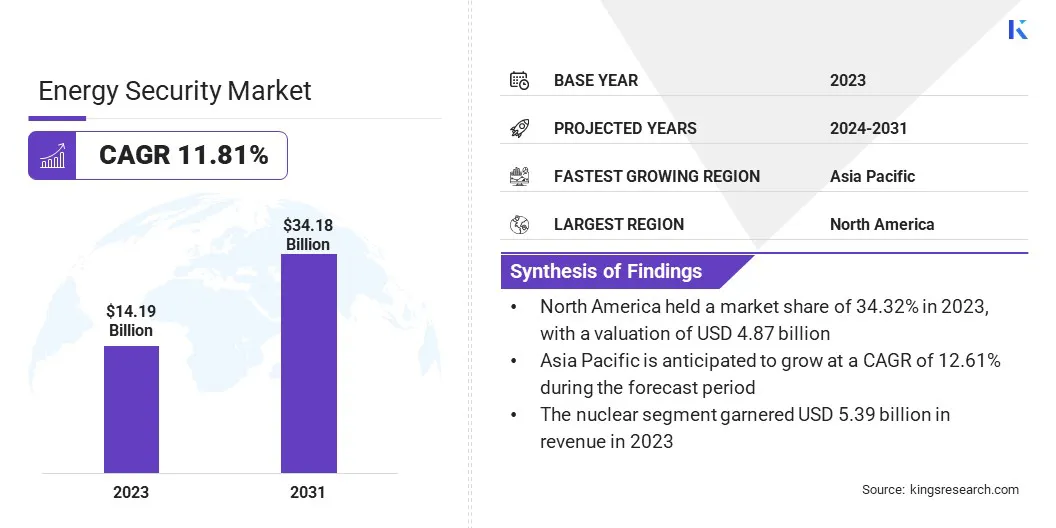

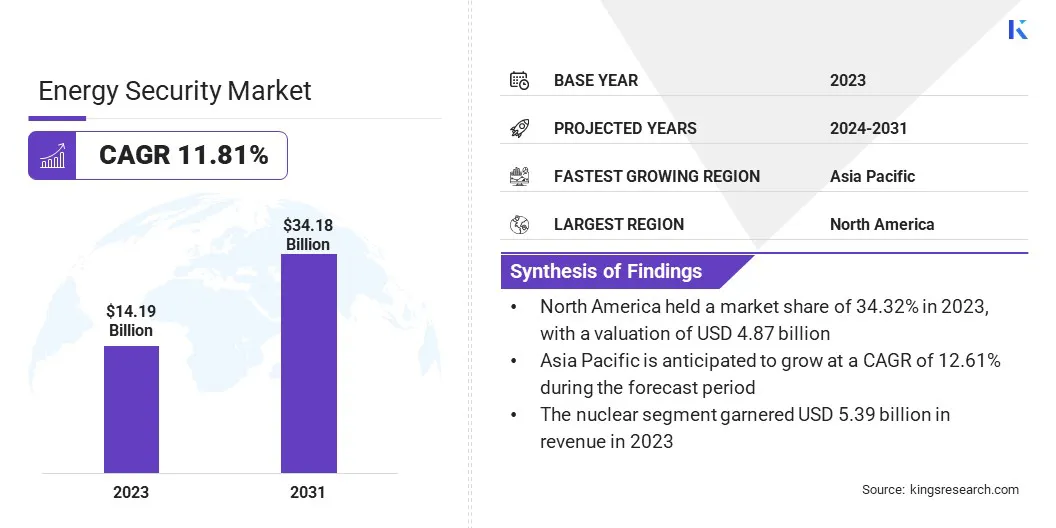

Energy Security Market Size

Global Energy Security Market size was recorded at USD 14.19 billion in 2023, which is estimated to be valued at USD 15.65 billion in 2024 and is projected to reach USD 34.18 billion by 2031, growing at a CAGR of 11.81% from 2024 to 2031. Rising threat of cyber-attacks on energy infrastructure and advancements in energy technologies are fostering the growth of the market.

In the scope of work, the report includes services offered by companies such as Siemens, Schneider Electric, Thales, Hexagon AB, Honeywell International Inc., General Electric, Lockheed Martin Corporation, Stealth Monitoring, Telefonaktiebolaget LM Ericsson, ABB, BAE Systems, and others.

