Offshore Drilling Market Size

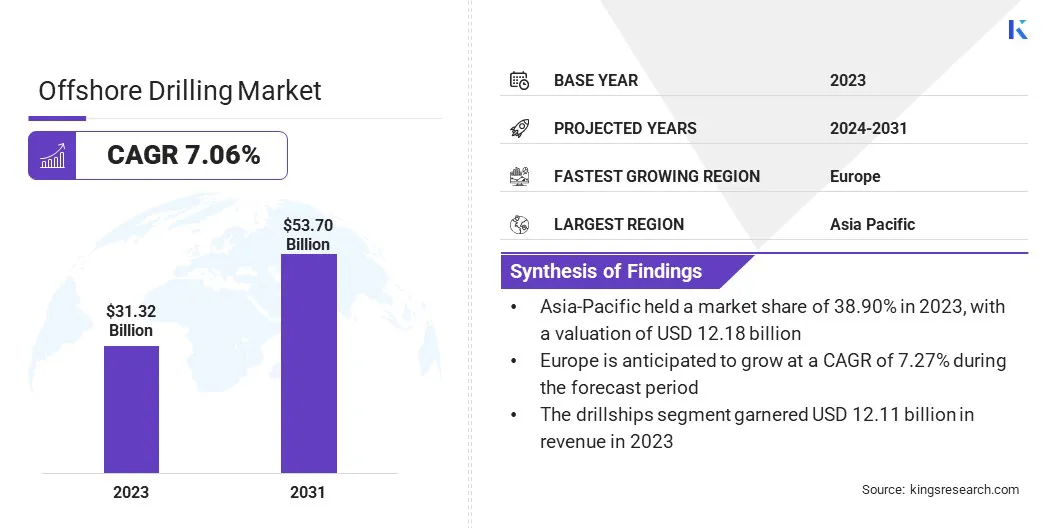

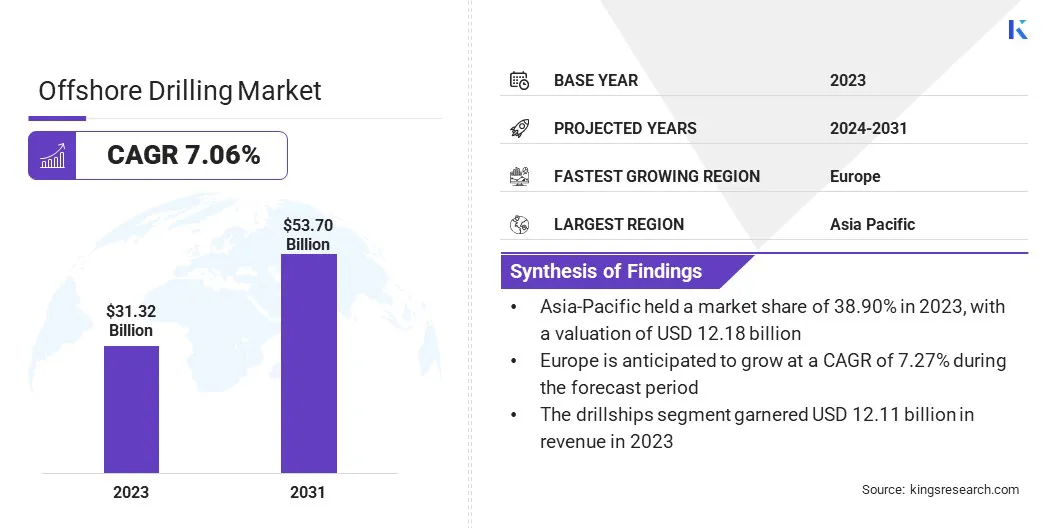

The global Offshore Drilling Market size was valued at USD 31.32 billion in 2023 and is projected to grow from USD 33.30 billion in 2024 to USD 53.70 billion by 2031, exhibiting a CAGR of 7.06% during the forecast period. The growth of the market is driven by increasing global energy demand, technological advancements in drilling methods, and the rising need to access deeper and more challenging oil and gas reserves.

In the scope of work, the report includes solutions offered by companies such as Baker Hughes Company, China National Offshore Oil Corporation, China Oilfield Services Limited, Exxon Mobil Corporation, Halliburton, Noble Corporation, Transocean Ltd., Weatherford, SAIPEM SpA, SLB, and others.

The expansion of the market is fueled by rising global energy demand and the depletion of onshore oil and gas reserves. Technological advancements have made offshore drilling more feasible, enabling access to previously unreachable deepwater and ultra-deepwater reserves.

