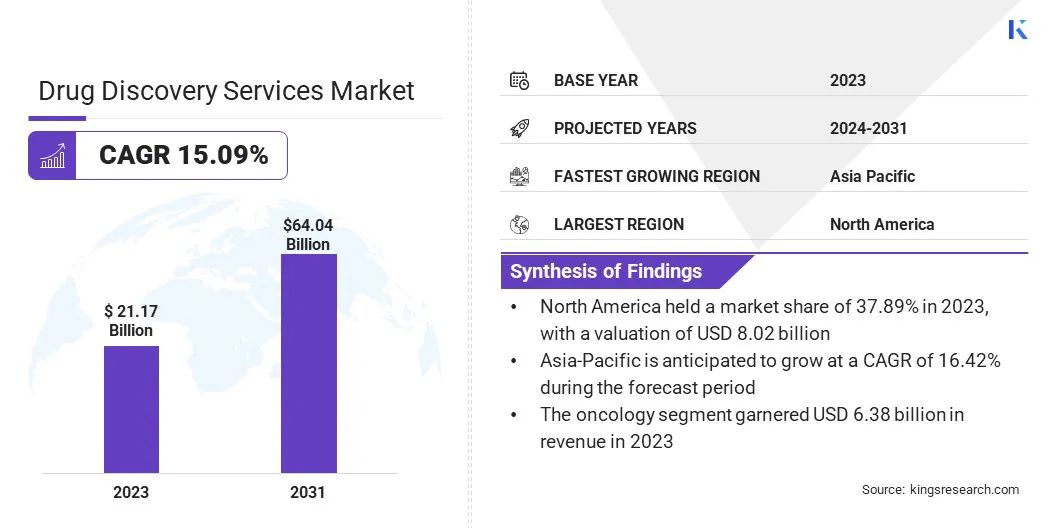

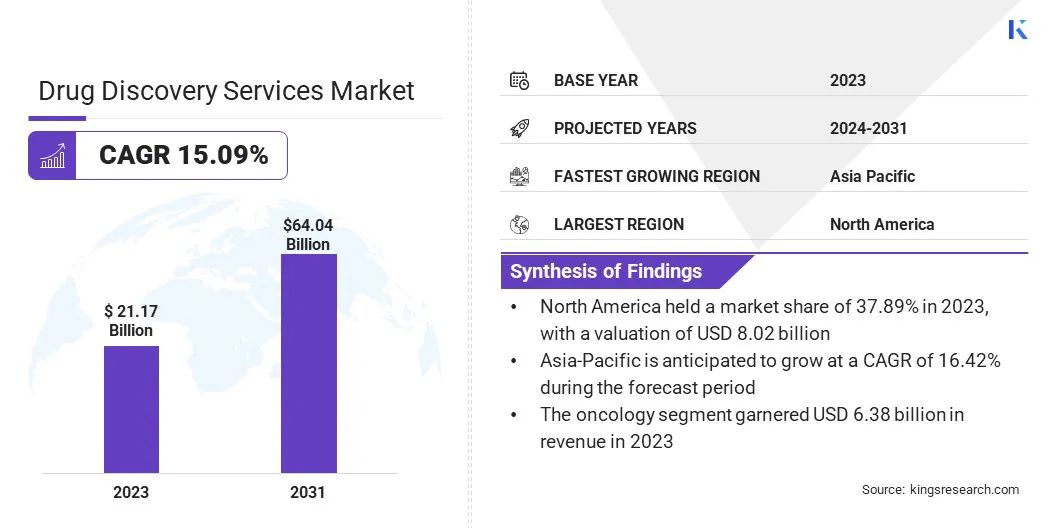

Drug Discovery Services Market Size

The global Drug Discovery Services Market size was valued at USD 21.17 billion in 2023 and is projected to grow from USD 23.94 billion in 2024 to USD 64.04 billion by 2031, exhibiting a CAGR of 15.09% during the forecast period. The growth of the market is propelled by rising pharmaceutical R&D investments and the growing demand for personalized medicine.

