Electronic Components Market Size

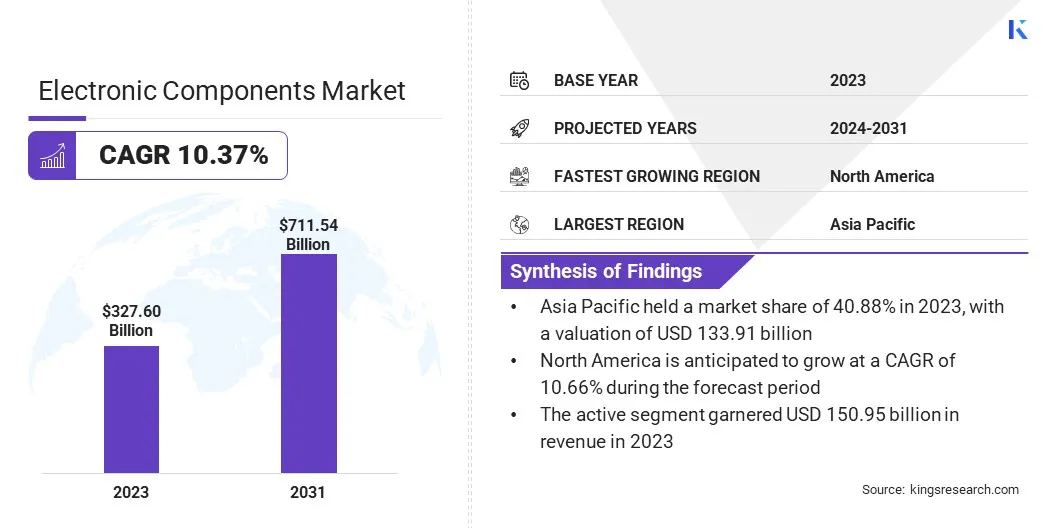

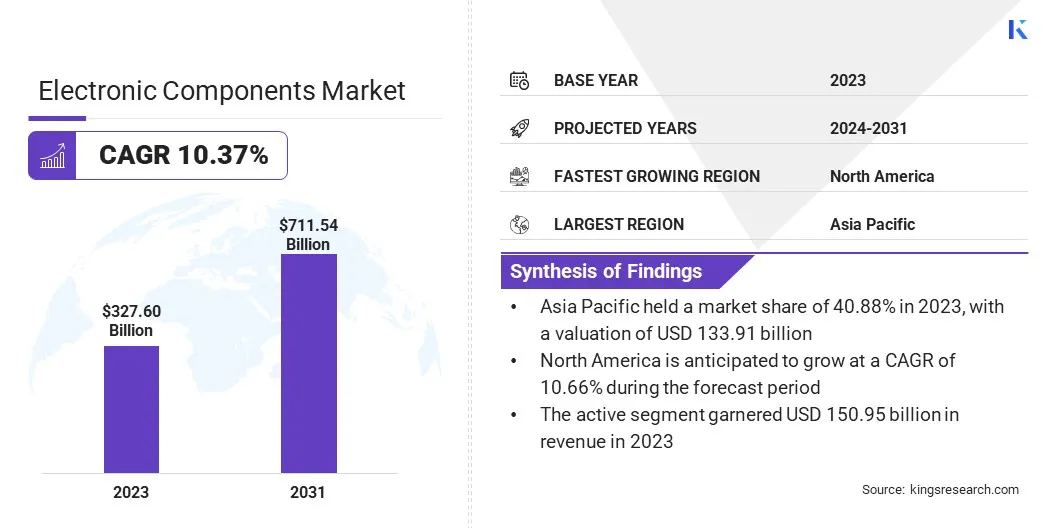

The global Electronic Components Market size was valued at USD 327.60 billion in 2023 and is projected to grow from USD 356.66 billion in 2024 to USD 711.54 billion by 2031, exhibiting a CAGR of 10.37% during the forecast period. The rising adoption of smartphones, laptops, wearables, and smart home devices is contributing to the growth of the market.

Consumers are increasingly seeking advanced features and connectivity, which requires sophisticated semiconductors, sensors, and capacitors.

In the scope of work, the report includes products offered by companies such as Texas Instruments Incorporated, Murata Manufacturing Co., Ltd., Samsung Electronics Co., Ltd., NXP Semiconductors N.V., Analog Devices, Inc., Kyocera Corporation, Amphenol Corporation, TE Connectivity Ltd., Broadcom Inc., Infineon Technologies AG, and others.

