Market Definition

Power amplifiers are electronic devices that boost electrical signal power, enabling effective transmission and operation across audio, radio frequency, and microwave ranges. They support consistent signal strength, high fidelity, and efficient energy delivery in various electronic systems.

Applications include consumer electronics, telecommunications, aerospace, defense, and broadcasting, where amplified signals ensure reliable performance and connectivity. Industries such as automotive, healthcare, entertainment, and military utilize these devices to enhance communication, audio quality, radar operations, and overall system efficiency.

Power Amplifier Market Overview

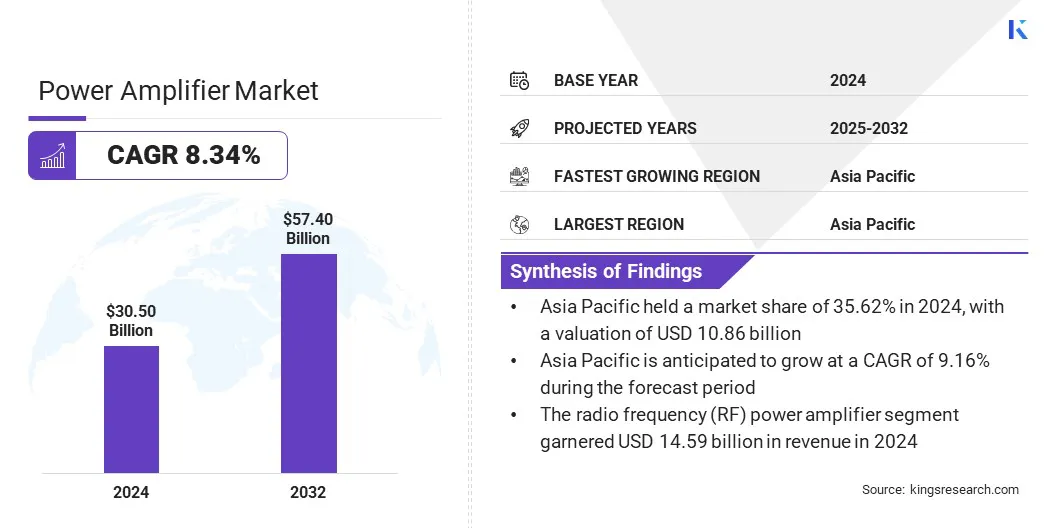

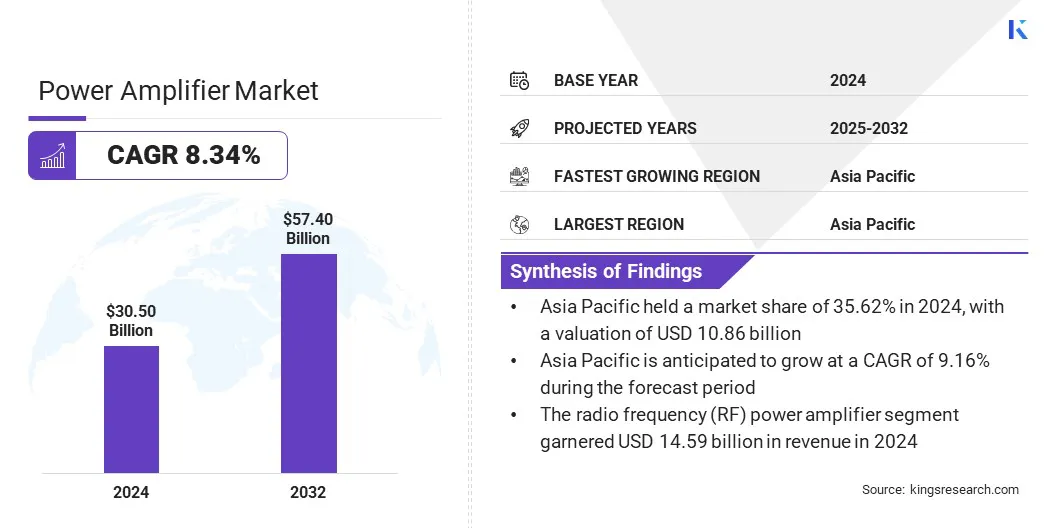

The global power amplifier market size was valued at USD 30.50 billion in 2024 and is projected to grow from USD 32.77 billion in 2025 to USD 57.40 billion by 2032, exhibiting a CAGR of 8.34% during the forecast period. This growth is attributed to the rising demand for high-performance electronic systems requiring reliable signal amplification across audio, radio frequency, and microwave applications.

