Market Definition

The liquid silicone rubber (LSR) market involves the production, distribution, and application of liquid silicone rubber, a high-performance elastomer that remains in a liquid form before undergoing curing to form a flexible, durable, and heat-resistant solid.

LSR is extensively used in automotive, medical, consumer goods, electronics, and industrial applications due to its exceptionally high thermal stability, chemical resistance, flexibility, and electrical insulation.

Liquid Silicone Rubber Market Overview

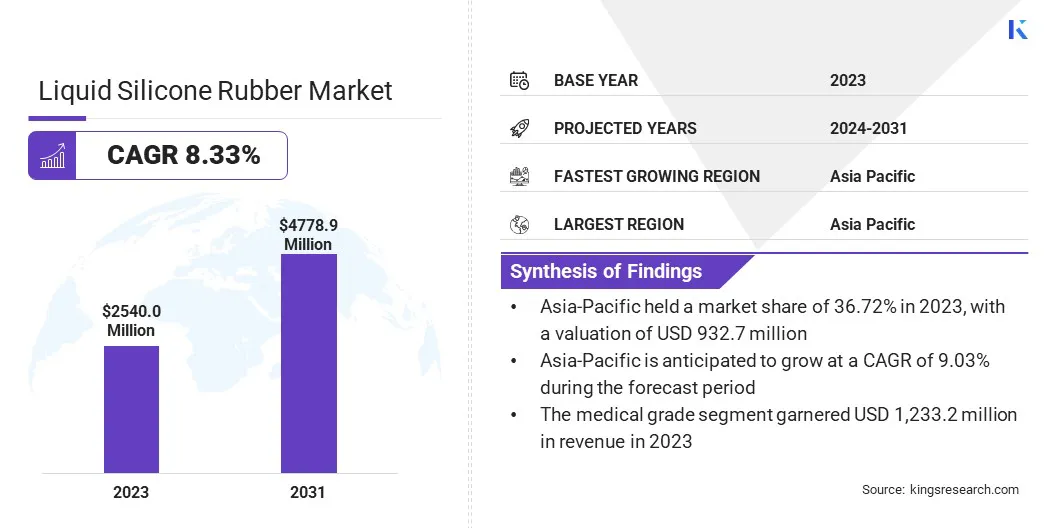

The global liquid silicone rubber market size was valued at USD 2,540.0 million in 2023 and is projected to grow from USD 2,729.3 million in 2024 to USD 4,778.9 million by 2031, exhibiting a CAGR of 8.33% during the forecast period.

LSR's high thermal stability, biocompatibility, and flexibility, make it ideal for applications that demand both durability and precision. Advancements in manufacturing technologies and an increasing emphasis on sustainability are anticipated to drive further market growth.

Major companies operating in the global liquid silicone rubber industry are Dow, Elkem ASA 2025, KCC SILICONE CORPORATION., Momentive Performance Materials, Reiss Manufacturing, Inc., Shin-Etsu Chemical Co., Ltd., Rubber Industries, Inc, SIMTEC Silicone Parts, LLC, Stockwell Elastomerics, Inc., Wacker Chemie AG, Avantor, Inc, Beacon MedTech Solutions, CHT Germany GmbH, Laur Silicone, and Shenzhen Square Silicone Co., Ltd.

The growing adoption of electric vehicles, alongside the rising demand for innovative medical devices, will also play a significant role in boosting LSR consumption over the forecast period. As industries continue to prioritize cutting-edge and eco-friendly solutions, the market is expected to witness substantial growth.

- In December 2024, Carlisle Fluid Technologies acquired Reinhardt Technik in a deal that significantly enhances Carlisle Fluid Technology's Sealants and Adhesives platform. This acquisition establishes Carlisle Fluid Technologies as a global player in advanced sealants and adhesives applications.

Key Highlights:

- The global liquid silicone rubber market size was recorded at USD 2,540.0 million in 2023.

- The market is projected to grow at a CAGR of 8.33% from 2024 to 2031.

- Asia-Pacific held a market share of 36.72% in 2023, with a valuation of USD 932.7 million.

- The medical grade segment garnered USD 1,233.2 million in revenue in 2023.

- The healthcare and medical devices segment is expected to reach USD 1,699.2 million by 2031.

- The Asia Pacific market is anticipated to grow at a CAGR of 9.03% during the forecast period.

