Market Definition

The market encompasses technologies and solutions designed to store energy for extended periods, typically ranging from 10 hours to several days. The market includes a range of storage systems, such as advanced batteries, compressed air, and thermal storage, aimed at addressing grid reliability, integration of renewable energy, and meeting peak demand needs in power systems.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Long Duration Energy Storage Market Overview

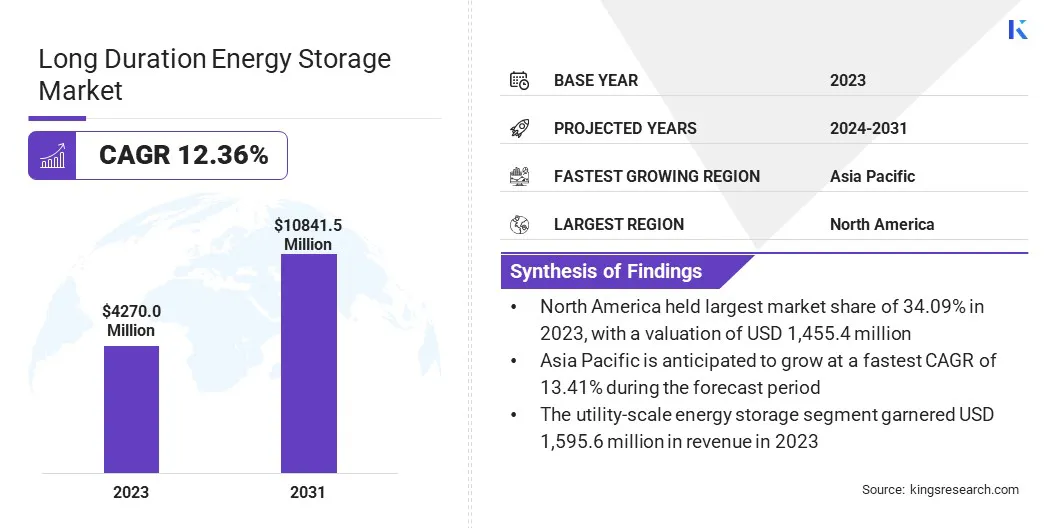

The global long duration energy storage market size was valued at USD 4,270.0 million in 2023 and is projected to grow from USD 4,793.9 million in 2024 to USD 10,841.5 million by 2031, exhibiting a CAGR of 12.36% during the forecast period.

The market is expanding due to rising demand for reliable power and the expansion of renewable energy. LDES solutions store excess energy from renewable sources such as wind and solar, ensuring availablity during peak demand or low production periods.

Major companies operating in the long duration energy storage industry are Fluence, Tesla, LG Corporation, ESS Tech, Inc., NextEra Energy Resources, LLC., Energy Vault, Inc., Panasonic Holdings Corporation, Highview Power, Bloom Energy, Contemporary Amperex Technology Co., Limited, Amperehour Solar Technology Pvt. Ltd., Ambri Incorporated, Form Energy, VoltStorage, and VRB ENERGY.

Market growth is further boosted by government incentives, improvements in storage technology, and increased investment in clean energy infrastructure. As countries aim to reduce carbon emissions and improve energy security, LDES is vital for providing a stable and sustainable power supply, particularly for utilities and industries.

- In April 2025, Ofgem launched a new cap and floor investment support scheme to support the development of long duration electricity storage (LDES) projects in Great Britain. This initiative aims to present funding for technologies such as super-batteries and pumped storage hydro, enhancing energy security and renewable energy integration.

Key Highlights

Key Highlights

- The long duration energy storage industry size was valued at USD 4,270.0 million in 2023.

- The market is projected to grow at a CAGR of 12.36% from 2024 to 2031.

