Market Definition

The market involves the use of advanced technologies and methodologies to assess and analyze the biological and cellular content of various samples in scientific research and drug development.

HCS typically involves automated imaging systems, software, and various types of assays that allows analysis of cellular behavior and molecular interactions in response to different treatments or conditions. The report highlights the primary market drivers, alongside significant trends, regulatory frameworks, and the competitive landscape, shaping the market expansion in the coming years.

High Content Screening Market Overview

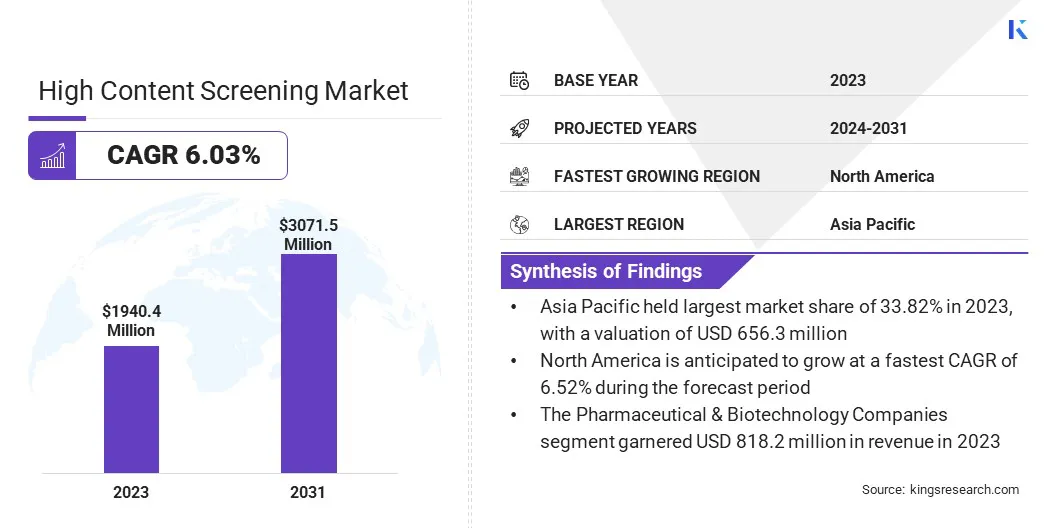

The global high content screening market size was valued at USD 1940.4 million in 2023, which is estimated to be USD 2038.2 million in 2024 and reach USD 3071.5 million by 2031, growing at a CAGR of 6.03% from 2024 to 2031.

The growing shift toward personalized medicine is driving the demand for HCS. HCS helps tailor treatments for better patient outcomes by identifying biomarkers and assessing individual therapeutic responses.

Major companies operating in the high content screening industry are DH Life Sciences, LLC., Revvity, Charles River Laboratories, Thermo Fisher Scientific Inc., Corning Incorporated, Bio-Rad Laboratories, Inc., EVIDENT, Yokogawa Electric Corporation, Nikon Instruments Inc., Creative Biolabs, Aligned Genetics, Inc., Visikol, Inc., Pharmaron, Ichor Life Sciences, Inc., and Sygnature Discovery.

The market is registering significant growth, due to the increasing demand for advanced drug discovery and personalized medicine. Driven by technological advancements in imaging, AI-driven data analysis, and automation, HCS enables researchers to efficiently analyze complex cellular models and gain deeper insights into disease mechanisms.

This has led to the adoption of HCS across various therapeutic areas, including oncology, neuroscience, and immunology. Furthermore, enhanced system modularity and improved data interpretation tools in the market expand the applications and accessibility of HCS.

- In January 2025, Molecular Devices launched the ImageXpress HCS.ai High-Content Screening System, offering modular, high-throughput imaging and AI-driven analysis for complex cell models. It provides rapid, high-quality imaging and deep insights, setting new standards for drug discovery & research.

Key Highlights:

- The high content screening industry size was valued at USD 1940.4 million in 2023.

- The market is projected to grow at a CAGR of 6.03% from 2024 to 2031.