The adoption of advanced power amplifier technologies, including gallium nitride (GaN) and gallium arsenide (GaAs) devices, is enhancing energy efficiency, output power, and operational reliability, further supporting market expansion.

Key Highlights

- The power amplifier industry size was USD 30.50 billion in 2024.

- The market is projected to grow at a CAGR of 8.34% from 2025 to 2032.

- Asia Pacific held a share of 35.62% in 2024, valued at USD 10.86 billion.

- The radio frequency (RF) power amplifier segment garnered USD 14.59 billion in revenue in 2024.

- The gallium arsenide (GaAs) segment is expected to reach USD 18.83 billion by 2032.

- The telecommunication segment is anticipated to witness the fastest CAGR of 8.96% over the forecast period.

- North America is anticipated to grow at a CAGR of 8.19% through the projection period.

Major companies operating in the power amplifier market are NXP Semiconductors, Analog Devices, Inc., Texas Instruments Incorporated, Infineon Technologies AG, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, STMicroelectronics, Broadcom, Qualcomm Technologies, Inc., Skyworks Solutions, Inc., Murata Manufacturing Co., Ltd., Qorvo, Inc., MACOM, Semiconductor Components Industries, LLC, Microchip Technology Inc., and ROHM Co., Ltd.

The increasing focus of industries such as telecommunications, consumer electronics, aerospace, and defense on signal integrity and system performance is fueling adoption of power amplifiers. Additionally, ongoing technological advancements, infrastructure upgrades, and rising investments in automotive, military, and broadcasting applications are further propelling market growth.

- In January 2023, NEC Corporation announced the development of a gallium arsenide (GaAs) power amplifier capable of delivering 10 mW output in the 150 GHz frequency band. The device is designed to support 5G Advanced and 6G wireless communication systems, including mobile access and fronthaul/backhaul applications. It provides high-speed, high-capacity signal amplification for next-generation network infrastructure.

Market Driver

Rising Demand for Advanced Communication Systems

The growth of the power amplifier market is fueled by the increasing demand for high-performance communication systems across audio, radio frequency, and microwave applications. These devices enable reliable signal amplification, high fidelity, and efficient energy delivery, supporting consistent connectivity and system performance.

Industries such as telecommunications, consumer electronics, aerospace, and defense are increasingly adopting power amplifiers to enhance communication quality, radar operations, and broadcasting capabilities. Adoption is being reinforced by the global rollout of 5G networks, satellite communications, and investments in wireless infrastructure. This shift is strengthening industries’ ability to deliver robust and efficient electronic and communication systems.

- In March 2025, Mitsubishi Electric announced sample shipments of a 16W gallium nitride (GaN) power amplifier module for 5G massive MIMO base stations. Operating in the 3.6–4.0 GHz band, the module targets North America and East and Southeast Asia. It aims to reduce power consumption and production costs, supporting the expansion of regional 5G networks.

Market Challenge

Low Operational Efficiency & Excessive Heat Dissipation

Low operational efficiency and excessive heat dissipation are hindering the expansion of the power amplifier market. Inefficient energy conversion generates heat that affects reliability, performance, and lifespan. Managing this thermal output demands advanced cooling systems, adding design complexity and cost.

Industries such as telecommunications, consumer electronics, aerospace, and defense face greater challenges as they require consistent signal amplification. The growing need for efficient thermal management and energy-optimized designs further complicates development and deployment, limiting widespread adoption across key high-performance applications.

To address these constraints, manufacturers are increasingly adopting advanced semiconductor technologies, optimized circuit designs, and innovative cooling techniques. These approaches aim to improve energy efficiency, reduce heat generation, and enhance the performance and reliability of power amplifiers across diverse applications.

- In February 2025, MaxLinear and RFHIC launched a high-efficiency power amplifier for 5G macro cell radio units. The solution integrates RFHIC’s GaN amplifiers with MaxLinear’s Sierra SoC and MaxLIN linearization, achieving 55.2% efficiency at 49.6 dBm output. It reduces power consumption, size, and weight, supporting more compact and energy-efficient Open RAN radio units.

