Market Definition

The market is focused on using advanced technologies to automate logistics operations which include the planning, execution, and management of the flow of goods, services, and information across the supply chain.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Logistics Automation Market Overview

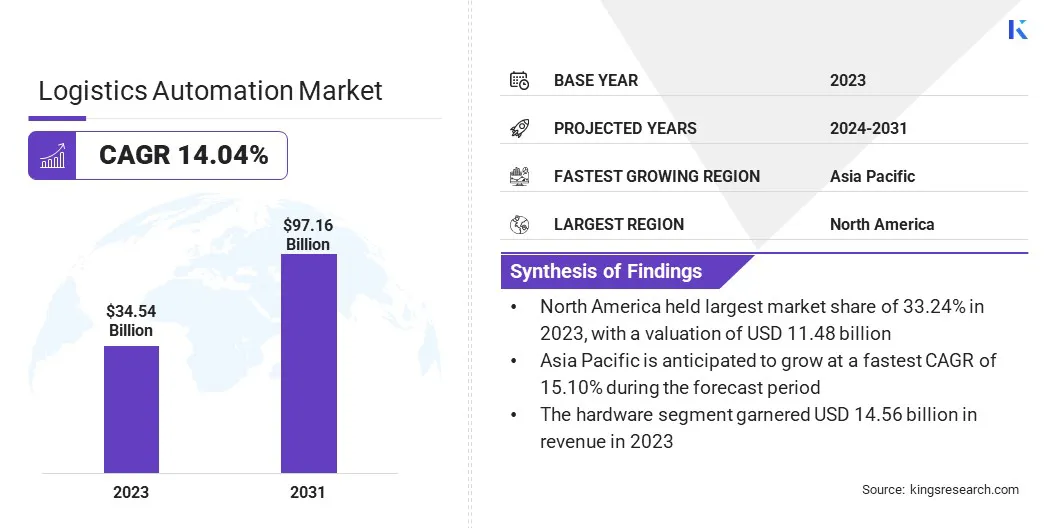

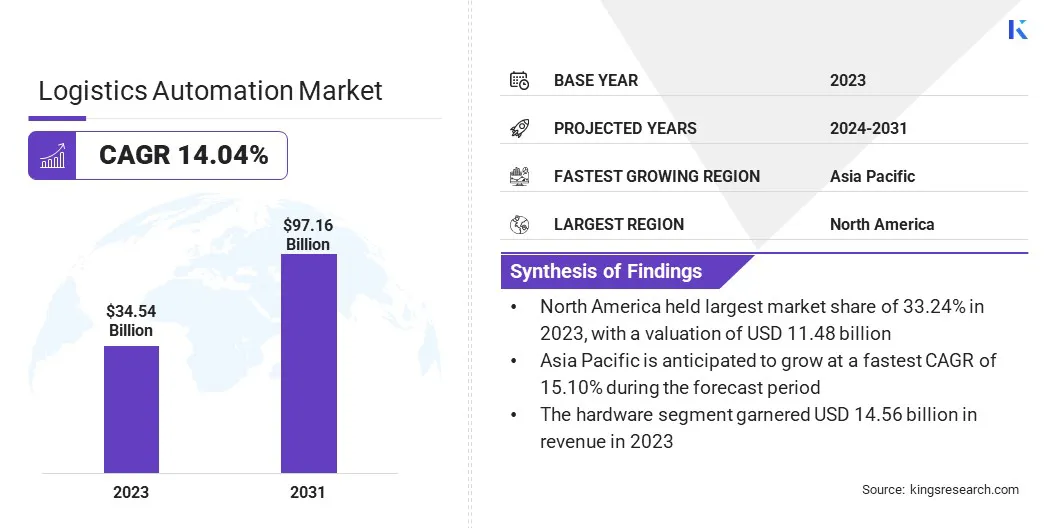

Global logistics automation market size was valued at USD 34.54 billion in 2023, which is estimated to be valued at USD 38.74 billion in 2024 and reach USD 97.16 billion by 2031, growing at a CAGR of 14.04% from 2024 to 2031.

