Market Definition

The market refers to the industry involved in the production of insulated concrete forms. ICFs are building materials used in the construction of walls, typically for residential, commercial and industrial buildings.

These forms are made of two layers of foam insulation with a concrete core in between, providing structural strength, thermal insulation, and soundproofing properties.

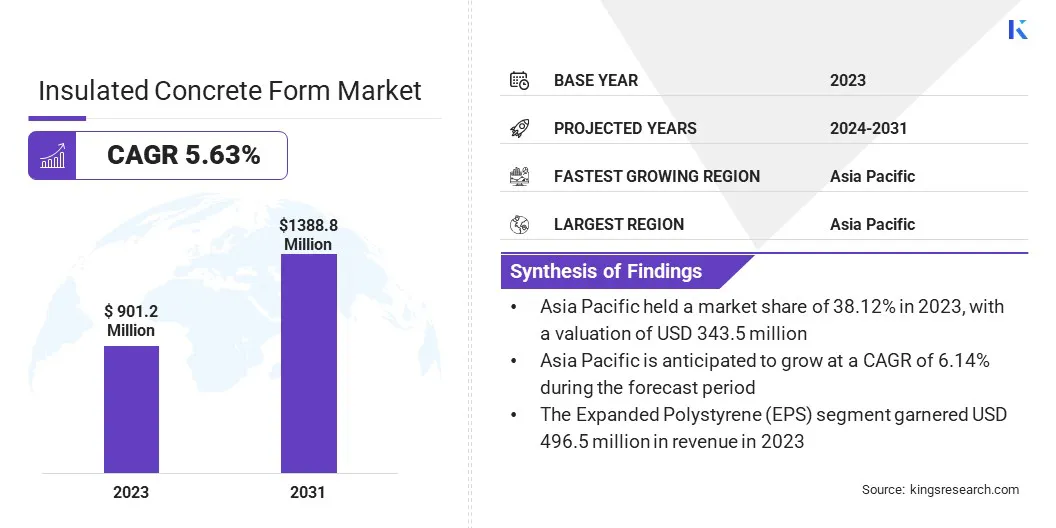

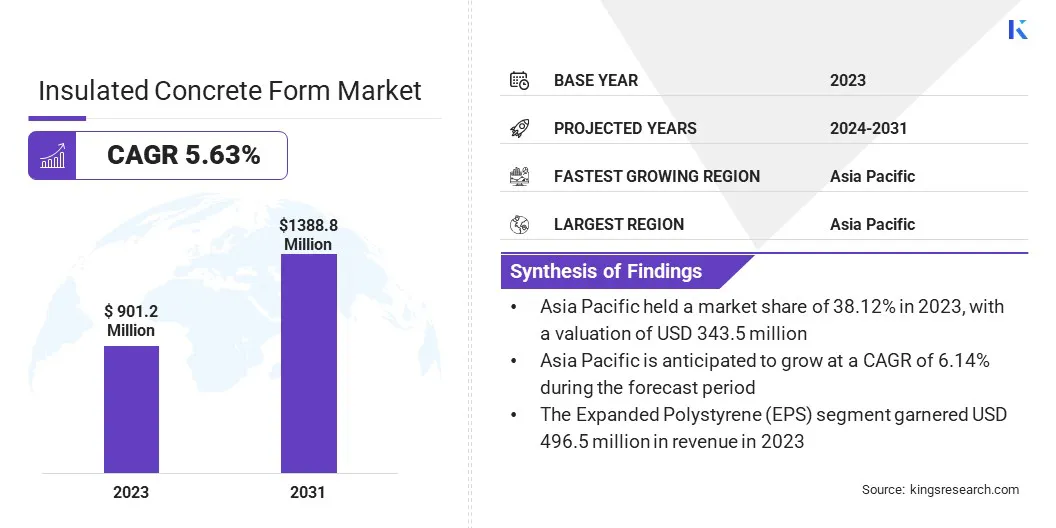

The global insulated concrete form market size was valued at USD 901.2 million in 2023, which is estimated to be USD 946.7 million in 2024 and reach USD 1,388.8 million by 2031, growing at a CAGR of 5.63% from 2024 to 2031.

