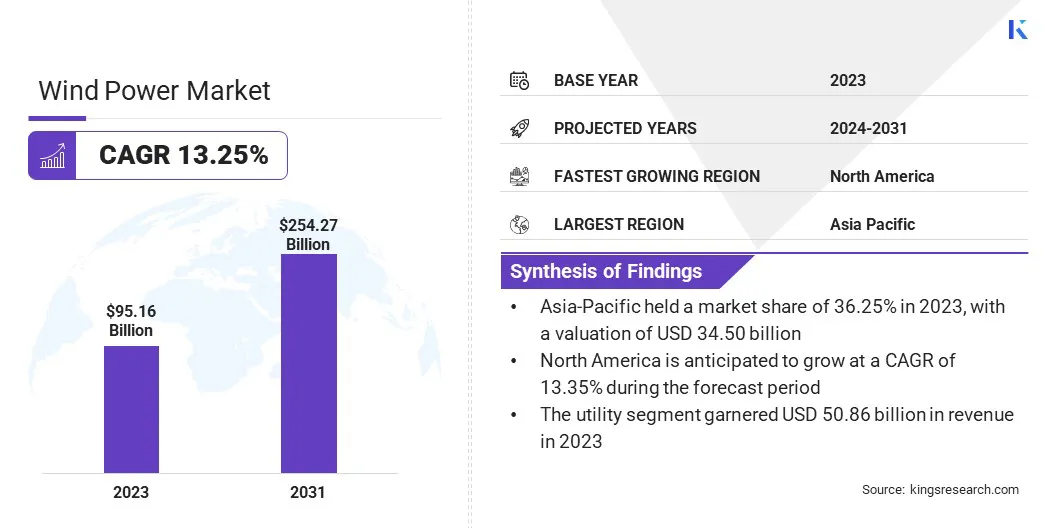

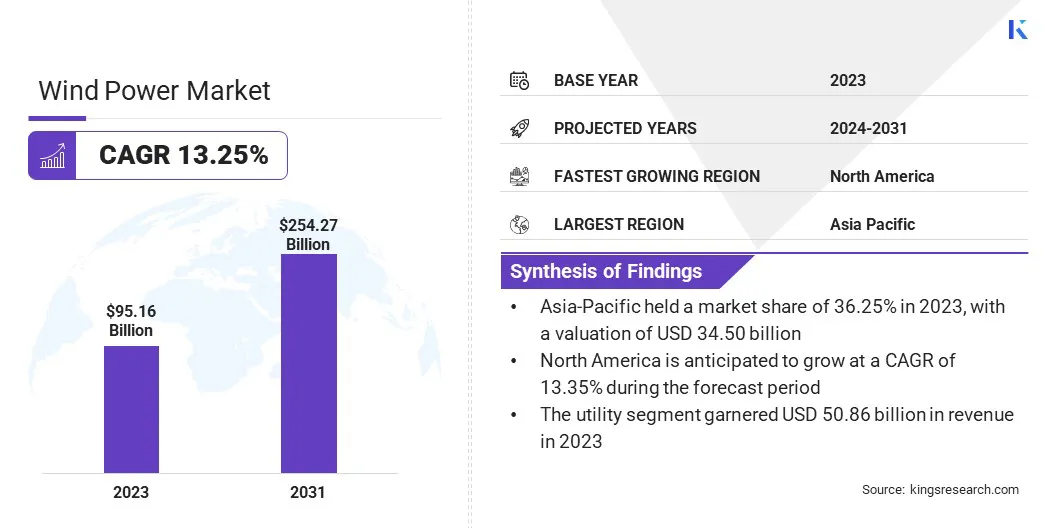

Wind Power Market Size

The global Wind Power Market size was valued at USD 95.16 billion in 2023 and is projected to grow from USD 106.42 billion in 2024 to USD 254.27 billion by 2031, exhibiting a CAGR of 13.25% during the forecast period. Growing adoption of offshore wind farms and surge in wind energy projects are augmenting market growth.

In the scope of work, the report includes services offered by companies such as General Electric, Ørsted A/S, NextEra Energy Resources, LLC, United Power, Acciona, Nordex SE, Suzlon Energy Limited, EDF Renewable Energy, ReGen Powertech, ABB and others.

The growing adoption of offshore wind farms is a significant trend in the wind power market. Offshore wind farms are being increasingly developed due to their numerous advantages over onshore counterparts. They benefit from stronger and more consistent wind speeds prevalent over the ocean, leading to higher energy yields and improved efficiency.

Additionally, offshore wind farms reduce land use conflicts, as they are situated away from populated and agricultural areas. Government incentives and advancements in technology are key factors fueling this trend. Many countries are offering subsidies, tax incentives, and supportive policies to promote the development of offshore wind projects.

Technological advancements, such as the development of larger and more efficient turbines designed to withstand harsh marine environments, are making offshore wind farms more viable and cost-effective. This trend contributes to lowering carbon emissions and reducing reliance on fossil fuels, thereby playing a crucial role in meeting the increasing global demand for renewable energy sources.

