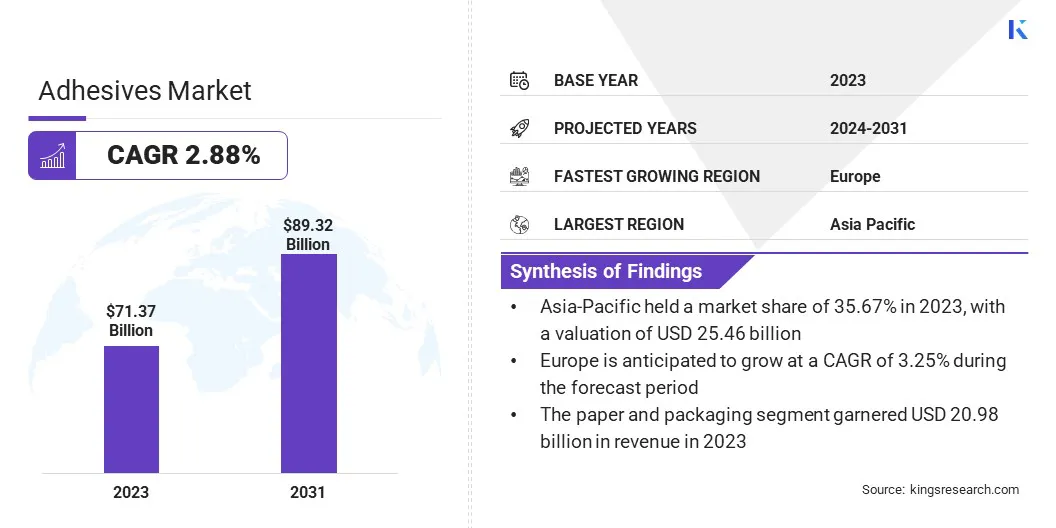

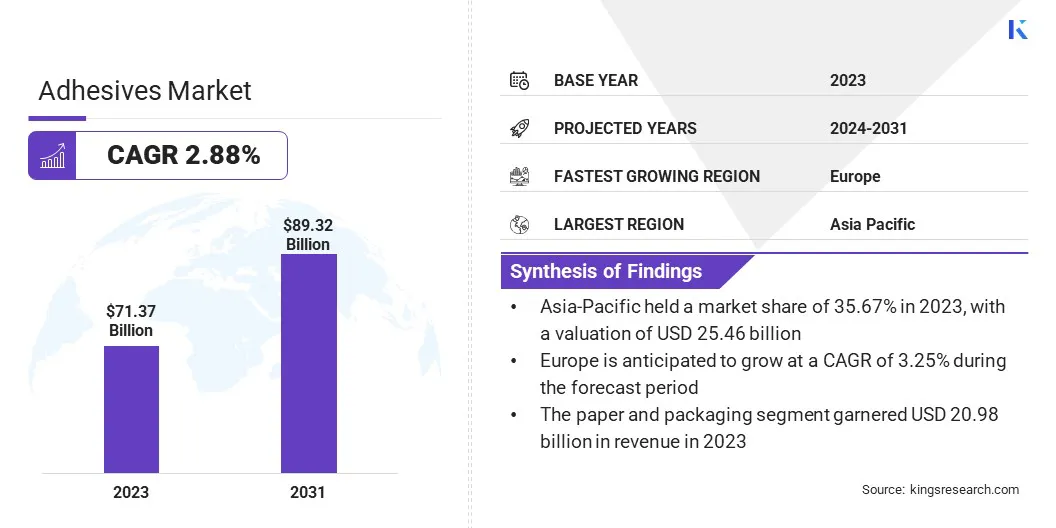

Adhesives Market Size

Global Adhesives Market size was recorded at USD 71.37 billion in 2023, which is estimated to be valued at USD 73.21 billion in 2024 and is projected to reach USD 89.32 billion by 2031, growing at a CAGR of 2.88% from 2024 to 2031.

Robust growth in the construction sector, driven by rapid urbanization and infrastructure development, is fueling the growth of the adhesives market. Adhesives are widely used in flooring, roofing, and panel bonding applications for their strength, durability, and design flexibility. The growing shift toward green buildings and energy-efficient solutions is increasing the demand for specialized adhesives that provide thermal insulation and air sealing.

In the scope of work, the report includes products offered by companies such as 3M, Henkel AG & Co. KGaA, H.B. Fuller Company, Sika AG, Arkema, Dow, Avery Dennison Corporation, Huntsman International LLC, Pidilite Industries Ltd, ITW Performance Polymers, and others.

Moreover, automotive manufacturers are leveraging adhesives for bonding lightweight materials such as composites and aluminum to improve vehicle fuel efficiency and reduce emissions. Their application enhances vehicle safety and durability by ensuring stress distribution and corrosion resistance. The global shift toward electric vehicles has further augmented the demand for specialized adhesives in battery assembly and thermal management.

Adhesives are substances that bond two surfaces together by forming a strong and durable attachment. They can be made from natural or synthetic materials and are used to bond various substrates, including metals, plastics, wood, ceramics, and composites.