The superior durability and disaster resistance of ICFs make them an ideal choice for resilient buildings. They withstand extreme weather, fire, and pest damage, contributing to long-lasting structures and boosting the market demand.

Major companies operating in the insulated concrete form industry are Airlite Plastics Company & Fox Blocks., Amvic Inc., BASF SE, Beco Products Ltd, RPM International Inc., BuildBlock Building Systems LLC, Logix Brands Ltd., Standard ICF Corporation, Quad-Lock Building Systems, Smart Block ICF, Polycrete International, LiteForm, Rastra, SuperForm, and Nexcem Inc.

The market provides energy-efficient, durable, and sustainable building solutions to the construction industry. It encompasses a wide range of companies offering various ICF products for residential, commercial, and industrial projects.

ICF construction is increasingly popular, due to its superior insulation properties, soundproofing benefits, and structural strength. Moreover, it caters to the global demand for green building practices and energy-efficient construction.

- In September 2024, Atlantic Builders Supply Northeast introduced customized ICF training to help builders meet Massachusetts' updated Stretch Energy Code requirements. This training emphasizes how ICF construction, with its superior insulation properties, supports enhanced energy efficiency and reduced Greenhouse Gas (GHG) emissions.

Key Highlights:

- The insulated concrete form industry size was valued at USD 901.2 million in 2023.

- The market is projected to grow at a CAGR of 5.63% from 2024 to 2031.

- Asia Pacific held a market share of 38.12% in 2023, with a valuation of USD 343.5 million.

- The Expanded Polystyrene (EPS) segment garnered USD 496.5 million in revenue in 2023.

- The flat wall system segment is expected to reach USD 677.1 million by 2031.

- The commercial segment is anticipated to register the fastest CAGR of 6.55% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 5.84% during the forecast period.

Market Driver

Long-term Durability and Disaster Resistance

The long-term durability and disaster resistance of ICFs are significant growth drivers of the market. Their ability to withstand extreme weather conditions, such as hurricanes and tornadoes, along with fire resistance and pest protection, makes them ideal for regions prone to natural disasters.

ICF structures provide a higher level of safety, reducing the need for costly repairs after environmental events. This durability attracts homeowners, builders, and developers who prioritize long-lasting, low-maintenance buildings, further accelerating the adoption of ICFs in construction projects.

- As per the Insulating Concrete Forms Manufacturers Association (ICFMA) article dated May 2023, ICFs offer superior disaster-resilience, with their ability to withstand extreme weather, fires, and earthquakes. This durability boosts demand, as homeowners and builders seek long-lasting, safe, and energy-efficient structures.

Market Challenge

Limited Awareness and Education

Limited awareness and education about the benefits of ICFs remain a significant challenge in the market. Many contractors and consumers are unaware of their advantages, such as energy efficiency, durability, and disaster resistance, which can limit their adoption.

Thus, manufacturers and industry associations should invest in educational campaigns, provide training programs for contractors, and offer clear, accessible information to consumers. Demonstrating the long-term cost savings and environmental benefits of ICFs can further boost their adoption.

Market Trend

Customization and Design Flexibility

A notable trend in the insulated concrete form market is the growing focus on customization and design flexibility. Manufacturers are offering a wide range of ICF options to cater to diverse architectural styles and building types. This includes customizable shapes, sizes, and finishes that allow for more creative and unique building designs.

Construction projects increasingly prioritize esthetic appeal alongside functionality, enabling architects and builders to incorporate ICFs in a variety of residential, commercial, and industrial structures without compromising on design or performance.

