Market Definition

Gallium nitride (GaN) is a wide bandgap semiconductor material known for high electron mobility and thermal stability. It supports efficient power conversion and high-frequency signal transmission in compact device designs.

The scope of the market spans power electronics for electric vehicles and renewable energy systems, radio-frequency components for 5G networks, light-emitting diodes, and laser diodes. Electronics manufacturers, automotive suppliers, and telecom equipment providers use GaN to improve energy efficiency, signal performance, and system miniaturization.

Gallium Nitride Market Overview

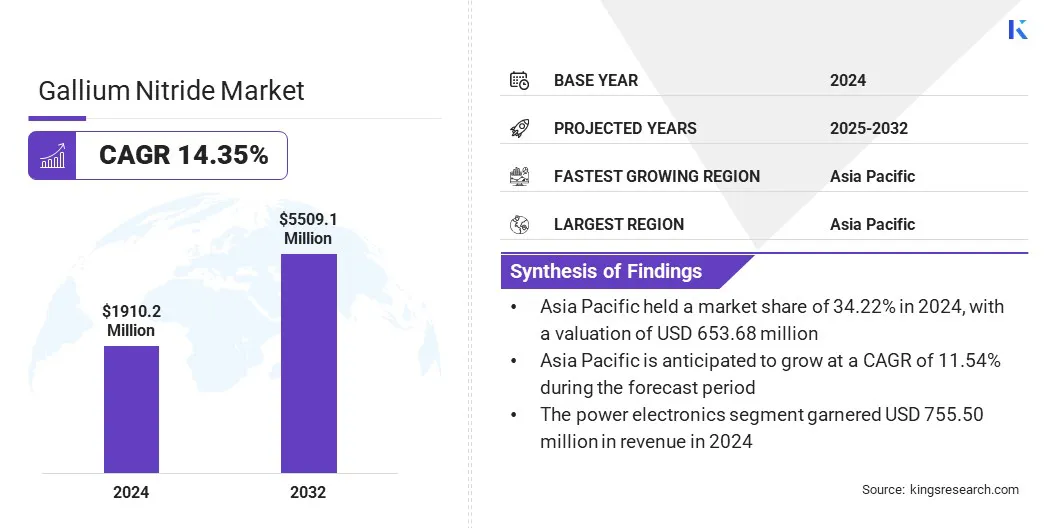

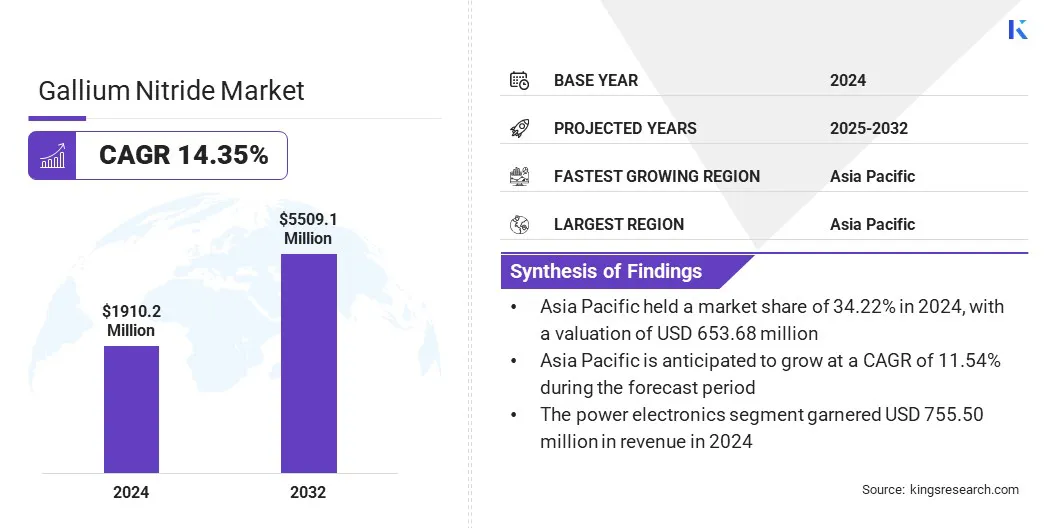

The global gallium nitride market size was valued at USD 1,910.23 million in 2024 and is projected to grow from USD 2,154.47 million in 2025 to USD 5,509.08 million by 2032, exhibiting a CAGR of 14.35% during the forecast period.

