Market Definition

Omnichannel order management is a centralized system that enables businesses to manage, track, and fulfill customer orders across multiple sales channels, including online, offline, and mobile channels. It provides real-time inventory visibility, integrates seamless sales and distribution networks, and ensures consistent customer experiences.

The system streamlines order processing, optimizes fulfillment, and improves operational efficiency while addressing rising consumer demands for convenience and flexibility.

Omnichannel Order Management Market Overview

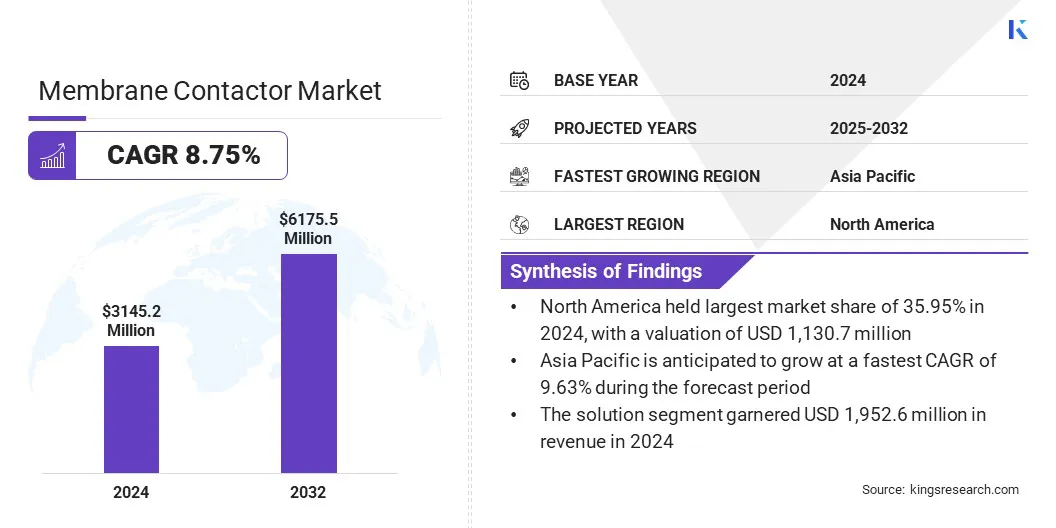

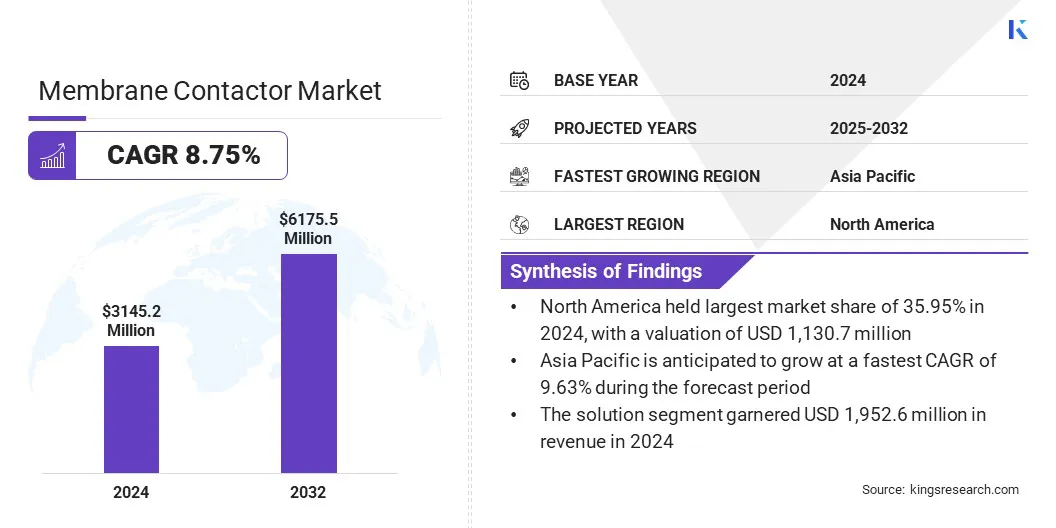

According to Kings Research, the global omnichannel order management market size was valued at USD 3,145.2 million in 2024 and is projected to grow from USD 3,413.2 million in 2025 to USD 6,175.5 million by 2032, exhibiting a CAGR of 8.75% during the forecast period.

This growth is driven by the rising adoption of cloud-based omnichannel platforms that enhance scalability, flexibility, and real-time visibility. These benefits support customer engagement while improving operational efficiency and cost optimization.