- In May 2023, Amvic Building System rebranded as Alleguard, reflecting its commitment to providing protective foam solutions. Its expanded engineering expertise and customizable options support diverse architectural needs, aligning with the growing trend of design flexibility in the insulated concrete foam market.

|

Segmentation

|

Details

|

|

By Material

|

Expanded Polystyrene (EPS), Polyurethane Foam, Cement-bonded Wood Fiber, Others

|

|

By Shape

|

Flat Wall System, Waffle Grid System, Post & Lintel System, Others

|

|

By Application

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material [Expanded Polystyrene (EPS), Polyurethane Foam, Cement-bonded Wood Fiber, Others]: The Expanded Polystyrene (EPS) segment earned USD 496.5 million in 2023, due to its cost-effectiveness, energy efficiency, and widespread adoption in residential and commercial construction.

- By Shape (Flat Wall System, Waffle Grid System, Post & Lintel System, Others): The flat wall system segment held 50.12% share of the market in 2023, due to its simplicity, strength, and ability to efficiently insulate large building surfaces.

- By Application (Residential, Commercial, Industrial): The residential segment is projected to reach USD 823.9 million by 2031, owing to the increasing demand for energy-efficient, sustainable homes and building regulations emphasizing insulation and energy saving.

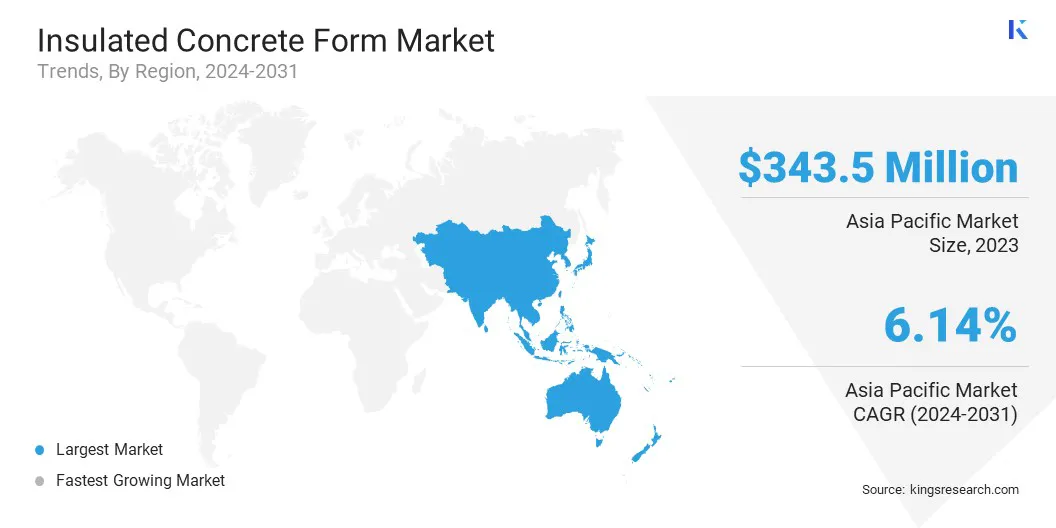

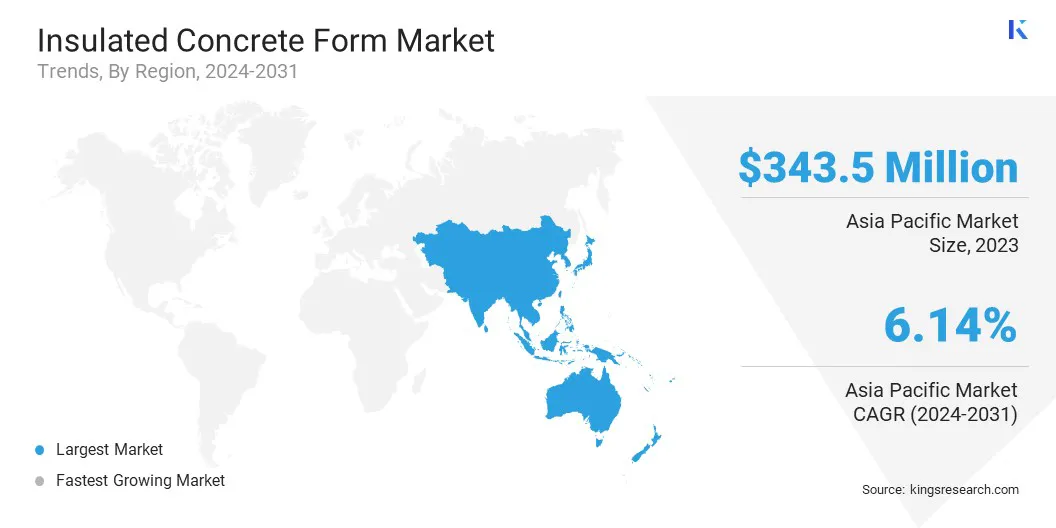

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a market share of around 38.12% in 2023, with a valuation of USD 343.5 million. Asia Pacific is emerging as the dominating region in the insulated concrete form market, driven by rapid urbanization, infrastructure development, and a growing emphasis on sustainable construction.

The booming construction industry, especially in countries like China, India, and Japan, is increasingly adopting energy-efficient building materials like ICFs to meet the demand for eco-friendly and resilient structures. Additionally, favorable government initiatives and growing awareness of the benefits of ICF, including cost savings and durability, are further accelerating its market growth.

The market in Europe is poised for significant growth at a robust CAGR of 5.84% over the forecast period. Europe is emerging as a fast-growing region in the market, driven by the increasing demand for energy-efficient and sustainable construction solutions on account of strict building codes and environmental regulations.

