Architectural Services Market Size

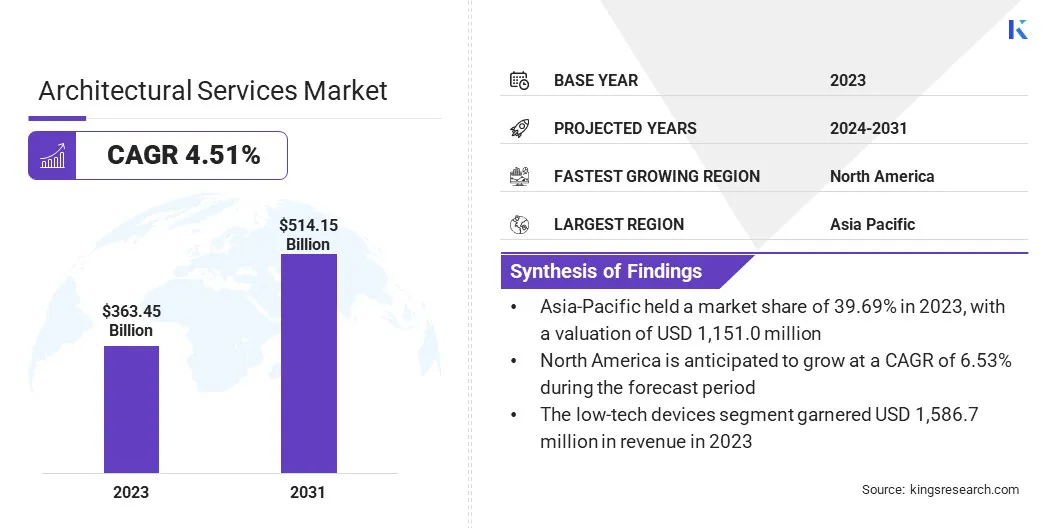

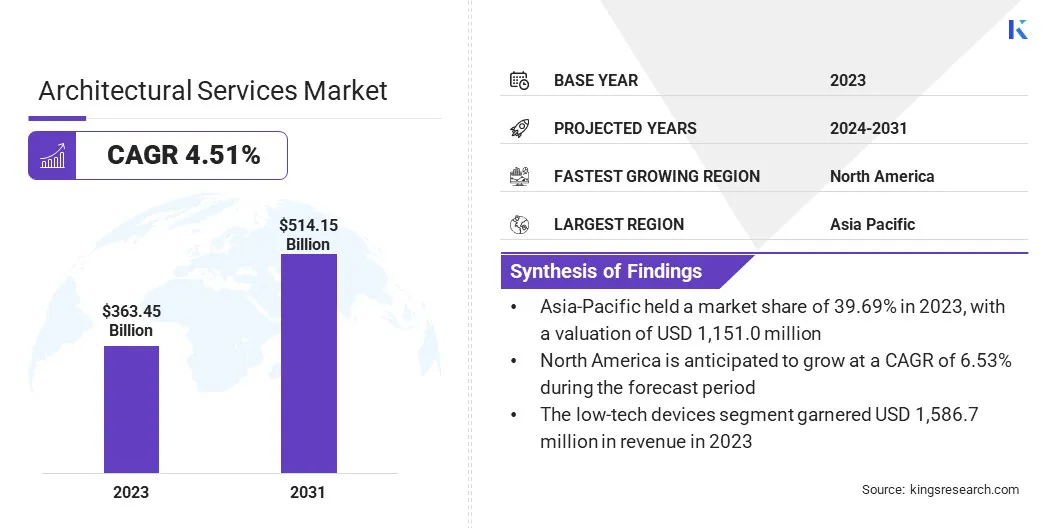

Global Architectural Services Market size was recorded at USD 363.45 billion in 2023, which is estimated to be at USD 377.65 billion in 2024 and projected to reach USD 514.15 billion by 2031, growing at a CAGR of 4.51% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Aedas, CallisonRTKL, Gensler, Hardlines Design Company, Skidmore, Owings & Merrill, Stantec, AECOM, HDR, Inc., HKS Inc., IBI Group, and others. The growth of the architectural services market is primarily driven by rapid urbanization, infrastructural development, and growing demand for sustainable designs.

The expansion of cities is resulting in an increased need for architectural expertise to plan and efficiently execute construction projects. Moreover, government initiatives focusing on infrastructure improvement fuel market growth. Additionally, the growing emphasis on environmentally friendly designs and energy efficiency is propelling the demand for architects skilled in sustainable practices.

The architectural services market encompasses a wide range of activities related to the design and planning of structures, including residential, commercial, and industrial buildings. Architectural firms offer services such as concept development, feasibility studies, design drafting, and project management. This market is characterized by intense competition among firms vying for projects, often based on their reputation, expertise, and innovative approaches.

Moreover, technological advancements, such as building information modeling (BIM) and computer-aided design (CAD), have revolutionized architectural practices, significantly enhancing efficiency and precision in design processes.

The architectural services market refers to the sector involved in providing architectural design, planning, and consulting services for various construction projects. This includes designing buildings, structures, and spaces while considering aspects such as functionality, aesthetics, and sustainability. Architectural firms collaborate with clients to understand their requirements, develop design concepts, and oversee project implementation. The market encompasses a diverse range of players, from large multinational firms to small independent practices, catering to both public and private sector clients.

Analyst’s Review

Manufacturers are making persistent efforts toward developing sustainable building materials and technologies. These innovations align with the growing demand for eco-friendly designs. Additionally, architects are leveraging advanced software to streamline design processes, enhance collaboration, and increase accuracy, thereby innovating the nature of their services and improving their service offerings. These factors are likely to contribute to the robust market growth in the forecast duration (2024-2031).