Key Market Highlights:

- The omnichannel order management industry size was recorded at USD 3,145.2 million in 2024.

- The market is projected to grow at a CAGR of 8.75% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 1,130.7 million.

- The solution segment garnered USD 1,952.6 million in revenue in 2024.

- The on-premises segment is expected to reach USD 3,410.7 million by 2032.

- The small and medium enterprises segment is anticipated to witness the fastest CAGR of 9.32% over the forecast period.

- The smart order management segment is estimated to hold a share of 29.94% by 2032.

- The manufacturing segment accounted for a share of 26.23% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 9.63% through the projection period.

Major companies operating in the omnichannel order management market are Zoho Corporation Pvt. Ltd., Sage Group plc, IBM Corporation, Manhattan Associates, Oracle, SAP SE, Salesforce, Inc., HCL Technologies Limited, Brightpearl, Aptean, Blue Yonder Group, Inc., Infosys Limited, Körber AG, Cognizant, and TATA Consultancy Services Limited.

Market development is propelled by the rising consumer demand for seamless cross-channel experiences. Modern consumers seek consistent engagement across physical stores, e-commerce platforms, and mobile applications along with real-time inventory visibility, unified pricing, and flexibility delivery or pickup options.

This shift has compelled retailers to invest in advanced order management systems that integrate multiple sales and distribution channels. Addressing these concerns helps businesses improve customer satisfaction, strengthen brand loyalty, and remain competitive in an increasingly digital-driven retail landscape.

A key factor fueling the growth of the omnichannel order management market is the accelerated development of e-commerce and online shopping platforms.

The demand for faster deliveries, personalized recommendations, and efficient return processes is further accelerating investments in advanced order management technologies, serve as a pivotal force in driving growth across the digital commerce ecosystem.

The surge in online retail is increasing the complexity of order processing, fulfillment, and last-mile delivery. Businesses are turning to omnichannel solutions to manage inventory effectively, synchronize operations, and offer seamless shopping experiences across multiple digital touchpoints.

- DHL reported that 70% of global consumers expect social media to be their primary shopping channel by 2030, with the same share already making purchases through these platforms. Malaysia leads at 95%, followed by Argentina at 94% and India at 93%, where Amazon drives omnichannel growth across diverse consumer segments.

A major challenge hindering the expansion of the omnichannel order management market is the persistent concerns regarding data privacy and cybersecurity in digital platforms. Organizations are facing threats such as data breaches, phishing, and ransomware, which compromise customer information and disrupt business continuity.

Rising volumes of sensitive transaction data across multiple channels are increasing vulnerabilities, making security a top priority for retailers and technology providers.

To address this challenge, companies are implementing advanced encryption, multi-factor authentication, and compliance with global data protection regulations. Leveraging secure cloud infrastructures and AI-driven threat detection is enabling companies to strengthen trust while ensuring safe omnichannel operations.

- For instance, in September 2024, Tata Consultancy Services (TCS) partnered with Google Cloud to deliver advanced cybersecurity solutions. The collaboration strengthens enterprise resilience by enabling security teams to detect and respond to threats more efficiently.

Growing Integration of AI and Machine Learning in Order Management

A notable trend influencing the omnichannel order management market is the growing integration of artificial intelligence (AI) and machine learning (ML). These technologies enable advanced capabilities such as real-time demand forecasting, intelligent inventory allocation, and optimized order routing across channels.

By leveraging AI and ML, enterprises can reduce stockouts, minimize delivery delays, and improve overall fulfillment accuracy. Businesses adopting AI-powered order management gain improved efficiency, enhanced customer experience, and a stronger competitive position in the omnichannel landscape.

- In April 2023, Oracle introduced new AI and automation features within the oracle fusion cloud applications suite to enhance supply chain planning (SCM), operational efficiency, and financial accuracy. Updates include advanced planning, usage-based pricing, rebate management, and improved quote-to-cash processes in oracle fusion cloud SCM.

Omnichannel Order Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Organization

|

Small and Medium Enterprises, Large Enterprises

|

|

By Application

|

Smart Order Management, Inventory Management, Logistics Automation, Customer Experience, Integrated POS, Others

|

|

By End Use

|

Manufacturing, Healthcare, Retail & E-commerce, Automotive, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution and Services): The solution segment garnered USD 1,952.6 million in revenue in 2024, mainly due to rising adoption of integrated platforms that streamline order processing, optimize inventory, and enhance cross-channel fulfillment efficiency.

