Market Definition

The market includes the global ecosystem of technologies and applications that use energy-based devices to remove or destroy targeted tissues. It covers a wide range of solutions used across multiple medical specialties such as cardiology, oncology, ophthalmology, gynecology, urology, and cosmetic surgery.

Key modalities include radiofrequency, laser/light, ultrasound, cryoablation, and emerging technologies. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Ablation Devices Market Overview

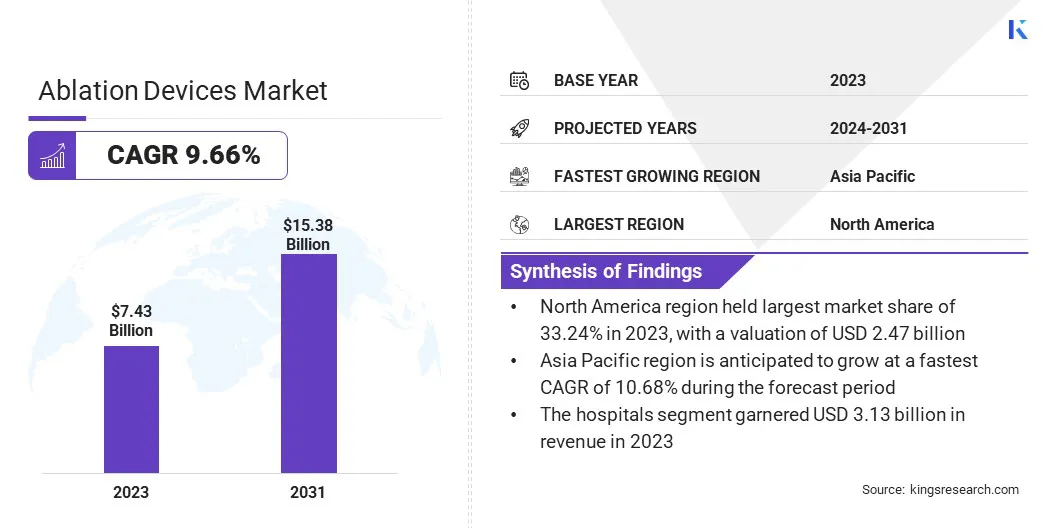

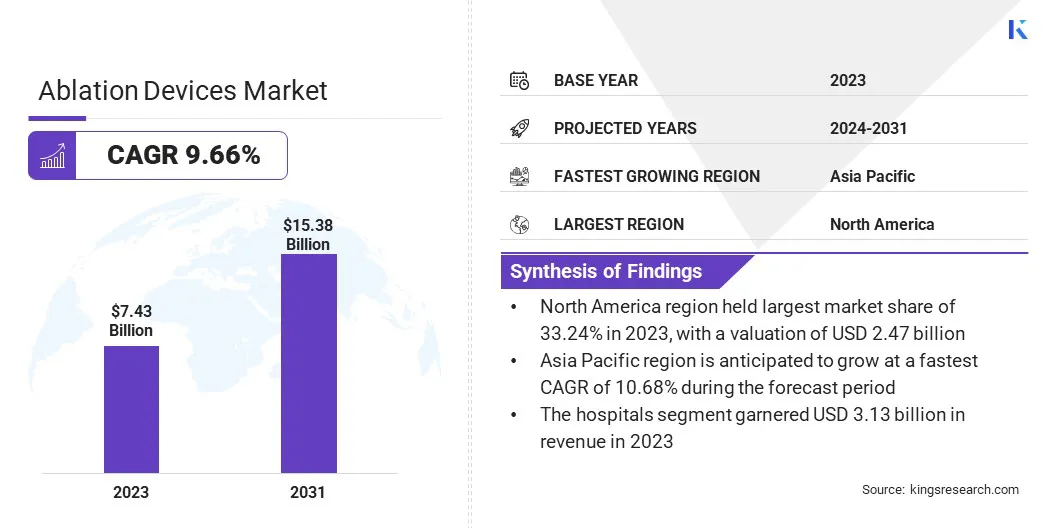

The global ablation devices market size was valued at USD 7.43 billion in 2023 and is projected to grow from USD 8.07 billion in 2024 to USD 15.38 billion by 2031, exhibiting a CAGR of 9.66% during the forecast period.

This growth is fueled by the rising prevalence of chronic diseases such as cardiovascular conditions, cancer, and arrhythmias. The growing aging population is boosting demand for effective treatment options such as ablation procedures. Technological advancements, including improved precision, real-time monitoring, and enhanced safety features, are further contributing to market growth.

