Methyl Isobutyl Ketone Market Size

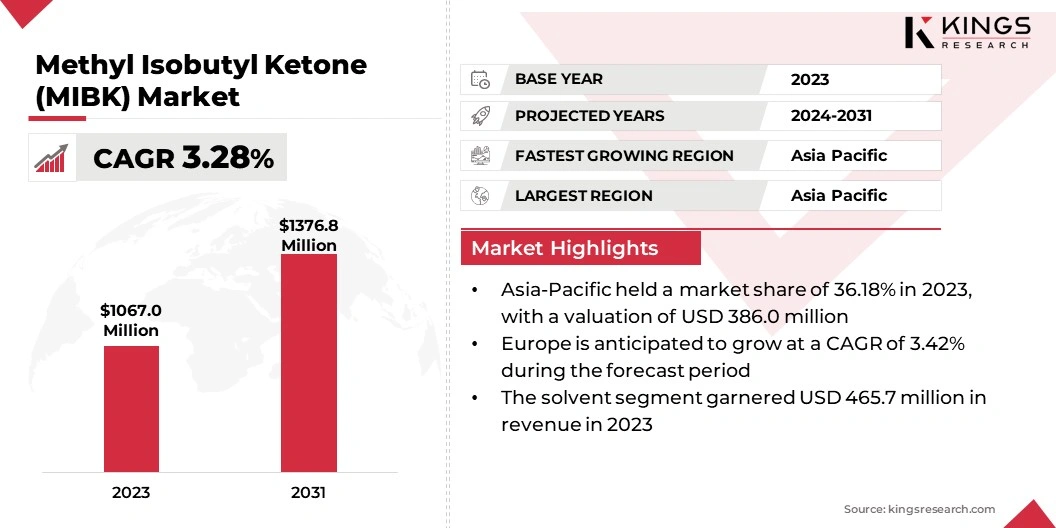

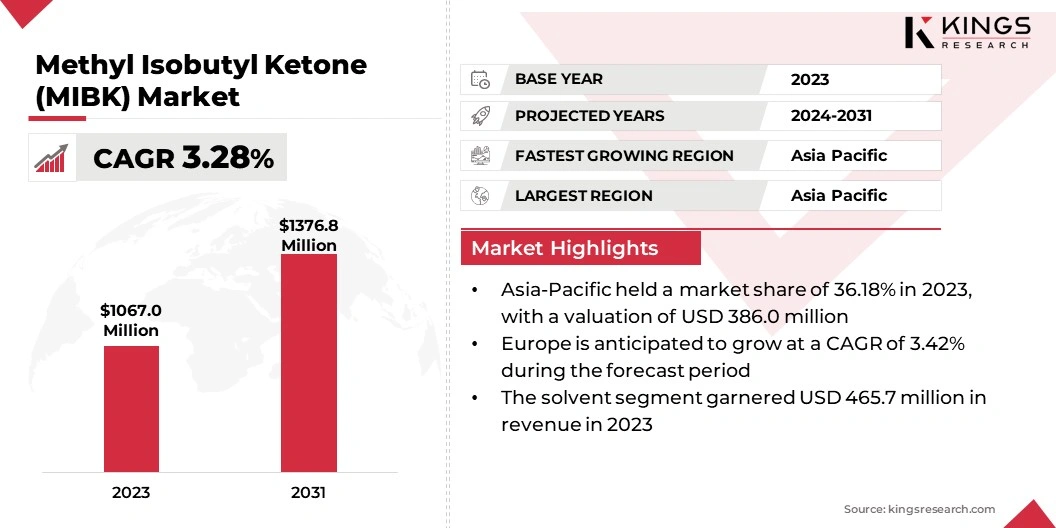

The global Methyl Isobutyl Ketone (MIBK) Market size was valued at USD 1,067.0 million in 2023 and is projected to grow from USD 1,098.4 million in 2024 to USD 1,376.8 million by 2031, exhibiting a CAGR of 3.28% during the forecast period. The expansion of the market is driven by its essential role as a solvent in paints, coatings, rubber processing, and adhesives.

