Market Definition

The market refers to the implementation of advanced digital systems to monitor, control, and manage substation equipment and operations. It involves the integration of SCADA systems, intelligent electronic devices (IEDs), communication networks, and software platforms.

The scope of the market includes automation design, system configuration, protocol standardization, and real-time data management. This market supports grid stability, enhances substation performance, and enables remote supervision. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Electric Power Substation Automation Integration Market Overview

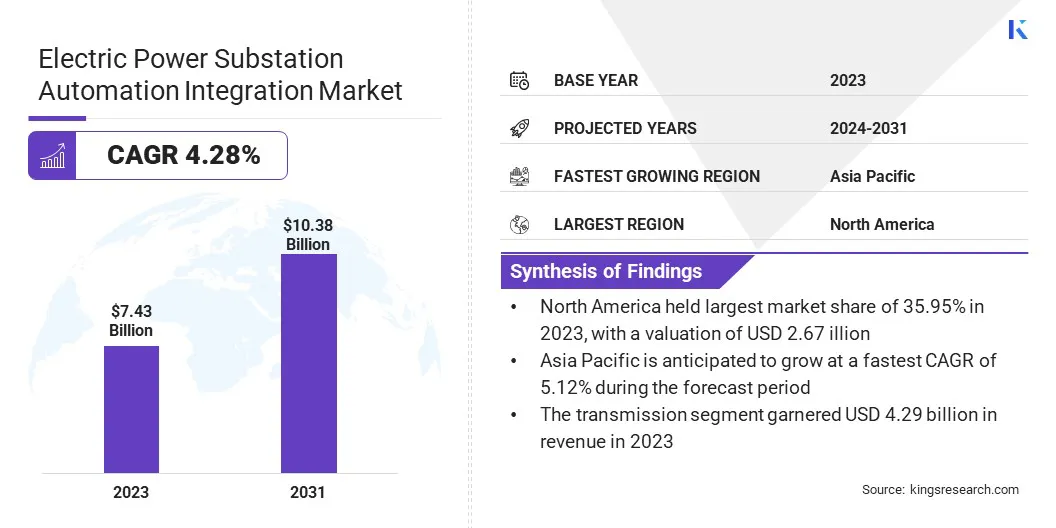

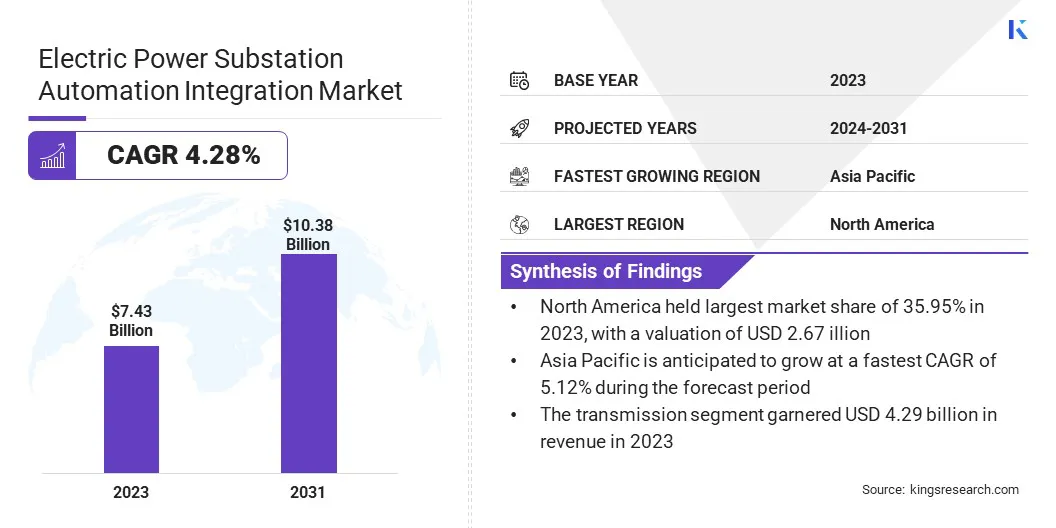

The global electric power substation automation integration market size was valued at USD 7.43 billion in 2023 and is projected to grow from USD 7.74 billion in 2024 to USD 10.38 billion by 2031, exhibiting a CAGR of 4.28% during the forecast period.

