Market Definition

The market involves the design and manufacturing of systems that combine different types of semiconductor components such as logic, memory, sensors, and radio frequency into a single package or module.

This approach enables the creation of smaller, faster, and more efficient devices by optimizing performance, reducing power consumption, and enhancing functionality through the seamless integration of diverse technologies within compact form factors. It is widely used in AI chips, 5G, automotive electronics, IoT devices, and high-performance computing systems.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Heterogeneous Integration Market Overview

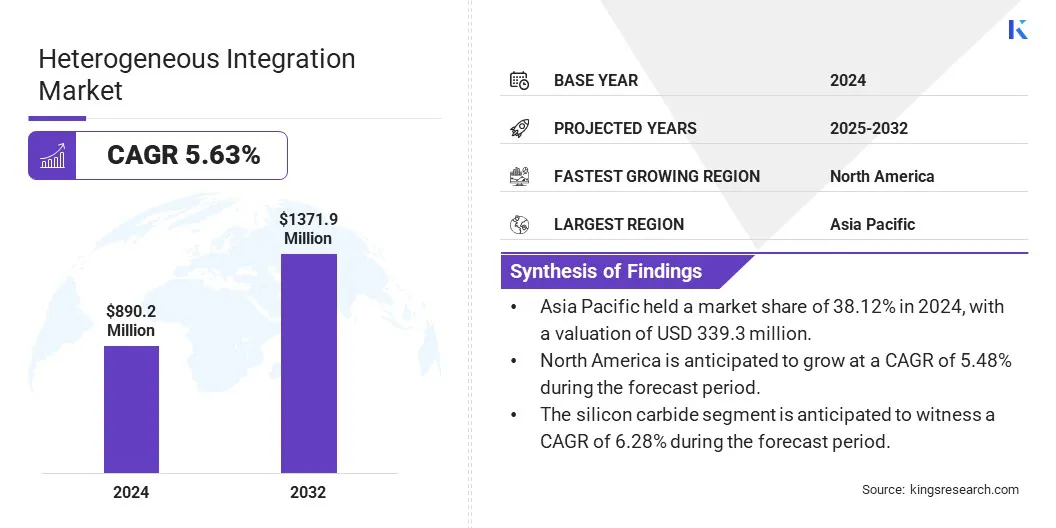

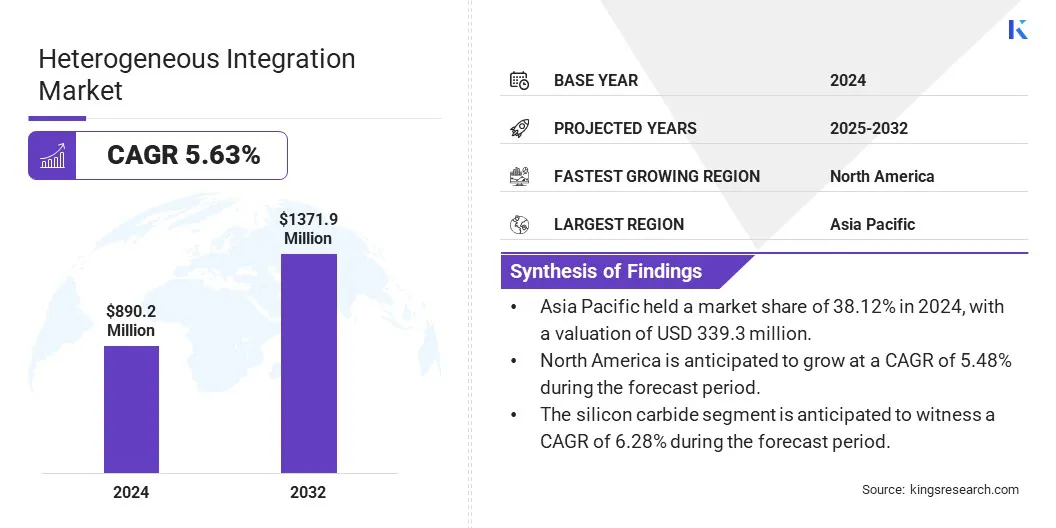

The global heterogeneous integration market size was valued at USD 890.2 million in 2024 and is projected to grow from USD 935.3 million in 2025 to USD 1371.9 million by 2032, exhibiting a CAGR of 5.63% during the forecast period.

The market is driven by chiplet-based architectures that improve performance and scalability. Additionally, advancements in high-throughput lithography enable precise multi-die patterning and complex packaging. These technologies collectively enhance manufacturing efficiency and support the growing demand for advanced semiconductors in AI, high-performance computing (HPC), and automotive applications.

