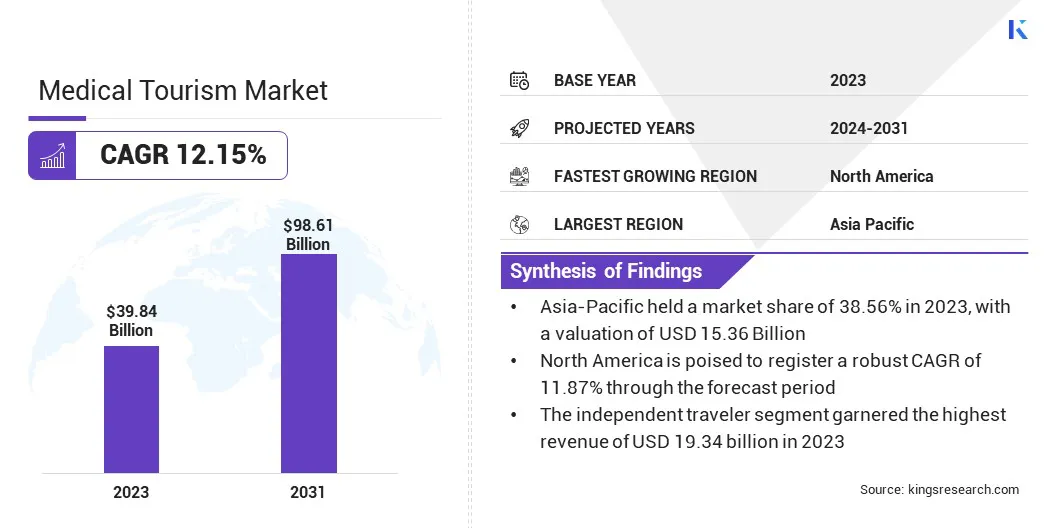

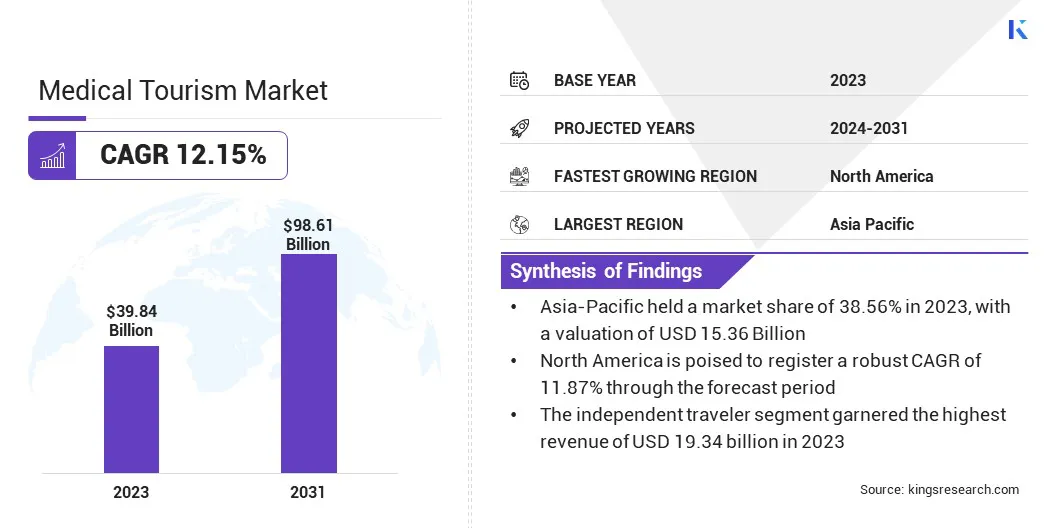

Medical Tourism Market Size

The global Medical Tourism Market size was valued at USD 39.84 billion in 2023 and is projected to grow from USD 44.19 billion in 2024 to USD 98.61 billion by 2031, exhibiting a CAGR of 12.15% during the forecast period. Advancements in medical technology and growing popularity of wellness tourism are fostering market growth.

In the scope of work, the report includes products offered by companies such as Bumrungrad International Hospital, Apollo International, MedRetreat, Asian Heart Institute, Raffles Medical Group, Prince Court Medical Centre, Livonta Global, KASEMRAD INTERNATIONAL HOSPITAL VIENTIANE, Samitivej PCL, KPJ Healthcare Berhad, and others.

Partnerships between hospitals and travel agencies are becoming increasingly important in the medical tourism market. These collaborations simplify seeking treatment abroad by offering comprehensive packages that cover medical consultations, hospital bookings, travel arrangements, and accommodations.

