Market Definition

Digital payments refer to the electronic transfer of value between payment accounts via digital devices or channels such as mobile apps, bank transfers, QR codes, cards, and online wallets. They enable fast, secure, and cashless transactions without physical currency. The market spans sectors including retail, banking, utilities, e-commerce, and peer-to-peer platforms, where efficient and interoperable payment flows are essential.

Key applications include point-of-sale purchases, online checkouts, peer transfers, subscription billing, and contactless payments, streamlining operations and enhancing user experience.

Digital Payment Market Overview

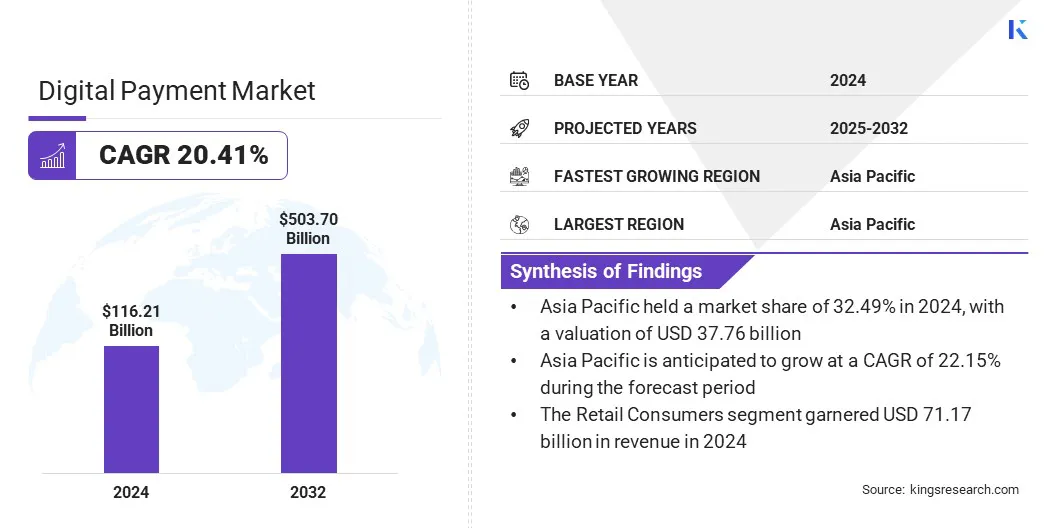

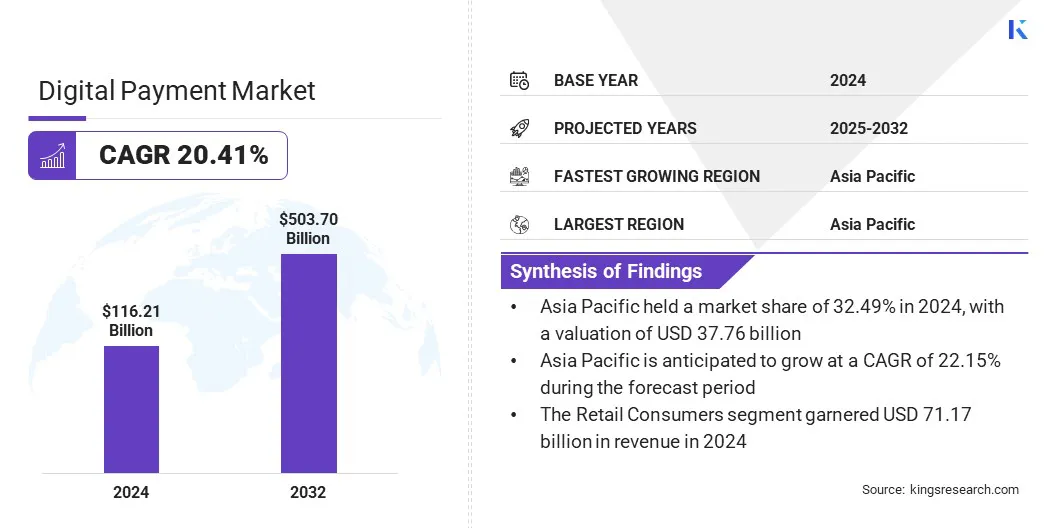

The global digital payment market size was valued at USD 116.21 billion in 2024 and is projected to grow from USD 137.23 billion in 2025 to USD 503.70 billion by 2032, exhibiting a CAGR of 20.41% during the forecast period.