Market Driver

"Growing Demand for Medical Devices"

The increasing demand for medical devices is driving the growth of the liquid silicone rubber market, fueled by the aging population, rising healthcare needs, and the growing prevalence of chronic diseases.

LSR’s biocompatibility, non-toxicity, and hypoallergenic properties render it particularly suitable for surgical implants, catheters, and pacifiers. Its compliance with stringent regulatory standards, including FDA, ensures the safety and reliability of medical-grade devices.

Moreover, LSR’s durability, flexibility, and resistance to temperature fluctuations and chemicals make it an ideal material for long-term applications such as implantable devices, prosthetics, and drug delivery systems.

- In February 2024, Trelleborg Sealing Solutions signed an agreement to acquire Baron Group. This acquisition enhances Trelleborg’s application expertise and manufacturing capacity, further solidifying the company's position as a global partner for medical technology products. With a focus on areas such as sleep apnea, respiratory care, and chronic obstructive pulmonary disease (COPD), this strategic move enables Trelleborg to expand its capabilities and offerings in the growing medical sector.

Market Challenge

"Complexity in Processing"

The complexity in silicone processing represents a significant challenge for the liquid silicone rubber market. LSR production requires specialized techniques, primarily injection molding and high-temperature curing, which necessitate precise control over temperature, pressure, and curing time to achieve consistent quality.

The process is time-intensive and demands specialized molds, equipment, and skilled personnel, all of which increaases the production cost and lead time. Unlike thermoplastics, LSR cannot be reprocessed once cured. Its limiting flexibility makes it difficult to correct errors during manufacturing. These factors present considerable barriers for companies lacking the necessary technical expertise or production capabilities.

The challenges of LSR processing can be resolved using several strategies. Investing in advanced machinery and automated curing systems enhances precision, reduces errors, and streamlines production. Using 3D printing and CAD software to optimize mold design improves accuracy and reduces lead times.

Employee training also ensures that personnel are well-equipped to handle LSR processing, improving consistency and minimizing mistakes. These strategies collectively enhance operational efficiency and reduce complexities associated with LSR manufacturing.

Market Trend

"Expansion in Automotive Industry"

The liquid silicone rubber adoption is rapidly expanding in the automotive industry due to its exceptional properties, including temperature resistance, durability, and flexibility.

LSR is used in a number of automotive components, such as seals, gaskets, and connectors, where it is capable of withstanding harsh conditions, including high temperatures and exposure to oils and chemicals.

With the rise of electric vehicles (EVs), LSR is also being integrated into critical components, such as battery seals and high-voltage connectors, owing to its heat resistance and electrical insulation capabilities.

As the automotive industry transitions toward more advanced and energy-efficient technologies, LSR’s ability to deliver reliable, long-lasting performance is driving its growing application in this sector.

- In July 2024, Dow launched NORDEL REN Ethylene Propylene Diene Terpolymers (EPDM), a bio-based version of its EPDM rubber material. This product is used in a variety of applications, including automotive, infrastructure, and consumer products, offering a more sustainable alternative to traditional EPDM.

Liquid Silicone Rubber Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Medical Grade, Food Grade, Industrial Grade

|

|

By End-User Industry

|

Healthcare and Medical Devices, Automotive, Electrical and Electronics, Consumer Goods, Building and Construction, Others (Beauty and Personal Care, Aerospace, Agriculture, and Textiles)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Grade (Medical Grade, Food Grade, Industrial Grade): The medical grade segment earned USD 1,233.2 million in 2023 due to the increasing demand for high-performance, biocompatible materials in healthcare applications such as implants and medical devices.

- By End-User Industry (Healthcare and Medical Devices, Automotive, Electrical and Electronics, Consumer Goods, Building and Construction, Others (Beauty and Personal Care, Aerospace, Agriculture, and Textiles)): The healthcare and medical devices segment held 30.33% of the market in 2023, due to the rising demand for biocompatible, durable materials in implants, prosthetics, and drug delivery systems.

Liquid Silicone Rubber Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific liquid silicone rubber market share stood at around 36.72% in 2023 in the global market, with a valuation of USD 932.7 million. Asia Pacific’s dominance in the LSR market can be attributed to the rapid industrialization in China, India, and Japan, which has significantly increased its demand across various sectors, including automotive, electronics, and healthcare.

