Market Definition

The market involves the production, distribution, and adoption of hysteroscopy devices and related services used for diagnostic and surgical procedures in the uterine cavity.

This market encompasses a wide range of instruments, including hysteroscopes, resectoscopes, fluid management systems, and operative tools, which aid in the diagnosis and treatment of conditions such as abnormal bleeding, fibroids, polyps, and infertility.

Hysteroscopy Procedures Market Overview

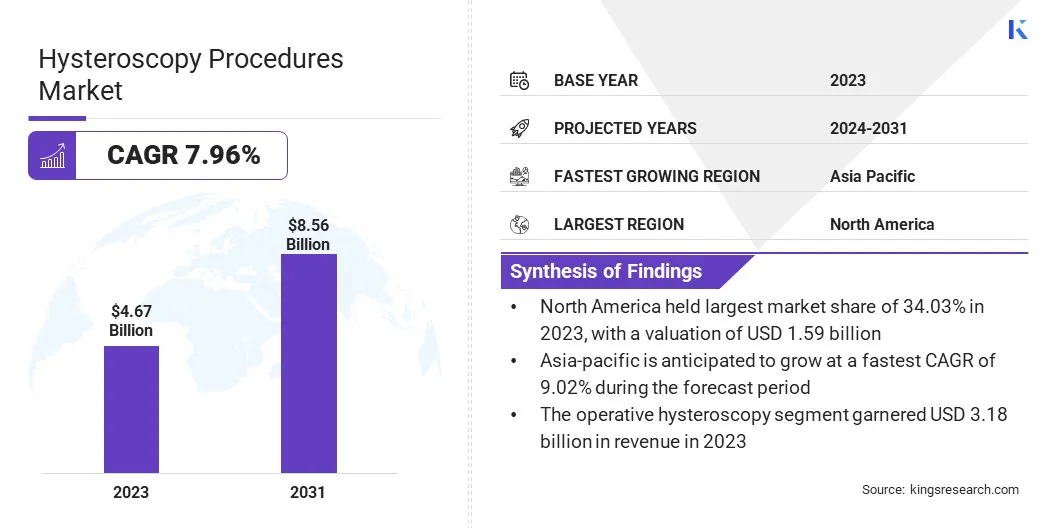

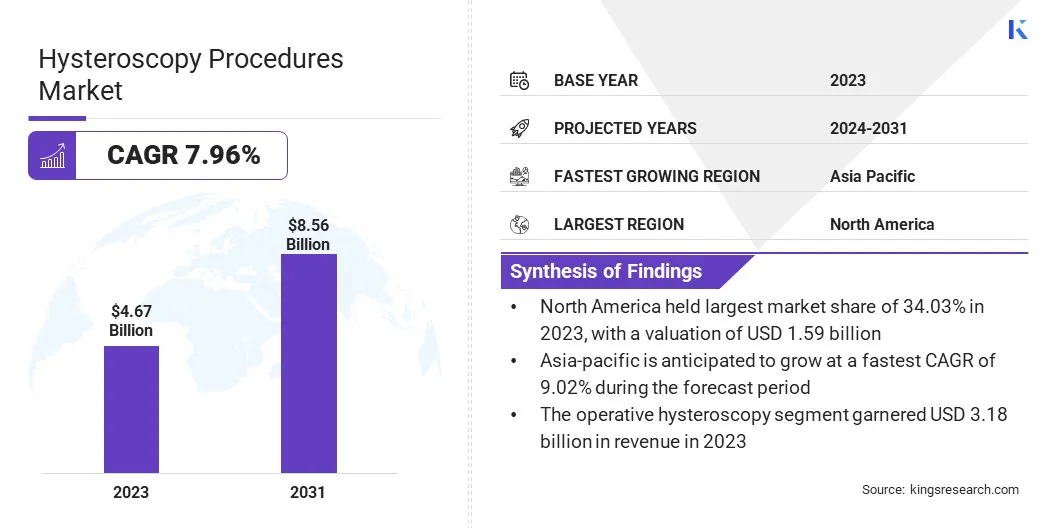

The global hysteroscopy procedures market size was valued at USD 4.67 billion in 2023 and is projected to grow from USD 5.01 billion in 2024 to USD 8.56 billion by 2031, exhibiting a CAGR of 7.96% during the forecast period.