This integration of services provides a hassle-free experience for medical tourists, who may otherwise find it challenging to navigate complex healthcare systems in foreign countries. Such partnerships boost patient confidence by ensuring the quality and accreditation of hospitals and doctors through travel agencies' endorsements. Hospitals, in turn, benefit by tapping into a broader market of international patients without focusing on travel logistics.

- For instance, in September 2023, According to Invest India, Apollo and Fortis have established International Patient Assistance Centers across several countries. These partnerships with local healthcare professionals, travel agencies, and wellness tourism agencies aim to enhance the experience for medical tourists and streamline patient journeys.

Additionally, these collaborations may lead to cost-effective solutions for patients through bundled services with discounted rates. The collaboration between the medical and travel sectors can significantly increase patient inflow as more individuals seek affordable, high-quality healthcare abroad. For medical tourism destinations, such partnerships enhance visibility, improve marketing, and strengthen global reputation.

Medical tourism involves traveling abroad for medical treatment, often to benefit from at lower costs or reduced wait times. Treatments sought can range from elective cosmetic procedures and dental work to complex surgeries, such as heart operations or orthopedic interventions.

In addition to the primary treatment, medical tourists typically undergo pre-treatment consultations through telemedicine or in-person assessments upon arrival. Booking a medical tourism package typically involves collaboration between healthcare providers and travel agencies, ensuring that patients have access to transportation, accommodations, and hospital appointments.

Tourists involved in medical tourism frequently travel to countries renowned for their healthcare expertise and affordable costs. Popular destinations such as Thailand, Mexico, India, and Turkey provide world-class medical services at a fraction of the cost compared to developed nations.

Medical tourists can combine their healthcare needs with leisure travel, a many hospitals and clinics in these destinations offer translators and concierge services to ensure a comfortable and secure stay.

Analyst Review

In the competitive landscape of the medical tourism market, key players are employing a range of strategies to maintain and expand their market positions. Companies are increasingly focusing on expanding their service offerings, enhancing patient care, and forming strategic partnerships with international healthcare providers and travel agencies.

Numerous firms are further investing heavily in digital platforms, enabling them to offer telemedicine services and streamline patient bookings, consultations, and follow-up care. This integration of technology has become a vital part of medical tourism, as it allows for better patient management, reduced costs, and enhanced coordination across borders.

- In August 2023, Invest India reported that AI technologies have revolutionized medical tourism by enhancing telemedicine services, enabling patients to remotely connect with healthcare professionals. Virtual consultations and AI-driven diagnostic tools, such as image analysis, allow patients to receive expert opinions, treatment advice, and second opinions remotely, thus improving global healthcare access.

Current market growth is propelled by rising healthcare costs in developed nations, leading more patients to seek affordable treatments abroad. Key market players are capitalizing on this trend by improving their marketing efforts to highlight the quality, safety, and affordability of their services.

Additionally, the development of specialized healthcare hubs focused on specific treatments such as cosmetic surgery, dental care, and fertility services allows companies to establish niche segments within the broader market. Navigating regulatory challenges and maintaining high standards of care are likely to be crucial for companies to sustain patient trust and sustain long-term growth.

Medical Tourism Market Growth Factors

Global demand for cosmetic procedures is rising due to increasing social acceptance, improved techniques, and a growing inclination toward aesthetic enhancement. Many individuals are opting for cosmetic surgeries such as liposuction, facelifts, rhinoplasty, and breast augmentation, particularly in countries where these procedures are more affordable. Furthermore, the desire for minimally invasive treatments such as Botox and dermal fillers is growing.

- For instance, in June 2024, The International Society of Aesthetic Plastic Surgery (ISAPS) revealed a 5.5% rise in global aesthetic surgical procedures, surpassing 15.8 million, and 19.1 million non-surgical treatments. Over the past four years, aesthetic procedures have grown by 40%, underscoring the surging global demand for cosmetic interventions.

Countries such as Brazil, South Korea, and Turkey are becoming popular destinations for cosmetic procedures due to their specialized expertise and affordable prices. These countries offer advanced medical facilities and skilled professionals, attracting patients worldwide. Lower costs relative to developed countries are a major driver of medical tourism for cosmetic procedures.

Additionally, the growing availability of specialized packages that include consultation, surgery, and recovery makes the process more accessible to international patients. Hospitals and clinics are increasingly offering customized services for cosmetic tourists, including translators, luxury accommodations, and post-surgical care, to meet rising demand. This trend reflects the increasing importance of personalization and quality in medical tourism for cosmetic enhancements.