In the market, the growing demand for speed and precision is a key driver for the widespread adoption of automated solutions. Automation not only improves accuracy but also minimizes human error, significantly enhancing throughput. This, in turn, ensures more efficient and reliable order fulfillment, meeting the increasing expectations of consumers and businesses alike.

Major companies operating in the global logistics automation industry are KION GROUP AG, Honeywell International Inc., Daifuku Co., Ltd., IBM, SAP SE, Oracle, ABB, SAMSUNG, Manhattan Associates, KUKA AG, TOSHIBA CORPORATION, Zebra Technologies Corp., Kardex, Symbotic Inc., and KNAPP AG.

The market is rapidly expanding, driven by the growing demand for faster, more accurate, and cost-efficient supply chain operations. It involves the use of advanced technologies like robotics, AI, IoT, and warehouse management systems to automate tasks such as inventory handling, order fulfillment, and transportation.

As e-commerce and omni-channel retail continue to grow, businesses are investing in automation to improve productivity, reduce errors, and meet customer expectations.

- In May 2023, Swisslog announced a logistics automation project at Northern Tool + Equipment’s Fort Mill, SC facility. Powered by SynQ software and AutoStore technology, the solution includes 62 robots and 23,175 bins, boosting omni-channel fulfillment efficiency without construction, and enhancing automated warehouse operations.

Key Highlights

- The logistics automation industry size was recorded at USD 34.54 billion in 2023.

- The market is projected to grow at a CAGR of 14.04% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 11.48 billion.

- The hardware segment garnered USD 14.56 billion in revenue in 2023.

- The transport management segment is expected to reach USD 34.54 billion by 2031.

- The healthcare segment is anticipated to witness the fastest CAGR of 14.19% during the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 15.10% during the forecast period.

What are the major factors affecting the market growth?

The logistics automation market is witnessing significant growth as companies respond to heightened consumer expectations for fast, accurate, and reliable delivery services. Automation technologies reduce human error in complex tasks such as picking, sorting, and packing, leading to fewer mistakes and returns.

By streamlining workflows and increasing throughput, companies can fulfill more orders in less time with higher precision. This boosts customer satisfaction and helps businesses stay competitive in a fast-paced, demand-driven retail and e-commerce environment.

- In September 2024, GXO partnered with Reflex Robotics to pilot a humanoid robot in live warehouse operations. This Robots-as-a-Service (RaaS) model enhances automation flexibility, supporting tasks like tote transfer and product picking. The initiative aims to optimize logistics workflows and improve fulfillment efficiency.

What are the major obstacles for this market?

One of the key challenges in the logistics automation market is the integration of new technologies with existing systems, particularly legacy warehouse management systems (WMS) and infrastructure.

Many businesses struggle to seamlessly incorporate new automated solutions with older systems, which can lead to inefficiencies, data silos, and operational disruptions.

To address this challenge, key players are investing in scalable automation platforms, developing integration-friendly software solutions, and forming strategic partnerships with system integrators.

These efforts aim to enhance compatibility with legacy systems, reduce deployment complexities, and support seamless end-to-end automation across warehouse and logistics operations.

How is AI integration affecting the market?

A prominent trend in the logistics automation market is the growing adoption of AI-driven manufacturing solutions. Manufacturers are increasingly integrating artificial intelligence to optimize their operations, enhance efficiency, and boost productivity.

AI enables real-time data analysis, supports predictive maintenance, and automates routine tasks, leading to reduced downtime and optimized resource use. This transition is helping companies lower operational costs and maintain competitiveness in a rapidly evolving manufacturing environment.

- In June 2024, Rockwell Automation collaborated with NVIDIA to advance intelligent automation and mobile robotics in manufacturing logistics. By integrating NVIDIA’s AI and robotics technologies with OTTO Motors’ autonomous mobile robots (AMRs), this partnership aims to enhance efficiency and performance in industrial environments.

Logistics Automation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Application

|

Transport Management, Warehouse Management, Labor Management, Others

|

|

By End Use

|

Automotive, Retail, Healthcare, Food & Beverages, Aerospace & Defense, Energy & Utility, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, Services): The hardware segment earned USD 14.56 billion in 2023 due to the growing demand for advanced robotics, automation systems, and integrated hardware solutions across industries like manufacturing and warehousing.