The increasing global focus on renewable energy integration offers significant opportunities for enhancing energy security. As countries transition from fossil fuels to cleaner, renewable sources such as solar, wind, and hydropower, they reduce energy imports and mitigate supply chain risks. By diversifying energy sources, nations build more resilient grids that are less susceptible to geopolitical disruptions, price volatility, and natural resource depletion.

- For instance, in April 2024, G7 ministers, following International Energy Agency (IEA) recommendations, pledged to strengthen energy security and accelerate clean energy transitions. The ministers recognized the importance of the IEA’s efforts in promoting global energy security and supporting sustainable, clean energy initiatives across advanced economies.

Moreover, integrating renewable energy with smart grids improves monitoring, forecasting, and load management, which enhances overall energy system stability. Furthermore, this notable shift toward renewables reduces carbon emissions, aligning energy security goals with sustainability efforts.

Additionally, the growing use of energy storage technologies, such as battery systems, enables surplus renewable energy to be stored during peak generation and deployed when demand is high or generation is low, ensuring a consistent energy supply. The transition to renewable energy systems offers both economic and environmental benefits while strengthening the resilience and security of national energy infrastructures.

Energy security ensures the continuous availability of energy at affordable prices while maintaining the sustainability and reliability of supply. It encompasses various components, such as energy infrastructure, supply chains, and energy sources, which determine the stability of a nation’s energy system. Technologies play a crucial role in energy security, with innovations in grid management, monitoring systems, and cybersecurity solutions helping safeguard energy networks.

Smart grids and IoT-based systems detect vulnerabilities in real-time, providing quicker responses to outages or threats. Additionally, energy storage systems, including batteries, help maintain stable energy flows by storing energy during peak generation and releasing it when needed. Renewable energy power plants are pivotal to energy security.

The integration of solar, wind, and hydropower plants diversifies the energy mix, reducing dependency on single sources enhancing resilience against disruptions from political conflicts, market volatility, or supply shortages. These components collectively reinforce a stable and secure energy ecosystem, safeguarding both consumers and industries.

Analyst’s Review

The global market is witnessing considerable growth as companies prioritize strategies that align with both resilience and sustainability imperatives. Numerous key players are heavily investing in advanced technologies such as smart grids, AI-driven monitoring systems, and robust cybersecurity measures to protect their energy infrastructures from growing threats like cyberattacks and physical sabotage.

Integrating renewable sources such as solar and wind into energy portfolios is emerging as a core strategy for companies aiming to reduce dependency on traditional fuels and increase energy resilience. To maintain competitiveness, businesses are focusing on building long-term collaborations with technology firms, energy storage providers, and governmental bodies to enhance their security frameworks.

- For instance, in June 2023, Hexagon’s Safety, Infrastructure & Geospatial division partnered with Fujitsu Limited to develop digital twin applications for predicting and mitigating natural disasters and traffic accidents. This collaboration demonstrates their commitment to building resilient, disaster-resistant cities through innovative urban safety solutions.

Additionally, companies are emphasizing decarbonization and sustainability initiatives, aligning with global climate goals while also creating opportunities for government incentives and public support. However, the need for large capital investments and maintaining a balance between operational efficiency and security is a major imperative for these firms. In this evolving landscape, innovation and collaboration are essential for sustained growth.

Energy Security Market Growth Factors

The growing threat of cyberattacks on critical energy infrastructure is stimulating the growth of the energy security market. The digitalization and interconnection of energy grids enhance their vulnerability to sophisticated cyber threats, including ransomware, data breaches, and system disruptions. These attacks cause significant economic damage, disrupt power supplies, and jeopardize national security. The energy sector, a vital part of any nation's economy, is often targeted by malicious actors aiming to disrupt essential services.

- For instance, in September 2023, according to weforum, cyberattacks on energy companies have doubled since 2020, with over 200 incidents reported in 2023. By June 2024, according to the European Commission, more than half of these attcks targeted Europe’s energy sector, underscoring the growing cybersecurity threats to critical infrastructure, which affect citizens, businesses, and public services.