Moreover, the growing reliance on cloud computing, big data analytics, and artificial intelligence is driving the expansion of data centers worldwide. These data centers need robust processing power, memory devices, storage solutions, and networking equipment, all of which depend on sophisticated electronic components.

Additionally, the development of smart cities is fueling the demand for electronic components used in smart infrastructure, urban automation, and connectivity systems. Smart cities rely on a network of interconnected devices, sensors, and communication systems to manage transportation, energy, waste, and public services efficiently.

These applications require advanced semiconductors, wireless modules, and power-efficient components, supporting the expansion of the electronic components market.

- In August 2024, the Indian government approved 12 new smart city projects under the National Industrial Corridor Development Programme (NICDP), with an estimated investment of USD 3.40 billion. This initiative aims to reshape the industrial landscape, establish a strong network of industrial nodes and cities, and boost economic growth and global competitiveness.

Electronic components are basic physical entities or devices used in electronic systems to control the flow of electrical currents or signals. These components serve as building blocks for electronic circuits and can include passive elements such as resistors, capacitors, and inductors, as well as active elements such as semiconductors, transistors, and diodes.

They perform essential functions such as signal amplification, power conversion, and data processing, crucial for the design and operation of electronic devices, including computers, smartphones, automotive systems, and industrial machinery.

Analyst’s Review

Continuous advancements in semiconductor fabrication, such as smaller node sizes (e.g., 5nm, 3nm), are enabling the production of faster, more energy-efficient electronic components, thereby augmenting electronic components market growth. These advancements improve the performance and reduce the power consumption of devices used in consumer electronics, automotive applications, and industrial systems.

- In May 2024, Arteris, Inc. partnered with Andes Technology to foster innovation in RISC-V-based SoC designs for applications in AI, 5G, networking, mobile, storage, AIoT, and space. This collaboration enables the integration of high-performance, low-power CPU IPs, improving system functionality and interoperability, particularly within the expanding RISC-V ecosystem.

The development of system-on-chip (SoC) technology, 3D packaging, and other innovative manufacturing techniques enhances the capability of electronic devices while reducing their size. These improvements are leading to a strong demand for advanced semiconductors across diverse industries, thus bolstering the growth of the market.

- In September 2023, MediaTek, a Taiwanese fabless chipmaker, developed its first system-on-chip (SoC) utilizing Taiwan Semiconductor Manufacturing Company's (TSMC) cutting-edge 3nm technology, with mass production scheduled to begin in 2024.

The ability to manufacture faster chips with lower power consumption is a major differentiator in current market, particularly as demand rises for smart, connected, and power-sensitive devices. This trend is expected to boost the demand for advanced electronic components, positioning semiconductor innovation as a key growth factor across multiple markets.

Electronic Components Market Growth Factors

The rise of Industry 4.0 and the need for smart manufacturing solutions foster the adoption of industrial automation, robotics, and AI-powered systems. These systems require highly reliable and efficient electronic components such as sensors, microcontrollers, actuators, and control modules. Automated production lines, robotic assembly, and process monitoring all depend on these components to enhance efficiency and reduce downtime.

- The 2024 report from the International Federation of Robotics indicates that industrial robot installations in the U.S. grew by 12% in 2023, totaling 44,303 units. Notably, the electrical and electronics sector saw a 37% increase, with installations reaching 5,120 units.

Moreover, the automotive industry is rapidly transitioning toward smart, connected vehicles. Advanced driver-assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies are increasingly integrated into modern vehicles, highlighting a pressing need for sensors, processors, power electronics, and control systems.

Furthermore, electric and hybrid vehicles rely on efficient battery management systems and power converters, which increase the demand for specialized electronic components.

However, the production of advanced electronic components involves significant R&D and manufacturing expenses, potentially limiting market growth. To address this challenge, companies operating in the market are investing in process optimization to improve efficiency and reduce costs.

Additionally, firms are exploring partnerships and collaborations to share R&D expenses and leverage economies of scale. Furthermore, companies are focusing on developing cost-effective materials and components to maintain competitive pricing and sustain electronic componentsmarket growth.

Electronic Components Market Trends

The global rollout of 5G networks is boosting the expansion of the electronic components market. Telecom infrastructure providers are deploying advanced base stations, modems, routers, and network equipment, all of which require complex semiconductor chips, RF modules, and communication ICs.

Increased data traffic and higher network speeds demand more efficient, high-performance components to handle communication and data processing. This expansion of network infrastructure, coupled with rising consumer demand for seamless connectivity, underscores the need for advanced electronic components in the telecommunications sector.

