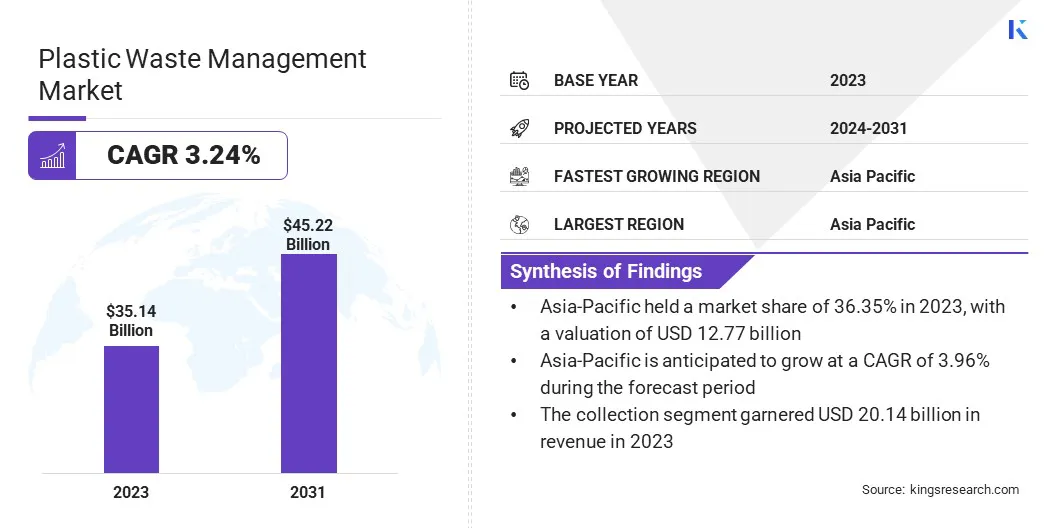

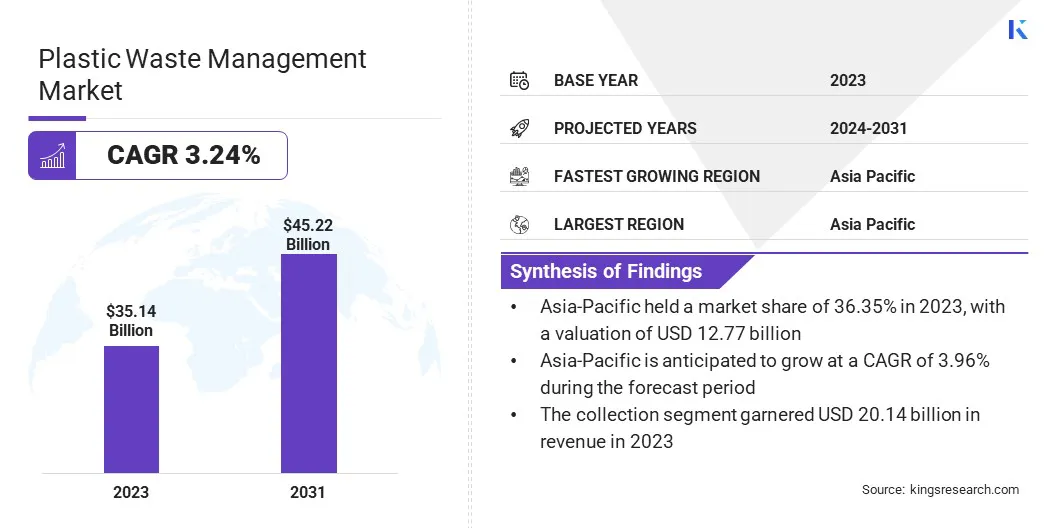

Plastic Waste Management Market Size

The global plastic waste management market size was valued at USD 35.14 billion in 2023, and is projected to grow from USD 36.16 billion in 2024 to USD 45.22 billion by 2031, exhibiting a CAGR of 3.24% during the forecast period.

