Extremities Market Size

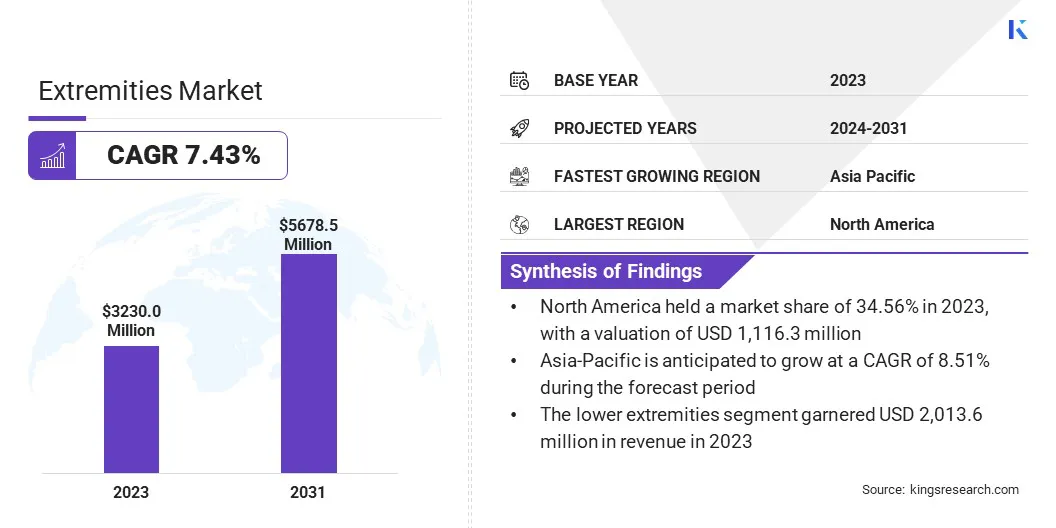

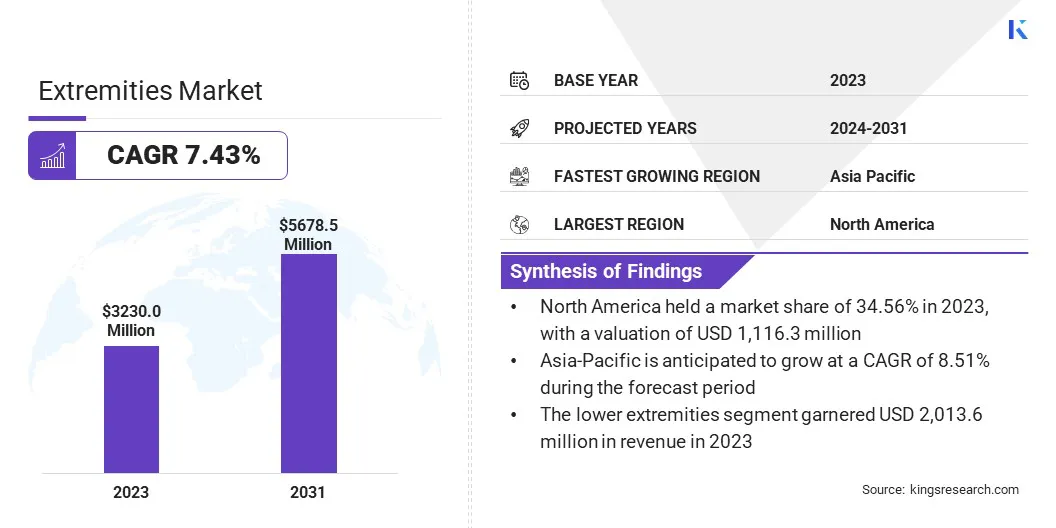

The global Extremities Market size was valued at USD 3,230.0 million in 2023 and is projected to grow from USD 3,438.5 million in 2024 to USD 5,678.5 million by 2031, exhibiting a CAGR of 7.43% during the forecast period. The market is experiencing rapid expansion due to the rising prevalence of orthopedic conditions among aging populations.

Technological advancements, including the development of 3D printing for customized implants and the implementation of minimally invasive surgeries are contributing significantly to market growth. These innovations improve patient outcomes by reducing recovery times and minimizing complications. Despite facing regulatory challenges, the market's focus on innovation and addressing healthcare demands positions it for sustained expansion in orthopedic care.