Architectural Services Market Growth Factors

The increasing demand for sustainable and eco-friendly architectural designs is propelling market growth. Clients and regulatory bodies are increasingly prioritizing environmental considerations in construction projects. Architects are responding to this growing demand by incorporating green building practices, such as energy-efficient designs and the use of sustainable materials, into their projects. This is fueled by growing awareness of climate change and the need to reduce carbon footprint. Architects are continuously innovating to integrate principles of sustainability seamlessly into their designs to meet client expectations and regulatory requirements while contributing to environmental conservation.

The fluctuating demand, influenced by economic cycles, presents a key challenge to market progress. Economic downturns result in a slowdown of construction activity, leading to reduced demand for architectural services. To mitigate this challenge, architectural firms are diversifying their service offerings to include sectors that are less susceptible to economic fluctuations, such as renovation and restoration projects and specialized consulting services.

Additionally, establishing long-term relationships with clients and maintaining a strong reputation for quality and reliability enables firms to secure projects even during periods of economic uncertainty.

Architectural Services Market Trends

The adoption of digital technologies in architectural design processes allows architects to effectively utilize tools such as building information modeling (BIM) and computer-aided design (CAD) software, thereby enhancing efficiency and precision in design development. BIM assists architects in creating 3D models that integrate various aspects of a building's design, including its structure, systems, and materials, which facilitates better collaboration and coordination among project stakeholders.

Moreover, CAD software enables architects to create detailed and accurate drawings, thus streamlining the design iteration process. These digital tools improve productivity while also empowering architects to explore innovative design solutions.

The growing emphasis on inclusive and accessible design practices is a prominent trend in the market. Architects are recognizing the importance of designing spaces that are accessible to people of all ages and abilities, including those with disabilities. This trend further aligns with the broader societal values that prioritize inclusivity and diversity, prompting architects to consider factors such as universal design principles, accessibility standards, and barrier-free environments in their projects. By incorporating inclusive design, architects enhance the usability and functionality of spaces, thus contributing to the creation of more equitable and inclusive built environments for all individuals.

Segmentation Analysis

The global architectural services market is segmented based on type, end-use, and geography.

By Type

Based on type, the market is segmented into construction and project management, engineering and interior designing, urban planning, and others. The construction and project management segment led the market in 2023, reaching a valuation of USD 154.28 billion. The segment is witnessing expansion due to increased infrastructure development projects globally. Governments and private entities are investing heavily in construction activities, resulting in a surge in demand for architectural services focused on project planning, execution, and management.

Additionally, the rising emphasis on efficient project delivery within budgetary constraints is leading to greater reliance on professional project management services. Architects who offer comprehensive construction solutions, including project management expertise, are well-positioned to capitalize on this segment's growth.

By End-Use

Based on end-use, the market is classified into industrial, residential, education, healthcare, retail, and others. The industrial segment secured the largest revenue share of 35.67% in 2023. This expansion is attributed to the robust growth in industrial infrastructure development and modernization initiatives across various sectors. Industries such as manufacturing, logistics, and energy are investing in new facilities and upgrading existing ones, thereby increasing demand for architectural services specifically tailored to meet diverse industrial needs. Architects specializing in industrial design are witnessing a rise in demand for designing efficient, safe, and sustainable industrial spaces that optimize operations and enhance productivity.

Architectural Services Market Regional Analysis

Based on region, the global architectural services market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Architectural Services Market share stood around 31.23% in 2023 in the global market, with a valuation of USD 117.94 billion. This dominance is primarily fueled by rapid urbanization, infrastructure development, and economic growth in countries such as China, India, and Southeast Asian nations. These countries are experiencing a surge in construction activities across residential, commercial, and industrial sectors, leading to a surge in demand for architectural services. Additionally, increasing investments in smart city projects, sustainable development initiatives, and government infrastructure spending are contributing to the region's leading position in the global marketplace.

North America is poised to witness significant growth over the forecast period at a CAGR of 6.31%. This growth is propelled by a strong resurgence in construction activities following the pandemic-induced slowdown. Subsequent investments in infrastructure projects, and growing demand for sustainable building designs are supporting regional market growth. Moreover, technological advancements in architectural software and digital tools are enhancing productivity and fostering innovation in the region's architectural firms.

Competitive Landscape

The global architectural services market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Architectural Services Market

- Aedas

- CallisonRTKL

- Gensler

- Hardlines Design Company

- Skidmore, Owings & Merrill

- Stantec

- AECOM

- HDR, Inc.

- HKS Inc

- IBI Group

Key Industry Developments

- April 2024 (Partnership): AECOM, in partnership with Jacobs, was appointed by Amtrak to operate as the delivery partner for its Frederick Douglass Tunnel Program, valued at approximately USD 6 billion, to undertake upgradation of a section of the Northeast Corridor (NEC). This program required the construction of two new high-capacity tubes for electrified passenger trains to replace the existing B&P Tunnel to deliver a faster, more reliable trip for over 12 million annual MARC and Amtrak customers.

- December 2023 (Partnership): HDR expanded its construction services and expertise by acquiring Boston's City Point Partners, forming HDR | City Point Partners. The acquired firm specializes in program management, project controls, public outreach, construction services, and owner's project management, with experience in higher education and municipal markets. This marked HDR's sixth acquisition in five years, reinforcing its position as a prominent employee-owned firm in the U.S.

The Global Architectural Services Market is Segmented as:

By Type

- Construction and Project Management

- Engineering and Interior Designing

- Urban Planning

- Others

By End-Use

- Industrial

- Residential

- Education

- Healthcare

- Retail

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America