Market Definition

The market encompasses the segment of healthcare focused on minimally invasive, image-guided procedures aimed at diagnosing, treating, and managing cancer.

This market includes a range of technologies and therapies such as ablation techniques, embolization therapies, and other catheter-based treatments that target tumors directly while minimizing damage to surrounding healthy tissue. The report highlights the key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Interventional Oncology Market Overview

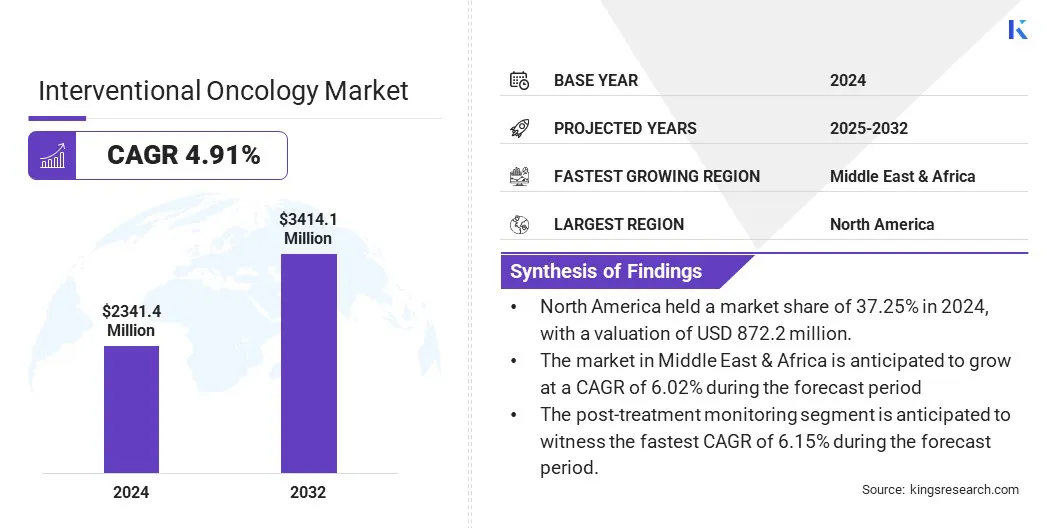

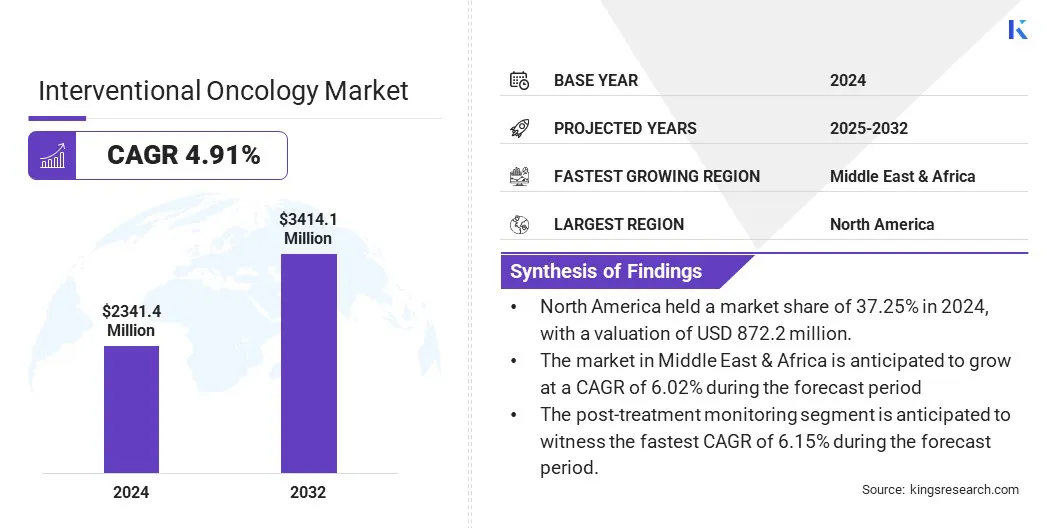

The global interventional oncology market size was valued at USD 2,341.4 million in 2024 and is projected to grow from USD 2,441.2 million in 2025 to USD 3,414.1 million by 2032, exhibiting a CAGR of 4.91% during the forecast period.