The adoption of ICFs is gaining momentum as countries across Europe focus on reducing carbon footprints and improving energy efficiency in buildings. Additionally, the rising trend of green building certifications and the need for disaster-resistant structures contribute to the rapid expansion of the market in the region.

- In September 2024, the Bristol Public Safety Building and David Prouty High School in New England showcased the benefits of ICF. Atlantic Builders Supply Northeast supplied Nudura ICF forms for both projects, contributing to energy efficiency and sustainability.

Regulatory Frameworks

- In the U.S., the International Energy Conservation Code (IECC), developed by the International Code Council (ICC), sets minimum efficiency standards and encourages the use of ICFs for enhanced insulation in new construction.

- The EU's Energy Performance of Buildings Directive (EPBD) promotes the use of high-performance insulation materials like ICFs for energy-efficient buildings.

- In India, the Green Rating for Integrated Habitat Assessment (GRIHA) encourages the use of sustainable construction materials such as ICFs to minimize resource consumption, waste generation, and ecological impact throughout a building's lifecycle.

Competitive Landscape:

Companies in the insulated concrete form industry are focusing on expanding their product portfolios by integrating advanced insulation technologies and enhancing manufacturing capabilities. They are investing in automation, improving distribution networks, and exploring strategic acquisitions to cater to the growing demand for energy-efficient and resilient building solutions.

This enables them to offer more sustainable, cost-effective, and high-performance products for residential, commercial, and infrastructure applications.

- In December 2024, Carlisle Companies completed the acquisition of Plasti-Fab, enhancing its portfolio in EPS insulation products. This move strengthens its position in the market, expanding capabilities in commercial, residential, and infrastructure construction.

List of Key Companies in Insulated Concrete Form Market:

- Airlite Plastics Company & Fox Blocks.

- Amvic Inc.

- BASF SE

- Beco Products Ltd

- RPM International Inc.

- BuildBlock Building Systems LLC

- Logix Brands Ltd.

- Standard ICF Corporation

- Quad-Lock Building Systems

- Smart Block ICF

- Polycrete International

- LiteForm

- Rastra

- SuperForm

- Nexcem Inc.

Recent Developments (Partnerships)

- In October 2023, Onsite ICF partnered with BASF East Africa to build affordable housing in Kenya. The collaboration combines Onsite ICF’s building technology and BASF’s construction materials, aiming to address the housing shortage by providing energy-efficient homes.