- By Deployment (On-premises and Cloud-based): The cloud-based segment is poised to record a CAGR of 9.41% through the forecast period, propelled by rising demand for scalability, cost efficiency, and real-time visibility across global omnichannel operations.

- By Organization (Small and Medium Enterprises and Large Enterprises): The large enterprises segment is estimated to hold a share of 61.72% by 2032, fueled by greater investments in advanced omnichannel platforms to handle complex, high-volume transactions and global supply chains.

- By Application (Smart Order Management, Inventory Management, Logistics Automation, Customer Experience, Integrated POS, and Others): The smart order management segment is projected to reach USD 1,848.9 million by 2032, owing to the rising adoption of AI-driven platforms enabling predictive analytics, automated decision-making, and enhanced customer experience.

- By End Use (Manufacturing, Healthcare, Retail & E-commerce, Automotive, and Others): The manufacturing segment held a share of 26.23% in 2024, fostered by the increasing need for integrated order management systems to optimize production cycles, streamline distribution, and manage multi-channel customer demand effectively.

Omnichannel Order Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

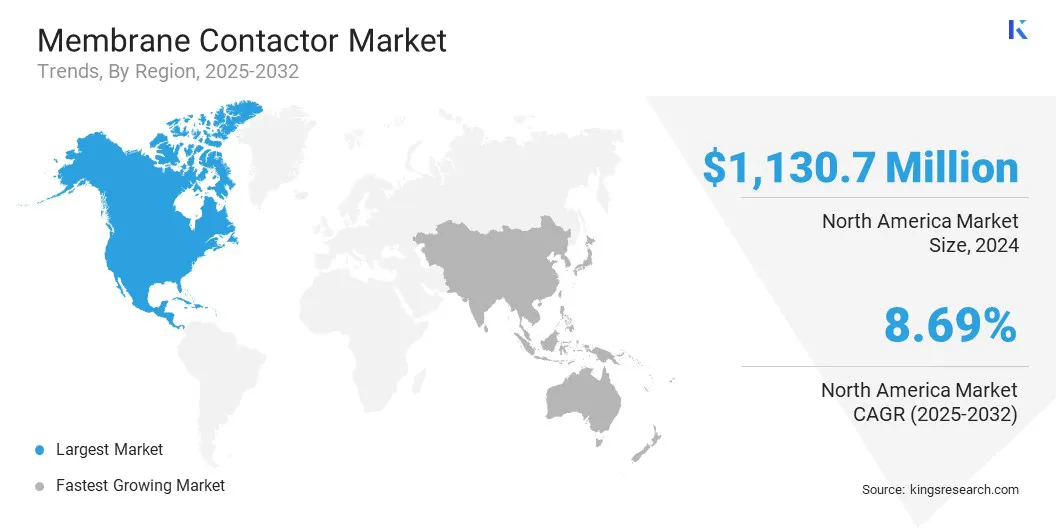

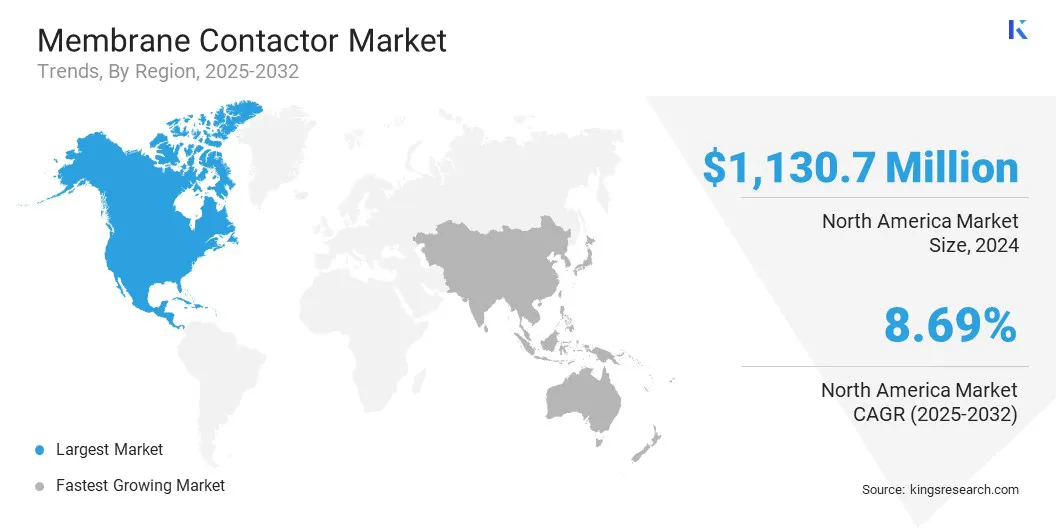

The North America omnichannel order management market segment accounted for a share of 35.95% in 2024, valued at USD 1,130.7 million. This dominance is reinforced by the growing expansion of digital retail and rising consumer demand for seamless purchasing experiences.