The growth of the market is driven by the rapid expansion of renewable energy capacity, which requires flexible and automated substations for stable power flow. Additionally, the deployment of smart grids and intelligent energy systems is driving demand for advanced automation to enhance grid visibility and control.

Major companies operating in the electric power substation automation integration industry are Hitachi Energy Ltd., Siemens, Schneider Electric, General Electric, Eaton, Schweitzer Engineering Laboratories, Inc., Emerson, Rockwell Automation, Cisco Systems, Honeywell International Inc., NovaTech, LLC, NIDEC CORPORATION, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation, and Larsen & Toubro Limited (L&T).

Governments and regulatory bodies are introducing policies that require utilities to adopt digital and automated systems in their infrastructure. These mandates aim to improve grid transparency, ensure uninterrupted power supply, and strengthen energy security.

As a result, utilities are increasingly adopting substation automation technologies to meet compliance requirements. This policy-driven demand is playing a key role in accelerating the growth of the market, particularly in countries prioritizing grid modernization and renewable energy integration.

- In February 2024, GE Vernova’s Grid Solutions division introduced GridBeats, a suite of software-defined automation solutions designed to support grid digitalization and strengthen grid resilience. This portfolio is developed to equip utilities with advanced tools for substation digitalization, autonomous grid zone management, and remote control of devices and communication infrastructure.

Key Highlights

Key Highlights

- The electric power substation automation integration industry size was valued at USD 7.43 billion in 2023.

- The market is projected to grow at a CAGR of 4.28% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 2.67 billion.

- The hardware segment garnered USD 3.13 billion in revenue in 2023.

- The transmission segment is expected to reach USD 5.96 billion by 2031.

- The intelligent electronic devices (IEDs) segment secured the largest revenue share of 35.65% in 2023.

- The transmission sector is poised for a robust CAGR of 4.39% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.12% during the forecast period.

Market Driver

"Expansion of Renewable Energy Capacity"

The growing share of renewables in the global energy mix requires greater flexibility and control at the substation level. Substation automation solutions manage fluctuations in solar and wind output, ensuring grid stability. These systems allow real-time load balancing and seamless integration of intermittent energy sources.

As renewable energy projects continue to expand, there is a growing need for adaptive and scalable control technologies in substations. This shift is propelling the electric power substation automation integration market, as utilities seek more flexible and reliable solutions to support the evolving energy landscape.

- In May 2023, Larsen & Toubro’s (L&T) Power Transmission & Distribution (PT&D) Business secured a contract to design, supply, and build a 380kV substation in the central region of Saudi Arabia. This substation will play a key role in integrating renewable energy into the grid, supporting the Kingdom’s strategic shift toward non-fossil fuel sources in its electricity mix.

Market Challenge

"Integration of Legacy Infrastructure"

A major challenge in the growth of the electric power substation automation integration market is the complexity of integrating modern automation systems with aging legacy infrastructure. Many existing substations were not designed for digital technologies, leading to compatibility issues, increased upgrade costs, and extended project timelines.

To address this, key players are investing in modular and interoperable automation solutions that support phased implementation. They are also offering retrofit services and digital twin technology to test integration plans before deployment.

These strategies help utilities modernize systems gradually while ensuring operational continuity and reducing the risks associated with system downtime.

Market Trend

"Deployment of Smart Grids and Intelligent Energy Systems"

The global shift toward smart grid frameworks is creating a strong demand for automated substations. These systems are key to enabling self-healing grids, real-time monitoring, and integrated energy management.

Substation automation plays a critical role in smart grid development by allowing advanced control and communication across the power network. This strategic importance is significantly contributing to the expansion of the electric power substation automation integration market on a global scale.