Increasing environmental concerns over plastic pollution, along with heightened awareness of its impact on ecosystems, is driving the demand for more efficient and sustainable plastic waste management solutions through regulatory actions and consumer-driven behavior.

In the scope of work, the report includes services offered by companies such as Veolia, SUEZ, Republic Services, CLEAN HARBORS, INC., Biffa, Stericycle, Inc, REMONDIS SE & Co. KG, Alba.com, Tana Oy, and Envac.

The plastic waste management industry is evolving rapidly as stakeholders across industries seek innovative solutions to address the growing environmental impact of plastic pollution. Companies and governments are focusing on improving waste processing and recycling capabilities, due to the increasing global attention on sustainability.

The market is seeing a shift toward efficient practices, with advancements in technologies and enhanced collaboration among stakeholders to drive environmental responsibility. This focus on sustainable plastic waste management is contributing to the market growth.

- According to the United Nations Environment Programme, 400 million tons of plastic waste are generated annually. Despite ongoing efforts to manage this waste, 75 to 199 million tons of plastic currently contaminate our oceans. This alarming amount of plastic is projected to continue accumulating in aquatic ecosystems, highlighting the urgent need for enhanced waste management practices and global collaboration to address the growing environmental crisis.

The plastic waste management market refers to the collection, recycling, disposal, and treatment of plastic waste generated from various sources, including households, industries, and commercial sectors. It encompasses a range of processes aimed at reducing the environmental impact of plastic waste by improving recycling rates, promoting waste segregation, and developing innovative waste-to-energy technologies.

The market involves governments, waste management companies, and industries that establish effective systems and infrastructure for handling plastic waste sustainably. With a growing emphasis on circular economy models, this market focuses on reducing plastic waste sent to landfills and oceans, improving recycling efficiencies, and minimizing the overall ecological footprint of plastic materials.

It plays a critical role in addressing global waste management challenges and promoting environmental sustainability.

- The Ocean Cleanup, a non-profit organization, is dedicated to eliminating plastic from the oceans, with a goal to remove 90% of floating ocean plastic pollution by 2040. To accomplish this ambitious objective, the organization employs a two-pronged strategy: intercepting plastic in rivers to prevent further pollution from entering the oceans, and cleaning up the existing plastic that has accumulated and will not naturally disappear.

Analyst’s Review

The growing awareness of plastic pollution and its environmental impact is driving a significant shift in the plastic waste management market, with companies and governments forming strategic partnerships. These collaborations are encouraging the adoption of sustainable practices, enhancing recycling technologies, developing waste-to-energy solutions, and focusing on reducing plastic production and improving product lifecycle management.

- In December 2024, Veolia and Saudi Investment Recycling Company (SIRC) formalized a partnership to manage organic, industrial, and hazardous waste in Saudi Arabia. This collaboration supports the Vision 2030 program, focusing on decarbonization, resource preservation, and advancing the circular economy, with Veolia expanding its footprint in the region.

With heightened regulatory pressure and consumer demand for eco-friendly products, businesses are investing in innovative solutions and updating their environmental goals to tackle the plastic crisis. This growing commitment to environmental sustainability is likely to accelerate the development of more efficient and impactful waste management systems.

- In December 2024, the Coca‑Cola Company updated its voluntary environmental goals as part of its sustainability efforts. To achieve these, Coca-Cola will invest in innovation and infrastructure, collaborate with partners, and aim to use 35-40% recycled materials in packaging, including 30-35% recycled plastic, and ensure 70-75% collection of bottles and cans.

Plastic Waste Management Market Growth Factors

Increasing consumer demand for eco-friendly products is driving the plastic waste management market. As consumers become more environmentally conscious, they are demanding products with sustainable packaging and recyclable materials. In response, governments are investing in technologies like biodegradable packaging that offer eco-friendly alternatives to traditional plastics.

- In August 2024, the Defence Research and Development Organisation (DRDO) shared its biodegradable packaging technology using PBAT, a polymer derived from petroleum or plant oils, with over 40 industries. These eco-friendly bags decompose within three months and are now used for distributing Tirupati laddus, serving as a model for broader applications.