Enterprises are adopting cloud-based and AI-enabled platforms to streamline order processing, optimize fulfillment, and address the complexities of multi-channel logistics. The strong presence of advanced technology providers and widespread adoption of cloud-based solutions are further supporting regional market expansion.

- For instance, in January 2025, Salesforce introduced AI-driven solutions for retailers, including Agentforce for Retail and Retail Cloud with Modern POS. These tools enhance associate productivity, streamline order management, and enable personalized shopping through pre-built agent skills for automated, scalable customer engagement.

The Asia-Pacific omnichannel order management industry is set to grow at a CAGR of 9.63% over the forecast period. This growth is bolstered by rapid e-commerce expansion and evolving consumer engagement for consistent shopping experiences across multiple touchpoints.

Businesses in the region are increasingly adopting unified platforms to integrate online, offline, and mobile sales channels. The surging penetration of digital payment systems, coupled with the strong adoption of mobile commerce, is further contributing to regional market growth.

Regulatory Frameworks

- In the U.S., the California Consumer Privacy Act (CCPA) governs consumer data privacy. It strengthens transparency and controls businesses to collect, store, and use customer data in omnichannel platforms.

- In the EU, the General Data Protection Regulation (GDPR) oversees personal data protection. It enforces strict guidelines on cross-border data transfers, ensuring customer data security in omnichannel order management systems.

- In Canada, the Personal Information Protection and Electronic Documents Act (PIPEDA) controls data handling practices. It directs businesses to obtain consent and safeguard consumer information across digital and retail channels.

- In the UK, the UK Data Protection Act 2018 supervises personal information usage. It manages compliance obligations for organizations implementing omnichannel order management solutions.

- In Australia, the Privacy Act 1988 enforces rules on data collection and disclosure. It governs businesses to maintain confidentiality and transparency in omnichannel order and inventory management systems.

- In Singapore, the Personal Data Protection Act (PDPA) directs organizations to responsibly manage customer information. It supervises consent-based usage and ensures secure handling of digital interactions across omnichannel platforms.

- In India, the Digital Personal Data Protection Act 2023 manages digital data governance. It enforces lawful processing, storage, and supervision of customer data critical to omnichannel operations and e-commerce ecosystems.

Competitive Landscape

Key players operating in the omnichannel order management industry are focusing on technology integration, regional expansion, and portfolio diversification.

They are developing advanced platforms incorporating AI, machine learning, and real-time analytics to enhance order processing and inventory visibility. Key strategies include mergers, acquisitions, and strategic alliances to strengthen market presence and enter new regions.

Companies are investing in R&D to foster innovation and scale cloud-based solutions. Additionally, players are directing efforts toward establishing strategic collaborations with logistics providers and e-commerce platforms while ensuring compliance with global data security regulations.

- In May 2025, Manhattan collaborated with Shopify to integrate its order management and store inventory and fulfillment solution within Manhattan Active Omni. It enables enterprises to manage complex operations, maintain real-time inventory visibility, and support multiple fulfillment options such as in-store, curbside, and same-day delivery.

Key Companies in Omnichannel Order Management Market:

- Zoho Corporation Pvt. Ltd.

- Sage Group plc

- IBM Corporation

- Manhattan Associates

- Oracle

- SAP SE

- Salesforce, Inc.

- HCL Technologies Limited

- Brightpearl

- Aptean

- Blue Yonder Group, Inc.

- Infosys Limited

- Körber AG

- Cognizant

- TATA Consultancy Services Limited

Recent Developments (Partnerships)

- In August 2025, Ahold Delhaize USA expanded its partnership with Instacart to utilize the FoodStorm order management system. The company enhances customer experiences for made-to-order items such as bakery platters, deli trays, desserts, and floral arrangements, while advances digital capabilities and strengthens omnichannel shopping across its brands.

- In May 2025, Manhattan Associates expanded its go-to-market partnership with Google Cloud, allowing customers to accelerate digital transformation. The alliance facilitates streamlined procurement, deployment, and management of Manhattan’s cloud-native supply chain execution, planning, and omnichannel commerce solutions.