Increased investments from major oil and gas companies are further supporting this growth, spurred by higher oil prices and the surging need for diversified energy sources. Moreover, government policies that support energy security and economic growth, along with substantial investments in exploration activities, propel market growth.

- For instance, in July 2024, Saipem was awarded two offshore projects under a Long-Term Agreement in Saudi Arabia with Saudi Aramco, totaling approximately USD 500 million. The first project involved the EPCI of a 50 km crude trunkline for the Abu Safa Field. The second project included production maintenance programs for the Manifa and Berri Fields. These initiatives have significantly strengthened Saipem’s presence in the Middle East.

The offshore drilling market comprises drilling activities conducted in offshore locations to explore and extract oil and gas resources. It includes shallow water, deepwater, and ultra-deepwater drilling operations. Key market players are investing heavily in advanced technologies to enhance efficiency and reduce operational costs.

Despite the high initial investments and operational risks, the potential for high returns attracts substantial interest. The market is highly competitive, with major companies vying for significant offshore leases and contracts. Offshore drilling refers to the process of extracting oil and natural gas from reserves located beneath the ocean floor.

It encompasses various techniques and technologies, including fixed platforms, floating rigs, and subsea systems, to reach different depths and geological formations.

This sector is critical for meeting global energy demands, particularly as onshore resources become increasingly limited. Offshore drilling operations are categorized based on water depth, such as shallow water (up to 500 feet), deepwater (500 to 5,000 feet), and ultra-deepwater (beyond 5,000 feet).

The industry involves complex logistics, stringent safety standards, and significant financial investments due to the challenging and hazardous nature of the offshore environment.

Analyst’s Review

Manufacturers in the offshore drilling market are increasingly focusing on innovation and efficiency. Key players are investing heavily in advanced technologies such as automation, artificial intelligence, and enhanced drilling equipment to improve operational performance and safety.

New products, including next-generation drillships and advanced subsea systems, are being introduced to the market, offering improved capabilities and cost-effectiveness. Companies are recommended to continue prioritizing technological advancements and sustainability initiatives to remain competitive.

- For instance, in July 2024, CNOOC Limited commenced production at the Wushi 23-5 Oilfields Development Project, an offshore oilfield designed with environmental considerations. The facility is located in the Beibu Gulf with an average water depth of 28 meters. The project included a renovated terminal and two new wellhead platforms. It is set to bring 43 wells into operation, including 28 oil wells and 15 water-injection wells. The project is expected to peak at 18,100 barrels of oil equivalent per day by 2026, distinguished by its low-carbon and efficient development approach.

Additionally, collaboration with regulatory bodies to ensure compliance and environmental stewardship is crucial. Expanding into untapped regions and diversifying energy portfolios with renewable integration is likely to provide long-term growth opportunities and resilience against market fluctuations.

Offshore Drilling Market Growth Factors

The continuous improvement in drilling technology is a key factor boosting market growth. Advances in robotics, automation, and data analytics are enhancing the efficiency and safety of offshore operations. These technological innovations are reducing downtime and operational costs while increasing the success rate of drilling activities.

The ability to drill in deeper and more complex environments is expanding potential resource bases, thus making previously uneconomical sites viable. By adopting these cutting-edge technologies, companies are achieving better productivity and mitigating risks associated with human error and harsh environmental conditions, thereby sustaining market growth and ensuring a more reliable energy supply.

A significant challenge hampering the development of the offshore drilling market is rising environmental concerns and increasing regulatory pressures. Offshore drilling poses risks to marine ecosystems, as spills and accidents may have severe environmental impacts.

To overcome this challenge, companies are adopting more stringent safety protocols and investing in spill response technologies. Enhanced monitoring systems and robust emergency response plans are being implemented to minimize risks.

Additionally, companies are exploring eco-friendly drilling practices and renewable energy integration to reduce their environmental footprint. By addressing these environmental concerns proactively, the offshore drilling industry is working to meet regulatory requirements and maintain its social license to operate, thereby ensuring sustainable development.

Offshore Drilling Industry Trends

A significant trend in the offshore drilling market is the increasing adoption of digital technologies. Companies are integrating Internet of Things (IoT) devices, artificial intelligence (AI), and big data analytics into their operations. These technologies are enhancing real-time monitoring, predictive maintenance, and operational efficiency.

By leveraging AI and machine learning algorithms, companies are optimizing drilling processes and improving decision-making. The use of digital twins, virtual replicas of physical assets, is becoming increasingly prevalent, allowing for better planning and risk management. This digital transformation is contributing significantly to cost reductions, increasing productivity, and enhancing safety standards in offshore drilling operations.

