Enquire Now

Low Carbon Hydrogen Market Size, Share, Growth & Industry Analysis, By Production Technology (Steam Methane Reforming (SMR) (With CCS), Electrolysis, Biomass Gasification, Methane Pyrolysis, Coal Gasification (With CCS), Other Technologies), By Distribution Mode, By Application, and Regional Analysis, 2025-2032

Pages: 180 | Base Year: 2024 | Release: October 2025 | Author: Versha V.

Key strategic points

Low carbon hydrogen is generated through production methods that limit carbon emissions, such as renewable-powered electrolysis, steam methane reforming with carbon capture, and biomass gasification. It provides a sustainable energy carrier that supports decarbonization efforts across industries.

The technology is used for power generation, transportation, and industrial operations such as refining, chemicals, and steel production. Its role in clean energy transition is strengthening through government policies, infrastructure investments, and advancements in storage and distribution solutions.

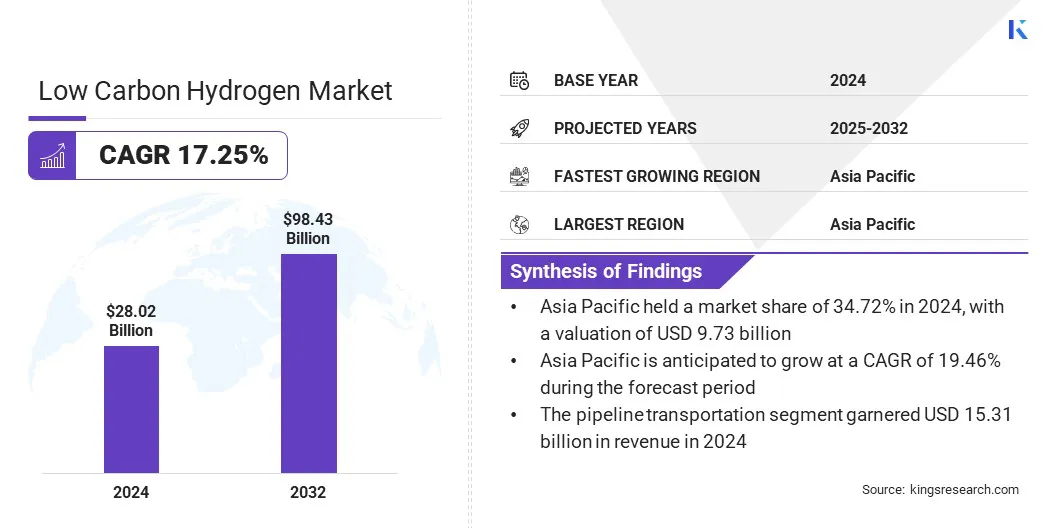

The global low carbon hydrogen market size was valued at USD 28.02 billion in 2024 and is projected to grow from USD 32.31 billion in 2025 to USD 98.43 billion by 2032, exhibiting a CAGR of 17.25% over the forecast period. This growth is attributed to increasing investments in clean hydrogen production as a result of decarbonization targets and net-zero commitments.

Rising demand from transportation, power generation, and heavy industries is further accelerating adoption due to the need for sustainable energy carriers and reduced emissions.

Major companies operating in the low carbon hydrogen market are Air Products and Chemicals, Inc., Plug Power Inc., Nel, Siemens Energy, ITM Power plc, Air Liquide Engineering & Construction, Linde PLC, McPhy Energy S.A., Bloom Energy, Infinite Green Energy, Equinor ASA, MITSUBISHI HEAVY INDUSTRIES, LTD., ENAPTER s.r.l., Acwa power, and FCHEA

Increasing focus on building large-scale infrastructure, efficient storage, and reliable distribution networks is promoting wider deployment of low carbon hydrogen across regions. Additionally, ongoing technological advancements, strategic partnerships, and cross-border collaborations are boosting market expansion.

Government Policies and Net-Zero Commitments

The growth of the low carbon hydrogen market is primarily fueled by government policies and net-zero commitments aimed at reducing greenhouse gas emissions. National hydrogen strategies, subsidies, tax incentives, and funding programs are encouraging investments in low carbon hydrogen production, storage, and distribution. Consequently, energy, industrial, and transportation sectors are increasingly adopting hydrogen solutions to meet regulatory targets and sustainability goals.