The growing prevalence of gynecological disorders, the increasing preference for minimally invasive procedures, and continuous advancements in hysteroscopic technology are fueling market expansion.

Growing awareness among patients and healthcare professionals, coupled with improved healthcare infrastructure and access to medical facilities, is aiding the demand for hysteroscopy procedures.

Major companies operating in the hysteroscopy procedures industry are Richard Wolf GmbH., KARL STORZ, Stryker, Olympus Corporation, Delmont imaging, Lasermed Co., Ltd., Hologic, Inc., Boston Scientific Corporation, LUMINELLE, Medtronic, Akino Medical, EMOS Technology GmbH, Cook, The Cooper Companies, Inc., and LiNA Medical ApS.

The integration of artificial intelligence (AI) and robotics in hysteroscopy devices and supportive government initiatives and reimbursement policies, is expected to enhance market growth.

- In May 2024, Meditrina received FDA 510(k) clearance for its Gen 2 bipolar RF hysteroscopy system, incorporating advanced bipolar radiofrequency technology along with the Aveta Glo bipolar RF device, representing a key advancement in minimally invasive gynecologic procedures.

Key Highlights

- The hysteroscopy procedures industry size was recorded at USD 4.67 billion in 2023.

- The market is projected to grow at a CAGR of 7.96% from 2024 to 2031.

- North America held a market share of 34.03% in 2023, with a valuation of USD 1.59 billion.

- The hysteroscopic instruments & accessories segment garnered USD 2.13 billion in revenue in 2023.

- The operative hysteroscopy segment is expected to reach USD 5.91 billion by 2031.

- The ambulatory surgical centers (ASCs) segment is anticipated to witness the fastest CAGR of 8.63% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.02% during the forecast period.

Market Driver

"Rising Prevalence of Gynecological Disorders"

The increasing prevalence of gynecological disorders like uterine fibroids, polyps, abnormal bleeding, and infertility is driving the demand for hysteroscopy procedures. Factors such as hormonal imbalances, lifestyle changes, and delayed pregnancies contribute to these conditions.

Hysteroscopy’s minimally invasive nature, high precision, and real-time visualization make it a preferred diagnostic and treatment method. Growing awareness, early diagnosis, and technological advancements further boost market adoption.

Additionally, the rising geriatric female population and increasing healthcare investments are expected to propel the demand for hysteroscopy procedures in the coming years.

- In October 2024, Minerva Surgical announced a strategic partnership with Black Maple Group LLC to enhance access to office-based solutions for WHAAPA (Women's Health Administrative and Purchasing Alliance) physician members, supporting the detection and treatment of uterine conditions.

Market Challenge

"High Cost of Hysteroscopic Procedures and Equipment"

The high cost of hysteroscopic procedures and equipment limits market growth, especially in low-income regions. Advanced devices such as hysteroscopes, resectoscopes, and high-resolution imaging systems require substantial investment, making them unaffordable for many healthcare facilities.

Continuous maintenance, sterilization, and staff training further increase operational costs. For patients, the procedure itself, along with hospital fees and anesthesia charges, can be financially burdensome, especially when insurance coverage is limited.

These cost-related challenges restrict accessibility, slowing the adoption of hysteroscopy despite its benefits in diagnosing and treating gynecological disorders.

To overcome the high cost of hysteroscopic procedures and equipment, manufacturers should focus on developing affordable, reusable, and portable devices to reduce expenses for healthcare providers.

Governments and insurance companies need to expand reimbursement policies, making procedures more accessible to patients. Hospitals can implement cost-effective training programs to maximize the efficiency of existing resources and reduce dependency on expensive equipment.

