Market Definition

The market involves the production, distribution, and use of excipients in the pharmaceutical sector. Excipients are inert substances that are used in the formulation of drugs alongside the active pharmaceutical ingredients.

These substances serve various roles as binders, fillers, preservatives, stabilizers, colorants, flavoring agents, and disintegrants, among others. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping industry growth.

Pharmaceutical Excipients Market Overview

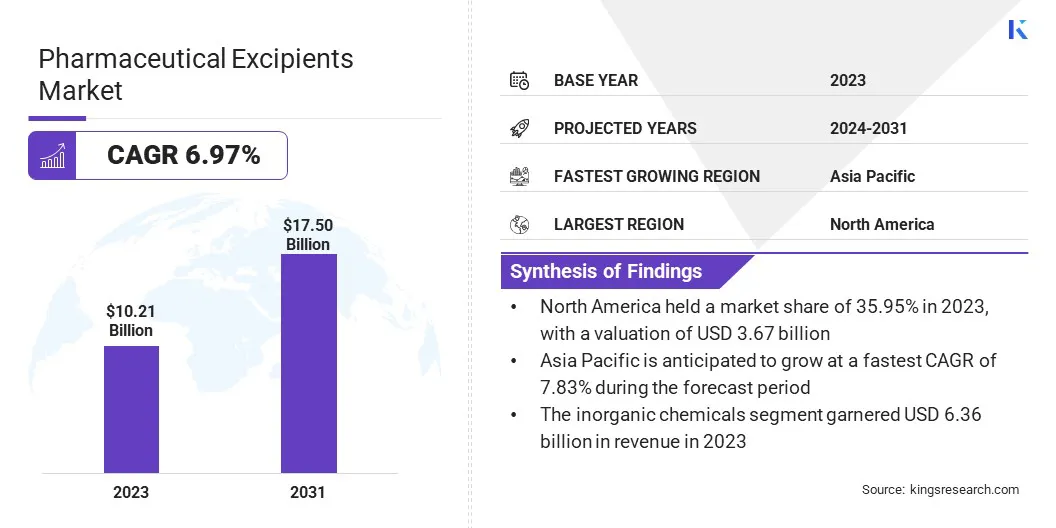

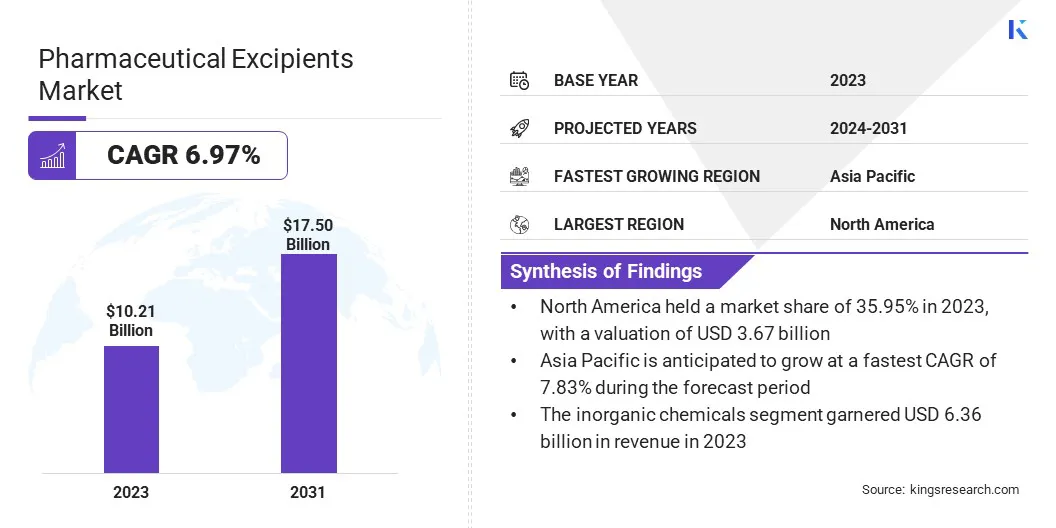

The global pharmaceutical excipients market size was valued at USD 10.21 billion in 2023 and is projected to grow from USD 10.92 billion in 2024 to USD 17.50 billion by 2031, exhibiting a CAGR of 6.97% during the forecast period.

Market expansion is driven by the growing demand for effective drug formulations and the increasing need for specialized excipients in new drug delivery systems. Advancements in controlled-release and targeted drug delivery technologies are expanding the use of excipients.

Major companies operating in the pharmaceutical excipients industry are Evonik Industries AG, BASF SE, Roquette, Lubrizol Corporation, Ashland Inc, DMV-Fonterra Excipients GmbH & Co. KG, Archer Daniels Midland Company, Croda International PLC, Kerry Group, Associated British Foods PLC, Avantor, Colorcon, DuPont, IFF, and JRS PHARMA.