The growth of the market is driven by increasing demand in RF and microwave applications, where GaN offers high efficiency and performance at high frequencies. Moreover, innovations such as GaN-on-silicon are boosting adoption by enabling cost-effective, high-performance power devices for automotive, renewable energy, and data center applications.

Key Highlights

- The gallium nitride industry size was USD 1,910.23 million in 2024.

- The market is projected to grow at a CAGR of 14.35% from 2025 to 2032.

- Asia Pacific held a share of 34.22% in 2024, valued at USD 653.68 million.

- The GaN-on-SiC segment garnered USD 655.40 million in revenue in 2024.

- The 125–150 mm segment is expected to reach USD 2,542.66 million by 2032.

- The power electronics segment secured the largest revenue share of 39.55% in 2024.

- The automotive segment is set to grow at a robust CAGR of 15.52% through the forecast period.

- North America is anticipated to grow at a CAGR of 14.40% over the projection period.

Major companies operating in the gallium nitride industry are Innoscience, Efficient Power Conversion Corporation, Infineon Technologies AG, NXP Semiconductors, STMicroelectronics, Texas Instruments Incorporated, Renesas Electronics Corporation, Navitas Semiconductor, Wolfspeed, Inc., Mitsubishi Chemical Group Corporation, ROHM Co., Ltd., Semiconductor Components Industries, LLC, Qorvo, Inc., EPISTAR Corporation, and Nichia Corporation.

Rising demand for energy-efficient power electronics is fueling market expansion. GaN-based devices deliver higher efficiency and faster switching speeds compared to traditional silicon components. These properties support the development of compact power supplies, high-frequency inverters, and fast chargers used across consumer electronics, telecommunications, automotive, and industrial automation.

- In November 2024, Infineon Technologies launched the CoolGaN Transistors 650 V G5 series of high-voltage GaN power discretes. These transistors are designed for switched-mode power supplies, USB-C chargers and adapters, lighting, TVs, telecom rectifiers, renewable energy, and motor drives.

Additionally, growing focus on reducing power loss in smartphones, data centers, and 5G base stations is highlighting the need for GaN solutions. Adoption in renewable energy inverters and electric vehicle chargers is expanding as companies seek reliable high-performance semiconductors, supporting market expansion.

Market Driver

Growth in RF and Microwave Applications

The growth of the gallium nitride market is being driven by increasing adoption in radio frequency (RF) and microwave applications across defense, aerospace, telecommunications, and industrial automation. GaN’s ability to operate efficiently at high frequencies is supporting its use in advanced radar systems for military surveillance, air-traffic control, and weather monitoring.

Increasing deployment of GaN amplifiers in satellite communications is enabling stable signal transmission for broadcasting, navigation, and broadband connectivity. Expansion of 5G base stations in urban and rural networks is creating strong demand for GaN components to achieve high output power and low signal distortion.

- In March 2025, Mitsubishi Electric launched the 16W GaN Power Amplifier Module for 5G massive Multiple-Input Multiple-Output base stations designed to operate in the 3.6–4.0 GHz frequency band. It is suited for 32T32R mMIMO base stations, reducing power consumption and production costs by requiring fewer PAMs compared to lower-power configurations.

Market Challenge

Material Defects and Reliability Issues

A key challenge impeding the progress of the gallium nitride market is addressing material defects that impact device reliability. Crystal imperfections such as dislocations reduce efficiency and shorten the operational life of GaN-based components. Heat dissipation difficulties further limit performance, particularly in high-power electronics such as electric vehicle chargers and in high-frequency systems such as 5G base stations and radar.

To address this challenge, market players are improving crystal growth techniques, enhancing substrate quality, and developing advanced thermal management solutions. These initiatives are strengthening device durability and supporting the wider adoption of gallium nitride technology in power electronics and RF applications.

- In October 2023, Transphorm launched the SuperGaN Top-Side Cooled TOLT FET, the TP65H070G4RS This is the company’s first standard GaN transistor in the JEDEC-standard TOLT package with top-side cooling. The surface-mountable device delivers TO-247 comparable thermal performance, enhanced efficiency, and improved manufacturability.