Wind power is the process of converting kinetic energy from wind into electrical energy using wind turbines. The main components of a wind power system include the wind turbine, which consists of blades, a rotor, a nacelle housing the generator, and a tower. The blades capture wind energy and transfer it to the rotor, which spins the generator to produce electricity. Wind turbines are installed onshore or offshore, with onshore turbines typically located in areas with consistent wind patterns, such as plains, hills, and coastal regions.

Offshore wind turbines are installed in bodies of water, usually on the continental shelf, where wind speeds are higher and more stable. Wind power is used in various applications, ranging from small-scale installations that provide energy to remote areas or individual buildings, to large-scale wind farms that supply electricity to the grid. It is a key component of the global renewable energy mix, contributing significantly to the reduction of greenhouse gas emissions and promoting energy independence and sustainability.

Analyst’s Review

The wind power market is witnessing robust growth, fueled by advancements in technology, supportive government policies, and increasing demand for sustainable energy solutions. Companies in this sector are adopting diverse strategies to enhance their market position and capitalize on potential growth opportunities. Strategic partnerships and collaborations are also prevalent, enabling companies to leverage complementary strengths and expand their market reach.

- For instance, in April 2024, Statkraft, Europe’s leading renewable energy producer, and Deutsche Bahn finalized additional PPAs for hydropower and onshore wind energy. These agreements, which cover approximately 147,000 MWh from 2024 to 2026, ensure early-stage economic operation of the wind turbines.

Current growth is marked by the expansion of both onshore and offshore wind projects, with significant investments directed toward emerging markets where wind energy potential is high. Key imperatives for prominent players include addressing the challenges associated with grid integration, managing supply chain complexities, and navigating regulatory landscapes. Companies are increasingly prioritizing sustainability and environmental impact, with the aim of developing efficient and cost-effective that minimize ecological footprints.

Wind Power Market Growth Factors

The surge in wind energy projects is a pivotal factor fostering the expansion of the wind power market. Governments and private investors are increasingly committing resources to the development of both onshore and offshore wind farms, recognizing the importance of renewable energy in combating climate change and reducing dependency on fossil fuels. This surge is facilitated by favorable government policies, such as subsidies, tax incentives, and renewable energy mandates, which create a conducive environment for investment in wind energy.

- For instance, in April 2024, EDF Renewables (South Africa), a subsidiary of EDF Renouveables and Electricité de France (EDF), ordered 50 N163/5.X turbines from the Nordex Group for two wind projects. Part of the Koruson 2 cluster, these projects, in partnership with Anglo American's Envusa Energy, are expected to collectively generate 295 MW of electricity.

Furthermore, technological advancements have significantly lowered the costs associated with wind energy projects, making them more economically viable. The expansion of wind energy projects contributes to the diversification of the energy mix, promotes job creation, and fosters economic growth in regions where these projects are implemented.

Grid integration issues present a significant challenge that impedes the development of the wind power market, particularly as the share of wind energy in the overall energy mix increases. Wind power generation is inherently subject to variability and intermittency, depending on rapidly changing wind patterns. This variability leads to instability in power supply, posing a challenge to grid operators tasked with maintaining a consistent and reliable electricity supply. Integrating large amounts of wind energy into existing electrical grids requires substantial upgrades to grid infrastructure, including the development of smart grids and energy management systems capable of handling fluctuating power inputs.

Additionally, the existing grid may need reinforcement to accommodate the new energy inputs without causing overloads or failures. Mitigating this challenge involves the deployment of advanced forecasting techniques to predict wind patterns more accurately, along with the implementation of demand response strategies to dynamically balance supply and demand. Moreover, increased investment in grid-scale energy storage solutions, such as batteries and pumped hydro storage, help buffer the variability of wind power and enhance grid stability.

Wind Power Market Trends

The integration of wind power with energy storage systems is an emerging trend that addresses its intermittency, which represents a significant limitation of wind energy. By pairing wind turbines with advanced storage solutions, such as lithium-ion batteries or pumped hydro storage, the energy generated during peak wind periods is stored and used during times of low wind activity or high demand. This trend is gaining significant traction due to advancements in energy storage technologies, which are enhancing efficiency and cost-effectiveness. The combination of wind power and storage systems enhances the reliability and stability of the electricity supply, making wind energy a more viable and consistent source of renewable energy.

Additionally, integrated storage systems help mitigates the impact of sudden fluctuations in wind power generation on the grid, thereby reducing the need for backup fossil fuel-based power plants. This trend is supported by government policies and incentives aimed at promoting the adoption of renewable energy and energy storage technologies.

Segmentation Analysis

The global market is segmented based on component, location, application, and geography.

By Component

Based on component, the market is categorized into turbines, support structures, electrical infrastructure, and others. The turbines segment captured the largest wind power market share of 39.65% in 2023, largely attributed to the significant advancements in wind turbine technology and the increasing scale of wind power projects globally. Wind turbines are the most critical component in wind power systems, serving to convert wind energy into electrical power. Innovations in turbine design, such as larger rotor diameters, higher hub heights, and improved blade aerodynamics, have greatly enhanced the efficiency and energy output of wind turbines.