Adhesives work through mechanisms such as chemical bonding, mechanical interlocking, or surface adhesion, offering alternatives to traditional fastening methods like nails or screws. Widely utilized across industries, including construction, automotive, packaging, and healthcare, adhesives provide advantages such as weight reduction, improved aesthetics, and enhanced performance.

Analyst’s Review

Rising environmental concerns and stringent regulations are promoting the adoption of eco-friendly adhesive products. Manufacturers are investing heavily in developing bio-based, water-based, and low-VOC adhesives that reduce environmental impact without compromising performance.

- In October 2024, researchers from the Leibniz Institute for Catalysis (LIKAT) in Rostock partnered with adhesives expert Henkel to develop bio-based adhesives with easy removal properties. As part of the BIOVIN project, the collaboration focused on creating new synthetic building blocks derived from carbohydrates and vegetable oils to produce adhesives with reversible bonding. These advancements aim to improve the repairability and recyclability of electronic devices and household appliances.

These innovations align with growing consumer preferences for sustainable solutions across industries such as packaging, construction, and automotive. Moreover, companies are focusing on recyclable adhesive formulations to support circular economy initiatives. This emphasis on sustainability is creating significant growth opportunities while reinforcing the market's alignment with global environmental goals.

Adhesives Market Growth Factors

The growing reliance on adhesives in the packaging sector is bolstering the growth of the adhesives market. The rise of e-commerce and the consumer goods industry has increased the demand for reliable bonding solutions in flexible packaging, carton sealing, and labeling.

- The International Trade Administration projects global B2C e-commerce revenue to reach USD 5.5 trillion by 2027, growing at a compound annual growth rate (CAGR) of 14.4%. Meanwhile, the global B2B e-commerce market has experienced steady year-over-year growth over the past decade, with its value expected to hit USD 36 trillion by 2026.

Adhesives ensure secure and tamper-proof packaging that meets stringent safety and quality standards. The trend toward eco-friendly and recyclable packaging materials has further increased the demand for innovative adhesive solutions designed for sustainable substrates.

Moreover, the increasing prevalence of chronic diseases and aging populations is boosting the demand for medical adhesives in advanced wound care and surgical applications. Additionally, the rising popularity of wearable medical devices for continuous monitoring has created potential opportunities for adhesive technologies that offer both durability and skin-friendliness, enhancing patient comfort and compliance.

However, stringent environmental regulations on the production and use of adhesives, particularly solvent-based variants, pose a significant challenge to market growth. These regulations aim to reduce volatile organic compound (VOC) emissions, which can limit the adoption of conventional adhesive solutions, particularly in regions with strict environmental policies.

Companies are addressing these challenges by developing eco-friendly adhesives, including water-based, bio-based, and low-VOC formulations. Investments in R&D to create innovative, sustainable products help manufacturers comply with regulations and meet customer demands. Strategic partnerships and collaboration with regulatory bodies facilitate seamless adaptation to evolving standards.

Adhesives Market Trends

The increasing integration in electronics manufacturing is reshaping the landscape of the adhesives market. Adhesives are essential for assembling components in devices such as smartphones, wearables, and consumer electronics, providing reliable bonds while supporting miniaturization.

Their use in heat dissipation, electrical insulation, and protective sealing enhances device performance and longevity. As emerging technologies such as 5G, IoT, and renewable energy systems grow, the demand for specialized adhesives that withstand thermal, electrical, and mechanical stresses has surged.

The global transition toward renewable energy is leading to increased adhesive usage in solar panels, wind turbines, and energy storage systems. Adhesives are used to bond photovoltaic modules, seal components in wind turbine blades, and assemble energy-efficient systems, where durability and weather resistance are paramount. Their ability to improve production efficiency and reduce maintenance costs makes them essential in renewable energy projects.

Segmentation Analysis

The global market has been segmented based on resin type, technology, end use industry, and geography.

By Resin Type

Based on resin type, the market has been segmented into acrylic adhesives, epoxy adhesives, polyvinyl acetate (PVA) adhesives, polyurethane (PU) adhesives, silicone, and others. The acrylic adhesives segment led the adhesives market in 2023, reaching a valuation of USD 28.31 billion.

Acrylic adhesives offer strong adhesion to a wide range of substrates, including metals, plastics, and composites, making them suitable for diverse applications in industries such as automotive, construction, electronics, and healthcare.

Their high resistance to environmental factors such as UV light, temperature fluctuations, and moisture ensures durability in challenging conditions. Moreover, advancements in formulation have led to the development of fast-curing acrylic adhesives, enhancing productivity in industrial assembly processes.

By Technology

Based on technology, the market has been classified into water-based adhesives, solvent-based adhesives, hot melt adhesives, reactive adhesives, and others. The water-based adhesives segment is further divided into acrylic dispersions, vinyl acetate-ethylene (VAE) emulsions, and polyvinyl acetate (PVA) emulsions.