This growth is further supported by ongoing advancements in high-throughput screening and AI-driven drug design. Rising focus on biologics and complex molecules is fueling the demand for specialized capabilities in protein engineering and genomic research. This dynamic landscape underscores ongoing innovation and outsourcing trends within the industry.

In the scope of work, the report includes solutions offered by companies such as Labcorp Drug Development, Charles River Laboratories International, GenScript, Thermo Fisher Scientific Inc., Pharmaron, Evotec SE, Eurofins Scientific, Piramal Pharma Solutions, Syngene International Limited, Curia Global, Inc., and others.

The drug discovery services market is experiencing robust growth, mainly fueled by increasing pharmaceutical R&D investments and a rising demand for personalized medicine. Pharmaceutical and biotechnology companies, which captured the largest market share of 75.67% in 2023, are increasingly outsourcing drug discovery activities to specialized service providers in order to leverage their expertise and infrastructure.

Key trends include a growing focus on biologics and complex molecules, which necessitate advanced capabilities in protein engineering and genomic research. Technological advancements such as high-throughput screening, AI-driven drug design, and bioinformatics are enhancing the efficiency of drug discovery processes, and accelerating the identification of novel therapies.

Drug discovery services refer to specialized scientific and technological activities conducted by service providers or organizations to identify and develop new pharmaceutical compounds or drugs. These services encompass various stages of the drug discovery process, including target identification, lead optimization, preclinical development, and, in some cases, early clinical trials.

They often involve advanced techniques such as high-throughput screening, computational modeling, medicinal chemistry, and pharmacokinetics to accelerate the discovery and development of potential therapeutic agents for disease treatment. Pharmaceutical companies frequently utilize drug discovery services to leverage external expertise and infrastructure, thereby advancing their drug development pipelines.

Analyst’s Review

The expansion of the drug discovery service market is stimulated by the increasing demand for personalized medicine and targeted therapies, which reflects a notable shift toward treatments tailored to individual genetic profiles. This trend underscores the growing importance of innovative drug discovery services that efficiently identify and develop novel therapeutics.

Furthermore, R&D investments and advancements in drug discovery technologies are pivotal in propelling market growth.

- For instance, in April 2024, Charles River Laboratories International, Inc. announced the launch of its Alternative Methods Advancement Project (AMAP). This initiative aims to develop alternatives to reduce animal testing, setting a new standard for drug discovery and development. The company has committed $200 million over the past four years and plans to invest an additional $300 million over the next five years.

This investment supports technology innovations, strategic partnerships, and advocacy efforts aimed at minimizing the use of animal testing in drug discovery and development, thereby fostering market growth.

Drug Discovery Services Market Growth Factors

The continuous demand for new drugs to address unmet medical needs across various diseases such as neurodegenerative disorders, cancer, rare genetic conditions, and cardiovascular diseases is boosting the expansion of the drug discovery services market. The emergence of new diseases and the evolving understanding of existing ones are significantly surging the demand for innovative therapeutics.

This increasing need for novel drugs is prompting pharmaceutical companies and biotechnology firms to intensify their efforts in drug discovery, thereby significantly boosting the demand for drug discovery services. The market is expected to witness substantial expansion, thereby supporting the development and discovery of new treatments.

- According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for approximately 17.9 million fatalities annually.

The high costs and extended timelines involved in drug discovery pose significant barriers to market growth. Moreover, increased development expenses may lead to higher product prices, thereby impacting affordability and adoption. Delays in introducing new therapies to the market further hinder growth by differing revenue generation and restricting patient access to novel treatments.

However, key players are leveraging advanced technologies such as high-throughput screening and AI-driven drug design to accelerate the identification of drug candidate, thereby stimulating market growth. Additionally, certain companies optimize efficiency and reduce costs through outsourcing, while others prioritize enhancing regulatory compliance to facilitate smoother market entry.