Ensuring consistent quality and safety in medical tourism is challenging due to varying regulations, accreditation systems, and medical standards. Hospitals and clinics in one country may adhere to different standards compared to another, which may impact patient outcomes. The lack of consistent oversight on medical facilities catering to foreign patients raises concerns regarding safety, quality, and liability, especially in complex procedures.

Medical tourists frequently lack awareness of these variations and rely on travel agencies or personal research to select their destination and provider. However, this creates gaps in maintaining consistent quality and safety for all patients. Addressing this challenge requires international regulatory frameworks to establish universal healthcare standards and accreditation systems to certify medical facilities based on globally accepted best practices.

Additionally, hospitals involved in medical tourism are increasingly implementing rigorous internal quality control measures, adopting technology for better monitoring of patient outcomes, and ensuring that doctors hold international certifications.

Collaboration between governments, health agencies, and global accreditation bodies are essential for mitigating safety risks. Promoting transparency and providing clearer information on hospital certifications and doctor qualifications is projected to enhance patient trust and safety internationally.

Medical Tourism Market Trends

Advancements in medical technology are revolutionizing the medical tourism market, making it more attractive for international patients seeking high-quality treatment. Cutting-edge innovations such as robotic surgery, minimally invasive techniques, and advanced imaging technology are improving the precision, safety, and effectiveness of medical procedures.

These developments are reducing recovery times and minimizing risks, making it easier for patients to consider traveling abroad for complex treatments. Technologies such as telemedicine are further enhancing pre- and post-treatment care, allowing patients to consult with specialists remotely and receive follow-up care after returning to their home country.

- For instance, in April 2024, the Medical Tourism Association survey highlighted that trust issues, poor patient experiences, and ineffective marketing strategies hinder growth in medical tourism. Over 53% of respondents reported a lack of patient leads, particularly impacting markets in Asia Pacific (31.8%), North America (22.7%), and the Middle East (20.5%).

Countries that invest heavily in advanced medical technologies, such as Singapore, Germany, and South Korea, are emerging as leading destinations for medical tourists due to their availability of procedures not widely available in other parts of the world.

Furthermore, technology enables hospitals to provide personalized treatments, including robotic-assisted surgeries and precision medicine approaches tailored to individual patients. The ongoing evolution of medical technology is anticipated to foster the growth of the medical tourism market by enabling safer and more effective treatments for a global patient base.

Segmentation Analysis

The global market has been segmented based on treatment, booking mode, tourist, location, and geography.

By Treatment

Based on treatment, the market has been segmented into cosmetic, dental, cardiovascular, orthopedics, and others. The cosmetic segment captured the largest medical tourism market share of 37.56% in 2023, primarily due to the growing global demand for aesthetic enhancement procedures. This rise is fueled by several factors, including increasing societal acceptance of cosmetic surgeries, advancements in minimally invasive techniques, and surging focus on physical appearance due to social media influence.

Countries such as South Korea, Brazil, and Turkey, renowned for their expertise in cosmetic surgery, have become key destinations for medical tourists seeking affordable procedures such as facelifts, rhinoplasty, liposuction, and breast augmentation. Additionally, the trend toward minimally invasive cosmetic treatments, such as Botox and dermal fillers, is contributing to the expansion of the segment.

As medical tourists seek affordable and safe options, the cosmetic segment has experienced notable growth. This growth is further supported by its accessibility and the ability of these countries to deliver superior results at a fraction of the cost compared to developed nations. The popularity of package deals that include travel, accommodation, and post-surgery recovery services has further bolstered the growth of the segment.

By Booking Mode

Based on booking mode, the market has been classified into phone, online, and counter. The online segment is expected to record a staggering compound annual growth rate (CAGR) of 13.51% through the forecast period, largely attributed to the increasing digitization of the healthcare and medical tourism industries.

Online platforms that facilitate the booking of medical procedures, consultations, and travel arrangements are becoming indispensable for medical tourists. These platforms offer transparency, allowing patients to compare costs, read reviews, and access information on the quality and accreditation of hospitals and doctors.

The rise of telemedicine services is further contributing to segmental growth, enabling patients to consult healthcare providers remotely before traveling for treatment. This seamless online process reduces costs and enhances patient convenience and trust. As more patients shift toward digital solutions for researching, booking, and managing their medical journeys, the demand for online services in medical tourism is expected to surge.