Major companies operating in the ablation devices industry are Imricor, Terumo Corporation, Merit Medical Systems, Smith+Nephew, Koninklijke Philips N.V., Medtronic, AngioDynamics, Johnson & Johnson Services, Inc., Lumenis Be Ltd., Biotronik, EDAP TMS SA, Boston Scientific Corporation, Stryker, Atricure, Inc., and Abbott.

Additionally, minimally invasive procedures are becoming increasingly preferred by both healthcare providers and patients due to the faster recovery times and reduced risk of complications. These procedures offer benefits such as smaller incisions, less tissue damage, and shorter hospital stays.

- In December 2023, Pulse Biosciences, Inc. completed the first five procedures in its first-in-human feasibility study of the investigational CellFX Nanosecond Pulsed Field Ablation cardiac catheter. Conducted at Na Homolce Hospital in Prague, the study treated atrial fibrillation patients using 3D mapping and navigation systems, marking a significant milestone in evaluating the safety and performance of nonthermal nsPFA energy for pulmonary vein isolation.

Key Highlights:

- The ablation devices market size was recorded at USD 7.43 billion in 2023.

- The market is projected to grow at a CAGR of 9.66% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, valued at USD 2.47 billion.

- The radiofrequency devices segment garnered USD 2.03 billion in revenue in 2023.

- The cardiology segment is expected to reach USD 3.78 billion by 2031.

- The Hospitals segment is projected to generate a value of USD 6.42 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.68% over the forecast period.

Market Driver

Rising Prevalence of Chronic Diseases

The expansion of the global market is propelled by the rising prevalence of chronic diseases. As conditions such as cancer, cardiovascular diseases, and arrhythmias become more widespread, there is a growing demand for effective treatment options.

Ablation devices provide a minimally invasive solution for managing these diseases, offering benefits such as faster recovery times and lower complication risks compared to traditional surgeries. This has led to an increased adoption of ablation procedures, particularly for treating cardiac arrhythmias such as atrial fibrillation. The rising burden of chronic diseases across the globe is leading to the growing demand for ablation devices.

- In October 2024, data from the Centers for Disease Control and Prevention (CDC) confirmed that heart disease remained the leading cause of death in the United States, affecting men, women and nearly all racial and ethnic groups. E On average, one person dies from cardiovascular disease every 33 seconds.

Market Challenge

High Cost of Devices and Procedures

A major challenge hampering the progress of the ablation devices market is the high cost of both the devices and associated procedures. The significant investment required for advanced technology makes these systems expensive for healthcare facilities, particularly in emerging markets. This cost barrier limits accessibility and adoption, particularly in budget-constrained regions.

To address this challenge, companies can focus on developing cost-effective ablation devices by optimizing manufacturing processes, reducing material costs, and adopting innovative technologies that maintain quality and safety. Additionally, offering flexible pricing models and partnerships with healthcare providers could also help make these devices more accessible to a broader range of facilities and patients.

Market Trend

Minimally Invasive Procedures

The global market is witnessing a significant shift toward minimally invasive procedures. This shift is supported by the numerous advantages these procedures offer, including faster recovery times, reduced risk of complications, and lower overall healthcare costs.

Techniques such as radiofrequency and cryoablation, which involve smaller incisions and less tissue damage, lead to shorter hospital stays and quicker recovery. Consequently, healthcare providers and patients are increasingly opting for these treatments over traditional surgeries, particularly for treating chronic conditions such as atrial fibrillation and cancer.

- In April 2024, AtriCure, Inc. launched cryoSPHERE+ cryoablation probe for post-operative pain management. The device, which is part of the cryoICE platform, incorporates new insulation technology that reduces freeze time by 25% compared to the previous cryoSPHERE model. It received FDA 510(k) clearance for peripheral and intercostal nerve ablation in adult and adolescent patients.

Ablation Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Radiofrequency devices, Laser/light ablation, Ultrasound devices, Cryoablation devices, Others

|

|

By Application

|

Cardiology, Oncology, Ophthalmology, Gynecology, Urology, Cosmetic surgery, Others

|

|

By End Use

|

Hospitals, Ambulatory surgical centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Radiofrequency devices, Laser/light ablation, Ultrasound devices, Cryoablation devices, and Others): The radiofrequency devices segment earned USD 2.03 billion in 2023 due to rising demand for minimally invasive treatments and improved procedural outcomes.