This growth is driven by rapid e-commerce expansion and rising demand for digital financial services, which have increased the volume and frequency of online transactions. Additionally, advancements in transaction security, including AI-driven fraud detection and biometric authentication, are boosting consumer trust and supporting the broader adoption of digital payment solutions.

Key Highlights

- The digital payment industry size was USD 116.21 billion in 2024.

- The market is projected to grow at a CAGR of 20.41% from 2025 to 2032.

- Asia Pacific held a share of 32.49% in 2024, valued at USD 37.76 billion.

- The card payments segment garnered USD 45.81 billion in revenue in 2024.

- The retail consumers segment is expected to reach USD 326.03 billion by 2032.

- The retail & e-commerce services segment secured the largest revenue share of 44.16% in 2024.

- The online payments segment is poised to grow at a robust CAGR of 22.34% through the forecast period.

- North America is anticipated to grow at a CAGR of 20.88% over the forecast period.

Major companies operating in the digital payment market are Stripe, Inc., PayPal, Inc., Block, Inc., Adyen, Checkout.com, Payoneer Inc., Wise Payments Limited, WeChat Pay Hong Kong Limited, Alipay+, Google Pay, Apple Inc., PhonePe Ltd., Paytm, JazzCash, and Red Dot Payment Pte. Ltd.

Widespread smartphone adoption and increased internet access are fueling the shift toward digital payment solutions worldwide. Consumers increasingly prefer digital wallets, contactless payments, and online payment gateways for their convenience, speed, and security. Mobile connectivity enables seamless transactions anytime, reducing reliance on cash and traditional banking.

- According to the World Bank, global internet usage reached 67.1%, up from 63.8% in 2022, with notable growth in low- and middle-income countries. Sub-Saharan Africa and South Asia recorded the largest gains in mobile internet adoption, expanding access to mobile-based financial services and digital payments.

Moreover, expanding internet penetration in emerging markets is bringing unbanked and underbanked populations into the digital economy. Payment service providers are leveraging this connectivity to innovate user-friendly platforms that support diverse payment options.

Market Driver

Expansion of E-Commerce Sector and Digital Finance Demand

Rapid expansion of the global e-commerce sector is boosting demand for digital payment solutions across the retail and service industries. Consumers are increasingly using digital channels for shopping, online banking, ticket booking, and bill payments, requiring fast and secure transaction methods.

- According to Ecommerce Tips (March 2025), two-thirds of adults globally use digital payments, with adoption reaching 89% in the U.S. , which is expected to account for 24% of the worldwide consumer spending by 2026. Digital wallets represent 49% of global ecommerce sales, while credit cards contribute 21%.

Businesses are integrating digital payment gateways to streamline checkout processes and improve customer experience. Growth in cross-border remittance services is further contributing to the uptake of digital platforms that offer real-time, low-cost transfers.

Fintech companies and financial institutions are developing versatile solutions to support both domestic and international digital transactions. The market is witnessing growth as online commerce and financial activities increasingly shift toward digital ecosystems.

Market Challenge

Rising Risks of Cyberattacks

A key challenge in the digital payment market is the rising threat of cyberattacks, data breaches, phishing, and malware targeting financial transactions. These security concerns are increasing with the rise of digital payment volumes, which expands exposure across user touchpoints and platforms.

Stringent data privacy laws such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA), and India’s Digital Personal Data Protection Act (DPDP) are adding regulatory complexity and operational overhead.

To address this challenge, market players are investing in advanced encryption technologies, multi-factor authentication, and AI-driven fraud detection systems to enhance transaction security. Companies are also strengthening compliance frameworks and updating privacy policies to align with evolving global and regional data protection requirements.

Market Trend

Rising Integration of AI-Powered Analytics and Biometric Authentication

A key trend influencing the digital payment market is the use of AI-powered analytics and biometric authentication to enhance real-time fraud detection. Payment platforms are leveraging machine learning models to monitor transaction patterns and identify anomalies instantly. Biometric tools such as face recognition and fingerprint scanning are enabling secure user verification without compromising convenience.