Companies are also investing heavily in innovative solutions, such as advanced recycling technologies, which, in turn, promotes circular economy. This shift not only helps businesses align with consumer values but also strengthens their market position by meeting the growing expectations for sustainability, leading to a more efficient and environmentally friendly approach to waste management.

- In October 2024, Alterra, a frontrunner in plastic circularity, completed the initial phase of its equity investment round, securing backing from Infinity Recycling, LyondellBasell, and Chevron Phillips Chemical. The funding will expedite the commercialization of Alterra's Advanced Recycling technology, converting waste plastic into useful raw materials and contributing to a sustainable, circular economy.

Lack of consumer awareness remains a significant challenge in plastic waste management, as many individuals are unaware of proper disposal and recycling practices, leading to increased contamination and inefficiency in waste streams. Targeted educational campaigns and public outreach programs can raise awareness about recycling processes, benefits, and the environmental impact of plastic waste.

Governments and organizations can collaborate to provide clear instructions and incentives for responsible waste disposal, encouraging active participation and improving recycling rates & overall waste management efforts.

Plastic Waste Management Industry Trends

The growing adoption of circular economy models is a key trend in the plastic waste management market, emphasizing the reduction of plastic waste, reuse of materials, and promotion of recycling. This approach aims to keep plastics in use for as long as possible by improving recycling processes, designing products for reuse, and reducing dependency on raw materials.

By focusing on extending the lifecycle of plastics, businesses and governments can reduce environmental impact, conserve resources, and move toward a more sustainable, closed-loop system.

- In May 2024, Ulsan College and the Ulsan International Development Cooperation Center, in partnership with United Nations Environment Programme (UNEP), hosted a five-day program in South Korea. The event, with over 80 participants, focused on sharing innovative plastic waste management practices, recycling technologies, and promoting circular economy solutions for developing countries.

The rise of advanced recycling technologies, such as chemical recycling, is revolutionizing the plastic waste management industry. Chemical recycling breaks down plastics into their original components, enabling their reuse in manufacturing processes. This innovation enhances recycling efficiency by allowing for a broader range of plastics to be recycled, including those that are typically non-recyclable through traditional methods.

By improving recycling capabilities, these technologies reduce plastic waste, conserve resources, and contribute to the development of a circular economy, promoting environmental sustainability.

- In November 2024, ExxonMobil announced a USD 200 million investment to expand its chemical recycling operations in Texas, aiming to increase its global recycling capacity to 500,000 tons per year by 2027. The company’s Exxtend pyrolysis technology enhances plastic recycling efficiency by converting hard-to-recycle plastics into raw materials for new products.

Segmentation Analysis

The global market is segmented based on type, end-user, source, service, and geography.

By Type

Based on type, the market has been segmented into polyethylene terephthalate (PET), high-density polyethylene (HDPE), low-density polyethylene (LDPE), polypropylene (PP), and others. The LDPE segment led the plastic waste management industry in 2023, reaching the valuation of USD 12.70 billion. The market for LDPE in plastic waste management is expanding, due to its widespread use in packaging, including plastic bags, shrink wraps, and flexible packaging.

LDPE is challenging to recycle through traditional mechanical methods. Hence, the demand for innovative recycling technologies, such as chemical recycling, is increasing. Companies are investing in advanced recycling solutions to efficiently handle LDPE waste and enhance recycling rates.

- In October 2024, LyondellBasell (LYB) acquired APK AG, a German company specializing in solvent-based recycling technology for LDPE. This acquisition strengthens LYB's commitment to sustainable solutions, enabling the production of high-purity materials for flexible packaging and advancing its circular economy goals.

By End-User

Based on end-user, the market has been classified into residential, commercial, and industrial. The residential segment secured the largest revenue share of 48.56% in 2023. The residential segment is registering significant expansion, as consumers become more environmentally conscious and seek eco-friendly solutions for managing plastic waste.