Furthermore, advancements in secure payment gateways, data privacy, and virtual health consultations are highlighting the major role of online platforms in international healthcare services. The growth of the online segment reflects a broader trend toward digitalization in healthcare.

By Tourist

Based on tourist, the medical tourism market has been divided into independent traveler, tour group, and package traveler. The independent traveler segment garnered the highest revenue of USD 19.34 billion in 2023, mainly propelled by the increasing preference for personalized and flexible medical tourism experiences.

Independent travelers, unlike those on packaged tours, exercise greater control over their healthcare journeys. They separately book medical treatments, travel, and accommodation, often selecting the best options to meet their specific needs. This trend is further fueled by the growing availability of online resources that allow patients to research and directly book medical procedures with hospitals and clinics, thereby eliminating intermediaries.

Additionally, independent travelers preferred cost savings, as they can negotiate prices and choose from a variety of accommodations, airlines, and recovery packages suited to their preferences.

The emergence of budget airlines and alternative accommodation options like short-term rentals has facilitated independent travel for patients seeking medical procedures. Independent travelers demand customized experiences that cater to both their healthcare and travel needs, thereby supporting the expansion of the segment.

Medical Tourism Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific medical tourism market accounted for a notable share of 38.56% and was valued at USD 15.36 billion in 2023. This dominance is reinforced by several factors, including affordable medical treatments, the availability of highly skilled healthcare professionals, and advanced medical facilities in countries such as Thailand, India, Malaysia, and Singapore.

These nations offer a wide range of medical services, including complex surgeries such as heart bypass and orthopedic procedures, as well as cosmetic treatments and wellness therapies. The region’s competitive pricing, significantly lower than in North America and Europe, is a major attraction for international patients. Furthermore, the regional market has capitalized on its well-developed tourism infrastructure, making it easier for medical tourists to combine treatment with leisure.

Governments in these countries are actively promoting medical tourism by implementing favorable policies, ensuring high-quality healthcare standards, and facilitating visas for medical tourists. With continuous investment in healthcare infrastructure and a focus on international accreditations, the Asia-Pacific region is expected to maintain its leading position in the medical tourism market in the upcoming years.

North America is poised to grow at a robust CAGR of 11.87% in the forthcoming years, primarily due to its increasing focus on outbound medical tourism and the rising cost of healthcare within the United States and Canada. Many patients seek medical treatment abroad to avoid long wait times, high out-of-pocket expenses, and limited insurance coverage for certain procedures.

With an increasing number of North Americans seeking affordable, high-quality healthcare services, the demand for medical tourism is expected to grow significantly. The growth of digital platforms and telemedicine is further facilitating this trend, enabling patients to consult with international doctors and plan their medical journeys more efficiently.

Additionally, North American medical institutions are forming partnerships with international healthcare providers, allowing patients to receive coordinated care across borders. The availability of specialized treatments, such as fertility services, cosmetic surgeries, and advanced dental care, is further stimulating North America market development.

Competitive Landscape

The global medical tourism market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Medical Tourism Market

- Bumrungrad International Hospital

- Apollo International

- MedRetreat

- Asian Heart Institute

- Raffles Medical Group

- Prince Court Medical Centre

- Livonta Global

- KASEMRAD INTERNATIONAL HOSPITAL VIENTIANE

- Samitivej PCL

- KPJ Healthcare Berhad

Key Industry Developments

- January 2024 (Launch): Ferns N Petals unveiled 'MediJourney,' its global medical tourism division, dedicated to offering personalized wellness solutions worldwide. MediJourney provides a range of services, including specialist consultations, medical visa assistance, Tele-Medicine, and post-treatment care, positioning the brand as a key player in international healthcare assistance.

- June 2023 (Investment): Bumrungrad International Hospital, Phuket, Thailand, initiated on a strategic expansion by establishing a 150-bed facility featuring advanced diagnostic technologies. This initiative aims to enhance personalized healthcare services and improve their ability to cater to a growing patient base with cutting-edge medical equipment.

- April 2023 (Partnership): Rattinan Medical Centre, a leading provider of cosmetic surgery and laser treatments in Thailand, partnered with FICO Group to establish a new clinic. This collaboration aims to enhance medical tourism services by specializing in wrinkle-free treatments, thereby positioning Thailand as a key destination for aesthetic healthcare.

The global medical tourism market has been segmented as:

By Treatment

- Cosmetic

- Dental

- Cardiovascular

- Orthopedics

- Others

By Booking Mode

By Tourist

- Independent Traveler

- Tour Group

- Package Traveler

By Location

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America