These technologies minimize unauthorized access and fraud across digital channels. Real-time risk scoring and adaptive authentication are supporting faster and more accurate decision-making. This growth is further fueled by intelligent and secure systems that balance convenience with proactive fraud prevention.

- In August 2024, NPST (Network People Services Technologies) launched a suite of AI-enabled digital payment solutions, including a Risk Intelligence Decisioning Platform. This platform uses AI and machine learning (ML) to learn transaction patterns, predict and prevent fraud, enhance compliance, and minimize financial risks for merchant acquirers and aggregators. Their EVOK 3.0 Payments Platform also utilizes AI/ML to streamline fraud management and payment analytics.

Digital Payment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Mode of Payment

|

Card Payments, Mobile Payments, Bank Transfers, Buy Now, Pay Later (BNPL)

|

|

By Customer Type

|

Retail Consumers, Small and Medium Enterprises (SMEs), Large Enterprises

|

|

By Application

|

Retail & E-commerce, Banking & Financial Services, Travel & Hospitality, Healthcare, Others

|

|

By Deployment Channel

|

Online Payments, Point of Sale (POS) Payments, ATM Payments, Unstructured Supplementary Service Data (USSD) Payments, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Mode of Payment (Card Payments, Mobile Payments, Bank Transfers, Buy Now, Pay Later (BNPL), and Others): The card payments segment earned USD 45.81 billion in 2024, due to its widespread acceptance across online and offline channels, established global infrastructure, and strong consumer preference for credit and debit-based transactions.

- By Customer Type (Retail Consumers, Small and Medium Enterprises (SMEs), and Large Enterprises): The retail consumers segment held a share of 61.24% in 2024, attributed to high transaction volumes driven by frequent online purchases and the widespread use of mobile wallets.

- By Application (Retail & E-commerce, Banking & Financial Services, Travel & Hospitality, Healthcare, and Others): The retail & e-commerce segment is projected to reach USD 203.17 billion by 2032, owing to increased consumer preference for contactless and app-based payments, and widespread merchant adoption of integrated digital checkout solutions.

- By Deployment Channel (Online Payments, Point of Sale (POS) Payments, ATM Payments, and Unstructured Supplementary Service Data (USSD) Payments, and Others): The online payments segment is set to grow at a significant growth at a CAGR of 22.34% through the forecast period, attributed to the rapid growth of e-commerce, increased consumer preference for remote transactions, and the widespread availability of internet-enabled devices.

Digital Payment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific digital payment market share stood at 32.49% in 2024, with a valuation of USD 37.76 billion. This dominance is attributed to the widespread use of smartphones as the primary means of internet access.

According to the GSM Association's 2025 report, there were 1.5 billion mobile internet users in Asia Pacific in 2024, a number expected to rise to 1.8 billion by 2030. By then, 91% of mobile connections in developed parts of the region are projected to operate on 5G networks. This shift is creating a strong demand for mobile payment solutions, including app-based wallets and QR code systems, thereby boosting regional market growth.

Moreover, the domestic market is witnessing strong public sector involvement in building digital payment infrastructure. Interoperable systems such as real-time payment networks and national ID-linked payment interfaces are strengthening consumer trust and boosting transaction growth. These government-led efforts are further fostering competition among private players, enhancing service quality and expanding market reach.

The North America digital payment industry is estimated to grow at a significant CAGR of 20.88% over the forecast period. This growth is fostered by the widespread use of credit cards, installment-based payment options, and Buy Now Pay Later (BNPL) services across both online and in-store purchases.

The availability of these flexible payment models, backed by a well-established credit infrastructure, is boosting digital transaction volumes, specifically in ecommerce and subscription-based markets.

Additionally, the increasing acceptance of cryptocurrency as a payment method is contributing to the expansion of digital payments in North America. Several retailers accept Bitcoin and stablecoins at checkout, while crypto-linked debit cards have entered mainstream use. This trend is broadening payment choices and attracting digitally active users to integrated platforms, further propelling regional market growth.

