Medical Devices Market Size

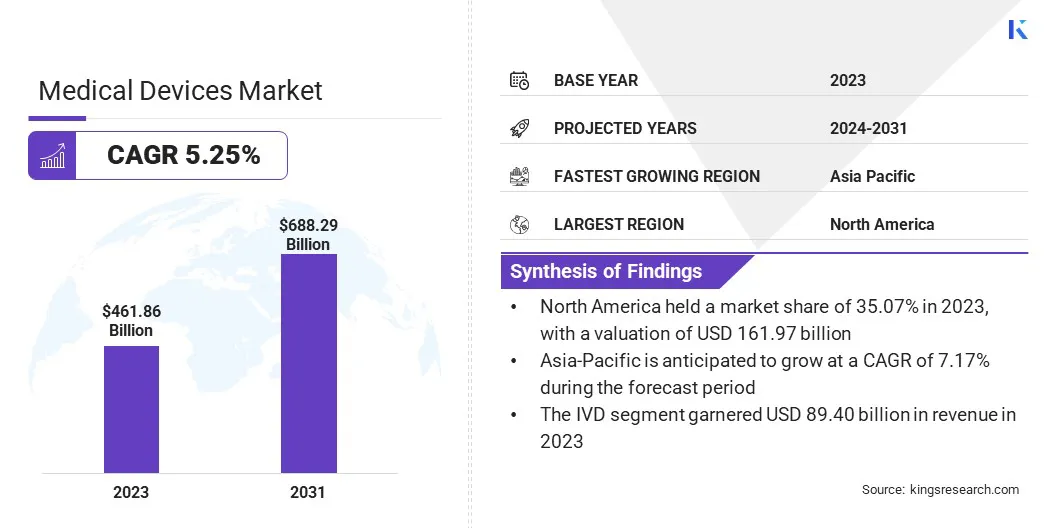

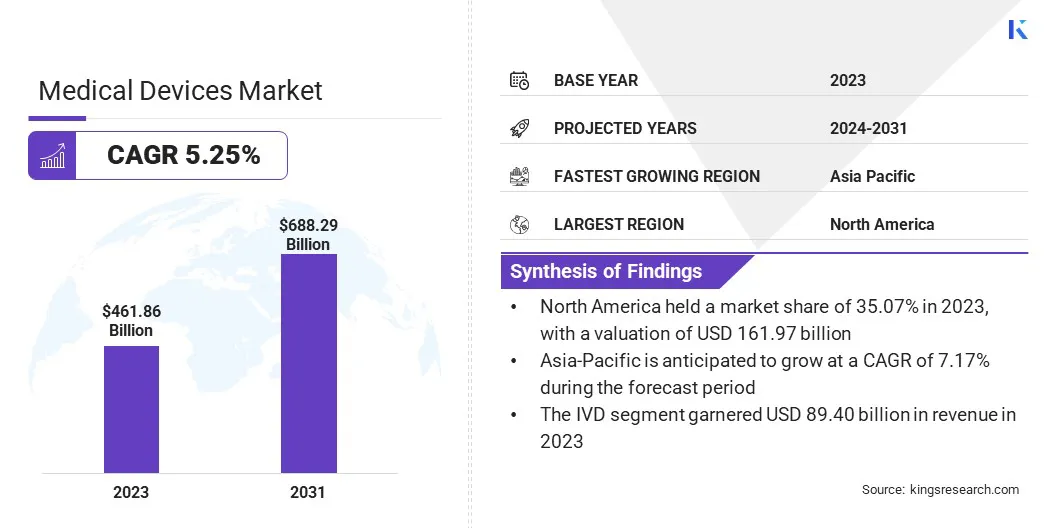

Global Medical Devices Market size was recorded at USD 461.86 billion in 2023, which is estimated to be at USD 481.05 billion in 2024 and projected to reach USD 688.29 billion by 2031, growing at a CAGR of 5.25% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Abbott, BD, Cardinal Health., GE HealthCare. GE, Johnson & Johnson Private Limited, Koninklijke Philips N.V., Medtronic, Siemens Industry Software Inc., Smith & Nephew Plc, Stryker, and others.

Technological advancements, increasing healthcare needs, and the rising prevalence of chronic diseases are driving the growth of the medical devices market. The global medical devices industry is experiencing robust growth, mainly fueled by technological innovations and an increasing focus on healthcare quality. North America and Europe hold a significant position in the market, owing to advanced healthcare infrastructure and high R&D investments. However, emerging economies in the Asia-Pacific region are advancing rapidly due to improved healthcare access and rising healthcare expenditures.

The expansion of the medical devices market is propelled by the increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders that necessitate ongoing advancements in diagnostic and therapeutic devices. Technological advancements, including AI and IoT integration, enhance device functionality and patient outcomes.