The expansion of manufacturing facilities and increased production capacity are improving supply security and reducing delivery times. Rising demand for specialized excipients is being efficiently met through such investments.

Additionally, these developments focus on sustainable and innovative manufacturing processes, enhancing product availability, supporting technological advancement, and strengthening market competitiveness.

- In September 2024, Evonik inaugurated a new facility for drying aqueous dispersions of EUDRAGIT polymers at its site in Darmstadt, Germany. The new multi-million-euro excipient manufacturing plant aims to meet the growing demand for functional excipients used in oral drug delivery. By expanding production capacities, the plant enhances supply security, shortens delivery times, and supports Evonik's position as a global hub for oral pharma excipients. The facility operates using green electricity and steam from local waste incineration, reducing CO2 emissions by over 1,000 tons annually.

Key Highlights:

- The pharmaceutical excipients market size was recorded at USD 10.21 billion in 2023.

- The market is projected to grow at a CAGR of 6.97% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 3.67 billion.

- The inorganic chemicals segment garnered USD 6.36 billion in revenue in 2023.

- The fillers & diluents segment is expected to reach USD 2.86 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.83% over the forecast period.

Market Driver

Advancements in Drug Delivery Systems

The development of advanced drug delivery systems is fueling demand for excipients that offer moisture protection, formulation flexibility, and enhanced stability.

The increasing use of moisture-sensitive active ingredients in pharmaceuticals and nutraceuticals requires excipients that can maintain product integrity under challenging conditions. This demand supports the growth of specialized excipients designed to improve the consistency, shelf life, and performance of modern drug formulations.

- In October 2023, Roquette expanded its portfolio of excipients for moisture-sensitive pharmaceutical and nutraceutical ingredients by adding three new grades such as LYCATAB CT-LM (partially pregelatinized starch), MICROCEL 103 SD, and MICROCEL 113 SD microcrystalline cellulose. Introduced at CPHI Barcelona, these products offer enhanced stabilization and moisture protection, empowering pharmaceutical manufacturers to optimize drug delivery across various production methods and formulations.

Market Challenge

Supply Chain Disruptions

A major challenge hindering the progress of the pharmaceutical excipients market is supply chain disruptions. Reliance on raw materials from specific regions and the market's global scope make it vulnerable to interruptions. These disruptions can lead to delays in production, increased costs, and shortages of critical excipients, affecting drug manufacturing timelines and prices.

Pharmaceutical excipient companies can diversify their supplier base and establish local sourcing options to address this challenge. Strengthening relationships with suppliers and investing in supply chain technology for better forecasting and risk management can mitigate delays. Additionally, maintaining safety stock and building more resilient supply chains can help ensure continuity in production.

Market Trend

Rise of Multifunctional Excipients

The growing need for efficiency in pharmaceutical manufacturing is promoting the shift toward multifunctional excipients, boosting the development of the market.

These excipients combine multiple functions, such as disintegration, lubrication, and improved powder flow, into a single product, reducing the need for multiple ingredients and manufacturing steps. This simplification leads to cost savings and streamlined production processes.

Additionally, as pharmaceutical manufacturing increasingly adopts direct compression and continuous manufacturing methods, demand grows for excipients that can support these advanced techniques. Multifunctional excipients enhance tablet hardness and ensure consistent product quality, aligning with the industry's focus on improving both productivity and quality.

- In June 2023, Ashland introduced Polyplasdone Plus, a co-processed multifunctional direct compression superdisintegrant containing a glidant and lubricant. This multifunctional disintegrant offers superior powder flow and lubrication in pharmaceutical manufacturing, streamlining equipment setup by eliminating two steps. It improves tablet hardness and supports consistent, high-quality production in both batch and continuous manufacturing. The product is designed to support improvements in pharmaceutical excipient processing.

Pharmaceutical Excipients Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Inorganic Chemicals (Calcium Phosphate, Metal Oxides, Halites, Calcium Carbonate, Others), Organic Chemicals (Oleochemicals, Carbohydrates, Petrochemicals, Proteins, Others)

|

|

By Functionality

|

Fillers & Diluents, Binders, Suspension & Viscosity Agents, Coatings, Flavoring Agents, Disintegrants, Colorants, Preservatives, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Inorganic Chemicals and Organic Chemicals): The inorganic chemicals segment earned USD 6.36 billion in 2023 due to the increasing demand for excipients that enhance the stability and bioavailability of active pharmaceutical ingredients, particularly in solid dosage forms like tablets and capsules.