This is attributed to the increasing prevalence of cancer globally, the rising preference for minimally invasive and targeted treatment options, and advancements in image-guided technologies.

Growing awareness among patients and healthcare providers regarding the clinical advantages of interventional oncology procedures, along with the expanding availability of innovative ablation and embolization therapies, are major factors driving market growth.

Major companies operating in the interventional oncology industry are Terumo Corporation, Merit Medical Systems, Boston Scientific Corporation, Medtronic, IceCure Medical Ltd, Siemens Healthcare Private Limited, ABK Biomedical Inc., Minimax Medical Holding Group, AngioDynamics, Johnson & Johnson Services, Inc., Teleflex Incorporated, Stryker, Cook, GE HealthCare, and BD (Becton, Dickinson and Company).

Continuous improvements in procedural efficacy, reduced recovery times, and increasing investments in research and development of innovative interventional oncology devices, image-guided therapies, and minimally invasive treatment techniques are further accelerating market growth.

Additionally, favorable reimbursement policies, expanding healthcare infrastructure, and the integration of advanced imaging modalities are fueling the growth of the market.

- In November 2024, ABK Biomedical received FDA Breakthrough Device Designation for its Eye90 microspheres, a Yttrium-90 radioembolization device designed to treat unresectable liver cancer. Prior to this, the company initiated the first patient treatment in its U.S.-based Route90 pivotal trial, which evaluates the device’s safety, efficacy, and image-guided capabilities.

Key Highlights

- The interventional oncology market size was valued at USD 2,341.4 million in 2024.

- The market is projected to grow at a CAGR of 4.91% from 2025 to 2032.

- North America held a market share of 37.25% in 2024, with a valuation of USD 872.2 million.

- The ablation devices segment garnered USD 727.9 million in revenue in 2024.

- The embolization segment is expected to reach USD 1,403.5 million by 2032.

- The post-treatment monitoring segment is anticipated to witness the fastest CAGR of 6.15% during the forecast period.

- The liver cancer segment garnered USD 868.4 million in revenue in 2024.

- The hospitals segment is expected to reach USD 1,557.7 million by 2032.

- The market in Middle East & Africa is anticipated to grow at a CAGR of 6.02% during the forecast period.

Market Driver

Rising Cancer Incidence Worldwide

The rising incidence of cancer worldwide is fueling the market. Increasing cases of cancers such as liver, lung, colorectal, and kidney cancer are driving the demand for effective and targeted treatment options that minimize damage to healthy tissue.

This is driven by factors including an aging population, lifestyle-related risks, and improved cancer detection methods. Interventional oncology addresses this need through minimally invasive procedures that provide precise tumor targeting with shorter recovery times, making these treatments increasingly preferred by patients and healthcare providers.

The growing cancer burden is driving demand for image-guided, minimally invasive treatments that improve outcomes and optimize clinical workflows, thereby driving market growth.

In February 2024, the World Health Organization reported that global cancer cases are projected to exceed 35 million by 2050 a 77% increase from 2022. This rise is driven by aging populations and lifestyle risk factors such as tobacco, alcohol, and obesity.

Market Challenge

High Cost of Procedures and Equipment

A significant challenge hindering the growth of the interventional oncology market is the high cost associated with procedures and specialized medical equipment. Equipment such as image-guided systems, ablation devices, and embolization tools require substantial capital investment and maintenance.

Additionally, the cost of consumables used during procedures such as probes, catheters, and embolic agents adds to the overall treatment expense. These financial barriers make it difficult for healthcare providers, especially in low- and middle-income countries, to adopt interventional oncology solutions.

To address these challenges, manufacturers are focusing on developing cost-effective devices and offering tiered pricing models suited to varying market needs. Collaborations between public and private sectors are also being established to support equipment procurement, training, and maintenance, especially in underserved regions.