Additionally, collaborations between medical technology firms and healthcare institutions can drive innovations that lower costs without compromising quality. Expanding telemedicine and remote training initiatives can further optimize resources, making hysteroscopy more affordable and widely available.

Market Trend

"Technological Advancements in Hysteroscopic Devices"

Technological advancements in hysteroscopic devices are enhancing precision, efficiency, and patient outcomes. Innovations such as HD imaging, miniaturized hysteroscopes, and fiber-optic technology improve visualization and diagnosis.

Robotic-assisted hysteroscopy enhances precision, while AI integration aids in real-time abnormality detection. The rise of single-use hysteroscopes reduces infection risks and eliminates sterilization requirements. Advanced fluid management systems and electrosurgical tools are making hysteroscopy safer, more efficient, and widely accessible.

- In August 2024, Minerva Surgical, Inc. launched the Symphion Fluid Deficit Readout, an accessory for the Symphion Operative Hysteroscopy System to imporve fluid management during procedures. This device automatically measures fluid deficit by monitoring saline bag weight in real time, ensuring high accuracy within +/- 50 mL.

Hysteroscopy Procedures Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Hysteroscopes, Hysteroscopic Instruments & Accessories (Rigid Hysteroscopes, Flexible Hysteroscopes), (Resectoscopes, Forceps, Scissors, Dilators, Fluid Management Systems, Electrosurgical Generators, Light Sources & Imaging Systems), Hysteroscopy Software & Services

|

|

By Application

|

Diagnostic Hysteroscopy (For examination and detection of uterine conditions), Operative Hysteroscopy (For surgical interventions)

|

|

By End-User

|

Hospitals, Ambulatory Surgical Centers (ASCs), Clinics, Diagnostic Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Hysteroscopes, Hysteroscopic Instruments & Accessories (Rigid Hysteroscopes, Flexible Hysteroscopes), (Resectoscopes, Forceps, Scissors, Dilators, Fluid Management Systems, Electrosurgical Generators, Light Sources & Imaging Systems), Hysteroscopy Software & Services): The hysteroscopic instruments & accessories segment earned USD 2.13 billion in 2023 due to the rising demand for advanced surgical tools, improved imaging systems, and increased adoption of minimally invasive procedures.

- By Application (Diagnostic Hysteroscopy (For examination and detection of uterine conditions), Operative Hysteroscopy (For surgical interventions)): The operative hysteroscopy segment held 68.10% of the market in 2023, due to rising gynecological disorders and the growing preference for minimally invasive surgeries.

- By End-User (Hospitals, Ambulatory Surgical Centers (ASCs), Clinics, Diagnostic Centers): The hospitals segment is projected to reach USD 4.24 billion by 2031, owing to advanced healthcare infrastructure, high patient volume, and increased adoption of hysteroscopic procedures.

Hysteroscopy Procedures Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America hysteroscopy procedures market share stood at around 34.03% in 2023 in the global market, with a valuation of USD 1.59 billion. The dominance of North America in the market is driven by its well-established healthcare infrastructure, high adoption of advanced medical technologies, and a growing prevalence of gynecological disorders.

The region also benefits from favorable reimbursement policies, increased awareness about minimally invasive procedures, and a strong presence of key market players. Rising demand for outpatient hysteroscopy procedures and continuous advancements in hysteroscopic devices further fuel market growth.

- In May 2024, Minerva Surgical launched a new disposable hysteroscope for exclusive distribution, debuting at the Annual Clinical & Scientific Meeting of the American College of Obstetricians and Gynecologists in San Francisco, CA. The company plans to rebrand the device as HERizon, focusing on improving efficiency and accessibility in gynecological care.

The market in Asia-Pacific is poised for significant growth at a robust CAGR of 9.02% over the forecast period, driven by increasing healthcare investments, rising awareness of minimally invasive procedures, and a growing prevalence of gynecological disorders.