These efforts collectively aim to boost productivity and innovation, thereby facilitating faster and more cost-effective development of new pharmaceuticals. These factors are expected to augment market growth in the coming years.

Drug Discovery Services Market Trends

The field of drug discovery is experiencing a notable rise in the adoption of advanced technologies such as high-throughput process development, bioinformatics, and combinatorial chemistry. These innovations are transforming the identification of drug candidates by making the process more refined, accurate, and time-efficient.

High-throughput process development is increasingly advancing manufacturing optimization, while bioinformatics is aiding in deciphering complex biological data to uncover new therapeutic insights. Combinatorial chemistry techniques enable the rapid synthesis of diverse compound libraries, thereby expediting the process of identifying potential treatments.

Additionally, the integration of artificial intelligence in disease diagnostics and treatment design is increasing significantly. This development promises substantial advancements in personalized medicine and treatment efficacy, thereby contributing to the drug discovery services market growth.

- In May 2023, GenScript Biotech Corporation launched the GenTitan™ Gene Fragments synthesis service, which utilizes a pioneering miniature semiconductor platform designed for high-throughput DNA synthesis. This breakthrough offers the highest gene sequence acceptance rate in the market at the lowest prices, facilitating the rapid production of large-scale synthetic DNA for research in synthetic biology, protein and antibody studies, and genomic research. GenTitan's service provides high-quality, double-stranded DNA fragments up to 1,800 base pairs, facilitating efficient gene construction and modification. This capability supports biological drug discovery and next-generation sequencing (NGS) efforts by accelerating research timelines and enhancing experimental capabilities.

Furthermore, the growing focus on biologics and complex molecules is boosting the expansion of the drug discovery service market. These molecules offer potent therapeutic possibilities, and require specialized expertise and advanced technologies for their effective development.

Pharmaceutical companies and biotech firms are investing heavily in drug discovery services that specialize in biologics, peptides, and oligonucleotides. This trend increases the demand for specialized services and fosters innovation, thereby accelerating the development of new drug development and stimulating market growth.

Segmentation Analysis

The global market is segmented based on therapeutic area, process, end-user, type, drug type, and geography.

By Therapeutic Area

Based on therapeutic area, the market is categorized into neurology, oncology, digestive system diseases, cardiovascular & respiratory diseases, infectious & immune system diseases, and other therapeutic area. The oncology segment led the drug discovery services market in 2023, reaching a valuation of USD 6.38 billion.

The rising prevalence of cancer globally necessitates continual innovation in therapeutic approaches. Drug discovery services tailored to oncology focus on identifying targeted therapies, personalized treatments, and immunotherapies. This specialization meets critical medical needs and attracts substantial R&D investments.

Advanced technologies such as genomic profiling, biomarker identification, and precision medicine strategies are pivotal in accelerating oncology drug development.

By Process

Based on process, the market is divided into target selection, target validation, hit-to-lead identification, lead optimization, and candidate validation. The hit-to-lead identification segment captured the largest drug discovery services market share of 43.56% in 2023. This process is designed to convert initial hits from screenings into lead compounds for further development.

Advances in computational modeling, high-throughput screening, and medicinal chemistry significantly enhance both the efficiency and accuracy of identifying promising drug candidates. Pharmaceutical companies rely heavily on specialized service providers to navigate this critical phase, thereby reducing timelines and costs associated with early-stage drug development.

The increasing demand for precise and rapid lead identification services bolsters segmental expansion, as biotech firms and pharmaceuticals intensify their efforts to strengthen their pipelines with viable therapeutic candidates. The hit-to-lead identification optimizes the crucial initial stages of drug discovery, thereby supporting the growth of the segment.

By End-User

Based on end-user, the market is categorized into pharmaceutical & biotechnology companies, academic institutes, and others. The pharmaceutical and biopharmaceutical companies segment is expected to garner the highest revenue of USD 50.85 billion by 2031.

These companies generate a demand for specialized services at various stages of drug development, encompassing target identification, preclinical testing, and early clinical trials. They increasingly outsource these activities to leverage external expertise and streamline processes, thereby reducing costs and accelerating the time-to-market for new therapies.

