Market Definition

The market includes the design and production of electronic devices and systems used in diagnostics, monitoring, treatment, and imaging. It covers technologies such as patient monitoring systems, implantable devices, diagnostic imaging equipment, and therapeutic electronics.

Processes involve circuit design, miniaturization, and signal processing, with strict regulatory compliance. These systems support precision, automation, and real-time data in patient care. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Medical Electronics Market Overview

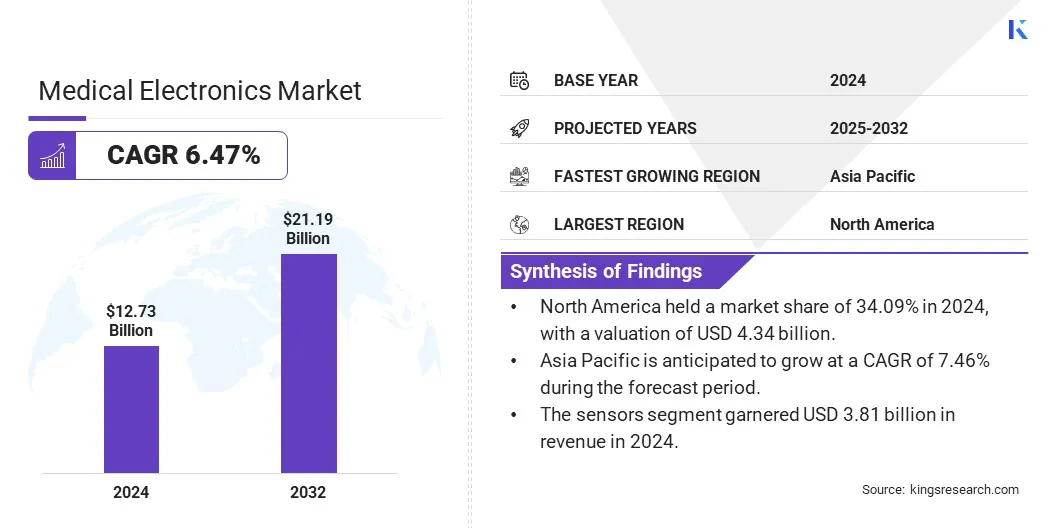

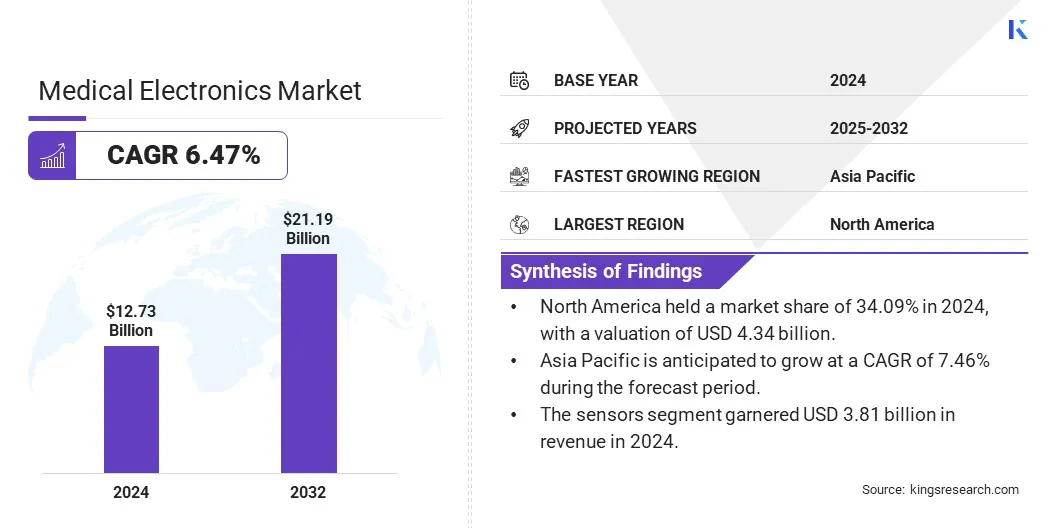

The global medical electronics market size was valued at USD 12.73 billion in 2024 and is projected to grow from USD 13.49 billion in 2025 to USD 21.19 billion by 2032, exhibiting a CAGR of 6.47% during the forecast period.