- By Functionality (Fillers & Diluents, Binders, Suspension & Viscosity Agents, Coatings, Flavoring Agents, Disintegrants, Colorants, Preservatives, and Others): The fillers & diluents segment held a share of 16.69% in 2023, largely attributed to their critical role in drug formulation, in ensuring tablet size, consistency, and overall stability.

Pharmaceutical Excipients Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America pharmaceutical excipients market is accounted for a share of around 35.95% in 2023, valued at USD 3.67 billion. This dominance is reinforced by the increasing demand for generic and biologic drugs, along with the presence of major pharmaceutical companies. Strategic acquisitions by the companies have expanded their production capabilities and regional reach.

Regional market expansion is further supported by well-established pharmaceutical manufacturing infrastructure, which enables efficient production and distribution. Additionally, the demand for advanced drug delivery systems and ongoing innovations in pharmaceutical formulations continues to propel this expansion.

- In March 2024, Roquette acquired IFF Pharma Solutions, a leading global producer of excipients for oral dosage forms. This initiative strengthens Roquette's position in the pharmaceutical industry by expanding its product range and accelerating growth. The acquisition enhances Roquette's U.S. presence and boosts its formulation and drug delivery capabilities.

The Asia Pacific pharmaceutical excipients industry is estimated to grow at a CAGR of 7.83% over the forecast period. This growth is bolstered by the region's expanding pharmaceutical manufacturing capabilities, increasing demand for both generic and branded drugs, and growing investments in healthcare infrastructure.

Additionally, the rising adoption of advanced drug delivery systems and the increasing focus on improving products further contribute to domestic market expansion. The region's growing population and increasing healthcare needs are boosting the demand for pharmaceutical excipients.

- In November 2024, Clariant introduced its latest healthcare product portfolio at the CPHI India tradeshow in Delhi NCR, showcasing its made-in-India solutions. The exhibition highlighted Clariant Health Care’s expertise in biologics, generics, and excipient production, targeting the growing Indian healthcare market.

Regulatory Framework

- In Europe, the European Medicines Agency regulates pharmaceutical excipients, requiring compliance with the European Pharmacopoeia (Ph. Eur.) quality standards. Additionally, excipients with known actions or effects must be clearly labeled to inform healthcare professionals and patients.

- In China, the National Medical Products Administration enforces stringent registration process. It mandates the submission of Drug Master Files (DMFs) detailing excipient quality, manufacturing, and safety data, ensuring compliance with regulatory standards.

- In the U.S., the Food and Drug Administration regulates pharmaceutical excipients under the Federal Food, Drug, and Cosmetic Act. Excipients must comply with the United States Pharmacopeia (USP) and are subject to FDA oversight to ensure safety and efficacy in pharmaceutical products.

Competitive Landscape

The pharmaceutical excipients market is characterized by a moderately consolidated competitive landscape, comprising both established multinational corporations and specialized regional players. Market participants are focusing on expanding their product portfolios to offer a wide range of high-quality excipients, as well as strengthening their regional market presence by entering new geographic markets.

Additionally, market players are aiming to provide versatile excipients tailored to various pharmaceutical applications, aiming to enhance flexibility and streamline product development and manufacturing.

- In February 2025, Brenntag announced a strategic partnership with MEGGLE Excipients to offer a broad portfolio of lactose-based excipients in the Netherlands, Belgium, Norway, Finland, and Sweden. The portfolio includes over 30 high-quality products for various pharmaceutical applications, such as tableting, powder preparations, and Dry Powder Inhalation. These versatile excipients provide optimal solutions to meet specific formulation requirements, ensuring flexibility and efficiency in product development and manufacturing.

List of Key Companies in Pharmaceutical Excipients Market:

- Evonik Industries AG

- BASF SE

- Roquette

- Lubrizol Corporation

- Ashland Inc

- DMV-Fonterra Excipients GmbH & Co. KG

- Archer Daniels Midland Company

- Croda International PLC

- bKerry Group

- Associated British Foods PLC

- Avantor

- Colorcon

- DuPont

- IFF

- JRS PHARMA

Recent Developments (M&A/New Product Launch)

- In February 2024, IMCD N.V. acquired the remaining 30% stake in Signet Excipients Private Limited, securing full ownership. The initial agreement was announced in September 2020.

- In May 2023, Roquette launched PEARLITOL ProTec, a plant-based co-processed excipient designed to enhance the stability and shelf life of moisture-sensitive ingredients like probiotics. Introduced at Vitafoods Europe 2023, the mannitol and maize starch blend offers improved consistency and supports innovative, consumer-friendly dosage formats. The launch underscores Roquette’s commitment to advancing nutraceutical solutions through versatile and stable excipient technologies.