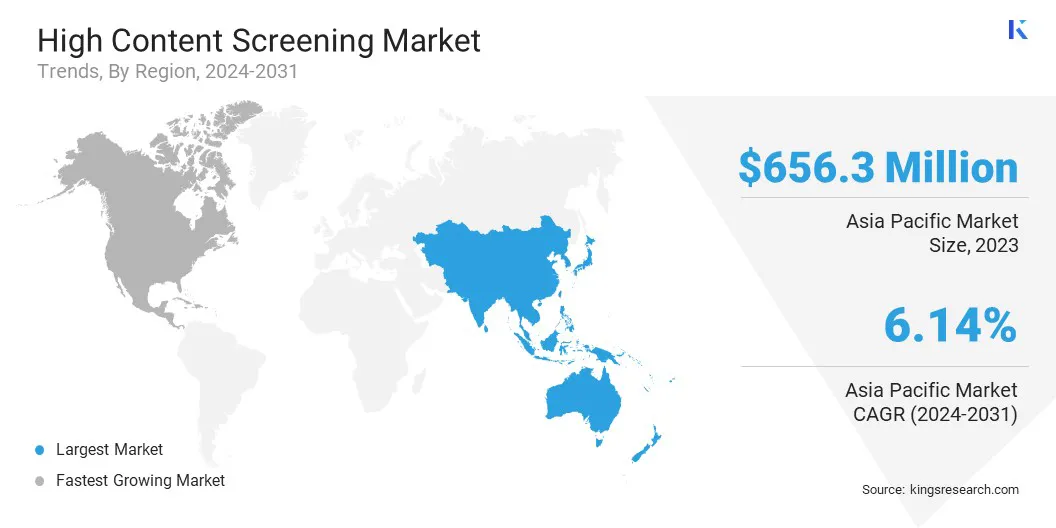

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 656.3 million.

- The instruments segment garnered USD 725.1 million in revenue in 2023.

- The primary & secondary screening segment is expected to reach USD 875.6 million by 2031.

- The academic and government institutions segment is anticipated to register the fastest CAGR of 6.15% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 6.52% during the forecast period.

Market Driver

Rising Demand for Personalized Medicine

The rise of personalized medicine is a key driver of the market. The need to identify specific biomarkers and evaluate individual responses to therapies is increasing as healthcare moves toward precision treatments.

HCS technologies enable researchers to assess cellular changes in response to drugs, improving the ability to design personalized treatment plans. This precision approach enhances treatment efficacy, reduces adverse effects, and aligns with the growing focus on patient-centered healthcare solutions.

- In January 2023, Bruker Corporation announced its acquisition of ACQUIFER Imaging GmbH, enhancing its bioimaging portfolio with ACQUIFER's HIVE data management system and the IM04 HCS instrument, advancing research in cellular phenotypic screening and big-data management.

Market Challenge

Lack of Standardization

A key challenge in the high content screening market is the lack of standardization, as variability in methodologies, reagents, and platforms can hinder the comparison of results across different studies. This inconsistency can lead to issues with reproducibility and data reliability.

Companies can focus on developing more standardized protocols, universal reagent kits, and integrated platforms that ensure consistency in data quality. Adopting these solutions can help researchers improve cross-study comparisons, driving more accurate and reliable outcomes in drug discovery and disease research.

Market Trend

Integration of Extensive Libraries

A key trend in the market is the integration of extensive compound libraries. Compound libraries are large collections of small molecules used in drug discovery to identify potential drug candidates. Incorporating these vast libraries into HCS platforms helps screening processes become more flexible and efficient.

This approach allows researchers to test a wider variety of compounds, improving the identification of promising drug targets. It also accelerates the discovery of new therapeutic candidates while enabling cost-effective and high-throughput experimentation.

- In April 2024, Metrion Biosciences enhanced its high-throughput screening (HTS) services by gaining access to Enamine’s extensive compound libraries. This addition provides greater flexibility and efficiency in screening, facilitating improved target identification and boosting drug discovery efforts globally.