Additionally, an aging global population significantly increases the demand for healthcare services and associated medical devices. Regulatory support and favorable government policies further boost market growth. Moreover, the rising focus on personalized medicine and minimally invasive procedures propels market progress, as these innovations require sophisticated medical devices.

- In December 2022, Palo Alto Networks announced the integration of Medical IoT Security to enhance cybersecurity for medical devices. This Zero Trust solution ensures the secure deployment of connected technologies in healthcare settings.

Automation of device discovery, segmentation, and threat protection enabled Palo Alto Networks to simplify Zero Trust implementation. Additionally, leveraging machine learning facilitates automated security responses, policy enforcement, vulnerability assessment, compliance checks, and network segmentation verification, thereby streamlining healthcare operations and ensuring patient data security.

The medical devices market encompasses a broad range of products used specifically for medical purposes, including diagnosis, treatment, monitoring, and disease prevention. These devices range from simple instruments such as thermometers and blood pressure monitors to complex technologies such as MRI machines and robotic surgical systems. The market includes both reusable and disposable devices, serving various healthcare settings including hospitals, clinics, and home care.

- Regulatory bodies, such as the FDA and CE, ensure the safety and efficacy of these devices through stringent approval processes, thereby influencing market dynamics and product availability.

Analyst’s Review

Manufacturers are actively innovating, and introducing advanced medical devices to meet evolving healthcare needs. Manufacturers are increasingly focusing on the development of minimally invasive surgical tools and smart wearable devices. Additionally, leading companies are actively implementing eco-friendly manufacturing practices.

Manufacturers should continue to invest in R&D for the development of innovative solutions, forge strategic partnerships to expand medical devices industry reach, and prioritize regulatory compliance to ensure product quality and safety. Moreover, enhancing post-market surveillance and customer support services will foster key partnerships, leading to long-term customer satisfaction and loyalty.

Medical Devices Market Growth Factors

Ongoing technological advancements are contributing significantly to the growth of the medical devices market. Continuous advancements in medical technology, such as the development of smarter devices and more efficient diagnostic tools, are driving market expansion. These innovations enhance patient care, streamline healthcare processes, and improve treatment outcomes. Additionally, the integration of emerging technologies such as artificial intelligence and the Internet of Things (IoT) stimulates market growth by enabling remote patient monitoring and personalized healthcare solutions.

Complex approval processes and regulatory compliance pose a major challenge impeding the development of the industry. Stringent regulations, particularly in regions such as the United States and Europe, often result in prolonging the time-to-market periods for new medical devices, thereby delaying their commercialization and revenue generation.

To overcome this challenge, companies are investing heavily in proactive regulatory strategies, such as early engagement with regulatory authorities, implementing robust quality management systems, and thorough documentation of clinical data. Collaboration between manufacturers and regulatory experts, along with the utilization of regulatory technology solutions, results in streamlining the approval process, thus expediting market entry.

- The approval of India’s National Medical Devices Policy, 2023 by the Union Government highlighted the pivotal role played by India's medical devices sector in supplying essential healthcare equipment globally. The policy aimed to enhance the sector's growth trajectory, by focusing on regulatory streamlining, infrastructure development, R&D, attracting investments, and human resources development. Its emphasis on innovation, affordability, and quality aligned with India's vision for self-reliance in healthcare manufacturing, supported by public-private partnerships.

Medical Devices Market Trends

The increasing adoption of remote monitoring technology is a prominent trend that is enabling real-time health data generation. The rise of telemedicine and wearable devices further aids in improving patient information and outcomes. This enhances patient care by aiding early detection of health issues, facilitating timely interventions, and reducing the need for in-person visits.

Moreover, it promotes patient convenience and accessibility to healthcare services, particularly in rural or underserved areas. The continuous evolution of healthcare technologies and services, including remote monitoring, is anticipated to lead to their integration with healthcare delivery systems, thus fueling medical devices market growth.

- In January 2024, Pylo Health, a prominent player specializing in the development of remote patient monitoring devices and a partner company to Prevounce, has introduced two next-generation patient devices viz. the Pylo 200-LTE weight scale and the Pylo 900-LTE blood pressure monitor. The 200-LTE and 900-LTE devices were available for use with the company’s remote care management platform. They integrated with independent health applications and management systems via the Pylo cloud API. These products were validated clinically and tested by connecting to multiple cellular networks to ensure accuracy in data transmission across the U.S.

There is a growing emphasis on sustainability and eco-friendly practices within the medical devices industry. The rising awareness regarding environmental concerns is prompting manufacturers to increasingly adopt sustainable materials, reduce waste, and implement energy-efficient processes in device production.

