Orthopedic Devices Market Size

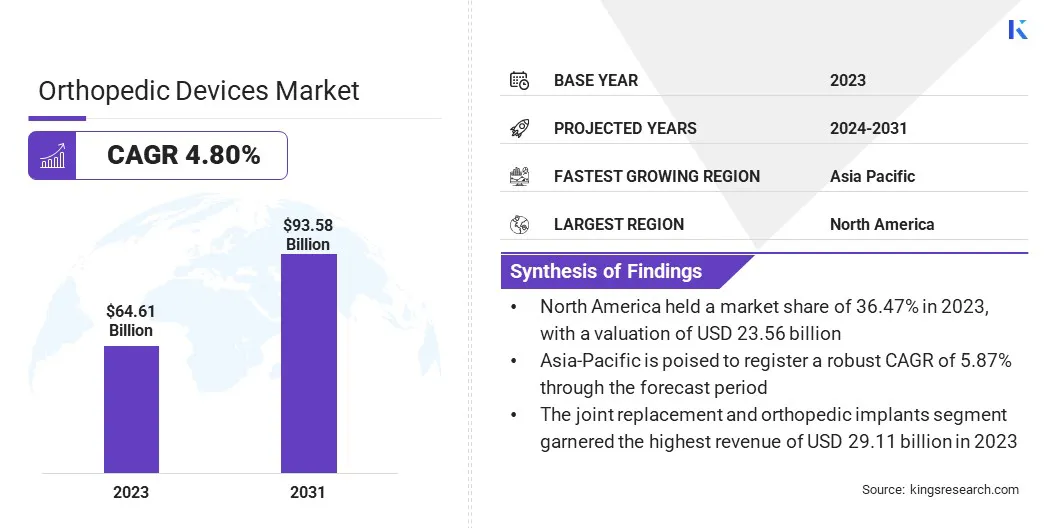

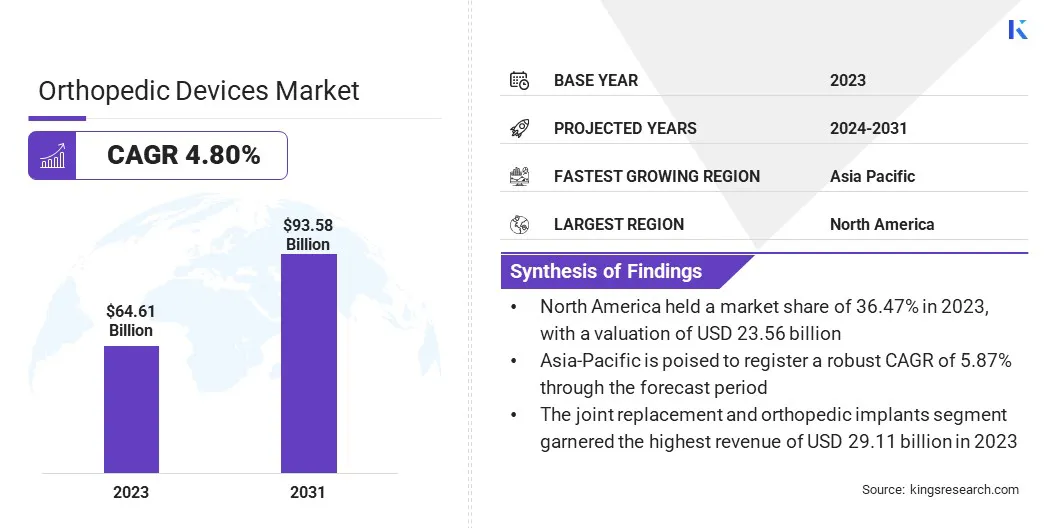

The global Orthopedic Devices Market size was valued at USD 64.61 billion in 2023 and is projected to grow from USD 67.40 billion in 2024 to USD 93.58 billion by 2031, exhibiting a CAGR of 4.80% during the forecast period. The market is expanding due to the rising demand for advanced surgical solutions, supported by the aging population and increasing rates of musculoskeletal disorders.

Technological innovations, such as 3D printing and robotic-assisted surgeries, are enhancing precision and patient outcomes, thereby fueling market growth. Additionally, the growing shift toward minimally invasive procedures is boosting the adoption of orthopedic devices globally.

In the scope of work, the report includes products offered by companies such as B. Braun SE, Enovis Corporation, Arthrex, Inc., ATEC Spine, Inc, NuVasive, Inc., Boston Scientific Corporation, CTL Amedica, Globus Medical, Medtronic, Stryker, and others.

The orthopedic devices market is experiencing robust growth, mainly driven by the increasing prevalence of spinal injuries and conditions.

- An article titled Vertebral Compression Fractures, published by National Institutes of Health in August 2023 highlighted that in younger patients, approximately 50% of spine fractures were caused by motor vehicle collisions, while 25% resulted from falls. Additionally, the global annual incidence of vertebral compression fractures was reported to be 10.7 per 1,000 women and 5.7 per 1,000 men.

This high incidence of spinal injuries is significantly boosting the demand for spinal orthopedic devices, thereby supporting expansion and fostering innovation in the market.