The growth of the market is driven by the increasing demand for diagnostic imaging systems, which require high-performance electronic components for accuracy and efficiency. Additionally, the rise of IoT-connected healthcare systems supports real-time monitoring and data integration, further accelerating the adoption of advanced medical electronic devices across care settings.

Major companies operating in the medical electronics industry are Medtronic plc, Johnson & Johnson Services, Inc., Abbott, Siemens, General Electric Company, Koninklijke Philips N.V., Stryker, Boston Scientific Corporation, Becton, Dickinson and Company, Baxter International Inc., Danaher Corporation, Intuitive Surgical, Analog Devices, Inc., TE Connectivity, and Texas Instruments Incorporated.

The global rise in lifestyle-related illnesses like diabetes, cardiovascular diseases, and respiratory disorders is contributing to the growth of the market. These conditions require continuous monitoring and periodic diagnosis, increasing the reliance on electronic devices such as insulin pumps, cardiac monitors, and pulmonary function systems.

The demand for accurate, real-time data for managing long-term conditions is pushing healthcare providers to adopt more advanced electronic medical systems, boosting market growth.

- In August 2024, Insulet Corporation announced that its Omnipod 5 Automated Insulin Delivery System received FDA clearance for use in individuals with type 2 diabetes aged 18 years and older in the U.S. This is the first automated insulin delivery system approved for managing both type 1 and type 2 diabetes, expanding access to advanced treatment options for insulin-dependent patients.

Key Highlights

- The medical electronics industry size was valued at USD 12.73 billion in 2024.

- The market is projected to grow at a CAGR of 6.47% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 4.34 billion.

- The sensors segment garnered USD 3.81 billion in revenue in 2024.

- The diagnostic & imaging systems segment is expected to reach USD 5.28 billion by 2032.

- The hospitals segment secured the largest revenue share of 33.24% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 7.46% during the forecast period.

Market Driver

Increasing Demand for Diagnostic Imaging Systems

The growth of the medical electronics market is strongly supported by the rising demand for diagnostic imaging systems such as CT, MRI, and ultrasound devices. Healthcare providers are focusing on early disease detection, leading to the adoption of high-resolution imaging technologies.

These systems rely on advanced electronic components for accurate signal processing and image clarity. Continuous innovation in imaging electronics and miniaturization of components is enabling hospitals and diagnostic centers to enhance clinical outcomes, thereby driving market growth.

- In February 2025, GE HealthCare unveiled the Freelium sealed MRI magnet and the Revolution Vibe CT scanner at the European Congress of Radiology (ECR) 2025. The Freelium magnet operates with less than 1% of the helium used in conventional systems, reducing operational costs and environmental impact. The Revolution Vibe CT scanner offers advanced cardiac imaging capabilities, including ECG-less cardiac imaging and AI-driven workflow enhancements, aiming to improve diagnostic accuracy and efficiency.

Market Challenge

Complex Regulatory Approvals and Compliance Requirements

A significant challenge limiting the growth of the medical electronics market is navigating complex and evolving regulatory frameworks. Varying standards across regions increase the time and cost of product approvals, delaying the market entry of medical electronics.

To address this, key players are investing in dedicated regulatory affairs teams and adopting global quality management systems like ISO 13485. They are also engaging in early consultations with regulatory bodies and participating in international audit programs such as the Medical Device Single Audit Program (MDSAP) to streamline approvals and ensure compliance, helping reduce time-to-market for new medical electronic technologies.

Market Trend

Growth in IoT-Connected Healthcare Systems

The use of Internet of Things (IoT) technology in healthcare is supporting the expansion of medical electronics. Devices such as wearable monitors, infusion pumps, and ventilators are increasingly being connected to centralized platforms. This allows for seamless data sharing, remote diagnostics, and centralized monitoring.

Medical electronics with built-in connectivity features are essential in modern healthcare networks, prompting manufacturers to develop compact, secure, and reliable communication systems tailored for clinical environments.