High Content Screening Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Instruments (Cell Imaging & Analysis Systems, Flow Cytometers), Consumables (Reagents & Assay Kits

Microplates, Others), Software, Services

|

|

By Application

|

Primary & Secondary Screening, Drug Discovery & Development, Toxicology, Compound Profiling, Others

|

|

By End User

|

Pharmaceutical & Biotechnology Companies, Academic and Government Institutions, Contract Research Organizations

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Instruments, Consumables, Software, Services): The instruments segment earned USD 725.1 million in 2023, due to the increasing demand for advanced imaging and automated systems in HCS.

- By Application (Primary & Secondary Screening, Drug Discovery & Development, Toxicology, Compound Profiling, Others): The primary & secondary screening segment held 28.47% share of the market in 2023, due to the growing use of HCS in drug discovery and personalized medicine.

- By End User (Pharmaceutical & Biotechnology Companies, Academic and Government Institutions, Contract Research Organizations): The pharmaceutical & biotechnology companies segment is projected to reach USD 1281.6 million by 2031, owing to increased investment in innovative therapeutic research and development.

High Content Screening Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a market share of around 33.82% in 2023, with a valuation of USD 656.3 million. Asia Pacific dominates the global high content screening market, due to rapid advancements in biotechnology, pharmaceutical industries, and research capabilities in the region.

The growing investment in drug discovery, healthcare innovation, and strong support for R&D in countries like China and India contribute significantly to its leadership in the market. The region’s expanding healthcare infrastructure and increasing adoption of advanced screening technologies further bolster its dominance.

The market in North America is poised for significant growth at a robust CAGR of 6.52% over the forecast period. North America is the fastest-growing region in the high content screening industry, due to its strong biotechnology and pharmaceutical sectors. The presence of leading research institutions, a high concentration of biopharma companies, and significant investments in healthcare innovation drive the demand for advanced screening technologies.

Moreover, collaborations between academic institutions and industries, along with the increasing adoption of automation and AI-based solutions, are further accelerating market growth, positioning North America as a key hub for HCS advancements.

- In January 2024, Nikon established new research hubs in the Greater Boston area and Japan, strengthening support for drug discovery. These centers focus on advancing HCS, imaging, and bioassay development, supporting innovative research in drug development and therapeutics.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) ensures the safety, efficacy, and security of medical devices, including HCS systems, overseeing their compliance with safety standards in drug discovery and diagnostics.

- In the EU, the Clinical Trials Regulation (EU) No 536/2014 governs the conduct, approval, monitoring, and reporting of clinical trials, harmonizing assessment and supervision processes across member states.

Competitive Landscape:

In the high content screening market, companies are increasingly developing advanced technologies that enable high-speed, high-resolution imaging of live cells for drug discovery and regenerative medicine research. These innovations focus on improving the efficiency of drug screening, offering detailed intracellular analysis, and enhancing data interpretation.

By integrating sophisticated software solutions, these systems accelerate research processes, providing researchers with valuable insights for identifying potential drug candidates and understanding complex biological mechanisms more effectively.

In January 2024, Yokogawa introduced the CellVoyager CQ3000 High-Content Analysis System, enhancing drug discovery and regenerative medicine research. This system offers high-speed, high-resolution live cell imaging, enabling efficient drug screening, while providing advanced software solutions for detailed intracellular analysis and accelerated research processes.

List of Key Companies in High Content Screening Market:

- DH Life Sciences, LLC

- Revvity

- Charles River Laboratories

- Thermo Fisher Scientific Inc.

- Corning Incorporated

- Bio-Rad Laboratories Inc

- EVIDENT

- Yokogawa Electric Corporation

- Nikon Instruments Inc.

- Creative Biolabs

- Aligned Genetics Inc

- Visikol Inc

- Pharmaron

- Ichor Life Sciences Inc

- Sygnature Discovery

Recent Developments (Product Launches)

- In January 2025, PhenoVista Biosciences partnered with NETRI to enhance organ-on-chip technologies for drug development. This collaboration combines PhenoVista’s high-content imaging expertise with NETRI’s microfluidic platforms, offering more precise, scalable assays to accelerate drug discovery and improve patient outcomes