In the scope of work, the report includes solutions offered by companies such as Exactech, Inc., CONMED Corporation, Integra LifeSciences Corporation., Stryker, Arthrex, Inc, Skeletal Dynamics, Inc., Smith+Nephew., Zimmer Biomet, Wright Medical Group N.V., DePuy Synthes, and others.

The extremities market is witnessing robust growth, fueled by several factors such as the increasing prevalence of orthopedic conditions, including osteoarthritis and fractures, particularly among aging populations. Technological advancements, including 3D printing and advanced imaging for customized implants, are reshaping treatment approaches. There is a rising trend toward minimally invasive surgeries, which offer benefits such as reduced recovery times and lower complication rates.

Moreover, healthcare providers are increasingly adopting innovative extremity devices that enhance patient outcomes. Despite encountering obstacles such as regulatory complexities, the market's growth trajectory is marked by innovation that addresses evolving healthcare needs and creates expanding opportunities in orthopedic care.

- According to the World Health Organization (WHO), osteoarthritis predominantly affects older adults, with about 73% of those affected being over 55 years old, and 60% of cases occurring in females. With a global prevalence of 365 million individuals affected, the knee is the most commonly impacted joint, followed by the hip and hand.

Extremities, in medical terms, refer to the limbs of the body, encompassing the arms, legs, hands, and feet, along with their respective joints, bones, and muscles. These anatomical structures are essential for mobility, dexterity, and overall physical function. Medical specialties such as orthopedics focus extensively on diagnosing and treating conditions that affect the extremities, including fractures, arthritis, and ligament injuries.

Innovations in medical technology, such as customized implants and minimally invasive surgical techniques, continue to advance the treatment of extremity-related conditions, significantly improving patient outcomes and quality of life across diverse age groups and healthcare settings.

Analyst’s Review

The extremities market is experiencing robust growth, mainly due to technological innovations and strategic collaborations. FDA approvals are pivotal in shaping market dynamics, as they provide regulatory validation and enhance product credibility.

- For instance, Integrum's OPRA Implant System, which received approval of US Patent and Trade Organization in October 2022, showcases the significant impact of regulatory milestones on market expansion.

This novel bone-anchored prostheses system, applicable to both upper and lower limbs, highlights advancements in prosthetic technology aimed at improving patient mobility and the quality of life. Moreover, collaborations between medical device companies and healthcare providers are fueling market growth by fostering innovation and expanding their market reach.

Extremities Market Growth Factors

The rising prevalence of orthopedic conditions such as osteoarthritis and fractures, especially among aging populations, significantly fuels the demand for extremity devices such as joint replacements and fracture fixation implants. Osteoarthritis is a degenerative joint disease that affects millions worldwide.

It occurs as the joints progressively deteroite over time, leading to pain and reduced mobility. Fractures, which are common in older adults due to age-related bone density loss, often require surgical intervention with implants to restore bone stability and function. As life expectancy increases and lifestyles evolve, the incidence of these conditions is increasing, which is fostering innovation in extremity device technologies.

Advanced materials and designs in joint replacements and implants aim to improve longevity, functionality, and patient outcomes, meeting the growing healthcare needs of aging populations globally.

The high cost associated with advanced orthopedic devices and treatments is a significant factor hampering the growth of the extremities sector. These increased costs create barriers for both healthcare providers and patients, limiting the adoption of innovative technologies and treatments.

In regions with constrained healthcare budgets or inadequate reimbursement policies, the financial burden may deter investment in new extremity care solutions and delay patient access to necessary treatments. However, key players are investing heavily in research and development aimed at innovating cost-effective solutions without compromising quality or efficacy.

This includes leveraging advanced materials and manufacturing processes to streamline production costs while maintaining product performance. In addition, strategic partnerships and collaborations with healthcare providers, insurers, and government agencies help negotiate favorable pricing agreements and reimbursement policies, which are slated to aid market growth.

Extremities Market Trends

The growing trend toward minimally invasive surgeries (MIS) for extremity conditions is fueling the growth of the extremities market. These procedures offer compelling advantages such as reduced recovery times, lower risk of complications, and improved patient outcomes, which are highly valued by both patients and healthcare providers.

As the demand for less invasive treatment options that prioritize quicker recovery and enhanced safety increases, medical device companies are investing heavily in developing advanced instruments, implants, and surgical techniques tailored for MIS. This innovation aids market expansion by meeting the evolving preferences of both healthcare professionals and patients, thereby shaping the landscape of extremity surgeries.