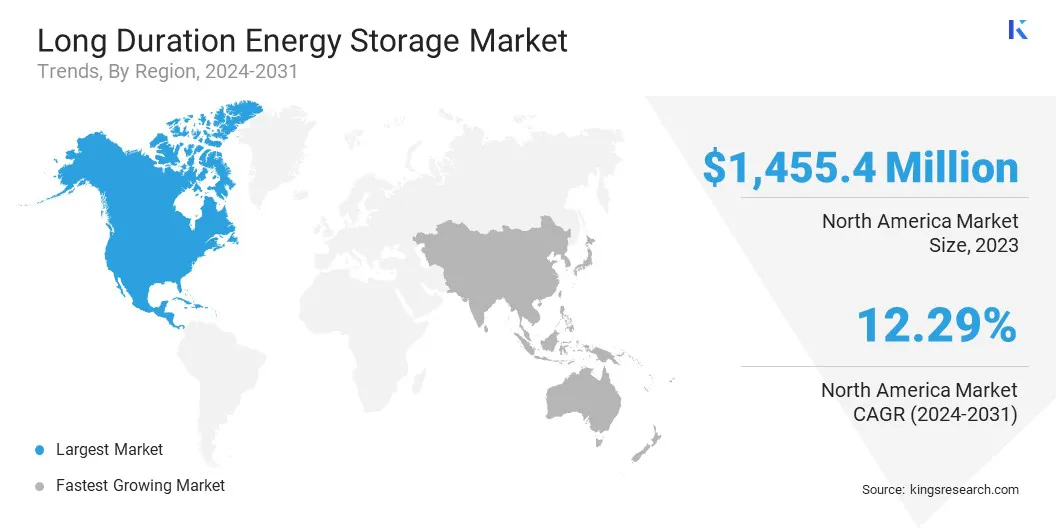

- North America held a market share of 34.09% in 2023, with a valuation of USD 1,455.4 million.

- The pumped hydro storage (PHS) segment garnered USD 1,165.8 million in revenue in 2023.

- The 8 - 23 hours segment is expected to reach USD 3,860.7 million by 2031.

- The utility-scale energy storage segment is projected to generate a revenue of USD 4,013.0 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 13.41% over the forecast period.

Market Driver

"Growing Renewable Energy Demand"

The long duration energy storage market is expanding rapidly, mainly due to the growing integration of renewable energy sources, particularly solar and wind power, into the energy grid. These intermittent renewable energy sources result in fluctuations in power generation.

Long duration energy storage systems address this issue by storing excess energy during periods of high generation and discharging it during low production periods, thus ensuring grid stability. As the reliance on solar and wind energy increases, the role of these storage systems becomes more critical in maintaining a reliable power supply.

Consequently, energy companies are increasingly investing in advanced long duration storage technologies to enhance grid resilience and ensure the continuous availability of electricity.

- In October 2024, the International Energy Agency (IEA) released its Renewables 2024 report, forecasting the addition of over 5,500 gigawatts of renewable energy between 2024 and 2030, with China accounting for nearly 60% of this growth. The report highlighted solar and wind power’s role in meeting nearly half of global electricity demand by 2030.

Market Challenge

"High Initial Investment Costs"

A major challenge hampering the expansion of the long duration energy storage (LDES) market is the high upfront investment required for advanced storage technologies.

Solutions such as flow batteries, liquid air energy storage, and other long-duration systems often involve significant costs for equipment, construction, and integration with existing grid infrastructure. While technological improvements are gradually lowering costs over time, high initial capital remains a major hurdle for many projects.

To address this challenge, companies and governments are exploring innovative financing models, public-private partnerships, and incentives to distribute costs and accelerate the adoption of long-duration storage solutions.

Market Trend

"Integration of Hybrid Storage Systems"

The long duration energy storage market is experiencing strong growth with a major trend toward the integration of hybrid storage systems. Companies are increasingly combining different storage technologies, such as pumped hydro storage with flow batteries or lithium-ion batteries, to build more efficient, flexible, and scalable solutions.

This hybrid approach optimizes performance across various energy demand scenarios and storage durations, effectively addressing the seasonal and intermittent nature of renewables.

This trend is further supported by continuous technology advancements, gradual cost reductions, and the growing need for stronger and more reliable energy systems that can support a cleaner and more renewable power grid. Technologies such as flow batteries and liquid air energy storage are advancing, offering new opportunities for long-duration applications as the market evolves.

- In October 2024, Highview Power revealed plans to develop four new 2.5 GWh liquid air energy storage plants in the UK by 2030, with support from the Department for Energy Security and Net Zero’s new investment support scheme. These projects are expected to contribute more than 10% of the UK’s long duration energy storage targets, supporting its goal of a net zero grid by 2030.

Long Duration Energy Storage Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Pumped Hydro Storage (PHS), Mechanical Storage, Electrochemical Storage, Thermal Energy Storage (TES), Hydrogen-Based Storage

|

|

By Duration

|

4 - 7 Hours, 8 - 23 Hours, 24 Hours – 1 Week, More than 1 Week

|

|

By Application

|

Utility-scale Energy Storage, Industrial & Commercial Energy Storage, Off-grid & Microgrid Applications, Residential Energy Storage

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Pumped Hydro Storage (PHS), Mechanical Storage, Electrochemical Storage, Thermal Energy Storage (TES), and Hydrogen-Based Storage): The pumped hydro storage (PHS) segment earned USD 1,165.8 million in 2023 due to its long-established technology and high efficiency in large-scale energy storage applications.

- By Duration (4 - 7 Hours, 8 - 23 Hours, 24 Hours – 1 Week, and More than 1 Week): The 8 - 23 hours segment held a share of 35.53% in 2023, as it provides an optimal balance of storage capacity for renewable energy during low-generation periods.

- By Application (Utility-scale Energy Storage, Industrial & Commercial Energy Storage, Off-grid & Microgrid Applications, and Residential Energy Storage): The utility-scale energy storage segment is projected to reach USD 4,013.0 million by 2031, propelled by the need for large-scale energy storage to support grid stability and renewable energy use.