- In June 2025, Apple, Google, Airbnb, and X initiated discussions with cryptocurrency firms to integrate stablecoin-based payments, aiming to reduce cross-border transaction fees. This move follows stablecoin payment volumes of USD 27.6 trillion in 2024 and reflects a broader strategy by major tech companies to manage settlement costs and enhance control over transaction data flows.

Regulatory Frameworks

- In the U.S., the Consumer Financial Protection Bureau (CFPB) supervises large digital wallet providers under its 2024 rule, applying bank-like oversight on fraud, data use, and disclosures. Payment firms must comply with Federal Reserve System rules, Anti-Money Laundering (AML) standards, and state-level money transmitter licensing laws. The Federal Deposit Insurance Corporation (FDIC) also applies if customer funds are held, ensuring secure and insured transactions.

- In the UK, the Payment Services Regulations, aligned with the European Union’s revised Payment Services Directive (PSD2), are enforced by the Financial Conduct Authority (FCA). These mandate Strong Customer Authentication (SCA), open banking API access, and transparent consumer protections. The FCA licenses payment institutions and e-money firms, requiring adequate capital, secure IT systems, and fraud monitoring frameworks, ensuring compliance across both fintech startups and legacy providers.

- In China, digital payment providers are regulated by the People’s Bank of China (PBOC), which enforces strict licensing and operational controls. Tech companies must limit ownership stakes in digital banking entities and adhere to real-name verification, capital requirements, and fund segregation. PBOC also manages the digital yuan rollout, setting usage policies, wallet tiers, privacy guidelines, and offline payment functionality to ensure state oversight while promoting the secure adoption of e-CNY.

- Japan regulates digital payments under the Payment Services Act and the Fund Settlement Act, administered by the Financial Services Agency (FSA). Providers of prepaid instruments, fund transfer services, and e-money must register, maintain a minimum capital buffer, and segregate customer funds in trust accounts. Licensing requires compliance with Anti-Money Laundering (AML), data protection, and refund rules. The regulatory framework ensures consumer security while supporting innovation in electronic financial services.

Competitive Landscape

Market players in the digital payment industry are expanding into physical retail, enhancing mobile app capabilities, and integrating contactless payment features to maintain competitiveness. Companies are also investing in product innovation and user experience improvements to attract and retain consumers.

Moreover, partnerships with merchants and financial service providers, along with ongoing investment in secure and scalable technology infrastructure, are key focus areas to strengthen market presence and aid growth.

- In May 2025, PayPal expanded its presence in physical retail locations across Germany. The latest version of the PayPal App, available on both iOS and Android, supports a new contactless payment feature. Designed for speed and convenience, the app allows users to easily activate the feature and spread the cost of larger in-store purchases directly through PayPal, offering greater flexibility at the point of sale.

Key Companies in Digital Payment Market:

- Stripe, Inc.

- PayPal, Inc.

- Block, Inc.

- Adyen

- Checkout.com

- Payoneer Inc.

- Wise Payments Limited

- WeChat Pay Hong Kong Limited

- Alipay+

- Google Pay

- Apple Inc.

- PhonePe Ltd.

- Paytm

- JazzCash

- Red Dot Payment Pte. Ltd

Recent Developments (Partnerships/Expansion/Product Launch)

- In July 2025, PayPal announced a set of global partnerships aimed at linking the world’s leading payment systems and digital wallets through a unified platform, beginning with interoperability between PayPal and Venmo. The initial group of partners collectively serves nearly two billion users worldwide. Built on open commerce APIs, the new platform, PayPal World uses a cloud-native, multi-region architecture to support cross-border transactions with low latency and high availability.

- In July 2025, Stripe introduced new products to support the expansion of businesses in Germany, including Stripe Capital, which uses transaction history for next-day financing eligibility. The company also enhanced fraud prevention for SEPA transactions through Stripe Radar. Additionally, Stripe expanded support to over 25 new payment methods, including Wero, and launched a pay-by-bank option built on Europe’s open banking framework.

- In May 2025, Fiserv expanded its Commerce Hub platform and acquired Payfare, aiming to drive growth in embedded finance. The company targets USD 5.5 billion in free cash flow and projects 10–12% organic revenue growth. The strategy focuses on unifying payroll card services and small business acquiring solutions within a single cloud-based infrastructure.