Market Trend

Development of GaN-on-Silicon and Advanced Substrate Innovations

A key trend influencing the gallium nitride market is the adoption of GaN-on-silicon and GaN-on-silicon-carbide substrates for power and RF devices. These advanced wafers are lowering manufacturing costs and supporting higher scalability for large production volumes. Improved thermal conductivity and lattice matching are enhancing device reliability and performance in demanding applications.

Power electronics, 5G infrastructure, and electric vehicle systems are adopting these substrates to achieve better efficiency and compact designs. Research and industrial investments are accelerating the shift from traditional materials to optimized GaN platforms.

- In July 2025, Navitas Semiconductor partnered with Powerchip Semiconductor Manufacturing Corporation (PSMC) to initiate 200 mm GaN-on-silicon production, leveraging PSMC’s 200 mm Fab 8B and its 180 nm CMOS process node. The collaboration aims to manufacture devices with voltage ratings from 100 V to 650 V, targeting applications that include 48 V infrastructure, electric vehicles, AI data centers, and renewable energy systems.

Gallium Nitride Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

GaN-on-Si, GaN-on-SiC, GaN-on-Sapphire, GaN-on-GaN

|

|

By Wafer Size

|

Up to 100 mm, 125–150 mm, 200 mm and Above

|

|

By Application

|

Power Electronics, Consumer Electronics, RF & Microwave Electronics, Optoelectronics

|

|

By Vertical

|

Automotive, Aerospace & Defense, Telecommunication, Energy & Power, Consumer Devices, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (GaN-on-Si, GaN-on-SiC, GaN-on-Sapphire, and GaN-on-GaN): The GaN-on-SiC segment earned USD 655.40 million in 2024, mainly due to its superior thermal conductivity and high breakdown voltage.

- By Wafer Size (Up to 100 mm, 125–150 mm, and 200 mm and Above): The 125–150 mm segment held a share of 41.65% in 2024, propelled by its optimal balance of production efficiency and cost-effectiveness.

- By Application (Power Electronics, Consumer Electronics, RF & Microwave Electronics, and Optoelectronics): The power electronics segment is projected to reach USD 2,408.67 million by 2032, owing to its widespread adoption in electric vehicles, renewable energy systems, and high-efficiency power conversion applications.

- By Vertical (Automotive, Aerospace & Defense, Telecommunication, Energy & Power, Consumer Devices, Healthcare, and Others): The automotive segment is set to grow at a robust CAGR of 15.52% through the forecast period, largely attributed to the growing adoption of electric and hybrid vehicles, which require high-efficiency power electronics, fast charging systems, and reliable GaN-based components.

Gallium Nitride Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific gallium nitride market share stood at 34.22% in 2024, valued at USD 653.68 million. This dominance is reinforced by strong investments in advanced semiconductor manufacturing, particularly in facilities producing GaN wafers and epitaxial layers.

- In May 2024, the Malaysian government announced initiatives to boost integrated circuit design capabilities, advanced packaging, and semiconductor chip manufacturing equipment. These measures aim to attract around USD 107 billion in investments to elevate the country’s position as a global semiconductor manufacturing hub.. Recent significant investments include Intel's USD 7 billion advanced chip packaging plant and Infineon's USD 5.9 billion power chip plant expansion.

Regional foundries are expanding capacity to meet the rising demand for high-performance materials in power conversion and RF systems. Consumer electronics companies in the region are increasing the use of GaN materials for compact and energy-efficient chargers, displays, and lighting products, which is supporting consistent regional market expansion.

The North America gallium nitride industry is set to grow at a robust CAGR of 14.40% over the forecast period, driven by rising demand for advanced radar and communication systems. Defense contractors are increasingly incorporating GaN-based RF devices to enhance performance in radar and satellite communications, as high-power, high-frequency GaN components enable systems to operate more efficiently under extreme conditions.

Additionally, investment in next-generation aerospace platforms is fueling the need for reliable GaN materials in critical applications. To support this growth, manufacturers are focusing on improving wafer quality and scaling production to meet stringent defense standards, ensuring both performance and reliability in demanding environments.