Long Duration Energy Storage Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America long duration energy storage market accounted for a substantial share of 34.09% in 2023, valued at USD 1,455.4 million. The U.S. leads in deploying long duration energy storage (LDES) technologies, particularly in regions with high renewable energy generation.

North America long duration energy storage market accounted for a substantial share of 34.09% in 2023, valued at USD 1,455.4 million. The U.S. leads in deploying long duration energy storage (LDES) technologies, particularly in regions with high renewable energy generation.

The significant investments from private companies in LDES technologies, coupled with the rapid expansion of utility-scale energy storage projects, have further bolstered regional market expansion. Additionally, the region’s advanced infrastructure and increasing need for reliable power supply continue to support its dominant position globally.

- In June 2024, Governor Kathy Hochul of New York announced over USD 5 million in funding for long duration energy storage projects through the state's Renewable Optimization and Energy Storage Innovation Program. The funding aims to advance scalable LDES solutions to support New York's electric grid and reduce reliance on fossil fuels.

Asia Pacific long duration energy storage industry is expected to register the fastest CAGR of 13.41% over the forecast period. China, a leading country in energy storage technology, has made significant progress in long duration energy storage (LDES) solutions, fostering regional market expansion.

In India, the growing need for energy in off-grid and remote areas is further boosting the use of LDES systems. The rapid industrialization and the shift toward energy security is further accelerating regional market expansion.

Regulatory Frameworks

- In the U.S., the Department of Energy (DOE) supports long-duration energy storage technologies through funding, research, and technical standards to ensure grid reliability and sustainability.

- In Europe, the European Commission (EC) advances energy storage under its Clean Energy for All Europeans package, offering financial incentives to integrate renewables and meet climate goals.

Competitive Landscape

The long duration energy storage industry is characterized by key players focusing on a range of strategies to strengthen their positions. Companies are forming strategic partnerships with renewable energy firms, utilities, and research institutions to jointly develop and scale innovative storage technologies.

Heavy investment in research and development is allowing companies to enhance energy storage performance and reduce costs, with a major focus on next-generation solutions such as advanced flow and solid-state batteries.

Additionally, several players are expanding their production capacities to meet the growing demand, including increasing manufacturing facilities and investing in new plants.

Geographic expansion is also a significant strategy, with companies targeting emerging markets in regions such as Asia Pacific, where demand for renewable energy and storage solutions is rapidly rising.

Additionally, firms are diversifying their product offerings to cater to a broader range of applications, including utility-scale, residential, and commercial solutions. Furthermore, some companies adopt mergers and acquisitions to access new technologies, expand product lines, and enhance market share.

- In June 2024, Eos Energy Enterprises, Inc. and Cerberus Capital Management LP entered a strategic investment agreement. The partnership focused on scaling production of its zinc-based energy storage systems.

List of Key Companies in Long Duration Energy Storage Market:

- Fluence

- Tesla

- LG Corporation

- ESS Tech, Inc.

- NextEra Energy Resources, LLC.

- Energy Vault, Inc.

- Panasonic Holdings Corporation

- Highview Power

- Bloom Energy

- Contemporary Amperex Technology Co., Limited

- Amperehour Solar Technology Pvt. Ltd.

- Ambri Incorporated

- Form Energy

- VoltStorage

- VRB ENERGY

Recent Developments (Agreements/Joint Venture/Investment)

- In April 2025, Energy Vault and SPML Infra Limited signed a 10-year, 30+ GWh license and royalty agreement. The partnership focused on manufacturing and deploying the B-VAULT Battery Energy Storage System (BESS) technology and VaultOS energy storage management software in India.

- In February 2025, Stryten Energy LLC and Largo Clean Energy Corp. formed a joint venture, Storion Energy, LLC, to provide domestically produced vanadium electrolyte through a unique leasing model. The partnership aims to boost the rapid commercialization and adoption of Vanadium Redox Flow Batteries (VRFBs) for long-duration energy storage applications.

- In May 2024, RWE Renewables made its investment decision to build the Limondale Battery Energy Storage System (BESS) in New South Wales, Australia. The 50+ megawatt, 400+ megawatt-hour project will store excess renewable energy, with Tesla supplying Megapack batteries and commissioning scheduled for late 2025.

Key Highlights

Key Highlights North America long duration energy storage market accounted for a substantial share of 34.09% in 2023, valued at USD 1,455.4 million. The U.S. leads in deploying long duration energy storage (LDES) technologies, particularly in regions with high renewable energy generation.

North America long duration energy storage market accounted for a substantial share of 34.09% in 2023, valued at USD 1,455.4 million. The U.S. leads in deploying long duration energy storage (LDES) technologies, particularly in regions with high renewable energy generation.