- By Application (Transport Management, Warehouse Management, Labor Management, Others): The transport management segment held 35.65% of the market in 2023, due to the increasing need for route optimization, real-time tracking, and improved delivery efficiency in the expanding e-commerce sector.

- By End Use (Automotive, Retail, Healthcare, Food & Beverages, Aerospace & Defense, Energy & Utility, Others): The retail segment is projected to reach USD 23.86 billion by 2031, owing to the rapid adoption of automated order fulfillment, inventory management, and omni-channel logistics solutions in the retail industry.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America logistics automation market share stood around 33.24% in 2023 in the global market, with a valuation of USD 11.48 billion. North America remains the dominating region for the market, driven by advanced technological adoption, robust infrastructure, and a strong presence of key players.

The region benefits from automation technologies, particularly in warehousing, transportation, and supply chain management. Moreover, the growing demand for faster and more efficient distribution networks, particularly in e-commerce, is further fueling the need for automation solutions.

- In February 2024, Dematic partnered with Groupe Robert to open the first fully automated cold storage facility in Quebec, Canada, featuring Dematic’s Automated Storage and Retrieval System (AS/RS). This 130-foot-tall system enhances fulfillment capabilities for both fresh and frozen products, optimizing efficiency in cold storage logistics.

Asia Pacific is poised for significant growth at a robust CAGR of 15.10% over the forecast period. The Asia-Pacific region is the fastest-growing market for logistics automation, driven by rapid industrialization, increasing e-commerce demand, and technological advancements.

Countries like China, Japan, and India are heavily investing in automation to enhance supply chain efficiency and meet growing consumer expectations. The rise of smart manufacturing, coupled with the adoption of AI, robotics, and data analytics, is further propelling growth.

Additionally, favorable government initiatives and increasing adoption of automation in key sectors such as retail and manufacturing are contributing to the market expansion in this region.

Regulatory Frameworks

- In the U.S., the NIST Cybersecurity Framework helps businesses of all sizes better understand, manage, and reduce their cybersecurity risk and protect their networks and data.

- The EU Cybersecurity Act introduces an EU-wide cybersecurity certification framework for ICT products, services and processes.

Competitive Landscape

In the logistics automation industry, companies are increasingly focusing on enhancing their product offerings through advanced technologies like AI, robotics, and machine learning.

These innovations are being integrated into warehouse management systems, transportation management solutions, and supply chain operations to boost efficiency, accuracy, and scalability.

- In January 2023, Jungheinrich AG acquired the Storage Solutions Group, a leading provider of warehouse automation and racking solutions based in Indiana, USA. This strategic acquisition significantly strengthens Jungheinrich’s position in North America, providing an enhanced platform offer its products and service offerings.

Key Companies in Logistics Automation Market:

- KION GROUP AG

- Honeywell International Inc.

- Daifuku Co., Ltd.

- IBM

- SAP SE

- Oracle

- ABB

- SAMSUNG

- Manhattan Associates

- KUKA AG

- TOSHIBA CORPORATION

- Zebra Technologies Corp.

- Kardex

- Symbotic Inc.

- KNAPP AG

Recent Developments (M&A/Partnerships)

- In October 2024, DHL Supply Chain expanded its partnership with Oracle to enhance its global operations through Oracle Fusion Cloud ERP. This collaboration allows DHL to streamline financial processes, improve efficiency, and accelerate decision-making across 40+ countries, ensuring resilience and agility in their supply chain.

- In September 2024, SAP completed its acquisition of WalkMe Ltd., a leading digital adoption platform. WalkMe’s technology will enhance SAP’s copilot Joule with AI-driven, context-aware assistance, improving user experience and workflow execution. This acquisition, valued at approximately USD 1.5 billion, supports SAP’s business transformation strategy

- In August 2024, Amazon entered into a commercial agreement with Covariant, licensing its robotic foundation models to enhance AI-driven automation across operations. The partnership aims to improve warehouse robotics, boost safety, and accelerate innovation in fulfillment technologies.