The region’s expanding manufacturing capabilities and a growing consumer base for medical devices and consumer goods, are further driving market growth. The increasing adoption of electric vehicles and a strong emphasis on sustainability-driven innovations are expected to continue fueling demand for LSR in Asia Pacific over the forecast period.

The presence of major LSR manufacturers and favorable government policies promoting technological advancements further support the market’s expansion in the region.

- In June 2023, Momentive launched NEVSIL, a new line of liquid silicone rubber (LSR) solutions specifically for the new energy vehicle (NEV) market. Momentive's LSR and HCR-based material technologies are engineering enablers, providing the ability to meet and exceed demanding application performance requirements for NEVs.

The liquid silicone rubber industry in Europe is poised for significant growth at a robust CAGR of 8.57% over the forecast period. This growth is driven by rising demand for high-performance materials across industries such as automotive, electronics, and medical devices.

Europe's strong focus on sustainability and stringent environmental regulations are facilitating the adoption of eco-friendly materials, such as LSR. The region’s well-established infrastructure for research and development, combined with ongoing manufacturing innovations, is expected to accelerate advancements in LSR technologies.

The increasing emphasis on electric vehicles and the growing need for sophisticated medical applications also provide significant opportunities for market expansion.

Regulatory Frameworks

- The ISO 10993-5:2009 standard, titled "Biological evaluation of medical devices — Part 5: Tests for in vitro cytotoxicity," provides guidelines for assessing the cytotoxicity of materials used in medical devices. This regulation ensures that LSR materials are safe for medical use by evaluating their potential to cause cell damage or toxicity when in contact with tissues or cells.

- The ISO 10993-10:2010 standard provides guidelines for assessing the irritation and sensitization potential of materials used in medical devices. It ensures that LSR materials are biocompatible and safe for human use by evaluating their potential to cause skin irritation or allergic reactions in medical applications.

- The REACH Regulation (EC 1907/2006) in European Union regulation addresses the registration, evaluation, authorization, and restriction of chemicals. It aims to protect human health and the environment by ensuring that all chemicals used in the EU, including those in manufacturing processes, are safely managed and meet established safety standards.

- The EU Ecolabel is a certification scheme established by the EU to promote products and services that meet the environmental and sustainability standards. It encourages the use of eco-friendly materials and processes, ensuring that products are produced with minimal impact on the environment throughout their lifecycle.

Competitive Landscape

The liquid silicone rubber market is characterized by a number of participants, including established corporations and emerging players. As the market continues to grow, companies are focusing on expanding their product offerings, improving manufacturing efficiency, and developing specialized formulations to cater to diverse industry needs.

Collaboration and partnerships are becoming increasingly important as businesses seek to combine expertise across different sectors, such as automotive, healthcare, and electronics.

Increasing emphasis on sustainability and regulatory compliance is shaping the competitive landscape, with companies striving to meet environmental standards and ensure the safety of their products.

For instances SIMTEC had been delivering LSR solutions to its customers for over 21 years. As an early pioneer and expert in LSR injection molding, SIMTEC was invited to share its knowledge and experience at the 2023 LSR Conference in Charlotte, NC.

- In December 2024, Elkem announced the launch of a new product, AMSil 20503 series, for Additive Manufacturing (AM)/3D Printing applications based on tailored LSR formulations. These advancements highlight Elkem’s commitment to driving the AM/3D Printing sector forward and contributing to a more sustainable economy.

List of Key Companies in Liquid Silicone Rubber Market:

- Dow

- Elkem ASA

- KCC SILICONE CORPORATION.

- Momentive Performance Materials

- Reiss Manufacturing, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Rubber Industries, Inc

- SIMTEC Silicone Parts, LLC

- Stockwell Elastomerics, Inc.

- Wacker Chemie AG

- Avantor, Inc

- Beacon MedTech Solutions

- CHT Germany GmbH

- Laur Silicone

- Shenzhen Square Silicone Co., Ltd.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In July 2024, DuPont completed the acquisition of Donatelle Plastics. This brings complementary advanced technologies and capabilities including medical device injection molding, liquid silicone rubber processing, precision machining, device assembly, and tool building.

- In September 2023, Beacon MedTech Solutions, a contract injection molder and vertically integrated partner in the Medical Device value chain, exhibited at BIOMEDevice Boston at the Boston Convention & Exhibition Center. Beacon MedTech brought its integrated LSR and thermoplastics expertise to BIOMEDevice Boston, showcasing its comprehensive solutions at the event.