Microplastic Detection Market Snapshot

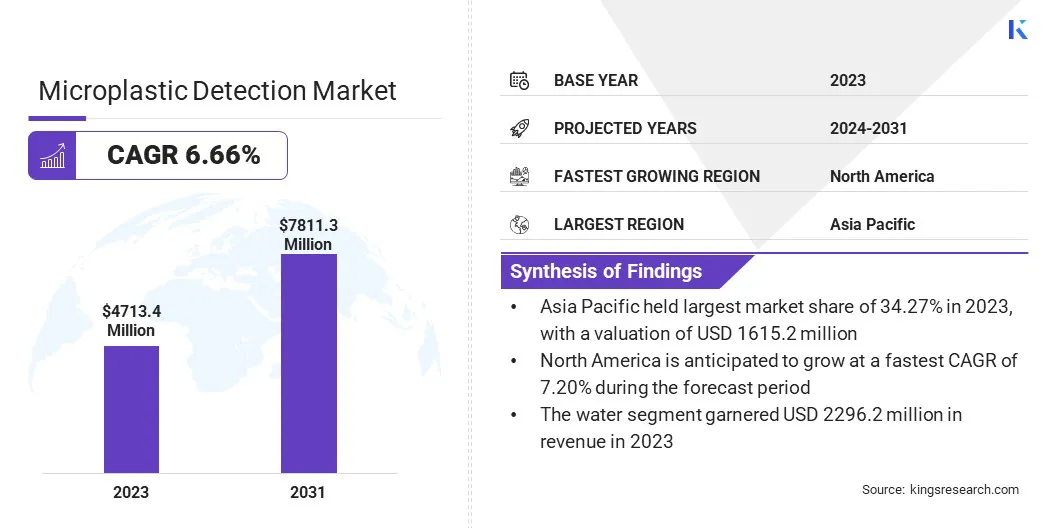

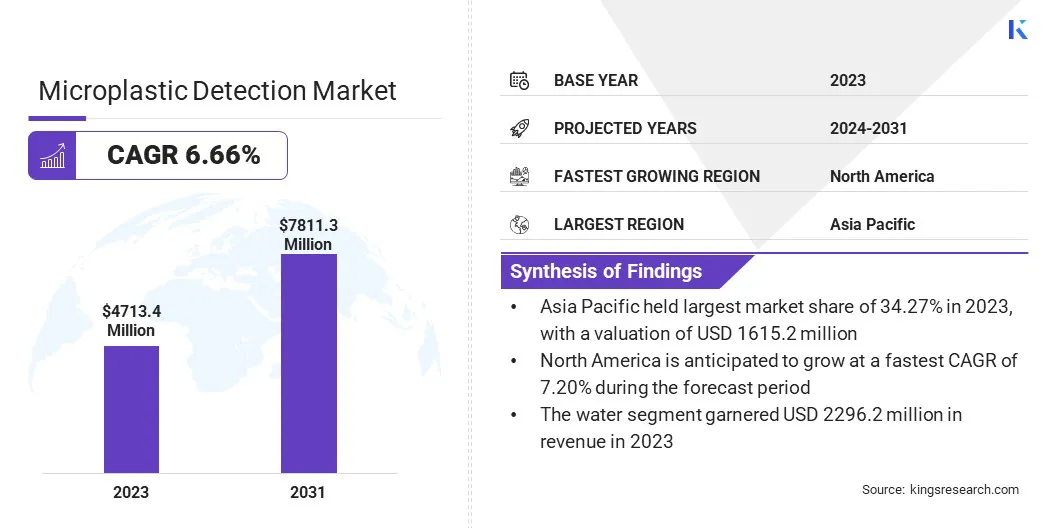

The global microplastic detection market size was valued at USD 4713.4 million in 2023 and is projected to grow from USD 4974.1 million in 2024 to USD 7811.3 million by 2031, exhibiting a CAGR of 6.66% during the forecast period.

The growth of the market is primarily driven by increasing environmental concerns regarding plastic pollution and the need for effective detection technologies. Governments, environmental agencies, and industries are prioritizing solutions to assess and manage microplastic contamination in water bodies, soils, and air.

Key Market Highlights:

- The market is projected to grow at a CAGR of 6.66% from 2024 to 2031.

- Asia Pacific held a share of 34.27% in 2023, valued at USD 1615.2 million.

- The polyethylene segment garnered USD 1709.3 million in revenue in 2023.

- The 1-3 Mm segment is expected to reach USD 3228.4 million by 2031.

- The water segment is anticipated to generate a revenue of USD 3682.2 million by 2031.