- By Application (Cardiology, Oncology, Ophthalmology, and Gynecology): The cardiology segment held a share of 24.47% in 2023, propelled by the growing prevalence of arrhythmias and increased adoption of ablation therapies.

- By End Use (Hospitals, Ambulatory Surgical Centers, and Others): The hospitals segment is projected to reach USD 6.42 billion by 2031, fueled by high patient inflow, advanced infrastructure, and skilled professionals.

Ablation Devices Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America ablation devices market share stood at around 33.24% in 2023, valued at USD 2.47 billion. This dominance is reinforced by strong healthcare infrastructure and early adoption of advanced medical technologies. High prevalence of cardiac disorders and cancer has increased the demand for ablation procedures.

Favorable reimbursement policies and increased healthcare spending have further supported regional market expansion. FDA approvals for novel ablation devices have accelerated clinical adoption, while the presence of key market players and continuous product innovation have reinforced the region’s dominance.

- In December 2023, Medtronic plc gained FDA approval for the PulseSelect Pulsed Field Ablation System to treat both paroxysmal and persistent atrial fibrillation, making it the first Pulsed Field Ablation technology to receive FDA approval.

Asia Pacific ablation devices industry is poised to grow at a CAGR of 10.68% over the forecast period. This growth is fueled by a rising patient population and increasing awareness about minimally invasive treatments. Government initiatives to strengthen healthcare systems and improve access to modern procedures are contributing significantly to this expansion.

Rapid urbanization, growing medical tourism, and the expansion of private hospitals have created new growth opportunities. Countries such as China, India, and South Korea are witnessing a surge in demand for ablation devices due to higher investments in healthcare infrastructure.

Regulatory Frameworks

- In the U.S, ablation devices are regulated by the Food and Drug Administration (FDA). These devices are classified under the Medical Device Amendment of 1976, which requires them to undergo a premarket notification (510(k)) or premarket approval (PMA) process, depending on the device classification. For most ablation devices, the 510(k) clearance process is followed, demonstrating that the device is substantially equivalent to a legally marketed device.

- In Europe, ablation devices are governed by the Medical Device Regulation (MDR) 2017/745. This regulation ensures that devices meet safety, health, and environmental protection requirements before being marketed. Manufacturers must obtain a CE mark by submitting documentation for device performance, clinical evidence, and risk management to a notified body for assessment and inspection.

Competitive Landscape

The ablation devices market is highly competitive, with key players employing a variety of strategies to strengthen their market positions and expand their market share. A significant strategy used by leading companies is product innovation. Many companies are focused on developing advanced, minimally invasive ablation devices that offer improved precision, reduced recovery times, and better patient outcomes.

Strategic partnerships and collaborations are also a key focus. Companies frequently collaborate with healthcare providers, research institutions, and technology firms to enhance product development, expand clinical applications, and improve distribution networks. These partnerships allow companies to access new technologies, gain insights into emerging treatment methods, and tap into new geographic markets.

- In November 2024, Boston Scientific Corporation announced its acquisition of Cortex, Inc., a privately held medical technology company. The acquisition aims to enhance Boston Scientific's electrophysiology portfolio by incorporating Cortex's OptiMap System, which helps identify triggers and drivers of atrial fibrillation, thereby improving the treatment of complex cases.

List of Key Companies in Ablation Devices Market:

- Imricor

- Terumo Corporation

- Merit Medical Systems

- Smith+Nephew

- Koninklijke Philips N.V.

- Medtronic

- AngioDynamicsc

- Johnson & Johnson Services, Inc.

- Lumenis Be Ltd.

- Biotronik

- EDAP TMS SA

- Boston Scientific Corporation

- Stryker

- Atricure, Inc.

- Abbott

Recent Developments (Approval)

- In March 2025, Abbott received CE Mark approval for its Volt PFA System to treat atrial fibrillation (AFib). The system improves workflows by allowing mapping, pacing, and ablation with a single catheter. Clinical trials demonstrated its effectiveness, achieving pulmonary vein isolation in 99.1% of veins with fewer energy applications compared to other PFA systems.

- In October 2024, Boston Scientific Corporation received FDA approval for the FARAWAVE NAV Ablation Catheter and FDA clearance for the FARAVIEW Software. These advancements, designed for integration with the FARAPULSE Pulsed Field Ablation System, improve visualization during cardiac ablation procedures and are fully compatible with Boston Scientific's OPAL HDx Mapping System.