- In May 2024, Vyvo received FDA clearance for its LifeWatch wearable device, which integrates blockchain technology for health and wellness tracking. LifeWatch allows users to monitor vital signs such as heart rate and blood pressure, and leverages Decentralized Physical Infrastructure network (DePIN) technology to enable users to monetize their health data securely.

Medical Electronics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Sensors, Batteries, Displays, MCUS/MPUS, Memory Chips, Others

|

|

By Device

|

Diagnostic & Imaging Systems, Patient Monitoring, Active Medical Implantable, Ventilators, Surgical Robotic Systems, Others

|

|

By End Use

|

Hospitals, Ambulatory Surgical Centers, Home care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Sensors, Batteries, Displays, MCUS/MPUS, Memory Chips, Others): The Sensors segment earned USD 3.81 billion in 2024 due to its critical role in real-time patient monitoring, diagnostics, and integration with connected healthcare systems.

- By Device (Diagnostic & Imaging Systems, Patient Monitoring, Active Medical Implantable, Ventilators, Surgical Robotic Systems, Others): The Diagnostic & Imaging Systems segment held 24.88% of the market in 2024, due to its critical role in early disease detection and the continuous demand for advanced imaging technologies in hospitals and diagnostic centers.

- By End Use (Hospitals, Ambulatory Surgical Centers, Home care, Others): The Hospitals segment is projected to reach USD 6.98 billion by 2032, owing to high patient volumes, advanced infrastructure, and continuous demand for sophisticated diagnostic and monitoring equipment.

Medical Electronics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America medical electronics market share stood at around 34.09% in 2024 in the global market, with a valuation of USD 4.34 billion. North America has one of the most advanced healthcare infrastructures globally, which supports early adoption of medical electronics.

Hospitals and clinics are well-equipped with modern diagnostic and monitoring systems that rely on high-performance electronics. Additionally, the availability of skilled professionals, advanced medical equipment, and streamlined procurement processes is accelerating the integration of new electronic technologies in healthcare institutions, thereby driving market growth in the region.

Moreover, hospitals and medical centers in North America are at the forefront of integrating robotics and AI into surgery, diagnostics, and patient care. These systems require advanced electronic components capable of real-time processing and precision control.

Moreover, the increasing demand for robotic-assisted surgeries and automated diagnostics in specialized medical centers is fueling the need for high-performance medical electronics across the region.

- In April 2025, Intuitive Surgical received FDA clearance for its SureForm 45 stapler, designed for single-port robotic surgery. Compatible with the da Vinci SP system, the stapler features SmartFire technology, optimizing staple line integrity in thoracic, colorectal, and urologic procedures, enhancing surgical precision and efficiency.

Asia Pacific medical electronics industry is poised for significant growth at a robust CAGR of 7.46% over the forecast period. Asia Pacific is witnessing the fast-paced development of hospitals, diagnostic centers, and specialty clinics, particularly in urban and semi-urban areas. These facilities require modern medical equipment that depends on advanced electronics.

Furthermore, to meet international care standards in medical tourism, hospitals are investing in modern equipment powered by medical electronics. This includes high-resolution imaging systems, robotic surgical equipment, and intelligent monitoring devices, which are driving demand for high-performance medical electronics across the region.

- In October 2023, Medical Microinstruments (MMI) expanded its global presence by entering the Asia Pacific market through distribution agreements with Device Technologies and TRM Korea. These partnerships aim to introduce MMI's Symani Surgical System to countries including Hong Kong, Singapore, Vietnam, Malaysia, Indonesia, Thailand, Philippines, Macau, New Zealand, and South Korea, contingent upon regulatory approvals. The Symani system is designed for microsurgery and supermicrosurgery, offering enhanced precision and control for complex soft tissue procedures.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) regulates medical electronics under the Federal Food, Drug, and Cosmetic Act. Devices are categorized into Class I, II, or III, based on risk. Class II devices require a 510(k) premarket notification, while Class III devices need Premarket Approval (PMA). The FDA has also begun regulating laboratory-developed tests (LDTs), requiring manufacturers to comply with adverse event reporting and premarket requirements.