- The FTIR spectroscopy segment is estimated to reach USD 2361.3 million by 2031.

- The water treatment segment garnered USD 1607.9 million in revenue in 2023.

- North America is anticipated to grow at a CAGR of 7.20% through the forecast period.

Key Companies in Microplastic Detection Market:

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Bruker

- JEOL Ltd.

- DH Life Sciences, LLC.

- TESCAN GROUP, a.s.

- ZEISS Group

- Oxford Instruments

- Malvern Panalytical

- Agilent Technologies, Inc.

- Renishaw plc.

- Shimadzu Corporation

- JASCO

- METTLER TOLEDO

- Endress+Hauser Group Services AG

Microplastic Detection Market Overview:

Technological advancements in detection methods, such as spectroscopy, chromatography, and filtration-based techniques, are expected to further propel market growth. Additionally, the rising awareness among consumers and industries regarding sustainability and environmental protection is fueling demand.

- In August 2024, University of British Columbia researchers developed a low-cost, portable microplastic detection tool that utilizes fluorescent labeling to detect plastic particles from 50 nanometers to 10 microns. Paired with an app, the device delivers rapid results, enhancing real-time monitoring of plastic pollution from everyday sources like water bottles and disposable cups.

Market Driver

"Growing Global Concern and Rise in Consumer Awareness"

The market is experiencing notable growth due to the growing global concern over environmental pollution caused by microplastics. As plastic waste continues to accumulate in oceans, rivers, and terrestrial environments, there is a heightened urgency for effective detection and monitoring systems.

Regulatory bodies and governments worldwide are implementing stringent policies aimed at reducing plastic pollution, leading to increased demand for microplastic detection technologies.

Additionally, the rise in consumer awareness about sustainability and the environmental impact of plastic waste is prompting industries to adopt microplastic detection solutions to comply with environmental regulations and enhance their sustainability efforts.

As environmental sustainability becomes a priority for both public and private sectors, the demand for reliable microplastic detection tools is expected to accelerate, with industries seeking to align with global sustainability goals.

- In 2024, according to Earth Action, nearly 70 million tons of plastic waste entered the environment, driven by an imbalance between consumption and waste management capacity. With plastic waste increasing 7.11% since 2021, demand for advanced microplastic detection technologies is surging, creating growth opportunities in environmental monitoring and regulatory compliance solutions.

Market Challenge

"High Cost and Complexity"

A major challenge hindering the expansion of the microplastic detection market is the high cost and complexity associated with current microplastic detection technologies.

Many detection methods require specialized equipment, extensive sample preparation, and skilled personnel, which can limit their adoption, particularly in emerging markets. A potential solution is the development of more affordable, user-friendly detection tools, supported by investments in research to streamline the detection process.

Reducing costs and enhancing accessibility may facilitate widespread implementation, particularly in resource-constrained regions. Additionally, collaboration between industry stakeholders, governments, and research institutions can foster the development of cost-effective alternatives, ensuring that detection technologies are accessible to a broader range of organizations and governments working to combat plastic pollution globally.

Market Trend

"Growing Use of Automated and Real-Time Detection Systems"

A significant trend influencing the market is the growing use of automated and real-time detection systems powered by advanced data analytics and artificial intelligence (AI).

These innovations are enabling faster, more accurate microplastic detection, offering industries and governments the ability to continuously monitor and assess environmental contamination. Real-time monitoring solutions are increasingly being integrated into environmental protection frameworks, improving the efficiency of pollution control measures.

With the ability to process large volumes of environmental data quickly, AI-driven systems can identify microplastic concentrations in various environments with high precision, reducing human error and labor costs.

As these technologies evolve, they will provide even greater accuracy, scalability, and cost-effectiveness, expanding microplastic detection accessibility across industries and regions.

Microplastic Detection Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polyethylene, Polystyrene, Polypropylene, PTFE, Others

|

|

By Size

|

<1 Mm, 1-3 Mm, 3-5 Mm

|

|

By Medium

|

Air, Water, Soil

|

|

By Technology

|

FTIR Spectroscopy, Micro-Raman Spectroscopy, Pyrolysis- Gas Chromatography- Mass Spectroscopy (Py-Gc-Ms) , Liquid Chromatography (Lc) With Mass Spectroscopy (Ms), Flow Cytometry, Scanning Electron Microscopy (Sem) , Others

|

|

By End Use

|

Water Treatment, Packaging, Cosmetics, Food and Beverage, Textiles, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Polyethylene, Polystyrene, Polypropylene, PTFE, and Others): The Polyethylene segment earned USD 1709.3 million in 2023, mainly due to its widespread use in various applications, including packaging, consumer goods, and industrial products.