- In October 2024, Schneider Electric introduced advanced technologies to improve energy flow management in smart grids. The updated PowerLogic T300 RTU is virtualized on the E4S hardware platform to streamline substation design and strengthen operational performance. Integrated with EcoStruxure ADMS and DERMS, the newly launched Digital Grid Sustainability Service Net Zero Dashboard provides key net-zero metrics and KPIs, enabling utilities to monitor grid decarbonization, track emissions, and develop informed sustainability strategies.

Electric Power Substation Automation Integration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Substation

|

Transmission, Distribution

|

|

By Technology

|

Intelligent Electronic Devices (IEDs), Programmable logic controller (PLC), Supervisory Control and Data Acquisition (SCADA), Others

|

|

By End-Use

|

Transmission Sector, Distribution Sector, Renewable Energy Sector

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, and Services): The hardware segment earned USD 3.13 billion in 2023 due to the essential role of physical components like protection relays, circuit breakers, and control systems in ensuring grid stability, reliability, and efficient automation implementation.

- By Substation (Transmission and Distribution): The transmission segment held 57.79% of the market in 2023, due to the increasing need for enhanced grid stability, efficiency, and the integration of renewable energy sources.

- By Technology (Intelligent Electronic Devices (IEDs), Programmable Logic Controller (PLC), Supervisory Control and Data Acquisition (SCADA), and Others): The intelligent electronic devices (IEDs) segment is projected to reach USD 3.69 billion by 2031, owing to their ability to enhance real-time monitoring, control, and protection of substations, enabling efficient grid management and reducing operational downtime.

- By End-Use (Transmission Sector, Distribution Sector, and Renewable Energy Sector): The transmission sector segment is poised for significant growth at a CAGR of 4.39% through the forecast period, attributed to its critical role in ensuring efficient and reliable power distribution across long distances.