Orthopedic devices are specialized medical tools designed to prevent, diagnose, treat, and manage musculoskeletal disorders and injuries affecting bones, joints, ligaments, tendons, and muscles. These devices include implants, prosthetics, braces, and surgical instruments used in procedures such as joint replacements, fracture repair, and spinal surgeries.

Orthopedic devices engineered to restore mobility, reduce pain, and improve the quality of life for patients suffering from conditions such as arthritis, fractures, and congenital deformities. With advancements in technology, these devices have evolved to become more sophisticated, offering enhanced precision, durability, and biocompatibility. This has made them integral to modern orthopedic care and rehabilitation.

Analyst’s Review

FDA clearance and strategic mergers and acquisitions among key players are anticipated to spur the growth of the orthopedic devices market. These regulatory approvals and consolidations enhance product offerings and expand market reach, thereby fueling growth and promoting innovation in the sector.

- For instance, in March, 2023, NuVasive, Inc., a leader in spine technology innovation, received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Precise all-internal limb lengthening solution, extending its use to pediatric patients. This expanded clearance broadens the clinical benefits of the Precise system, thereby advancing treatment options for a wider patient population.

Furthermore, the integration of advanced technologies through strategic acquisitions significantly boosts product innovation and strengthens competitiveness in the orthopedic devices sector.

- In April 2023, Alphatec Holdings, Inc., a provider of innovative spine surgery solutions, acquired all assets related to the REMI Robotic Navigation System from Fusion Robotics, LLC, for USD 55 million. This acquisition broadens Alphatec's technological offerings and expands its capabilities in robotic-assisted spine surgery.

By integrating innovative solutions and acquiring cutting-edge technologies, these companies are aiding growth and improving patient outcomes.

Orthopedic Devices Market Growth Factors

The increasing global geriatric population is boosting the demand for orthopedic devices. As the population ages, the prevalence of age-related conditions such as osteoporosis and arthritis is rising. This trend is leading to a higher incidence of bone fractures, joint deterioration, and mobility issues.

- For instance, according to a 2024 report by the Centers for Disease Control and Prevention (CDC), over 54 million people aged 18 and above in the U.S. are living with arthritis. This number is projected to rise significantly, with an estimated 78 million individuals expected to be affected by 2040.

Older adults are particularly susceptible to these musculoskeletal disorders, which often require surgical intervention and the use of specialized orthopedic devices for treatment. This demographic shift is highlighting the rising need for joint replacements, spinal implants, and fracture fixation devices, which is contributing to the substantial growth of the orthopedic devices market.

The market faces challenges, including the high costs associated with advanced technologies, regulatory hurdles, and the variability in healthcare infrastructure across different regions. These factors may limit access to innovative treatments and increase operational complexities for manufacturers.

Key industry players are addressing these challenges by investing heavily in cost-effective technologies and streamlining production processes to reduce prices. Furthermore, they are engaging in strategic collaborations and partnerships to navigate regulatory requirements more efficiently.

- For instance, in September, 2023, Enovis Corporation announced a definitive agreement to acquire LimaCorporate S.p.A., a prominent global leader in orthopedic, for approximately USD 851 million. This acquisition includes USD 745 million in cash and USD 106 million in Enovis common stock. By acquiring Lima, Enovis aims to enhance its product portfolio and expand its market reach, addressing the challenges of high technology costs and expanding access to innovative solutions.

Additionally, companies are expanding their presence in emerging markets by enhancing healthcare infrastructure and offering tailored solutions to meet diverse regional needs.

Orthopedic Devices Market Trends

Technological advancements in orthopedic surgery, particularly the development of minimally invasive procedures and robotic-assisted surgeries, are revolutionizing patient care. These innovations are enhancing clinical outcomes by minimizing tissue damage, reducing recovery times, and lowering the risk of complications.

Robotic-assisted systems offer unparalleled precision in implant placements, resulting in enhanced alignment and improved long-term functionality of orthopedic devices.

- In October 2023, Johnson & Johnson MedTech officially launched the VELYS Robotic-Assisted Solution from DePuy Synthes to the European market. The VELYS system has been successfully used for Total Knee surgeries in Germany, Belgium, and Switzerland. This launch marks an expansion of DePuy Synthes’ Digital Surgery Platform, significantly enhancing its capabilities to meet needs that were not fully addressed by previous orthopedic robotics technologies.

These advancements are leading to higher adoption rates of orthopedic devices; as healthcare providers are increasingly preferring these advanced techniques to deliver superior patient care. This trend is likely to fuel market expansion in the foreseeable future.

The market is witnessing a significant shift toward the adoption of biodegradable implants, which are enhancing patient outcomes and reducing healthcare costs. These implants are specifically designed to gradually resorb within the body, thereby eliminating the need for secondary removal surgeries. This design minimizes patient risk and lowers long-term treatment expenses.

This innovation is gaining considerable traction, particularly in pediatric and trauma surgeries, where traditional implants often require subsequent procedures. As healthcare providers increasingly prioritize less invasive and cost-efficient solutions, the demand for biodegradable implants is poised to stimulate market growth.