- According to the March 2024 report by 5G Americas, global 5G connections grew significantly in 2023, reaching 1.76 billion, a 66% increase due to 700 million new connections. Additionally, IoT subscriptions globally totaled 3.1 billion, while smartphone subscriptions reached 6.6 billion in the same year. Projections for 2026 estimate the rise of IoT subscriptions to 4.5 billion, with smartphone subscriptions expected to increase to 7.4 billion.

Additionally, consumers are increasingly demanding smaller, more portable electronic devices, such as smartphones, wearables, and medical devices. This trend toward miniaturization requires advanced electronic components that offer higher performance while occupying less space, thereby fueling the expansion of the market.

This shift is prompting manufacturers to innovate and invest in smaller, high-performance components that meet evolving consumer preferences.

Segmentation Analysis

The global market has been segmented based on component type, application, and geography.

By Component Type

Based on component type, the market has been segmented into passive, active, and electromechanical. The active segment led the electronic components market in 2023, reaching a valuation of USD 150.95 billion. Active components, including semiconductors, transistors, and integrated circuits, are essential for controlling and amplifying electrical signals in a variety of applications.

The surge in consumer electronics, electric vehicles, and industrial automation leads to increased demand for high-performance active components, enhancing device capabilities, efficiency, and functionality. Additionally, advancements in technologies such as 5G and AI increase the reliance on active components, as they are fundamental to processing, connectivity, and power management.

By Application

Based on application, the market has been classified into consumer electronics, automotive, industrial, telecommunication, healthcare, and others. The automotive segment is set to witness significant growth at a robust CAGR of 12.25% through the forecast period.

Rapid advancement in automotive technology, including the rise of electric vehicles (EVs) and autonomous driving systems, has resulted in increased demand for sophisticated electronic components.

Modern vehicles require a multitude of sensors, processors, and control units to support features such as advanced driver-assistance systems (ADAS), infotainment systems, and battery management. Additionally, the shift toward enhanced safety, connectivity, and energy efficiency in vehicles has prompted manufacturers to incorporate high-performance electronics, thereby boosting segmental development.

