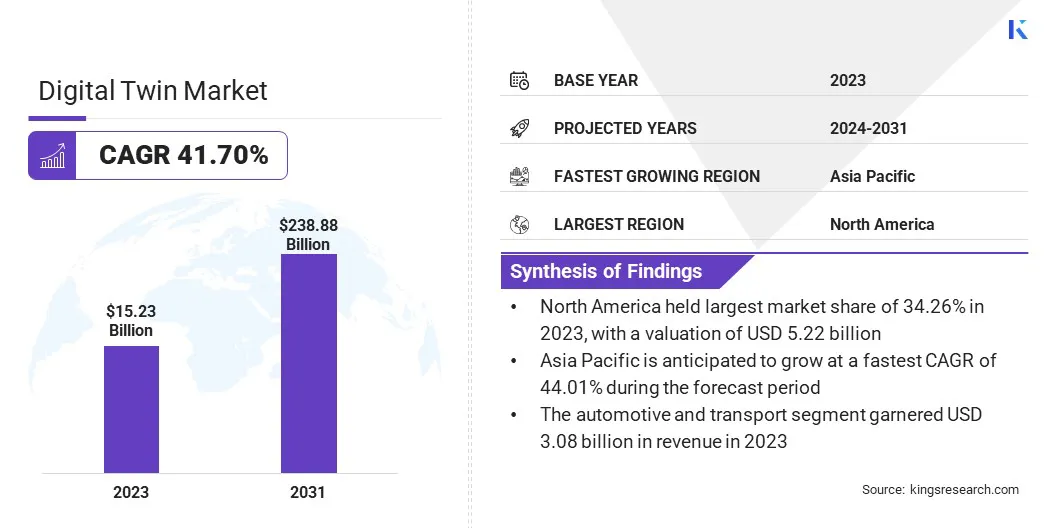

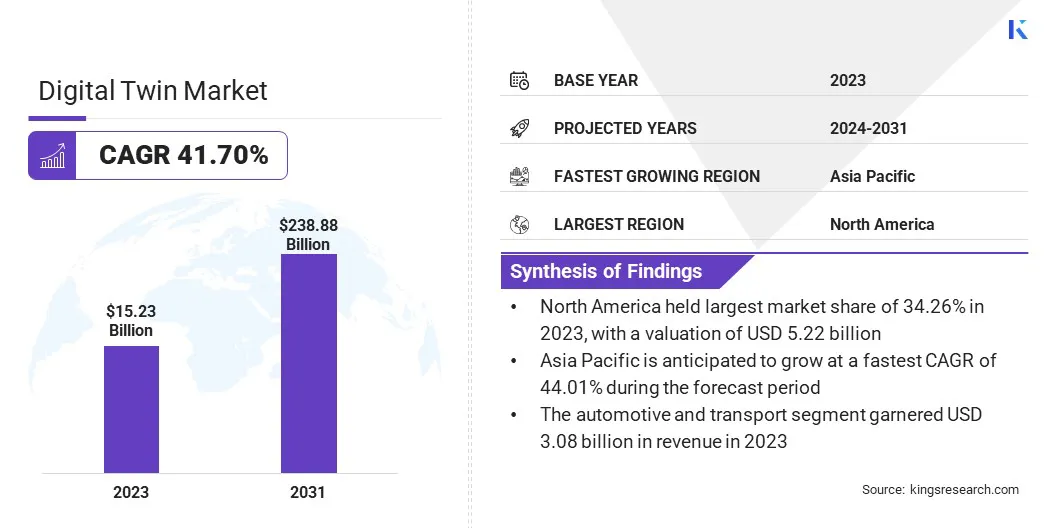

The global digital twin market size was valued at USD 15.23 billion in 2023 and is projected to grow from USD 20.82 billion in 2024 to USD 238.88 billion by 2031, exhibiting a CAGR of 41.70% during the forecast period.

Manufacturing industries are utilizing digital twins to optimize production workflows, reduce errors, and improve product quality. These virtual models help simulate factory layouts, test production scenarios, and integrate automation in processes.

- In June 2023, Hexagon integrated its HxDR reality-capture and Nexus manufacturing platforms with NVIDIA Omniverse. This integration, powered by NVIDIA’s AI technologies, ehances Hexagon’s major ecosystems, offering significant advantages. Professionals and developers gain access to advanced tools in reality capture, digital twins, AI, simulation, and visualization, optimizing complex graphics workflows—from virtual prototyping to digital factories.

As advancements in technology make these solutions more affordable and accessible, the adoption of digital twins in small- and medium-sized enterprises (SMEs) is increasing.

In the scope of work, the report includes products and services offered by companies, such as General Electric, Siemens, NVIDIA Corporation, IBM Corporation, Microsoft, ANSYS, Inc., Bentley Systems, Incorporated, Dassault Systems, Oracle, Altair Engineering Inc., and others.