- By Size (<1 Mm, 1-3 Mm and 3-5 Mm): The 1-3 Mm segment held a share of 40.36% in 2023, attributed to its prevalence in both aquatic and terrestrial environments. This size range is prevalent in water bodies, where microplastics pose significant environmental and health risks, leading to increased demand for detection technologies.

- By Medium (Air, Water, and Soil): The water segment is projected to reach USD 3682.2 million by 2031, fueled by rising contamination in water bodies. As aquatic ecosystems serve as major reservoirs for microplastic particles, growing regulatory measures and monitoring efforts are fostering the adoption of detection technologies for waterborne microplastics.

- By Technology (FTIR Spectroscopy, Micro-Raman Spectroscopy, Pyrolysis- Gas Chromatography- Mass Spectroscopy (Py-Gc-Ms), and Liquid Chromatography (Lc) With Mass Spectroscopy (Ms), Flow Cytometry, Scanning Electron Microscopy (Sem), and Others): The FTIR spectroscopy segment is projected to reach USD 2361.3 million by 2031, propelled by its effectiveness in identifying polymer types and characterizing microplastic particles in various matrices.

- By End Use (Water Treatment, Packaging, Cosmetics, Food and Beverage, Textiles, and Others): The water treatment segment is projected to reach USD 2648.0 million by 2031, on account of the increasing regulatory pressures and the rising need for clean water free from contaminants such as microplastics.

Microplastic Detection Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Largest Region: Asia Pacific

Asia Pacific microplastic detection market captured a share of around 34.27% in 2023, valued at USD 1615.2 million. This dominance is attributed to rapid industrialization, urbanization, and the growing environmental concerns over plastic pollution in countries such as China, India, and Japan.

Asia Pacific's vast coastline, coupled with the rising contamination of marine environments, has led to increased demand for advanced microplastic detection solutions. Governments and industries in this region are increasingly investing in research and technologies to address microplastic pollution.

Additionally, regulatory frameworks in countries such as China and India are becoming stricter, highlighting the need for efficient detection systems across various sectors, including water treatment and packaging.

- For instance, in August 2024, the Food Safety and Standards Authority of India (FSSAI) launched a project to address microplastic contamination in food. The initiative aims to develop and validate detection methods and assess the prevalence of microplastics in various food products across India, responding to growing environmental concerns.

Fastest Growing Region (2024-2031): North America

North America microplastic detection Industry is poised to grow at a significant CAGR of 7.20% over the forecast period. The region's strong environmental policies, coupled with technological advancements and increased awareness of microplastic pollution, are boosting the adoption of detection solutions across multiple industries.

As regulations become more stringent, demand for microplastic detection technologies in sectors such as water treatment, food safety, and environmental monitoring is expected to rise significantly.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates environmental pollution, including microplastics, by setting standards for monitoring and controlling plastic contamination in water bodies. The EPA’s research and guidelines influence the demand for detection technologies, shaping methodologies for identifying microplastics in water, air, and soil.

- In Europe, the European Commission (EC) regulates the Microplastic Detection Market through policies such as the European Green Deal and the Circular Economy Action Plan to reduce plastic pollution. Additionally, the REACH Regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals) governs the safety of chemicals, including microplastics.

Competitive Landscape

The global microplastic detection market is characterized by a large number of participants, including both established corporations and emerging players. Key market participants are proactively prioritizing technological advancements and innovations to reinforce their competitive positioning in a rapidly expanding industry.

With applications ranging from environmental monitoring and water treatment to food safety and packaging, companies are continually enhancing their detection solutions to address specific sector needs.

As the market grows significantly, businesses are focusing on regional market penetration, tailoring their technologies to meet localized requirements while expanding their operations to capitalize on opportunities in global markets.

These efforts are particularly critical as governments and industries intensify their focus on combating plastic pollution, prompting the demand for more efficient, scalable detection methods.

As regulations become stricter and awareness increases, companies are integrating cutting-edge technologies such as AI, machine learning, and real-time monitoring into their offerings to remain at the forefront of the market. This focus on technological improvement and geographic expansion positions players to leverage both regional and international market growth effectively.

Recent Developments (M&A)

- In February 2024, Bruker Corporation acquired Nanophoton Corporation, a Japanese leader in research Raman microscopy. With over 20 years of expertise, this acquisition strengthens Bruker's capabilities in advanced analytical solutions, expanding its portfolio to enhance microplastic detection and material analysis applications and fostering innovation in scientific research.