Additionally, there is a notable shift toward designing products with a focus on recyclability and reducing the carbon footprint throughout the product lifecycle. This trend is further fueled by stringent regulatory requirements, along with surging consumer demand for environmentally responsible healthcare solutions. As sustainability becomes a key consideration, companies that prioritize eco-friendly practices are poised to gain a competitive edge in the market.

Segmentation Analysis

The global market is segmented based on product type, end-use, and geography.

By Product Type

Based on product type, the market is categorized into orthopedic devices, cardiovascular devices, diagnostic imaging, IVD, MIS, wound management, diabetic care, ophthalmic devices, dental devices, nephrology, general surgery, and others. The IVD segment led the medical devices industry in 2023, reaching a valuation of USD 89.40 billion. This notable growth is mainly attributable to the increasing prevalence of infectious diseases and chronic conditions that necessitate frequent diagnostic testing, leading to the increased demand for IVD products.

Additionally, technological advancements in molecular diagnostics and point-of-care testing are improving the accuracy and efficiency of diagnostic procedures, fueling the growth of the segment. Moreover, the rising global geriatric population increases the need for early disease detection and monitoring, thereby contributing to the expansion of the IVD segment.

By End-Use

Based on end-use, the medical devices market is classified into hospitals & clinics, diagnostic centers, research laboratory, and pharmaceutical companies. The diagnostic centres segment is poised to witness significant growth, registering a CAGR of 6.06% through the forecast period (2024-2031). The increasing emphasis on preventive healthcare and early disease detection boosts the demand for diagnostic services provided by specialized centers.

Moreover, advancements in medical imaging technologies and diagnostic modalities enhance the capabilities of diagnostic centers, thereby attracting more patients who seek accurate and comprehensive diagnostic evaluations. Additionally, the growing healthcare infrastructure, particularly in emerging economies, supports the establishment and expansion of diagnostic centers, thereby propelling segmental growth.

Medical Devices Market Regional Analysis

Based on region, the global medical devices industry is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Medical Devices Market share stood around 35.07% in 2023 in the global market, with a valuation of USD 161.97 billion. This dominance is fostered by the region's advanced healthcare infrastructure and high levels of healthcare expenditure, thus facilitating widespread adoption of medical devices and technologies.

Additionally, strong research and development capabilities, coupled with a supportive regulatory environment, promote innovation and product development in the region. Moreover, the presence of major medical device manufacturers and a large patient population contribute to North America's leading position in the medical devices market.

Asia-Pacific is poised to witness significant growth, registering a CAGR of 7.17% over the forecast period. This considerable growth is primarily fueled by the region's burgeoning population, coupled with improving healthcare infrastructure and rising disposable incomes, which are fueling the demand for medical devices and technologies.

Additionally, governments in countries such as China and India are increasing healthcare spending and implementing favorable regulatory policies to promote healthcare access and innovation. Furthermore, growing awareness regarding healthcare issues and the increasing prevalence of chronic diseases leads to the widespread adoption of medical devices in the region.

Competitive Landscape

The medical devices industry study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Medical Devices Market

- Abbott

- BD

- Cardinal Health.

- GE HealthCare. GE

- Johnson & Johnson Private Limited

- Koninklijke Philips N.V.,

- Medtronic

- Siemens Industry Software Inc.

- Smith & Nephew Plc

- Stryker

Key Industry Developments

- April 2024 (Launch): CERENOVUS, Inc., a division of Johnson & Johnson MedTech, Inc., introduced the CEREGLIDE 71 Aspiration Catheter in Europe. This advanced catheter, which features TruCourse technology, is designed to aid in the revascularization of patients with acute ischemic stroke. Positioned within the CERENOVUS Stroke Solutions portfolio, the CEREGLIDE 71 has been optimized for efficient blood clot aspiration and is compatible with various stent retrievers. This launch marked a significant addition to the company's line of catheters for stroke treatment.

- February 2024 (Launch): Smith and Nephew introduced the AETOS Shoulder System, which was acquired in early 2021. This launch aligned with their growth strategy for Trauma & Extremities. AETOS offered benefits to both patients and surgeons, such as MetaStem technology, catering to the trend of minimally invasive short stem devices. By providing easier implantation, improved bone preservation, and better anatomical fit, this product has fortified Smith and Nephew's position in the rapidly growing shoulder repair market.

The global medical devices market is segmented as:

By Product Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- IVD

- MIS

- Wound Management

- Diabetic Care

- Ophthalmic Devices

- Dental Devices

- Nephrology

- General Surgery

- Others

By End-Use

- Hospitals & Clinics

- Diagnostic Centers

- Research Laboratory

- Pharmaceutical Companies

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America