Additionally, continuous investment in R&D by major pharmaceutical companies, coupled with advancements in biotechnology and personalized medicine, stimulates the demand for innovative drug discovery solutions. This collaboration between service providers and pharmaceutical firms supporting the growth of the segment.

By Drug Type

Based on drug type, the market is bifurcated into small-molecule drug and biologics. The small-molecule drug segment is expected to capture the largest market share of 62.34% by 20231. Small-molecule drug is designed to screen and optimize compounds that efficiently target specific biological processes. Advanced technologies such as high-throughput screening and computational modeling enhance the efficiency and success rates of small-molecule drug discovery.

Pharmaceutical firms increasingly rely on specialized service providers to expedite these processes, thereby reducing development timelines and costs. The expanding application of small-molecule drugs across diverse therapeutic areas amplifies the demand for tailored drug discovery services, thereby fostering innovation and meeting global healthcare needs effectively.

Drug Discovery Services Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America drug discovery services market share stood around 37.89% in 2023 in the global market, with a valuation of USD 8.02 billion. This dominance is reinforced by several factors such as increased investments by drug development firms, substantial government grants, and the presence of major pharmaceutical companies.

The regional market benefits from a robust healthcare infrastructure and is facing rising incidences of chronic diseases, including cancer.

- For instance, the ACS estimates that there were 1,918,030 new cancer cases and 609,360 cancer-related deaths in the United States in 2022. This underscores the significant need for drug discovery services specifically focused on oncology.

This surging prevalence of disease propels regional market growth, thereby stimulating innovation and advancements in cancer treatment strategies.

Asia-Pacific is anticipated to witness robust growth at a staggering CAGR of 16.42% over the forecast period. Rising investments in healthcare infrastructure and pharmaceutical R&D, particularly in countries such as China, Japan, and India, are fueling domestic market growth.

- The drug discovery services market benefits from the robust influential pharmaceutical industry in India, which is valued at $50 billion. India serves as a major exporter of Pharmaceuticals to over 200 countries, highlighting its extensive global reach and distribution network. In addition to its role in generic drug production, India plays a crucial role in global vaccine production, meeting approximately 60% of the world's vaccine demand. This includes critical vaccines such as DPT, BCG, and Measles, with 70% of WHO's vaccine supply sourced from India as per the essential Immunization schedule.

India's prominence in pharmaceutical exports and vaccine manufacturing solidifies Asia Pacific's pivotal position in global healthcare and drug discovery efforts.

Competitive Landscape

The global drug discovery services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Drug Discovery Services Market

- Labcorp Drug Development

- Charles River Laboratories International

- GenScript

- Thermo Fisher Scientific Inc.

- Pharmaron

- Evotec SE

- Eurofins Scientific

- Piramal Pharma Solutions

- Syngene International Limited

- Curia Global, Inc.

Key Industry Development

- March 2023 (Collaboration): CHARM Therapeutics, a 3D deep learning biotechnology company focused on discovering and developing transformational medicines, announced a strategic discovery collaboration with Bristol Myers Squibb. The collaboration aimed to identify and optimize compounds against selected targets of Bristol Myers Squibb. CHARM leveraged DragonFold, its proprietary deep learning platform designed to identify novel molecules through protein-ligand co-folding, to discover innovative compounds during the collaboration.

The global drug discovery services market is segmented as:

By Therapeutic Area

- Neurology

- Oncology

- Digestive System Diseases

- Cardiovascular & Respiratory Diseases

- Infectious & Immune System Diseases

- Other Therapeutic Area

By Process

- Target Selection

- Target Validation

- Hit-to-lead Identification

- Lead Optimization

- Candidate Validation

By End User

- Pharmaceutical & Biotechnology Companies

- Academic Institutes

- Others

By Type

- Chemistry Services

- Biology Services

By Drug Type

- Small-Molecule Drug

- Biologics

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America