Continued policy support and global decarbonization initiatives are also promoting technological advancements and large-scale deployment, positioning low carbon hydrogen as a key component of clean energy transition and fueling significant market growth.

Slow Pace of Hydrogen Infrastructure Development

The slow development of hydrogen infrastructure poses a significant barrier to the growth of the low carbon hydrogen market. Limited pipelines, storage facilities, and refueling stations restrict large-scale distribution and adoption across industrial, transport, and energy sectors, often resulting in complex logistical challenges and higher operational costs. These challenges increase project timelines and capital requirements, making it difficult for smaller producers and emerging companies to participate effectively.

Industries and governments aiming to deploy hydrogen solutions face additional hurdles, as the establishment of reliable and safe infrastructure demands technical expertise, regulatory compliance, and coordination with multiple stakeholders. Limited access to advanced storage and transport technologies further exacerbates these challenges.

To overcome these barriers, stakeholders are investing in large-scale infrastructure projects, modular storage solutions, and innovative transport systems. These efforts aim to accelerate network expansion, improve reliability, and support broader commercialization of low carbon hydrogen.

Advancement of Green Hydrogen Technologies

The low carbon hydrogen market is witnessing strong momentum in green hydrogen production, driven by rising demand for sustainable energy solutions across industrial, transport, and power sectors.

Electrolysis technologies are being optimized for higher efficiency, lower energy consumption, and improved integration with renewable energy sources, while large-scale production facilities are being designed to meet growing global demand. This shift has gained further traction as governments and industries accelerate decarbonization efforts to achieve net-zero targets and comply with climate regulations.

In September 2025, the International Energy Agency reports that China leads global low-emissions hydrogen deployment, holding 65% of installed or committed electrolyzer capacity and nearly 60% of global manufacturing capacity.

Energy companies, technology providers, and research institutions are investing in advanced electrolyzers, modular production systems, and collaborative projects to scale green hydrogen deployment. Continuous improvements in green hydrogen technologies are expected to aid clean energy transition and support significant market growth over the forecast period.

|

Segmentation |

Details |

|

By Production Technology |

Steam Methane Reforming (SMR) (With CCS), Electrolysis, Biomass Gasification, Methane Pyrolysis, Coal Gasification (With CCS), and Other Technologies |

|

By Distribution Mode |

Pipeline Transportation, Bulk Liquid Hydrogen Transportation, and Compressed Hydrogen Transportation |

|

By Application |

Transportation, Industrial Use, Power Generation and Energy Storage, and Residential & Commercial Heating |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific low carbon hydrogen market share stood at 34.72% in 2024, and was valued at USD 9.73 billion. Favorable government policies, growing renewable energy capacity, and strong industrial demand for low carbon hydrogen are driving the region forward.

The region benefits from significant investments in green hydrogen production technologies and large-scale infrastructure projects, which are accelerating adoption across power, transportation, and manufacturing application.

Strategic partnerships between local and international companies, along with favorable regulatory frameworks, further strengthen growth prospects. Continuous improvements in electrolyzer efficiency, storage solutions, and distribution networks have made Asia Pacific a key hub for low carbon hydrogen development.

The Europe low carbon hydrogen industry is projected to grow at a CAGR of 16.90% over the forecast period. This growth is fueled by decarbonization targets, rising investments in green hydrogen projects, and the expansion of renewable energy capacity in the region. Government incentives, regulatory support, and cross-border collaborations are strengthening the low carbon hydrogen ecosystem in Europe.

Increasing industrial adoption in steel, refining, and chemicals sectors is creating strong opportunities for hydrogen integration and emissions reduction. In addition, advancements in electrolyzer technologies, modular storage solutions, and distribution networks are accelerating deployment, positioning Europe as a key growth engine for the market.

Companies operating in the low carbon hydrogen industry are maintaining competitiveness through investments in advanced electrolysis technologies, carbon capture integration, and modular storage and distribution solutions. They are focusing on expanding production capacity and improving operational efficiency to meet rising demand across industrial, transportation, and power sectors.

Key players are broadening their portfolios to include green hydrogen, blue hydrogen, and integrated hydrogen solutions, supported by strategic collaborations, joint ventures, and infrastructure partnerships.

The market is emphasizing strengthening ties with governments, research institutions, and technology providers to accelerate project deployment and reduce commercialization timelines. Additionally, companies are improving technical skills, digital monitoring, and integrated services, while using automation and smart energy systems to maintain a competitive edge.

Frequently Asked Questions