Increased awareness about the environmental impact of plastic waste, along with government regulations and initiatives promoting recycling, is driving households to adopt responsible disposal practices. The rise in sustainable packaging, waste segregation programs, and recycling services offered by municipalities are further encouraging residents to participate actively in waste management.

Companies are also developing convenient solutions, such as curbside collection, compostable plastic alternatives, and waste-to-energy technologies, supporting the transition to a more sustainable residential waste management system.

By Source

Based on source, the market is bifurcated into municipal solid waste (MSW) and industrial waste. The industrial waste segment is poised for significant growth at a CAGR of 3.90% through the forecast period. The need for plastic waste management in the industrial sector is rapidly growing, as industries face increasing pressure to manage plastic waste efficiently and sustainably.

With rising environmental concerns and stricter regulations, companies are adopting advanced recycling technologies and waste reduction strategies to minimize plastic waste generation. Industrial sectors, including manufacturing, construction, and automotive, are investing in sustainable solutions such as material recovery, waste-to-energy conversion, and closed-loop recycling systems to reduce environmental impact.

Additionally, industries are focusing on product design and packaging innovations that enable easier recycling and lower waste generation, thus meeting corporate sustainability goals while aligning with global circular economy initiatives.

Plastic Waste Management Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific accounted for around 36.35% share of the plastic waste management market in 2023 in the global market, with a valuation of USD 12.77 billion. Asia Pacific is the dominant region in the market, largely due to its high plastic waste generation driven by rapid urbanization, industrialization, and large populations.

Countries like China, India, and Japan are leading the charge with significant investments in advanced recycling technologies, waste management infrastructure, and sustainable practices. Stringent government regulations, combined with rising environmental awareness and consumer demand for eco-friendly solutions, are encouraging businesses to adopt circular economy models.

Furthermore, public-private partnerships and international collaborations are accelerating innovation, particularly in waste-to-energy technologies, positioning Asia Pacific as a key player in the global market.

The market in Europe is poised for significant growth over the forecast period at a CAGR of 3.53%. This is attributed to the strong focus on sustainability and environmental responsibility in the region. Stringent regulations and policies aimed at reducing plastic waste, combined with increasing consumer awareness, are encouraging the adoption of advanced recycling technologies & waste management practices as well as promoting circular economy.

The growing emphasis on circular economy principles is pushing industries to adopt sustainable packaging and improve recycling efficiencies. As a result, Europe is emerging as a key player in advancing plastic waste management solutions, contributing to a more sustainable and resource-efficient future.

- In June 2024, the European Environment Agency (EEA) introduced a new monitoring tool as part of its Circularity Metrics Lab to track plastic circularity progress in Europe. This tool provides critical insights for policymakers and the public, aiding in efforts to transition to a circular economy for plastics.

Competitive Landscape

The global plastic waste management market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in Plastic Waste Management Market

- Veolia

- SUEZ

- Republic Services

- CLEAN HARBORS, INC.

- Biffa

- Stericycle, Inc

- REMONDIS SE & Co. KG

- com

- Tana Oy

- Envac

Key Industry Developments

- December 2024 (Partnership): SUEZ and Saudi Investment Recycling Company (SIRC) have formed a strategic partnership to accelerate circular economy initiatives in Saudi Arabia. This collaboration aims to develop waste-to-energy infrastructures, enhance waste management solutions for municipal, medical, and hazardous waste, and support decarbonization efforts through biochar production, aligning with Vision 2030’s sustainability goals.

- August 2024 (Expansion): PepsiCo India, in collaboration with The Social Lab (TSL), expanded the Tidy Trails initiative in India to raise awareness about plastic circularity. This program encourages plastic recycling and waste management through collaboration with local businesses, supporting sustainability and the creation of products like recycled benches, fostering a cleaner environment.

The global plastic waste management market is segmented as:

By Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Others

By End-User

- Residential

- Commercial

- Industrial

By Source

- Municipal Solid Waste (MSW)

- Industrial Waste

By Service

- Collection

- Recycling and Disposal

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America