Segmentation Analysis

The global market is segmented based on product, end user, and geography.

By Product

Based on product, the orthopedic devices market is categorized into joint replacement and orthopedic implants, trauma devices, sports medicine solutions, and orthobiologics. The joint replacement and orthopedic implants segment garnered the highest revenue of USD 29.11 billion in 2023.

The joint replacement and orthopedic implants segment is further divided into lower limb implants, spinal implants, dental and craniomaxillofacial implants, and upper limb implant. The growth of the segment growth is largely attributed to the rising incidences of arthritis, aging populations, and continual advancements in technology.

- For instance, in January 2023, SynerFuse, Inc. announced favorable results from a study evaluating the safety and tolerability of simultaneously implanting spinal fusion and neuromodulation devices for chronic lower back pain. These results are expected to promote the adoption of spinal implants.

- Additionally, Spine Wave and eCential Robotics established a partnership in October 2023 to develop and commercialize optimized robotic spine surgery solutions.

These developments, coupled with the increasing demand for advanced and personalized implants, are poised to foster segmental growth.

By End User

Based on end user, the market is categorized into hospitals and ambulatory and outpatient centers. The hospitals segment captured the largest orthopedic devices market share of 63.87% in 2023.

Hospitals are adopting state-of-the-art orthopedic devices to enhance surgical outcomes and improve patient care. This growth is further fueled by the expansion of orthopedic departments, the integration of advanced imaging and robotic systems, and the adoption of minimally invasive techniques, which collectively reduce recovery times and improve patient outcomes.

Additionally, hospitals are investing heavily in comprehensive orthopedic care programs and upgrading their facilities to accommodate higher patient demands, thereby supporting the expansion of the hospitals segment.

Orthopedic Devices Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America orthopedic devices market share stood around 36.47% in 2023 in the global market, with a valuation of USD 23.56 billion, primarily due to high surgical volumes and ongoing technological advancements.

- According to an article published in February 2024 by the American College of Rheumatology, the U.S. conducts approximately 790,000 total knee replacements and 544,000 hip replacements annually. This substantial volume of procedures underscores the growing demand for orthopedic devices, which is attributed to an aging population and the increasing prevalence of musculoskeletal disorders.

Additionally, hospitals in the region are actively adopting cutting-edge technologies, including robotic-assisted surgeries and minimally invasive techniques, thereby aiding regional market expansion. Furthermore, mergers and acquisitions in the region are strengthening companies' global presence and expanding their product offerings.

- For instance, in September 2023, Globus Medical, a U.S.-based medical device company, finalized its USD 3.1 billion merger with NuVasive, a specialist in minimally invasive spine surgery. The merger combined their complementary global scale, expanded their commercial reach, and integrated their comprehensive portfolios in spine and orthopedics.

The aforementioned factors are anticipated to bolster regional market growth in the forthcoming years.

Asia-Pacific is anticipated to witness robust growth at a CAGR of 5.87% over the forecast period, mainly propelled by increasing healthcare investments and rising awareness of advanced orthopedic treatments. The region is experiencing a surge in orthopedic surgeries due to the growing prevalence of sports injuries, road traffic accidents, and lifestyle-related disorders.

Countries such as China and India are seeing significant infrastructure development, which is improving access to advanced orthopedic care. Moreover, local manufacturers are investing heavily in R&D to create cost-effective, high-quality devices tailored to regional needs. The rise in middle-class incomes and healthcare expenditure is further boosting the demand for innovative orthopedic solutions across the Asia-Pacific region, thereby aiding domestic market progress.

Competitive Landscape

The global orthopedic devices market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Orthopedic Devices Market

- Braun SE

- Enovis Corporation

- Arthrex, Inc.

- ATEC Spine, Inc

- NuVasive, Inc.

- Boston Scientific Corporation

- CTL Amedica

- Globus Medical

- Medtronic

- Stryker

Key Industry Developments

- January 2024 (Product Launch): Arthrex, a global leader in minimally invasive surgical technology and education, launched TheNanoExperience.com. This new patient-focused resource highlighted the science and benefits of Nano arthroscopy. This advanced, minimally invasive orthopedic procedure aims to enable a quicker return to activity and reduce pain.

- August 2024 (Acquisition): Stryker, a global leader in medical technologies, announced a definitive agreement to acquire Vertos Medical Inc. This privately held company specializes in minimally invasive solutions for the treatment of chronic lower back pain caused by lumbar spinal stenosis.

The global orthopedic devices market is segmented as:

By Product

- Joint Replacement and Orthopedic Implants

- Lower Limb Implants

- Spinal Implants

- Dental and Craniomaxillofacial Implants

- Upper Limb Implant

- Trauma Devices

- Fixation Implants

- Supporting Accessories

- Surgical Instruments

- Sports Medicine Solutions

- Reconstruction and Repair

- Supportive Accessories

- Monitoring and Evaluation Tools

- Recovery and Rehabilitation Aids

- Orthobiologics

- Viscosupplements

- Bone Grafts and Substitutes

- Advanced Therapies

- Others

By End User

- Hospitals

- Ambulatory and Outpatient Centers

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America