Another prominent trend is the growing focus on sustainability and environmental responsibility. Companies are increasingly investing in greener technologies and practices to minimize their environmental impact. This includes the development of carbon capture and storage (CCS) techniques and the integration of renewable energy sources, such as offshore wind, into their operations.

There is a notable shift toward more transparent reporting on environmental performance and the adoption of stricter environmental regulations. This trend is further supported by regulatory pressures and rising stakeholder demands for more sustainable practices. By prioritizing environmental responsibility, the offshore drilling industry is advancing toward a more sustainable and socially acceptable future.

Segmentation Analysis

The global market is segmented based on rig type, water depth, and geography.

By Rig Type

Based on rig type, the market is categorized into drillships, semisubmersibles, jackups, and other types. The drillships segment led the offshore drilling market in 2023, reaching a valuation of USD 12.11 billion. This expansion is supported by their superior mobility and operational flexibility.

Drillships are equipped with advanced dynamic positioning systems, allowing them to operate in deeper and harsher environments compared to other rig types. This adaptability makes them ideal for exploring and developing new offshore oil and gas fields. Their ability to move quickly between drilling sites reduces downtime and increases efficiency.

Additionally, technological advancements in drillship design and functionality are enhancing their performance and safety standards, thereby supporting segmental growth.

By Water Depth

Based on water depth, the market is classified into shallow water, deepwater, and ultra-deepwater. The shallow water segment is poised to witness significant growth at a CAGR of 8.92% through the forecast period (2024-2031). This notable growth is largely attributed to lower operational costs and reduced technical challenges compared to deepwater and ultra-deepwater drilling.

Shallow water drilling requires less complex infrastructure and shorter drilling times, making it more economically viable. The proximity to existing offshore facilities and easier access to transportation and logistics further enhance its attractiveness.

Additionally, regulatory frameworks and environmental considerations are often less stringent in shallow waters, facilitating quicker project approvals. The growth of the segment is further supported by these cost efficiencies and operational advantages, making shallow water drilling an appealing option for numerous oil and gas companies.

Offshore Drilling Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific offshore drilling market held a substantial share of around 38.90% in 2023, with a valuation of USD 12.18 billion. This dominance is reinforced by the region's abundant natural resources and extensive coastline, providing ample opportunities for exploration and production. Countries such as China, India, and Indonesia are investing heavily in offshore projects to meet their growing energy demands.

Additionally, favorable government policies and increased investments in infrastructure are supporting the expansion of offshore drilling activities. The presence of major oil and gas companies and ongoing technological advancements are further aiding regional market growth. Asia-Pacific's strategic focus on energy security and economic development is solidifying its leading position in the global market.

Europe is poised to experience significant growth at a robust CAGR of 7.27% over the forecast period. This considerable growth is fostered by the region's growing focus on energy transition and sustainable development. The North Sea, in particular, remains a vital hub for offshore exploration and production, with substantial investments in both conventional and renewable energy projects.

Technological advancements and innovations in drilling techniques are enhancing operational efficiency and safety, attracting more investments. Additionally, supportive regulatory frameworks and government incentives are promoting exploration activities. Europe's commitment to reducing carbon emissions and increasing energy independence is bolstering the growth of the Europe market.

Competitive Landscape

The global offshore drilling market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Offshore Drilling Market

- Baker Hughes Company

- China National Offshore Oil Corporation

- China Oilfield Services Limited

- Exxon Mobil Corporation

- Halliburton

- Noble Corporation

- Transocean Ltd.

- Weatherford

- SAIPEM SpA

- SLB

Key Industry Developments

- May 2024 (Agreement): CNOOC Limited's wholly owned subsidiaries secured petroleum exploration and production concession contracts with Empresa Nacional de Hidrocarbonetos and Mozambique’s Ministry of Mineral Resources and Energy for five offshore blocks. The blocks, located offshore Mozambique, cover approximately 29,000 square kilometers with water depths ranging from 500 to 2,500 meters. The initial exploration phase spans four years, with CNOOC subsidiaries holding operating interests of 70% to 80% in the blocks, while ENH retains the remaining interests.

- February 2024 (Agreement): Baker Hughes secured a major contract from Petrobras for integrated well construction services in the Buzios field, offshore Brazil. The project, scheduled to commence in early 2025, involves drilling, wireline, cementing, and various other services across three rigs. Previously, Baker Hughes had significantly contributed to the Buzios field by providing advanced technology, including WAG manifolds, over 240 kilometers of flexible pipes, and turbomachinery for FPSOs, thereby significantly enhancing the field's development efforts.

The global offshore drilling market is segmented as:

By Rig Type

- Drillships

- Semisubmersibles

- Jackups

- Other Types

By Water Depth

- Shallow Water

- Deepwater

- Ultra-Deepwater

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America