The rising trend toward customization of extremity implants is revolutionizing orthopedic care, leveraging technologies such as 3D printing and advanced imaging for precise surgical planning and implant design. By tailoring implants to fit individual patient anatomy and specific surgical requirements, these innovations enhance surgical outcomes, reduce complications, and promote faster recovery times.

This personalized approach improves patient satisfaction and reflects a notable shift toward more effective and efficient orthopedic treatments. As demand for personalized healthcare solutions grows, the integration of customized extremity implants is poised to stimulate growth and foster innovation in the orthopedic device industry.

Segmentation Analysis

The global market is segmented based on type, end-use, and geography.

By Type

Based on type, the extremities market is categorized lower extremities and upper extremities. The lower extremities segment garnered the highest revenue of USD 2,013.6 million in 2023. It encompasses a range of treatments and devices tailored for conditions affecting the lower limbs, such as knee and hip replacements, ankle injuries, and fractures.

As the global population ages, there has been a notable increase in orthopedic conditions such as osteoarthritis and fractures, which has increased the demand for effective lower extremity solutions. Technological advancements, including innovations in prosthetics and minimally invasive surgical techniques, further enhance treatment outcomes and accelerate patient recovery.

Regulatory approvals, such as those from the FDA, play a crucial role in validating the safety and efficacy of these innovations, thereby enhancing market confidence and facilitating broader adoption.

By End-Use

Based on end-use, the market is divided into hospitals, clinics, ambulatory care, and others. The hospitals segment captured the largest extremities market share of 45.67% in 2023. These facilities offer sophisticated surgical capabilities and medical expertise necessary for treating injuries and disorders related to the lower and upper extremities. This dominance is further reinforced by its ability to meet the increasing patient demand for surgical interventions, including joint replacements and trauma care.

- In April 2024, Mumbai's Kokilaben Dhirubhai Ambani Hospital (KDAH) launched the Arthrex Modular Glenoid System, which included VIP (Virtual Implant Positioning) to improve shoulder replacement surgeries in India. This advanced technology is anticipated to significantly enhance outcomes for many individuals with shoulder joint issues.

Hospitals increasingly utilize technological advancements such as minimally invasive procedures and customized treatment plans to improve patient outcomes and foster the adoption of advanced extremity-specific therapies.

Extremities Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America extremities market share stood around 34.56% in 2023 in the global market, with a valuation of USD 1,116.3 million. This notable growth is propelled by advanced healthcare infrastructure, substantial healthcare spending, and a high prevalence of orthopedic conditions. The region is at the forefront of adopting innovative technologies and treatments for extremity-related disorders, including joint replacements and trauma surgeries.

Favorable reimbursement policies and regulatory frameworks further support regional market growth. The aging population is leading to increasing incidences of conditions such as osteoarthritis and fractures, thereby bolstering the demand for extremity devices and treatments. Moreover, strategic collaborations between healthcare providers and medical device manufacturers propel innovation and support market expansion, establishing North America as a key market for extremities.

Asia-Pacific is anticipated to witness significant growth at a robust CAGR of 8.51% over the forecast period. The increasing aging population, particularly in countries such as Japan, China, and India, leads to a higher prevalence of orthopedic conditions affecting the extremities. This demographic trend boosts the demand for extremity devices such as joint replacements and fracture fixation implants.

Moreover, improving healthcare access and infrastructure across APAC nations are enhancing the availability of advanced orthopedic treatments and surgical interventions. The region's rising burden of sports injuries and fractures among younger populations further supports the expansion of the Asia-Pacific extremity market.

Competitive Landscape

The global extremities market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Extremities Market

- Exactech, Inc.

- CONMED Corporation

- Integra LifeSciences Corporation.

- Stryker

- Arthrex, Inc

- Skeletal Dynamics, Inc.

- Smith+Nephew.

- Zimmer Biomet

- Wright Medical Group N.V.

- DePuy Synthes

Key Industry Development

- October 2023 (Approval): Johnson & Johnson MedTech announced that DePuy Synthes has received 510(k) clearance from the FDA for its TriLEAP™ Lower Extremity Anatomic Plating System. This system is designed to cater to the complex needs of orthopedic surgeons, podiatric doctors, and foot and ankle specialists. It features a modular design with contoured and conventional plates, accommodating various screw diameters, and includes instruments for bone reduction, internal fixation, and fusion procedures.

The global extremities market is segmented as:

By Type

- Lower Extremities

- Upper Extremities

By End-Use

- Hospitals

- Clinics

- Ambulatory care

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America