Market Trend

Notable Shift Toward Semiconductor Materials

The power amplifier market is experiencing a significant shift toward advanced semiconductor materials such as gallium nitride (GaN) and silicon carbide (SiC). This is fueled by the need for higher efficiency, greater power output, and improved thermal management in demanding applications. These innovations enable more compact, reliable, and energy-efficient amplifiers, enhancing performance across telecommunications, aerospace, defense, and consumer electronics.

- In May 2025, Ampleon introduced a 2.4 GHz GaN RF power amplifier lineup for industrial, scientific, and medical applications. The amplifiers deliver up to 350 W output and feature a compact, energy-efficient design with built-in monitoring. Featuring GaN-on-SiC technology, dual-stage architecture, and built-in monitoring, they simplify thermal management and ensure robust performance.

Industries are increasingly adopting semiconductor-optimized power amplifiers to support 5G infrastructure, satellite communications, radar systems, and high-fidelity audio solutions. Advanced materials help reduce energy consumption, improve signal quality, and extend device lifespan.

Power Amplifier Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Audio Power Amplifier, Radio Frequency (RF) Power Amplifier, and Others

|

|

By Technology

|

Gallium Nitride (GaN), Gallium Arsenide (GaAs), Silicon Germanium (SiGe), and Other Technologies

|

|

By Vertical

|

Consumer Electronics, Healthcare, Aerospace and Defense, Telecommunication, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Audio Power Amplifier, Radio Frequency (RF) Power Amplifier, and Others): The radio frequency (RF) power amplifier segment earned USD 14.59 billion in 2024, mainly due to rising demand for high-speed wireless communication and 5G network deployment.

- By Technology (Gallium Nitride (GaN), Gallium Arsenide (GaAs), Silicon Germanium (SiGe), and Other Technologies): The gallium arsenide (GaAs) segment held a share of 32.74% in 2024, propelled by its high-frequency performance and widespread use in telecommunications and aerospace applications.

- By Vertical (Consumer Electronics, Healthcare, Aerospace and Defense, Telecommunication, and Others): The consumer electronics segment is projected to reach USD 21.64 billion by 2032, owing to the growing adoption of smart devices, home entertainment systems, and wearable technologies requiring high-performance amplification.

Power Amplifier Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific power amplifier market share stood at 35.62% in 2024, valued at USD 10.86 billion. This dominance is reinforced by rapid technological advancements, widespread 5G network deployment, and strong growth in consumer electronics and smart device adoption.

Growth is further supported by significant investments in telecommunications infrastructure, aerospace, defense, and automotive electronics, along with government initiatives, strategic industry partnerships, and a robust manufacturing ecosystem. Continuous improvements in semiconductor technologies, thermal management, and high-efficiency amplifier designs position Asia Pacific as a key hub for power amplifiers.

- In February 2025, Japan-based TEAC Corporation announced the AP-507 stereo power amplifier featuring a custom-tuned Hypex NCOREx module. The device delivers high output power with options for stereo, bi-amp, and BTL configurations. It incorporates balanced circuitry, a dual-mono buffer, and a fanless design for quiet operation. The AP-507 is scheduled for global release in Spring 2025 and will be available in black and silver finishes.

The North America power amplifier industry is set to grow at a CAGR of 8.19% over the forecast period. This growth is fueled by increasing deployment of high-speed communication networks, rising demand for consumer electronics, and growing adoption of advanced power amplifier technologies across sectors such as telecommunications, aerospace, and defense.

Expanding industrial and commercial applications in the region are leveraging high-efficiency amplifiers and innovative semiconductor materials to enhance signal quality, reduce energy consumption, and improve system reliability. Additionally, government initiatives supporting 5G infrastructure and investments in smart devices are fostering domestic market expansion.

Furthermore, industries are prioritizing compact designs, thermal management solutions, and energy-efficient amplification, supported by continuous R&D and technological advancements, to enable next-generation electronic and communication systems. The proliferation of connected devices and increasing demand for reliable high-frequency transmission are further propelling regional market growth.