The growing adoption of cloud-based platforms is accelerating the growth of the digital twin market. Cloud computing offers scalable infrastructure for creating, storing, and analyzing digital twin data. Businesses can access real-time insights and seamlessly collaborate across geographies using cloud-based digital twin solutions.

A digital twin is a virtual replica of a physical object, system, or process, created to simulate, monitor, and optimize its real-world counterpart. It integrates real-time data from sensors and IoT devices to mirror physical conditions and behaviors, enabling predictive modeling, performance analysis, and decision-making.

Digital twins can be used across various industries, including manufacturing, healthcare, automotive, and urban planning, to improve efficiency, reduce costs, and enhance functionality. By continuously updating and analyzing data, digital twins allow proactive management of assets, operations, and processes, fostering more informed and agile business practices.

Analyst’s Review

Companies adopt advanced strategies that leverage technological innovations to drive the growth of the digital twin market. One key strategy is the integration of immersive technologies such as virtual reality (VR) and augmented reality (AR) with digital twin platforms.

- In January 2025, NVIDIA unveiled spatial streaming for the Omniverse digital twins workflow, delivering unparalleled visual fidelity and performance for XR experiences. Partners such as Accenture, Innoactive, and Katana have started incorporating this workflow into their existing spatial workflows.

Additionally, companies are investing in the development of robust simulation tools that enable testing in a risk-free digital space, which optimizes productivity and refines operational processes. Through continuous innovation and the expansion of software capabilities, businesses are maximizing cost efficiency and enhancing overall performance.

These strategic initiatives are accelerating the adoption of digital twins across industries, fostering growth and positioning digital twin solutions as essential tools for innovation and optimization.

Strategic partnerships and mergers with key technology providers are another crucial tactic. Companies are forming alliances with software giants and technology firms to access advanced digital twin solutions and accelerate product development.

- In January 2025, Accenture acquired Percipient, a Singapore-based fintech company known for its expertise in banking technology transformation. Percipient's digital twin technology platform for banks will strengthen Accenture’s existing banking modernization offerings. This acquisition enables Accenture to help its financial services clients across the Asia Pacific accelerate the modernization and reinvention of their core systems.

Digital Twin Market Growth Factors

The increasing implementation of IoT and AI technologies has significantly enhanced the growth of the market. IoT sensors enable real-time data collection, while AI-powered analytics offer insights into system performance and assist in predictive modeling. These capabilities allow businesses to simulate scenarios, optimize operations, and reduce risks.

The ability to create dynamic virtual replicas of physical assets fosters innovation across industries such as manufacturing, healthcare, and automotive. This trend underscores the growing reliance on IoT and AI to drive efficiency, improve decision-making, and ensure seamless integration between the physical and digital environments.

- In October 2024, Ola Electric introduced its Ola Digital Twin platform, designed to revolutionize manufacturing processes and product development. Leveraging the Nvidia Omniverse platform, this advanced system combines artificial intelligence (AI), simulation technologies, and Internet of Things (IoT) capabilities to create highly detailed digital replicas of real-world environments.

The rising need for predictive maintenance across industries is also propelling the digital twin market. Companies use digital twins to monitor the performance of machinery, predict potential failures, and optimize maintenance schedules. This proactive approach reduces downtime, enhances asset reliability, and lowers operational costs.

Industries such as aerospace, energy, and manufacturing rely on digital twins to ensure uninterrupted operations and extend the lifecycle of critical equipment.

However, the rising concerns over data privacy and security is restraining the growth of the market. Digital twins rely on the collection and transmission of vast sets of real-time data, making them susceptible to cyberattacks and data breaches.

To address these challenges, companies are implementing robust cybersecurity measures, including encryption, multi-factor authentication, and advanced threat detection systems, to protect sensitive data.

Additionally, businesses are adopting decentralized data storage solutions and compliance frameworks to meet regional data protection regulations, ensuring that digital twin platforms remain secure while promoting greater trust among users and stakeholders.

Digital Twin industry Trends

The growth of digital twin market is strongly linked to the increasing focus on smart cities and infrastructure projects. Urban planners and governments use digital twins to simulate urban environments, optimize resource allocation, and improve decision-making for infrastructure investments. These virtual models help design efficient transportation systems, manage utilities, and enhance sustainability initiatives.

- In November 2024, Bentley Systems partnered with Google to incorporate high-precision geospatial data into its digital twin platform. This collaboration is set to transform the design, construction, and operation of infrastructure projects on a global scale.

The global emphasis on building resilient, connected urban environments is accelerating the adoption of digital twins in projects that enhance quality of life and drive long-term economic growth.

Furthermore, the global rollout of 5G networks is bolstering the digital twin industry by enabling faster and more reliable data transfer. Reduced latency and increased bandwidth support real-time synchronization between physical assets and their digital counterparts. These advancements improve the scalability of digital twin applications in logistics, telecommunications, and healthcare.

Segmentation Analysis

The global market has been segmented based on component, end use, and geography.