- For instance, in May 2024, Finnish energy firms Fortum and Helen inaugurated the Pjelax wind farm to generate over 1 TWh annually, contributing approximately 5% to Finland’s total wind power output.

Additionally, the development of offshore wind farms, which typically utilize larger and more advanced turbines, has contributed to the dominance of the turbines segment. The reduction in the cost of wind turbine manufacturing, driven by economies of scale and improved production techniques, has further played a crucial role in boosting this growth. Furthermore, government policies and incentives promoting renewable energy have spurred significant investments in wind power projects, leading to increased demand for turbines.

By Location

Based on location, the market is classified into onshore and offshore. The offshore segment is poised to record a staggering CAGR of 13.56% through the forecast period. Offshore wind farms benefit from stronger and more consistent wind speeds compared to onshore locations, resulting in higher energy yields and improved efficiency. The increasing global emphasis on reducing carbon emissions and transitioning to renewable energy sources is fostering investments in offshore wind projects.

Governments across the world are offering substantial incentives, subsidies, and favorable policies to promote the development of offshore wind farms, recognizing their potential to contribute significantly to renewable energy targets. Technological advancements in turbine design, foundation structures, and installation techniques are making offshore wind projects more viable and cost-effective. Additionally, the availability of large expanses of ocean space allows for the deployment of larger turbines and the creation of extensive wind farms, endeavors that are impractical on land due to land constraints.

By Application

Based on application, the wind power market is divided into utility and non-utility. The utility sector garnered the highest revenue of USD 50.86 billion in 2023, propelled by the large-scale deployment of wind energy projects aimed at meeting rising electricity demand and renewable energy targets. Utilities are increasingly investing in wind power to diversify their energy portfolios and reduce their reliance on fossil fuels, fueled by regulatory requirements and the growing emphasis on sustainability. The economies of scale achieved by utility-scale wind farms enable the production of electricity at lower costs, making wind energy a competitive alternative to traditional power sources.

Furthermore, government incentives, subsidies, and supportive policies are prompting utilities to invest heavily in wind power projects. The integration of advanced technologies, such as smart grids and energy storage systems, is enhancing the efficiency and reliability of wind energy, thereby augmenting its adoption in the utility sector.

Wind Power Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific wind power market accounted for a significant share of 36.25% and was valued at USD 34.50 billion in 2023, reflecting the region's significant commitment to renewable energy development. The rapid expansion of wind power in Asia-Pacific is reinforced by the growing energy needs of its populous nations, particularly China and India, which are making substantial investments in both onshore and offshore wind projects. China has emerged as major country in wind power capacity due to its aggressive renewable energy targets, extensive government support through subsidies, and favorable policies.

Moreover, India's national wind-solar hybrid policy and other initiatives are bolstering wind energy deployment. The region's abundant wind resources, coupled with technological advancements and decreasing costs of wind power generation, are propelling domestic market growth. Additionally, the increasing environmental awareness and the urgent need to reduce greenhouse gas emissions are prompting countries across Asia-Pacific to adopt wind energy as a key component of their energy strategies.

North America is set to grow at a robust CAGR of 13.35% in the forthcoming years, largely attributable to several factors such as ongoing technological advancements, supportive regulatory frameworks, and increasing investments in renewable energy. The incentives are prompting utilities and independent power producers to invest in new wind projects. Additionally, advancements in wind turbine technology, including the production of larger and more efficient turbines, are reducing the cost of wind energy, thereby enhancing its competitiveness compared to traditional energy sources.

- For instance, in 2023, according to US Department of Energy, Wind energy in the United States contributed to the reduction of 336 million metric tons of carbon dioxide emissions annually, which is equivalent to the emissions generated by 73 million cars.

Canada is further supporting this growth with its favorable wind resources and supportive provincial policies aimed at expanding renewable energy capacity. The commitment to sustainability and reducing carbon emissions is leading to the widespread adoption of wind energy in North America.

Competitive Landscape

The global wind power market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Wind Power Market

- General Electric

- Ørsted A/S

- NextEra Energy Resources, LLC

- United Power

- Acciona

- Nordex SE

- Suzlon Energy Limited

- EDF Renewable Energy

- ReGen Powertech

- ABB

Key Industry Developments

- June 2024 (Expansion): Vestas secured a 124 MW order for a wind project in Telsiai, Lithuania. The order, placed by Utilitas Wind and Latvenergo AS, includes the supply, delivery, and commissioning of 20 V162-6.2 MW wind turbines.

- May 2024 (Partnership): Suzlon Group announced a 551.25 MW wind power project order from the Aditya Birla Group. Suzlon is set to install 175 Hybrid Lattice Tubular (HLT) tower wind turbines, each with a 3.15 MW capacity, across designated sites in Rajasthan and Gujarat, India.

The global wind power market is segmented as:

By Component

- Turbines

- Support Structures

- Electrical Infrastructure

- Others

By Location

By Application

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America