The solvent based adhesives segment is segmented into polychloroprene adhesives, polyurethane adhesives, and phenolic resins. The hot melt adhesives segment is classified into ethylene vinyl acetate (EVA), amorphous polyalphaolefin (APAO), and polyamide adhesives. Whereas, the reactive adhesives segment is further categorized into epoxy adhesives, polyurethane adhesives, and silicone adhesives.

The water-based adhesives segment secured the largest revenue share of 36.78% in 2023. These adhesives are free from volatile organic compounds (VOCs), supporting global sustainability efforts and compliance with strict environmental regulations. Their compatibility with a wide range of substrates, including carbon fiber composites, makes them highly suitable for bonding in automotive, aerospace, and construction applications.

By End Use Industry

Based on end use industry, the market has been divided into building & construction, paper& packaging, automotive & transportation, woodworking & joinery, footwear & leather goods, medical, electronics, and others.

The automotive & transportation segment is poised to witness significant growth, recording a robust CAGR of 4.98% through the forecast period. This expansion is largely attributed to the growing emphasis on lightweighting and sustainability in vehicle manufacturing.

Adhesives play a crucial role in bonding lightweight materials such as composites, aluminum, and plastics, replacing traditional mechanical fasteners. This transition enhances fuel efficiency and reduces emissions, aligning with global regulatory standards. The rise of electric vehicles (EVs) has further boosted the demand for adhesives in battery assembly, thermal management, and sealing.

Adhesives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific adhesives market accounted for a significant share of around 35.67% in 2023, valued at USD 25.46 billion. This dominance is reinforced by increasing investments in construction and infrastructure projects across emerging economies such as China, India, and Southeast Asian countries.

Rapid urbanization and industrialization have created a strong demand for adhesives in flooring, roofing, and panel bonding applications. Government initiatives aimed at modernizing transport infrastructure, including railways, highways, and airports, are increasing the demand for advanced adhesive solutions that ensure durability, energy efficiency, and reduced installation time, making adhesives essential for infrastructure projects in the region.

- According to the Press Information Bureau, India’s National Highway (NH) network has grown by 60%, from 91,287 km in 2014 to 1,46,145 km in 2023. The length of four-lane NHs has surged 2.5 times, from 18,387 km in 2014 to 46,179 km in November 2023. The average construction pace of NHs has accelerated by 143%, rising from 12.1 km/day in 2014 to 28.3 km/day. As of January 31, 2024, over 100 Vande Bharat train services are operational, with 96.62% occupancy rate in 2022-23. On March 12, 2024, the government launched 10 new Vande Bharat trains.

Additionally, Asia Pacific's position as a global leader in electronics production is contributing significantly to regional market growth. Adhesives are extensively used in the assembly of consumer electronics, including smartphones, wearables, and home appliances. Countries such as China, South Korea, and Taiwan are at the forefront of this trend, generating a strong demand for adhesives.

Europe is set to experience significant growth, recording a CAGR of 3.25% over the forecast period. Europe's commitment to a circular economy is reshaping the regional market, promoting the development of recyclable and re-manufacturable adhesive solutions. Manufacturers are prioritizing adhesive formulations that allow easy material recovery during recycling processes, particularly in industries such as packaging, where dismantling and reusing materials is critical.

Moreover, the rise of high-tech manufacturing clusters in Europe, particularly in countries like Germany, France, and the UK, is creating demand for adhesives tailored for precision manufacturing.

These clusters focus on industries such as robotics, advanced machinery, and clean energy systems, which require adhesives capable of withstanding mechanical stress, chemical exposure, and extreme environmental conditions. This concentration of innovation hubs is boosting regional demand for advanced adhesive technologies.

Competitive Landscape

The global adhesives market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Adhesives Market

- 3M

- Henkel AG & Co. KGaA

- B. Fuller Company

- Sika AG

- Arkema

- Dow

- Avery Dennison Corporation

- Huntsman International LLC

- Pidilite Industries Ltd

- ITW Performance Polymers

Key Industry Developments

- May 2024 (Business Expansion): Dow began commercial operations of a new VORATRON Polyurethanes Systems adhesive and gap filler production line at its facility in Ahlen, Germany. This expansion increases VORATRON's production capacity tenfold, addressing the rising demand for materials used in battery assembly for the e-mobility sector.

- February 2024 (Product Launch): 3M launched a new medical adhesive designed to enhance patient care by offering a premium wear time of up to 28 days. This innovative adhesive reduces the need for frequent dressing changes, making it ideal for patients requiring long-term dressing wear.

The global adhesives market is segmented as:

By Resin Type

- Acrylic Adhesives

- Epoxy Adhesives

- Polyvinyl Acetate (PVA) Adhesives

- Polyurethane (PU) Adhesives

- Silicone

- Others

By Technology

- By Technology

- Water-Based Adhesives

- Solvent-Based Adhesives

- Hot Melt Adhesives

- Reactive Adhesives

- Others

By End Use Industry

- Building & Construction

- Paper& Packaging

- Automotive & Transportation

- Woodworking & Joinery

- Footwear & Leather Goods

- Medical

- Electronics

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America