- In March 2025, Empower RF Systems announced a distribution agreement with RFMW, a distributor of RF, microwave, millimeter-wave, and power components. The collaboration aims to expand access to Empower RF’s high-performance amplifier solutions, including smart module power amplifiers with modular scalability, advanced monitoring, and software-defined control. The partnership enhances both companies’ ability to serve industries such as defense, aerospace, medical, and communications.

Regulatory Frameworks

- In the U.S., 47 CFR § 97.315 regulates external RF power amplifiers capable of operation below 144 MHz. It mandates certification for use in amateur radio, ensuring devices meet technical and safety standards.

- In the European Union, EMC Directive 2014/30/EU oversees electromagnetic compatibility of electrical and electronic equipment. It ensures that power amplifiers do not cause electromagnetic interference and are immune to such interference, facilitating their safe operation.

- In Japan, Technical Regulations Conformity Certification for Radio Equipment (Radio Law) governs electromagnetic interference from radio equipment. It ensures that power amplifiers used in telecommunications and broadcasting comply with interference standards to maintain communication quality.

Competitive Landscape

Companies operating in the power amplifier industry are maintaining competitiveness through investments in advanced semiconductor technologies, high-efficiency circuit designs, and strategic partnerships and acquisitions. They are developing power amplifiers for high-performance applications in telecommunications, consumer electronics, aerospace, and defense sectors to enhance signal quality, reliability, and energy efficiency.

Market players are expanding their offerings with GaN- and GaAs-based solutions, compact designs, and thermal management innovations to meet evolving industry requirements. Moreover, they are establishing regional manufacturing and support centers, collaborating with technology providers, and offering technical assistance and training programs to boost adoption and sustain competitive positioning.

- In May 2025, NAD Electronics introduced the Masters M33 V2 BluOS Streaming Amplifier and M23 V2 Stereo Power Amplifier at the HIGH END Show in Munich. The M33 V2 features advanced DAC and amplifier modules, while the M23 V2 offers high dynamic range and low distortion.

Top Key Companies in Power Amplifier Market:

- NXP Semiconductors

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Infineon Technologies AG

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- STMicroelectronics

- Broadcom

- Qualcomm Technologies, Inc.

- Skyworks Solutions, Inc.

- Murata Manufacturing Co., Ltd.

- Qorvo, Inc.

- MACOM

- Semiconductor Components Industries, LLC

- Microchip Technology Inc.

- ROHM Co., Ltd

Recent Developments (M&A/New Product Launch)

- In March 2025, Technical Audio Devices Laboratories, Inc. (TADL) introduced the TAD-M2500TX, a two-channel power amplifier in its Evolution Series. The amplifier delivers 550 watts per channel at 4 ohms and features a redesigned circuit, upgraded power transformers, and a machined aluminum chassis.

- In February 2025, MaxLinear and RFHIC Corporation unveiled a high-efficiency power amplifier solution for 5G macro cell radio units. The solution integrates RFHIC’s GaN power amplifier with MaxLinear’s Sierra SoC and MaxLIN digital pre-distortion technology, achieving 55.2% efficiency. It reduces power consumption, size, and weight, supporting more compact and energy-efficient Open RAN deployments.

- In January 2025, Guerrilla RF introduced the GRF0020D and GRF0030D GaN on SiC HEMT dice. The transistors provide up to 50 W of saturated power across DC to 7 GHz and support 28 V or 50 V supply rails. They are intended for integration into custom MMICs for applications in wireless infrastructure, military, aerospace, and industrial heating.

- In May 2024, Ampleon introduced advanced high-power RF transistors featuring its ART technology. The ART2K5TFUS and ART2K5TPU models operate in Class AB from 1 MHz to 400 MHz with 80–90% efficiency, offering high breakdown voltage and ruggedness. The transistors are designed for industrial, scientific, and medical applications such as plasma generators, CO₂ lasers, UHF radars, and MRI scanners.

- In October 2023, AMETEK, Inc. acquired Amplifier Research Corp., a manufacturer of radio frequency (RF) and microwave amplifiers. The acquisition strengthens AMETEK’s offerings in electronic test and measurement solutions. Amplifier Research Corp. provides high-performance amplifiers for applications across aerospace, defense, and communications industries.