The expansion of medical tourism, improving healthcare infrastructure, and the presence of a large patient pool are further boosting market demand. Government initiatives to enhance women’s healthcare, increasing adoption of advanced hysteroscopic technologies, and rising disposable incomes contribute to the region's rapid growth.

Countries like China, India, and Japan are expected to lead the market due to expanding hospital networks and improved access to specialized gynecological care.

Regulatory Frameworks

- In U.S. Food and Drug Administration (FDA) Center for Devices and Radiological Health (CDRH) regulates medical devices under the Federal Food, Drug, and Cosmetic Act (FD&C Act), ensuring their safety, effectiveness, and quality before market approval through a stringent premarket review and post-market surveillance process.

- The European Medicines Agency (EMA) enforces Medical Device Regulation (MDR 2017/745), which establishes strict requirements for the safety, performance, and clinical evaluation of medical devices before they receive CE marking for market approval in the European Economic Area (EEA).

- The Health Canada enforces Medical Devices Regulations (SOR/98-282) to govern the licensing, safety, effectiveness, and quality control of medical devices, requiring manufacturers to meet stringent regulatory standards before market authorization in Canada.

- The National Medical Products Administration oversees Medical Device Regulations in China, ensuring that medical devices meet strict safety, quality, and performance standards through classification, registration, and post-market surveillance before commercialization.

Competitive Landscape

The hysteroscopy procedures industry is highly competitive, with key players focusing on technological advancements, strategic partnerships, and product innovations to strengthen their market presence.

The industry is driven by continuous R&D investments, expansion strategies, and the growing adoption of minimally invasive procedures, AI-integrated imaging systems, and single-use hysteroscopes. Increasing mergers, acquisitions, and collaborations with healthcare institutions further enhance global reach and product portfolios.

- In October 2023, Hologic, Inc. collaborated with the American Association of Gynecologic Laparoscopists (AAGL) and Inovus Medical to enhance OB-GYN training in minimally invasive surgeries. Through this partnership, Hologic will supply Omni hysteroscopes for AAGL’s Essentials in Minimally Invasive Gynecologic Surgery (EMIGS) program, which provides hands-on hysteroscopy training for OB-GYN residents, supporting advancements in women’s healthcare through improved education.

List of Key Companies in Hysteroscopy Procedures Market:

- Richard Wolf GmbH.

- KARL STORZ

- Stryker

- Olympus Corporation

- Delmont imaging

- Lasermed Co., Ltd.

- Hologic, Inc.

- Boston Scientific Corporation

- LUMINELLE

- Medtronic

- Akino Medical

- EMOS Technology GmbH

- Cook

- The Cooper Companies, Inc.

- LiNA Medical ApS

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In October 2024, Caldera Medical acquired UVision 360, Inc., expanding its minimally invasive hysteroscopy portfolio with the LUMINELLE hysteroscopy and cystoscopy systems. This acquisition was done to enhance cost-effective, high-resolution diagnostic and therapeutic solutions, aligning with Caldera Medical’s mission to improve women’s health globally.

- In October 2024, Inovus Limited launched five new procedural modules for its HystAR hysteroscopy simulator, enhancing surgical training with realistic soft tissue pathologies. These modules cover Retained Products of Conception (RPOC), uterine septum, dilation and curettage (D&C), endometrial ablation/resection, and fundal block training, offering an immersive and advanced learning experience.

- In June 2024, Shady Grove Fertility introduced a Minimally Invasive Gynecologic Surgery (MIGS) program to support patients in maintaining their reproductive health. The program provides hysteroscopic, laparoscopic, vaginal, and mini-open procedures, designed to treat benign gynecologic conditions with shorter recovery times and improved patient outcomes.

- In April 2023, Inovus Limited was appointed as the official simulation partner by the Global Community of Hysteroscopy (GCH) to enhance hysteroscopy training worldwide. As part of this collaboration, HystAR simulators and the TOTUM digital surgery platform were integrated into GCH-certified workshops and events.