Electronic Components Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

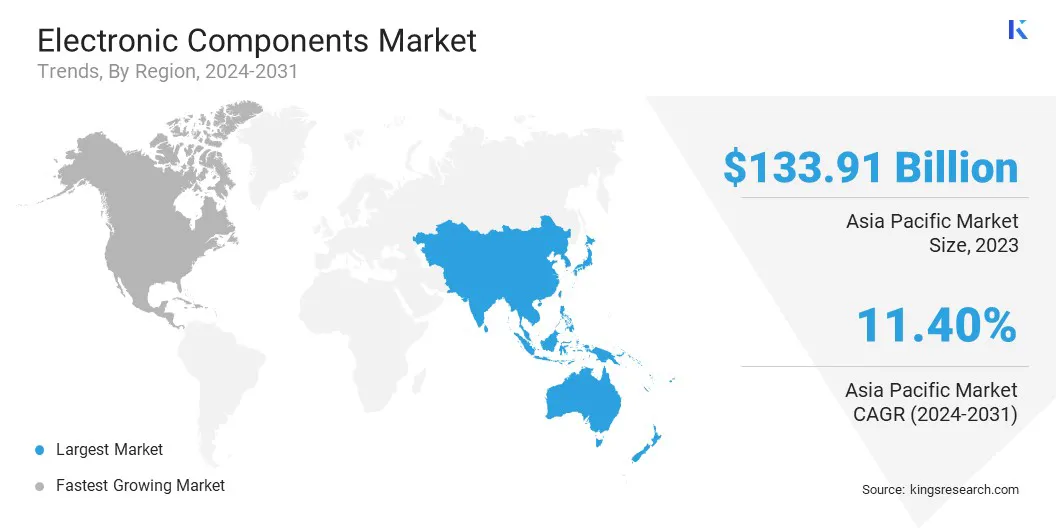

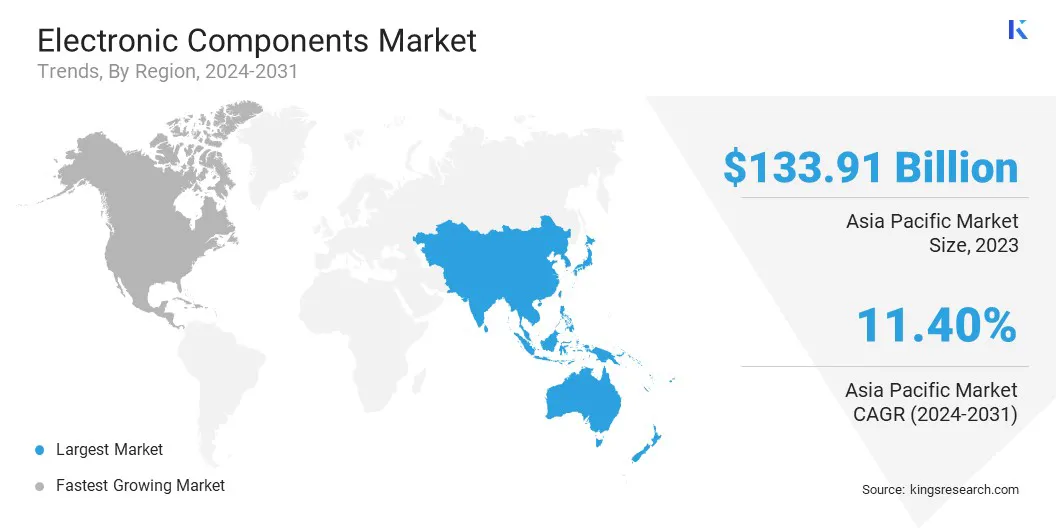

The Asia Pacific electronic components market captured a substantial share of around 40.88% in 2023, with a valuation of USD 133.91 billion. Asia Pacific is home to some of the world’s largest semiconductor manufacturers, including companies in Japan, Taiwan, South Korea, and China.

Several countries are investing heavily in semiconductor manufacturing infrastructure, with Taiwan and South Korea leading in advanced node technology, while China is striving for self-sufficiency through massive investment programs. This robust manufacturing ecosystem supports the entire supply chain, from raw materials to component production, thereby stimulating Asia Pacific market growth.

- In May 2024, the Asian Development Bank reported that East Asia and Southeast Asia account for more than 80% of global semiconductor manufacturing. Japan hosts some of the largest companies supplying essential equipment and materials to the semiconductor industry, while China is at the forefront of the global photovoltaic cell production, a vital segment of the semiconductor sector.

Moreover, the regional market is experiencing a surge in demand for consumer electronics such as smartphones, laptops, tablets, and wearables. With large populations and rising incomes, countries such as China, India, Japan, and South Korea are witnessing a growingdemand for advanced consumer gadgets. Local manufacturing hubs and robust consumer markets bolster the growth of Asia Pacific market.

North America is poised to experiencesignificant growth at a robust CAGR of 10.66% over the forecast period. The adoption of the Internet of Things (IoT) is growing rapidly in North America, supported by the surging demand for smart home devices, connected appliances, and industrial IoT solutions.

Consumers are increasingly adopting smart home technologies such as voice-activated assistants, security systems, and energy management devices, all of which rely on advanced sensors, connectivity modules, and microcontrollers.

- According to the 2024 IoT M2M Council reports, nearly 20% of U.S. households possess six or more smart home devices. Additionally, the Smart Home Dashboard survey reveals that 45% of U.S. internet households own at least one smart home device, with 18% owning six or more.

Additionally, in the industrial sector, IoT systems are used to optimize operations and monitor equipment. This expansion of IoT applications across various sectors in contributing significantly to the expansion of the North America market.

Competitive Landscape

The global electronic components market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Electronic Components Market

- Texas Instruments Incorporated

- Murata Manufacturing Co., Ltd.

- Samsung Electronics Co., Ltd.

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- Kyocera Corporation

- Amphenol Corporation

- TE Connectivity Ltd.

- Broadcom Inc.

- Infineon Technologies AG

Key Industry Developments

- September 2024 (Product Launch): Infineon Technologies AG launched the XENSIV PAS CO2 5V sensor, designed to enhance energy efficiency in buildings by optimizing ventilation based on actual occupancy. Utilizing Photoacoustic Spectroscopy (PAS) technology, this sensor is engineered to reduce carbon emissions associated with heating, ventilation, and air conditioning (HVAC) systems.

- June 2024 (Product Launch): Texas Instruments (TI) unveiled the industry's first Gallium Nitride (GaN) Integrated Power Module (IPM), designed to facilitate the development of smaller and more energy-efficient high-voltage motors. This innovative technology aims to enhance performance in applications such as electric vehicles and industrial automation by reducing the size and improving the efficiency of power systems.

The global electronic components market has been segmented below as:

By Component Type

- Passive

- Active

- Electromechanical

By Application

- Consumer Electronics

- Automotive

- Industrial

- Telecommunication

- Healthcare

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America