Major companies operating in the heterogeneous integration industry are Taiwan Semiconductor Manufacturing Company Limited, Samsung, Intel Corporation, ASE, Applied Materials, Inc, EV Group (EVG), Amkor Technology, JCET Group, SAL, Skywater Technology, NXP Semiconductors, Analog Devices, Inc., KYOCERA Corporation, Micross, and Etron Technology, Inc.

The market is driven by the growing demand for high-performance computing in AI and data centers, where complex algorithms and massive data processing require faster and more efficient hardware solutions.

By integrating multiple specialized chiplets such as CPUs, GPUs, and memory into a single package, heterogeneous integration enables enhanced processing power, reduced latency, and improved energy efficiency. This approach supports the scalability and flexibility needed for advanced AI workloads..

- In June 2024, Merck acquired Unity-SC to enhance its semiconductor portfolio with advanced metrology tools vital for heterogeneous integration and advanced packaging. Unity-SC’s precision inspection technologies improve chip quality and yield, supporting chiplet-based 3D architectures essential for AI, High-Performance Computing (HPC), and High Bandwidth Memory (HBM) applications, thereby strengthening Merck’s role in enabling next-generation high-performance chips for data centers and AI technologies.

Key Highlights:

- The heterogeneous integration market size was recorded at USD 890.2 million in 2024.

- The market is projected to grow at a CAGR of 5.63% from 2025 to 2032.

- Asia Pacific held a market share of 38.12% in 2024, with a valuation of USD 339.3 million.

- The 2.5D integration segment garnered USD 338.3 million in revenue in 2024.

- The logic devices segment is expected to reach USD 632.4 million by 2032.

- The silicon carbide segment is anticipated to witness a CAGR of 6.28% during the forecast period.

- The consumer electronics segment is expected to have a market share of 46.65% in 2032.

- North America is anticipated to grow at a CAGR of 5.48% during the forecast period.

Market Driver

Rising Adoption of Chiplet-Based Architectures

The market is driven by the rising adoption of chiplet-based architectures, enabling enhanced performance, flexibility, and scalability in semiconductor design.

By separating functional blocks into smaller chiplets and integrating them within a single package, manufacturers are able to optimize power, performance, and cost. This architecture supports modular upgrades and efficient integration of diverse technologies such as AI accelerators and memory.

It significantly accelerates development timelines and system-level innovation, particularly in high-performance computing and automotive applications, where adaptability and rapid deployment are critical.

- In March 2024, Cadence Design Systems and Arm partnered to launch a chiplet-based reference design and software development platform for accelerating software-defined vehicle (SDV) innovation, initially targeting ADAS applications. Leveraging Arm’s Automotive Enhanced technologies and Cadence IP, the scalable solution supports heterogeneous integration and interface interoperability. A SOAFEE-compliant digital twin enables early software development and streamlined hardware-software integration, reducing time-to-market.

Market Challenge

Thermal Management and Power Delivery Issues in Densely Packed Systems

The heterogeneous integration market faces a significant challenge in thermal management and power delivery due to the dense packaging of multiple chips within a single module.

As components like CPUs, GPUs, and memory are integrated closely, they generate substantial heat, making it difficult to maintain optimal performance and reliability. Inadequate heat dissipation leads to thermal throttling or system failure. Additionally, delivering stable power across various chiplets with different requirements adds complexity.

To address this, companies are developing advanced cooling solutions such as microfluidic cooling, integrated heat spreaders, and thermal vias. They are also optimizing power delivery networks and using AI-driven thermal simulation tools to predict heat distribution, identify hotspots, and guide efficient thermal design during early development stages.

Market Trend

Advancement in Heterogeneous Integration

The market is experiencing advancement through the evolution of high-resolution, high-throughput lithography systems tailored for complex packaging needs. These innovations enable precise multi-die patterning and integration of diverse chiplets, essential for applications like AI, HPC, and automotive electronics.

Enhanced tools support fan-out wafer-level and panel-level packaging, ensuring scalability and performance. As demand for miniaturized, high-performance systems grows, these advancements accelerate production efficiency, improve alignment accuracy, and support the next generation of semiconductor technologies across high-volume manufacturing environments.

- In May 2025, EV Group launched the LITHOSCALE XT, the industry’s first high-throughput, high-resolution digital lithography system designed for high-volume heterogeneous integration manufacturing. Featuring a dual-stage design and dual-wavelength laser source, it delivers up to five times the throughput of previous models. LITHOSCALE XT is ideal for multi-die patterning, fan-out wafer-level packaging, MEMS, and advanced sensors in AI, HPC, automotive, and security sectors.