In response, energy companies are increasing their investments in cybersecurity measures such as AI-driven monitoring systems, advanced firewalls, and encryption technologies. These solutions are designed to safeguard operational technologies (OT) and information technologies (IT) across energy networks.

Moreover, governments are enacting stricter regulations and cybersecurity standards to protect energy infrastructures from cyber threats. Additionally, the integration of real-time threat detection and automated response systems is becoming a critical component of the energy security landscape. This proactive approach to cyber defense strengthens the resilience of the energy grid against attacks.

High costs associated with implementing comprehensive energy security solutions present a significant challenge for several energy companies. These solutions often involve the integration of advanced technologies such as smart grids, cybersecurity measures, energy storage systems, and real-time monitoring platforms. Although crucial for safeguarding energy infrastructure, these innovations entail substantial capital expenditures.

The deployment of robust cybersecurity systems requires significant investment in hardware, software, and ongoing costs for maintenance, monitoring, and personnel training. Additionally, energy security infrastructure upgrades often require large-scale overhauls of existing systems, which are time-consuming and financially challenging for smaller utilities or companies operating with tight margins.

These costs are especially challenging in emerging markets, where budgets are limited, and the focus is often on expanding access over security improvements. To mitigate this challenge, companies are exploring partnerships, public-private collaborations, and government grants to share the financial burden. Additionally, adopting scalable and modular security solutions allows organizations to gradually implement upgrades, avoiding budget strain.

Energy Security Market Trends

The integration of smart grid technologies is transforming the global energy landscape, enhancing both operational efficiency and security. This is emerging as a significant trend influencing the energy security market. Smart grids utilize advanced communication technologies, automation, and real-time data analytics to enable a more dynamic and responsive energy system.

Unlike traditional grids with limited flexibility, smart grids provide real-time monitoring of energy demand, generation, and distribution, optimizing energy management. This technology enhances energy security by enabling faster detection of grid faults, cyber threats, and power outages, and while also providing automated responses to minimize downtime.

- For instance, in August 2024, the U.S. Department of Energy (DOE) announced a USD 2.2 billion investment to strengthen the national power grid. Supporting the Biden-Harris Administration's "Investing in America" agenda, the funding will enhance resilience against extreme weather, reduce community costs, and expand grid capacity to meet rising industrial demand.

Smart grids further facilitate the integration of renewable energy sources by balancing energy loads and managing fluctuating power generation from wind or solar plants. Governments and energy providers worldwide are investing in smart grid infrastructures to address growing energy demands and to support the transition to more sustainable energy models. By improving the stability and resilience of energy networks, smart grids are playing a critical role in future-proofing energy infrastructure against potential disruptions for the market.

Segmentation Analysis

The global market has been segmented on the basis of component, technology, power plant, and geography.

By Component

Based on component, the market has been bifurcated into solution and services. The solution segment captured the largest energy security market share of 68.55% in 2023, largely attributed to the growing need for advanced and integrated energy security solutions across industries. With rising threats to energy infrastructures from cyberattacks, physical sabotage, and natural disasters, there is a growing demand for comprehensive security solutions.

These solutions include cybersecurity systems, surveillance technologies, access control systems, and real-time monitoring platforms designed to protect both digital and physical energy assets. Governments and energy providers are prioritizing investments in these solutions to enhance the resilience and reliability of their grids. Additionally, the rise in renewable energy integration and smart grid technologies necessitates advanced security measures to manage and protect complex, interconnected energy systems.

Solution providers offer tailored, scalable platforms that address the specific vulnerabilities of energy infrastructures, ensuring regulatory compliance and mitigating risks. The high adoption rate of these comprehensive solutions across key sectors, such as oil and gas, nuclear, and power generation, is contributing to the dominance of the solution segment.

By Technology

Based on technology, the market has been classified into physical security and network security. The physical security segment is poised to record a staggering CAGR of 12.03% through the forecast period due to the growing emphasis on safeguarding critical energy infrastructure from physical threats.

Energy facilities, including power plants, oil refineries, and substations, are increasingly vulnerable to physical security risks such as vandalism, terrorism, and natural disasters. Energy companies are investing heavily in advanced physical security systems, including perimeter security, surveillance cameras, biometric access controls, and intrusion detection technologies.