Market Trend

Growing Preference for Minimally Invasive Oncology Procedures

Minimally invasive oncology procedures are increasingly being adopted as a preferred treatment option due to their targeted approach, reduced patient trauma, and quicker recovery times. Techniques such as radiofrequency ablation (RFA), microwave ablation (MWA), and transarterial chemoembolization (TACE) are being widely utilized to treat various types of cancer with precision and minimal disruption to surrounding healthy tissues.

These procedures are gaining popularity for their ability to deliver effective results while avoiding the extended hospital stays and complications commonly associated with traditional surgery. Additionally, the compatibility of these interventions with outpatient care models enhances their cost-effectiveness and convenience for both patients and healthcare systems.

This trend is driven by the growing emphasis on patient-centered care, advancements in imaging technologies, and the increasing demand for less invasive yet effective cancer treatment solutions, firmly establishing minimally invasive procedures as a vital component of modern oncology practice.

- In March 2025, Varian, part of Siemens Healthineers, revealed a U.S. co-marketing and sales collaboration with Embolx for the Sniper Balloon Occlusion Microcatheter. This innovative device facilitates accurate embolization and combination treatments, including embolization followed by ablation, to better address liver metastases. The agreement strengthens Varian’s interventional oncology offerings and broadens the availability of image-guided cancer therapies.

Interventional Oncology Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Ablation Devices, Embolization Particles, Catheters, Guidewires, Stents, Software Platforms

|

|

By Procedure Type

|

Ablation, Embolization, Supportive Procedures

|

|

By Technology Stage

|

Diagnostic Imaging Support, Interventional Treatment Delivery, Post-Treatment Monitoring

|

|

By Cancer Type

|

Liver Cancer, Lung Cancer, Kidney Cancer, Bone Metastases, and Others

|

|

By End User

|

Hospitals, Oncology Centers, Ambulatory Surgical Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Ablation Devices, Embolization Particles, Catheters, Guidewires, Stents, Software Platforms): The ablation devices segment earned USD 727.9 million in 2024 due to the rising demand for minimally invasive tumor treatment solutions offering precision, safety, and quicker recovery.

- By Procedure Type (Ablation, Embolization, Supportive Procedures): The embolization segment held 41.09% of the market in 2024, due to its widespread use in treating various solid tumors by effectively cutting off blood supply to cancerous tissues, enhancing treatment efficacy and patient outcomes.

- By Technology Stage (Diagnostic Imaging Support, Interventional Treatment Delivery, Post-Treatment Monitoring): The interventional treatment delivery segment is projected to reach USD 1,939.4 million by 2032, owing to the increasing adoption of advanced minimally invasive therapies that offer targeted cancer treatment with improved precision and reduced recovery times.

- By Cancer Type (Liver Cancer, Lung Cancer, Kidney Cancer, Bone Metastases, and Others): The lung cancer segment is anticipated to grow at a CAGR of 5.87% during the forecast period due to the rising prevalence of lung cancer worldwide and the increasing adoption of minimally invasive interventional therapies for effective tumor management.

- By End User (Hospitals, Oncology Centers, Ambulatory Surgical Centers): The hospitals segment is projected to reach USD 1,557.7 million by 2032, owing to their extensive infrastructure, availability of advanced imaging technologies, and growing preference for comprehensive cancer care services under one roof.

Interventional Oncology Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America interventional oncology market share stood at around 37.25% in 2024, with a valuation of USD 872.2 million. Leading hospitals and specialized cancer centers across the region are increasingly adopting advanced minimally invasive procedures to improve patient outcomes and reduce recovery times.

The increasing integration of advanced imaging technologies and personalized treatment plans is driving demand for interventional oncology solutions across urban and suburban healthcare facilities. This is supported by strong government funding and private sector investments focused on cancer research and technology development.

Furthermore, collaborations between academic institutions and medical device manufacturers are boosting the development of new interventional techniques to enhance the expertise of healthcare professionals and drive market growth in the region.