Heterogeneous Integration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Integration Technology

|

2.5D Integration, 3D Integration, Fan-Out Packaging, Embedded Die

|

|

By Component

|

Logic Devices, Memory Devices, RF & Analog ICs, Photonic Devices

|

|

By Material

|

Silicon, Gallium Nitride (GaN), Silicon Carbide (SiC), Glass Interposers

|

|

By End-use Industry

|

Consumer Electronics, Telecommunications, Automotive, Industrial IoT

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Integration Technology (2.5D Integration, 3D Integration, Fan-Out Packaging, Embedded Die): The 2.5D integration segment earned USD 338.3 million in 2024 due to its ability to deliver high interconnect density, enhanced bandwidth, and improved thermal performance, making it ideal for advanced computing and AI applications.

- By Component (Logic Devices, Memory Devices, RF & Analog ICs, and Photonic Devices): The logic devices segment held 45.13% of the market in 2024, due to the increasing demand for high-performance processors and AI accelerators in data centers, edge computing, and advanced consumer electronics.

- By Material (Silicon, Gallium Nitride (GaN), Silicon Carbide (SiC), and Glass Interposers): The silicon segment is projected to reach USD 772.4 million by 2032, due to its widespread availability, cost-effectiveness, and well-established fabrication ecosystem, making it the preferred material for large-scale heterogeneous integration.

- By End-use Industry (Consumer Electronics, Telecommunications, Automotive, Industrial IoT): The consumer electronics segment held 46.65% market in 2032, due to the surging demand for compact, high-performance devices such as smartphones, AR/VR headsets, and wearables that leverage heterogeneous integration for enhanced functionality and energy efficiency.