Additionally, increased regulatory requirements and governmental mandates are boosting the adoption of stringent physical security protocols in the energy sector to prevent unauthorized access and ensure the safety of both personnel and assets. The rapid expansion of energy infrastructure, particularly in emerging markets, is further supporting the growth of the segment as new facilities require robust security frameworks.

By Power Plant

Based on power plant, the market has been divided into thermal and hydro, nuclear, oil and gas, and renewable energy. The nuclear segment garnered the highest revenue of USD 5.39 billion in 2023, propelled by several the growing importance of nuclear energy in ensuring energy security.

This growth is primarily fueled by the increasing global reliance on nuclear power as a reliable, low-carbon energy source that meets rising electricity demands and aids nations in achieving their carbon reduction goals. As countries strive to reduce their dependency on fossil fuels, nuclear energy is emerging as a critical part of the energy mix, offering a consistent and scalable power supply.

Furthermore, significant investments in upgrading aging nuclear infrastructure and building new reactors are bolstering segmental expansion. Advanced nuclear technologies, such as small modular reactors (SMRs), are gaining significant traction due to their enhanced safety features, cost efficiency, and flexibility in deployment. Government support, through favorable policies and financial incentives, is further augmenting the growth of the nuclear segment.

Energy Security Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America energy security market held the largest share of 34.32% and was valued at USD 4.87 billion in 2023. This dominance is reinforced by the region’s significant investments in energy infrastructure and increasing focus on energy security. The region’s robust energy grid, extensive industrial base, and reliance on advanced technologies are further contributing to this growth.

The United States is at the forefront of energy security initiatives, with key government agencies and energy providers actively investing in cybersecurity, physical security systems, and smart grid technologies to protect critical infrastructure. The rising prevalence of cyber threats, particularly ransomware attacks on energy assets, has highlighted the need for comprehensive security solutions within the sector.

Additionally, North America’s diversified energy mix, including renewable energy sources, nuclear, and fossil fuels, requires sophisticated security frameworks to ensure reliable energy supply. Government regulations and policies, such as the U.S. Department of Energy’s focus on grid modernization and security, are further bolstering regional market expansion.

Asia-Pacific energy security market is poised to grow at the highest CAGR of 12.61% in the forthcoming years, mainly due to rapid industrialization, urbanization, and increasing energy demand across major economies such as China, India, and Japan. This region is experiencing significant infrastructure development, with several countries expanding their energy grids and integrating renewable energy sources into their power generation portfolios.

The fast-growing energy infrastructure necessitates advanced security measures to protect against physical threats, cyberattacks, and natural disasters. Additionally, the Asia-Pacific market faces unique challenges due to geopolitical tensions and the need to secure energy supplies in the face of regional conflicts.

Governments in this region are prioritizing energy security through large-scale investments in smart grid technologies, cybersecurity systems, and energy storage solutions. China is at the forefront of modernizing its grid and improving its nuclear energy infrastructure, both of which are crucial for regional market growth.

Competitive Landscape

The global energy security market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Energy Security Market

- Siemens

- Schneider Electric

- Thales

- Hexagon AB

- Honeywell International Inc.

- General Electric

- Lockheed Martin Corporation

- Stealth Monitoring

- Telefonaktiebolaget LM Ericsson

- ABB

- BAE Systems

Key Industry Developments

- July 2024 (Partnership): Boson Energy and Siemens AG signed a Memorandum of Understanding (MoU) to collaborate on converting non-recyclable waste into clean energy. This partnership aims to enhance sustainable, local energy security by enabling hydrogen-powered EV charging infrastructure, ensuring grid stability, and maintaining consumer affordability.

- April 2024 (Launch): Hexagon’s Safety, Infrastructure & Geospatial division announced that Qognify, a leading physical security provider, has fully integrated the Hexagon identity. This integration, following Qognify’s acquisition in April 2023, marks a new chapter in physical security innovation, enhancing the protection of assets, infrastructure, and communities.

The global energy security market has been segmented:

By Component

By Technology

- Physical Security

- Network Security

By Power Plant

- Thermal and Hydro

- Nuclear

- Oil and Gas

- Renewable Energy

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America