- In April 2025, Delcath Systems received FDA clearance for its Investigational New Drug application for a Phase 2 trial of HEPZATO in patients with liver-dominant HER2-negative metastatic breast cancer. The trial will assess HEPZATO in combination with chemotherapy across over 20 sites in the U.S. and Europe.

The interventional oncology industry in Middle East & Africa is poised for significant growth at a robust CAGR of 6.02% over the forecast period. This growth is attributed to the increasing investments in healthcare infrastructure, rising cancer prevalence, and the increasing adoption of minimally invasive treatment technologies.

Moreover, government initiatives aimed at improving cancer care facilities, expanding access to specialized oncology centers, and enhancing medical training programs are further driving the market growth. Additionally, partnerships with international healthcare providers and rising awareness among patients and clinicians are fueling market expansion in the Middle East & Africa.

- In December 2023, the International Centers for Precision Oncology (ICPO) Foundation partnered with Misr Radiology Center to establish it as a global collaborating center. This collaboration aims to advance precision oncology education, training, and best practices in Egypt and North Africa, expanding access to cutting-edge cancer therapies in the region.

Regulatory Frameworks

- In the United States, the Food and Drug Administration (FDA) regulates interventional oncology devices under the Medical Device Amendments to the Federal Food, Drug, and Cosmetic Act. It requires manufacturers to obtain premarket approval (PMA) or clearance through the 510(k) process to ensure device safety and effectiveness.

- In the European Union, Regulation (EU) 2017/745 on medical devices (Medical Device Regulation, MDR) governs interventional oncology devices. It establishes strict requirements for device safety, performance, and clinical evaluation.

- The International Organization for Standardization’s ISO 13485 standard regulates quality management systems for medical device manufacturers. It specifies requirements to ensure the consistent design, development, production, and delivery of safe and effective medical devices.

Competitive Landscape

The interventional oncology market is characterized by a competitive landscape, featuring a mix of established global medical device manufacturers, specialized technology providers, and emerging players focusing on minimally invasive cancer treatments.

Companies are prioritizing innovation, advanced treatment solutions, and strategic partnerships to enhance procedural efficacy and address the growing demand for targeted oncology therapies. Leading players are heavily investing in R&D to develop cutting-edge devices, improve imaging guidance, and expand their therapeutic portfolios.

Strategic collaborations with healthcare providers, research institutions, and technology firms are enabling companies to broaden their market presence and accelerate product development.

The rising demand for effective, less invasive cancer treatments is intensifying competition, with market participants focusing on the introduction of novel ablation technologies, embolization materials, and integrated software platforms to meet the evolving needs of hospitals, oncology centers, and ambulatory surgical facilities worldwide.

- In June 2023, the Philips-led IMAGIO consortium received a USD 26.2 million grant from the Innovative Health Initiative to advance less invasive cancer treatments. With around 30 partners across Europe, the project focuses on improving outcomes for lung cancer, liver cancer, and soft tissue sarcomas using advanced imaging and interventional oncology techniques.

List of Key Companies in Interventional Oncology Market

- Terumo Corporation

- Merit Medical Systems

- Boston Scientific Corporation

- Medtronic

- IceCure Medical Ltd

- Siemens Healthcare Private Limited

- ABK Biomedical Inc.

- Minimax Medical Holding Group

- AngioDynamics

- Johnson & Johnson Services, Inc.

- Teleflex Incorporated

- Stryker

- Cook

- GE HealthCare

- BD (Becton, Dickinson and Company)

Recent Developments (M&A/ Agreements)

- In November 2024, Boston Scientific Corporation entered into an agreement to acquire Intera Oncology Inc., a medical device company specializing in liver cancer treatment. The acquisition aims to strengthen Boston Scientific’s interventional oncology portfolio including Intera’s FDA-approved implantable pump, the Intera 3000. It delivers chemotherapy directly to the liver, offering a targeted therapy for metastatic colorectal cancer.

The acquisition aims to strengthen Boston Scientific’s interventional oncology portfolio and is expected to close in the first half of 2025.