Heterogeneous Integration Market Regional Analysis

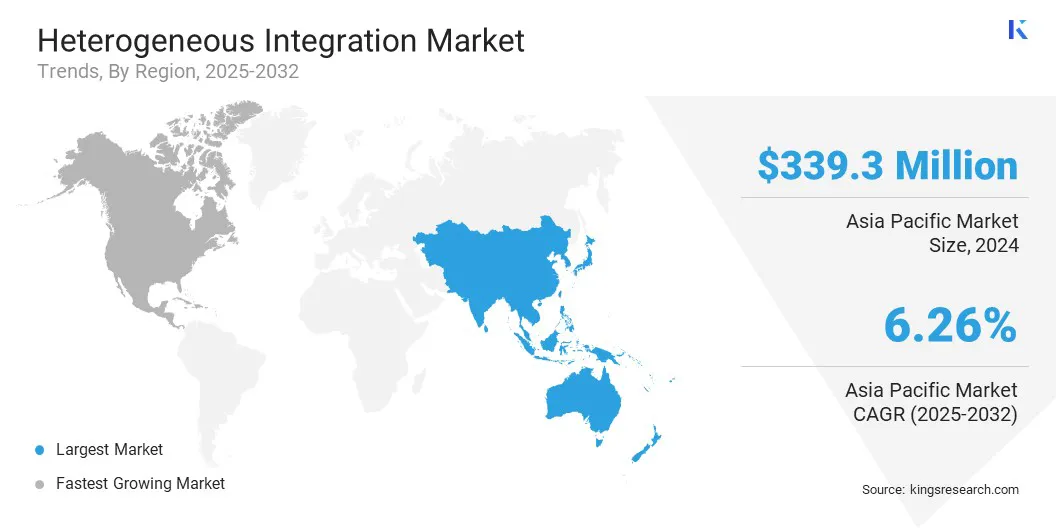

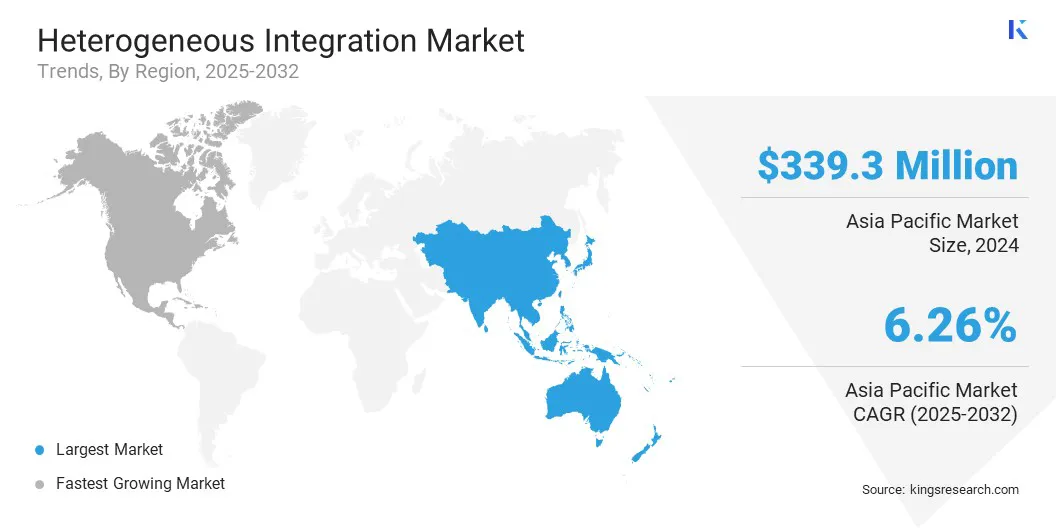

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific heterogeneous integration market share stood at around 38.12% in 2024 in the global market, with a valuation of USD 339.3 million. Asia Pacific dominates the market driven by significant investments in semiconductor manufacturing infrastructure, including fabs and advanced packaging facilities.

The region’s strong government support boosts an integrated ecosystem encompassing compound semiconductors, silicon photonics, sensors, and assembly, testing, marking, and packaging services. This comprehensive ecosystem accelerates innovation, reduces production lead times, and enhances manufacturing capabilities.

Additionally, large-scale projects with substantial capital deployment contribute to Asia Pacific’s leadership in delivering advanced heterogeneous integration solutions that meet rising demand across diverse high-performance computing and AI applications.

North America is poised for significant growth at a robust CAGR of 5.48% over the forecast period. The growth of the North America heterogeneous integration industry is driven by the concentration of leading semiconductor manufacturers and advanced research institutions specializing in innovative packaging technologies.

Significant investments in AI, high-performance computing, and 5G infrastructure are increasing demand for heterogeneous integration to improve chip performance, reduce power consumption, and enable complex multi-chip configurations.

This well-established ecosystem facilitates rapid development and commercialization of advanced integration solutions, strengthening North America’s position as a key innovator and leader in the global semiconductor industry.

Regulatory Frameworks

- In the U.S., Semiconductor Equipment and Materials International (SEMI) and the Institute of Electrical and Electronics Engineers (IEEE) play key roles in regulating heterogeneous integration. SEMI sets packaging and integration standards, while IEEE develops technical standards supporting chiplet interoperability, advanced packaging, and system-level design across semiconductor ecosystems.

- In India, the Ministry of Electronics and Information Technology (MeitY) regulates heterogeneous integration by formulating policies and promoting electronics manufacturing and semiconductor development.

Competitive Landscape

Key players in the heterogeneous integration market are actively leveraging strategies such as mergers and acquisitions, strategic partnerships, and new product launches to drive market growth. Companies are expanding their technology portfolios and manufacturing capabilities through acquisitions and forming collaborations to enhance innovation and market reach.

Additionally, they are introducing advanced solutions and next-generation packaging technologies to strengthen their competitive position and address the evolving industry demands.

- In July 2023, Applied Materials introduced advanced materials and systems enabling chipmakers to integrate chiplets using hybrid bonding and through-silicon vias for 2.5D and 3D packaging. These heterogeneous integration solutions address 2D scaling limits, enhancing chip performance, power efficiency, size, and time-to-market. Applied Materials remains a leading provider of comprehensive chipmaking technologies supporting next-generation semiconductor innovation.

List of Key Companies in Heterogeneous Integration Market:

- Taiwan Semiconductor Manufacturing Company Limited

- Samsung

- Intel Corporation

- ASE

- Applied Materials, Inc

- EV Group (EVG)

- Amkor Technology

- JCET Group

- SAL

- Skywater Technology

- NXP Semiconductors

- Analog Devices, Inc.

- KYOCERA Corporation

- Micross

- Etron Technology, Inc.

Recent Developments (Partnerships/Product Launch)

- In February 2024, Cadence and Intel Foundry partnered to develop an integrated advanced packaging flow using Embedded Multi-Die Interconnect Bridge (EMIB) technology, streamlining heterogeneous multi-chip(let) design for HPC, AI, and mobile applications. This collaboration enables a seamless transition from system-level planning to physical signoff, reducing design cycles. The flow integrates Cadence’s comprehensive tools for placement, routing, analysis, verification, and thermal signoff, enhancing efficiency in complex multi-die packaging.

- In January 2023, NXP Semiconductors announced the i.MX 95 family, featuring multi-core high-performance computing, Arm Mali-powered 3D graphics, and an integrated eIQ Neutron NPU. This heterogeneous integration enables advanced machine learning, real-time safety, and high-speed connectivity for automotive, industrial, and IoT edge applications, supporting compliance with automotive ASIL B and industrial SIL-2 safety standards.