By Component

Based on component, the market has been segmented into solution, process, and system. The system segment of the digital twin market led the market in 2023, reaching the valuation of USD 6.27 billion. This dominance can be attributed to the growing adoption of system-level digital twins across aerospace, automotive, and manufacturing to simulate and optimize complex operations.

These systems enable real-time monitoring, predictive maintenance, and enhanced performance management, driving significant demand. The component and process segments are also witnessing growth due to applications in specific operational areas, supported by advancements in IoT and AI.

By End Use

Based on end use, the market has been classified into manufacturing, agriculture, automotive & transport, energy & utilities, healthcare & life sciences, residential & commercial, retail & consumer goods, aerospace, telecommunication, and others. The automotive & transport segment of the market secured the largest revenue share of 3.08 billion in 2023.

This is due to the increasing use of digital twin technology in vehicle design, testing, and predictive maintenance. Automakers are leveraging digital twins to optimize production processes, enhance fuel efficiency, and improve overall vehicle performance.

Additionally, the adoption of digital twins in connected and autonomous vehicle development is accelerating to achieve real-time simulation and data analysis, ensuring safety and efficiency.

Digital Twin Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America digital twin market share stood around 34.26% in 2023 in the global market, with a valuation of USD 5.22 billion. This dominance is largely due to the region's advanced healthcare infrastructure, which facilitates the adoption of innovative technologies.

Leading healthcare providers in North America such as Mayo Clinic and Cleveland Clinic are integrating this technology for use in personalized medicine, virtual surgeries, and predictive analytics for equipment maintenance.

- In January 2024, Mayo Clinic partnered with SimBioSys to enhance AI-driven digital precision medicine for breast cancer patients. This collaboration aims to create cloud-based clinical software tools that assist in personalized surgical planning, treatment selection, and risk assessment for early-stage breast cancer patients. The initiative responds to the urgent need for individualized care in a rapidly evolving treatment landscape.

Moreover, government initiatives in the region are driving the growth of the digital twin market. These initiatives are providing funding and resources to create a conducive environment to technological innovation and the adoption of digital twin technology in North America.

- In November 2024, the CHIPS for America program announced a proposed USD 285 million award for establishing a CHIPS Manufacturing USA Institute for Digital Twins, headquartered in North Carolina. This initiative is expected to enhance R&D in digital twin technologies, thereby accelerating their integration into various industries across the region.

Asia-Pacific is poised for significant growth at a robust CAGR of 44.01% over the forecast period. Rapid industrialization and smart city initiatives in the Asia Pacific region are driving the adoption of digital twin technology to optimize manufacturing processes and improve urban infrastructure management.

For instance, China, India, and Japan are integrating digital twin technology into key industries such as manufacturing, energy, and urban planning to optimize processes and enhance infrastructure management.

- In February 2024, the Department of Telecommunications (DoT) of the Government of India announced the Sangam: Digital Twin Initiative. This initiative focuses on reforming infrastructure planning and management across the country by utilizing digital twin technology for real-time monitoring and analysis.

The rapid adoption of Industry 4.0 technologies across the Asia Pacific is further driving growth in the market. As countries continue to modernize their manufacturing sectors, the demand for digital twin solutions to optimize production processes, reduce costs, and improve efficiency is expected to surge in this region.

Competitive Landscape

The global digital twin market report provides valuable insight with a focus on the fragmented nature of the industry. Leading players are adopting various strategic approaches such as partnerships, mergers and acquisitions, product advancements, and collaborations to enhance their service offerings and strengthen their market presence across diverse regions.

Key initiatives, including increased investments in R&D, the development of advanced simulation platforms, and the integration of IoT and AI technologies, are anticipated to open new avenues for market growth.

List of Key Companies in Digital Twin Market

- General Electric

- Siemens

- NVIDIA Corporation

- IBM Corporation

- Microsoft

- ANSYS, Inc

- Bentley systems, incorporated

- Dassault Systems

- Oracle

- Altair Engineering Inc.

Key Industry Developments

- January 2025 (Launch): Siemens introduced Teamcenter Digital Reality Viewer, integrating NVIDIA Omniverse technology for photorealistic and physics-based digital twins. This tool enables real-time visualization and interaction with complex datasets, enhancing collaboration and decision-making across product lifecycles.

- January 2025 (Partnership): KION has partnered with NVIDIA and Accenture to enhance supply chains through AI-driven robots and digital twins. This collaboration introduces a digital twin that replicates the principles and characteristics of the physical world, to optimize the performance of smart warehouses.

The global digital twin market has been segmented:

By Component

- Solution

- Sensors and Actuators

- Mechanical Parts

- Electrical Components

- Others

- Process

- System

- Industrial Systems

- Smart Infrastructure

- Transportation Systems

By End Use

- Manufacturing

- Agriculture

- Automotive & Transport

- Energy & Utilities

- Healthcare & Life Sciences

- Residential & Commercial

- Retail & Consumer Goods

- Aerospace

- Telecommunication

- Others

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America