- In May 2024, Raytheon Technologies delivered an advanced radar system to the U.S. Missile Defense Agency. This system, incorporating gallium nitride (GaN) technology, enhances the nation's defense capabilities against hypersonic missiles. The integration of GaN semiconductors significantly improves the radar's sensitivity, range, and resistance to electronic interference.

Regulatory Frameworks

- In the U.S., GaN materials and devices are subject to export controls under the Export Administration Regulations (EAR), administered by the Bureau of Industry and Security (BIS). Specific items are classified under Export Control Classification Numbers (ECCNs) such as 3C001, 3C005, and 3C006. These classifications require exporters to obtain licenses and provide end-user documentation, particularly when exporting to countries of concern. EAR outlines these requirements, aiming to prevent the proliferation of technologies that could enhance adversarial military capabilities. Manufacturers must also comply with environmental regulations such as the Clean Air Act and the Clean Water Act, which govern emissions and wastewater discharges.

- In China, the Ministry of Commerce (MOFCOM) regulates GaN materials and devices under the Export Control Law of the People's Republic of China, effective since 2021. Exporters must secure licenses for items on China's export control lists and provide end-user documentation.

- In Japan, GaN materials and devices are subject to the Export Trade Control Order, administered by the Ministry of Economy, Trade, and Industry (METI). The order lists items that require export approval, including GaN-related equipment and technologies. Exporters must obtain approval from METI prior to export.

- In India, export controls on GaN materials and devices are enforced under the Special Chemicals, Organisms, Materials, Equipment, and Technologies (SCOMET) list, maintained by the Directorate General of Foreign Trade (DGFT). Exporters must secure licenses and provide end-user documentation before exporting listed items.

Competitive Landscape

Major players in the gallium nitride industry are adopting strategies such as increased research and development, strategic partnerships, and technological advancements to remain competitive. Companies are focusing on improving the efficiency, reliability, and integration of GaN components to meet the growing demand in automotive, renewable energy, and data center applications.

Collaboration with other technology providers allows faster innovation and accelerates the introduction of new products. Investment in next-generation IC designs and packaging technologies ensures higher power density and thermal performance. Firms are also expanding production capabilities to scale up output while maintaining quality standards.

- In April 2025, Navitas Semiconductor unveiled the 650V bi-directional GaNFast ICs featuring IsoFast isolated gate drivers. These automotive-qualified ICs (AEC-Q100/Q101) are designed for EV charging (on-board and roadside), solar inverters, energy storage, motor drives, and AI data centers power supplies.

Key Companies in Gallium Nitride Market:

- Innoscience

- Efficient Power Conversion Corporation

- Infineon Technologies AG

- NXP Semiconductors

- STMicroelectronics

- Texas Instruments Incorporated

- Renesas Electronics Corporation.

- Navitas Semiconductor

- Wolfspeed, Inc.

- Mitsubishi Chemical Group Corporation.

- ROHM Co., Ltd.

- Semiconductor Components Industries, LLC

- Qorvo, Inc.

- EPISTAR Corporation

- Nichia Corporation

Recent Developments (M&A/Agreement/Product Launches)

- In July 2025, Renesas Electronics introduced its Gen IV Plus 650V GaN FETs for multi-kW AI data centers, EV charging, battery energy storage, solar inverters, and power systems. Built on SuperGaN platform, the devices offer multiple package options and target high voltage, high power applications with reduced switching losses.

- In March 2025, STMicroelectronics and Innoscience signed a joint development agreement to advance gallium nitride (GaN) power technology. This collaboration aims to enhance GaN power solutions for applications such as artificial intelligence data centers, renewable energy systems, and electric vehicles.

- In March 2025, Texas Instruments launched new integrated GaN power stages and a 48V hot-swap eFuse (TPS1685) for data center applications. The integrated GaN power stages combine a gate driver and GaN FET in TOLL packages, enhancing efficiency and power density for power supplies, particularly in server power management.

- In June 2024, Renesas Electronics Corporation acquired Transphorm Inc., to strengthen its capabilities in wide bandgap (WBG) technologies and positions the company to address the growing demand for energy-efficient power solutions. The acquisition includes Transphorm's portfolio of GaN-based power products and reference designs, which are pivotal for applications in electric vehicles, renewable energy systems, and data centers.