- Medical electronics in the European Union are governed by Regulation (EU) 2017/745 on Medical Devices (MDR) and Regulation (EU) 2017/746 on In Vitro Diagnostic Devices (IVDR). Products must bear the CE mark, indicating conformity with EU health, safety, and environmental standards. Unique Device Identification (UDI) and registration in the European Database on Medical Devices (EUDAMED) are required. Manufacturers must follow ISO 14971 for risk management and implement post-market surveillance.

- In China, the National Medical Products Administration (NMPA) regulates medical electronics. Devices are categorized into Class I (low risk), Class II (moderate risk), and Class III (high risk). Class II and III devices require registration, clinical evaluation, and testing by certified labs. Compliance with Chinese Good Manufacturing Practices (GMP) is mandatory. Foreign manufacturers must appoint a local agent for registration and communication with the NMPA.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and Ministry of Health, Labour and Welfare (MHLW) oversee medical electronics under the Pharmaceuticals and Medical Devices Act (PMD Act). Devices are classified into Classes I to IV based on risk. Approval paths vary: Class I devices need notification, Class II may be certified by Registered Certification Bodies, and Class III and IV require direct approval by the MHLW with PMDA review.

Competitive Landscape

Market players are adopting strategies such as integrating advanced imaging technologies, enhancing robotic surgical systems, and incorporating AI-driven diagnostics into medical devices, contributing to the market expansion. These efforts are aimed at improving precision, reducing surgeon fatigue, and increasing the overall safety of procedures.

By focusing on innovation that supports complex clinical needs, companies are strengthening their competitive position while meeting the growing demand for reliable and efficient medical electronics.

- In December 2024, AUO Corporation unveiled its 3D Smart Surgical Imaging Platform in Taiwan. This platform integrates ADP's "Naked-eye 3D Solution" with the Saroa Robotic Surgery System, enabling surgeons to perform complex procedures without visual strain. The system also incorporates AI-assisted diagnostic tools and real-time 3D imaging, enhancing surgical efficiency and safety.

List of Key Companies in Medical Electronics Market:

- Medtronic plc

- Johnson & Johnson Services, Inc.

- Abbott

- Siemens

- General Electric Company

- Koninklijke Philips N.V.

- Stryker

- Boston Scientific Corporation

- Becton, Dickinson and Company

- Baxter International Inc.

- Danaher Corporation

- Intuitive Surgical

- Analog Devices, Inc.

- TE Connectivity

- Texas Instruments Incorporated

Recent Developments (Product Launches)

- In March 2025, Canon Medical Systems announced FDA clearance for AI enhancements to its Aquilion ONE / INSIGHT Edition CT scanner. The updates include the PIQE 1024 matrix and SilverBeam technology, expanding the scanner's capabilities across a broader range of clinical applications and enhancing image quality while reducing radiation dose.

- In March 2025, Canon Medical Systems USA launched Adora DRFi, following its FDA 510(k) clearance. The Adora DRFi is a hybrid imaging system that combines radiographic and fluoroscopic imaging capabilities in a single solution, designed to enhance diagnostic versatility and patient throughput.

- In February 2025, Medtronic's deep brain stimulation system was approved by the FDA for treating Parkinson's disease. This device offers personalized therapy, adjusting stimulation parameters to patient needs, aiming to improve motor symptoms and quality of life for individuals with Parkinson's.

- In November 2024, LifeSignals announced FDA Class II 510(k) clearance for its UbiqVue 2A Multiparameter System. This single-use, wearable biosensor collects twelve physiological parameters, including oxygen saturation, ECG, and respiration rate. Data is transmitted securely in near real-time to a cloud-based system, enabling continuous patient monitoring in various settings.

- In October 2024, iRhythm Technologies obtained FDA 510(k) clearance for enhancements to its Zio AT device, a wearable patch for outpatient cardiac telemetry. The device records continuous ECG data for up to 14 days, transmitting information to the ZEUS system, which uses deep-learning algorithms to analyze cardiac events, aiding in clinical decision-making.