With the increasing demand across diverse industries, the focus on sustainability and regulatory compliance is fostering innovation in production methods, ensuring sustained growth in the face of evolving market dynamics. In the scope of work, the report includes solutions offered by companies such as Arkema Group, Eastman Chemical Company, Celanese Corp., Kumho P&B Chemicals., Inc., Mitsui Chemicals Asia Pacific, Ltd, Monument Chemical, Shell plc, Sasol, Merck KGaA, Solvay, and others.

The growth of the methyl isobutyl ketone market is fueled by its versatile applications in various industries such as paints, coatings, rubber processing, adhesives, and cleaning agents. With increasing demand from sectors such as automotive and construction, MIBK's role as a solvent and processing aid remains pivotal. The market is evolving with a focus on sustainable production methods and regulatory compliance.

Key players are investing heavily in R&D to develop bio-based alternatives and enhance manufacturing efficiencies. Despite regulatory challenges, strategic partnerships and advancements in technology are poised to contribute to robust market growth, catering to the rising global demand for high-performance chemicals in industrial applications.

Methyl isobutyl ketone (MIBK) is a colorless liquid solvent with a distinct mild odor. It is widely used in various industrial applications such as paints, coatings, adhesives, and rubber processing due to its excellent solvency properties. MIBK is produced through the catalytic condensation of acetone and hydrogenation of diacetone alcohol.

It plays a crucial role in enhancing the performance and quality of products across diverse industries, including automotive and construction, where solvents are essential for formulation and processing.

Analyst’s Review

The increasing use of methyl isobutyl ketone (MIBK) in the automotive industry, particularly due to the rising shift toward electric vehicles (EVs), is significantly fostering market growth.

- For instance, the U.S. aims for EVs to make up 50% of new passenger car and light truck sales by 2030, according to the International Energy Agency (IEA). This transition necessitates advanced materials and solvents such as MIBK for the production of batteries and other components, leading to its increased demand.

To capitalize on this trend, key market players are increasingly focusing on producing bio-based MIBK and improving manufacturing technologies to reduce environmental impact. These strategies align with evolving consumer preferences for sustainability and enhance MIBKs position as a more competitive and versatile solution in the automotive sector. By investing heavily in sustainable production methods and innovative applications, companies are striving to meet the rising demand from the EV market and other advancements in the automotive industry.

Methyl Isobutyl Ketone Market Growth Factors

The increased use of methyl isobutyl ketone (MIBK) in the automotive industry is a significant factor supporting the growth of the market. MIBK is essential in rubber processing by contributing to the production of high-performance tires and components. Additionally, it serves as a solvent in automotive paints and coatings, ensuring high-quality finishes and quick drying times. Additionally, it is used in adhesives and sealants that are crucial for vehicle assembly and maintenance. Its role as a cleaning and degreasing agent further boosts its demand.

This surge in vehicle production boosts the demand for MIBK, which is essential in rubber processing for high-performance tires and serves as a solvent in automotive paints and coatings.

- General Motors announced an investment of over USD 7 million in 2022 to produce electric vehicles in the U.S., leading to the pressing need for MIBK in adhesives, sealants, and cleaning agents for vehicle assembly and maintenance.

A significant challenge hampering the development of the methyl isobutyl ketone (MIBK) market is the increasing stringency of environmental and regulatory constraints. MIBK, similar to many industrial solvents, is subject to regulations due to its potential environmental and health impacts. Regulatory bodies such as the Environmental Protection Agency (EPA) impose strict guidelines regarding the production, usage, and disposal of MIBK to mitigate its environmental footprint and ensure safe handling practices.

However, investing in research and development for eco-friendly alternatives is essential to meet stringent environmental regulations while reducing the carbon footprint associated with MIBK production. Implementing advanced compliance and monitoring systems ensures adherence to regulatory guidelines set by agencies such as the Environmental Protection Agency (EPA), thereby ensuring safe handling and disposal practices.

Methyl Isobutyl Ketone Market Trends

There is an increasing trend toward the use of environmentally friendly and sustainable solvents, attributable to stringent environmental regulations and growing awareness regarding the health and environmental impacts of traditional solvents. This trend is leading to the development and widespread adoption of bio-based and low-VOC (volatile organic compound) alternatives.

While MIBK is a widely used solvent, the methyl isobutyl ketone market is witnessing a notable shift toward greener alternatives, prompting manufacturers to innovate and improve the sustainability of their products, which is slated to fuel the expansion of the market.

Advancements in production technologies are emerging as a significant trend in the market. Manufacturers are investing heavily in research and development to enhance the efficiency and sustainability of MIBK production processes. Innovations such as catalytic processes and the use of alternative feedstocks are being explored to reduce production costs, improve yield, and minimize environmental impact.

These technological advancements assist in meeting regulatory requirements and provide a competitive advantage by ensuring a consistent and high-quality supply of MIBK, thereby boosting market growth.

Segmentation Analysis

The global market is segmented based on application, end-use industry, and geography.

By Application

Based on application, the methyl isobutyl ketone market is categorized into solvent, chemical intermediate, extracting agent, and others. The solvent segment garnered the highest revenue of USD 465.7 million in 2023. This notable expansion is propelled by its indispensable role across various industries. MIBK's efficacy as a solvent in paints, coatings, adhesives, and pharmaceutical formulations enhances product performance and manufacturing efficiency.

With an increasing demand for high-quality coatings and adhesives in the automotive, construction, and consumer goods sectors, the solvent segment is experiencing steady expansion. Moreover, innovations in eco-friendly formulations and stringent regulatory compliance stimulate segmental growth by meeting sustainability goals and enhancing market competitiveness.

By End-Use Industry

Based on end-use industry, the market is divided into paints & coatings industry, rubber industry, pharmaceutical industry, and others. The paints & coatings industry segment captured the largest methyl isobutyl ketone market share of 46.38% in 2023, primarily due to its wide-ranging applications and increasing demand across various industries.

In construction, rapid urbanization and infrastructure development worldwide is leading to increased demand for decorative and protective coatings. In the automotive sector, advanced coatings are crucial in enhancing vehicle aesthetics and durability, thereby supporting growth in vehicle production. Additionally, industrial coatings cater to diverse needs such as corrosion protection and thermal insulation, thereby expanding segmental growth.

Methyl Isobutyl Ketone Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific methyl isobutyl ketone market share stood around 36.18% in 2023 in the global market, with a valuation of USD 386.0 million. This expansion is bolstered by initiatives such as India's 'Make In India' campaign, which showcases robust growth dynamics across various industries, including electronics and semiconductors. According to the India Electronics and Semiconductor Association, the semiconductor component market in India is projected to reach USD 32.35 billion by 2025.

This growth is fueled by increas investments in semiconductor manufacturing, as part of the government's initiative aimed at enhancing local production capabilities and reducing dependency on imports. The region's expanding automotive, construction, and consumer electronics sectors further bolster demand for paints, coatings, and other industrial chemicals, supporting the growth of the Asia-Pacific market.

Europe is anticipated to witness a significant growth at a CAGR of 3.42% over the forecast period. Europe represents a significant market for methyl isobutyl ketone (MIBK), primarily attributable to its diverse industrial applications and stringent regulatory standards. The region's automotive sector extensively utilizes MIBK in the rubber processing involved in tire manufacturing, particularly within the automotive production hubs in countries such as Germany, France, and Italy.

Moreover, the construction industry's growing reliance on MIBK for paints and coatings underscores its integral role in enhancing both product performance and durability. Innovations in eco-friendly solvents and compliance with REACH regulations (Registration, Evaluation, Authorization and Restriction of Chemicals) further shape the regional market landscape, ensuring sustainable growth opportunities while meeting environmental standards.

Competitive Landscape

The global methyl isobutyl ketone market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Methyl Isobutyl Ketone Market

- Arkema Group

- Eastman Chemical Company

- Celanese Corp.

- KUMHO P&B CHEMICALS.,INC.

- MITSUI CHEMICALS ASIA PACIFIC, LTD

- Monument Chemical

- Shell plc

- Sasol

- Merck KGaA

- Solvay

The global methyl isobutyl ketone market is segmented as:

By Application

- Solvent

- Chemical Intermediate

- Extracting Agent

- Others

By End-Use Industry

- Paints & Coatings Industry

- Rubber Industry

- Pharmaceutical Industry

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America