Electric Power Substation Automation Integration Market Regional Analysis

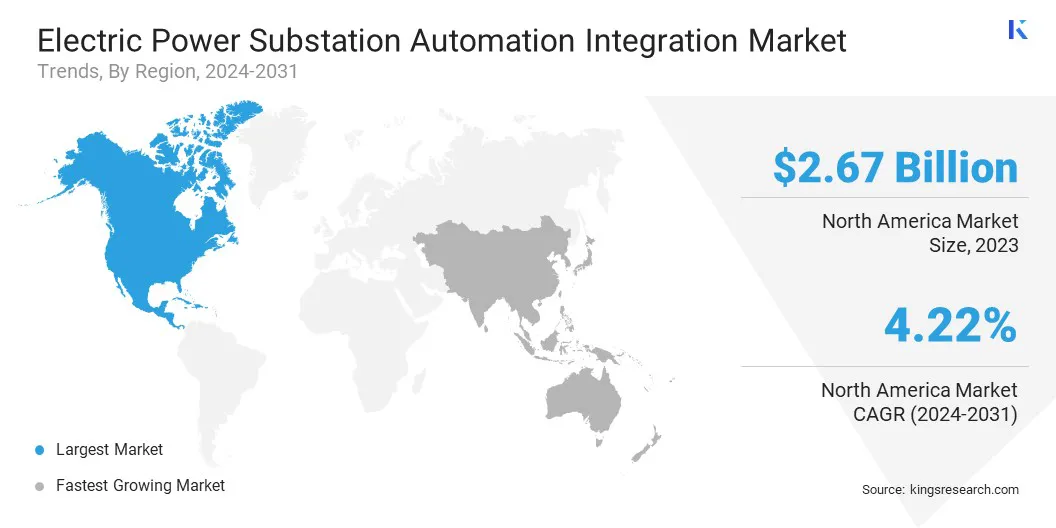

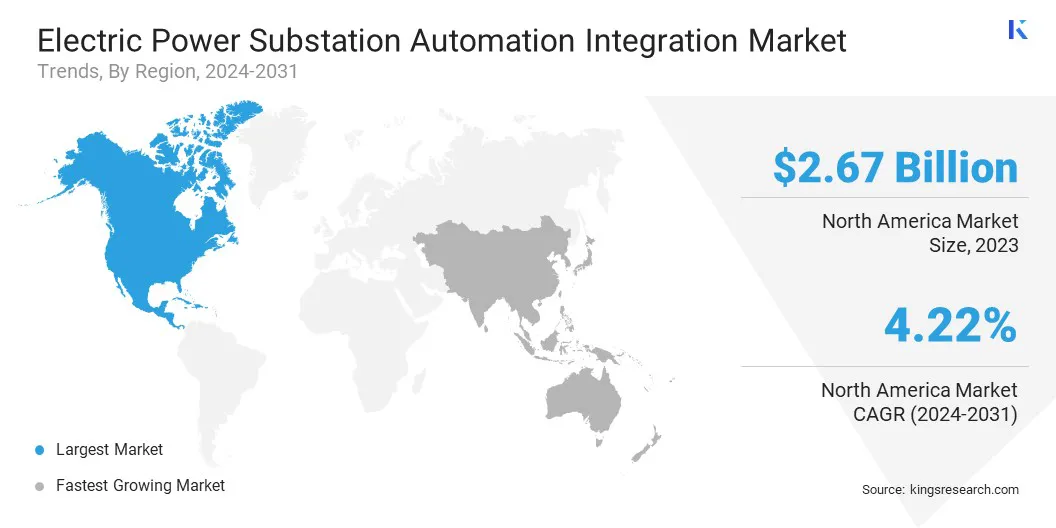

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America electric power substation automation integration market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 2.67 billion. North America is rapidly expanding its solar and wind capacity, especially in remote and rural areas.

The North America electric power substation automation integration market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 2.67 billion. North America is rapidly expanding its solar and wind capacity, especially in remote and rural areas.

Substation automation is essential to manage variable generation and maintain grid stability. As more renewable projects are added to the grid, the market is growing in response to the need for real-time control and flexibility.

Moreover, the western U.S. faces frequent wildfire threats, which are increasingly linked to grid infrastructure. Utilities are investing in substation automation to detect faults, shut down lines safely, and isolate incidents before they spread. These capabilities reduce fire risk and protect communities. This growing focus on grid safety is accelerating the growth of the market in wildfire-prone areas.

Asia Pacific electric power substation automation integration industry is poised for significant growth at a robust CAGR of 5.12% over the forecast period. Asia Pacific is witnessing a large-scale expansion of high-voltage transmission networks to connect remote generation sites with urban centers.

This requires automation to manage complex power flows and reduce losses across long distances. Substation automation is being deployed to improve grid control and system stability, propelling the growth of the market across the region.

- In September 2023, East Japan Railway Company partnered with Hitachi, Ltd. to co-develop a fully digital substation system, scheduled for implementation in fiscal year 2025. The system will support dual configurations for both transmission lines and protection-control functions within the substation, ensuring a stable electricity supply that supports uninterrupted railway operations.

Regulatory Frameworks

- In the U.S., substation automation is governed by NERC’s Critical Infrastructure Protection (CIP) standards, which enforce cybersecurity and operational reliability for bulk power systems.

- The EU supports substation automation through ENTSO-E guidelines and energy digitization policies. Member states widely implement IEC 61850 for interoperability and standardized communication between devices. These frameworks encourage automation integration to enhance renewable adoption, grid efficiency, and cross-border power exchange, aligning with Europe’s broader decarbonization and energy transition goals.

- China’s substation automation is directed by the State Grid Corporation, which mandates smart grid development across provinces. The focus is on deploying fully digital substations that support renewable integration, stability, and remote control. National standards are aligned with IEC 61850, and implementation is tightly linked to China’s energy transition goals

Competitive Landscape

Market players in the electric power substation automation integration industry are increasingly adopting strategies like collaboration and securing contracts from industries such as utilities, renewable energy, and transportation.

By forming partnerships and winning major contracts, companies can expand their reach, access new technologies, and improve service offerings. These strategic moves enable them to strengthen their position in the market and meet the growing demand for efficient substations.

- In March 2025, Schneider Electric was awarded a contract by Tata Power Company Limited to deploy 11kV SF6-Free Ring Main Units (RMUs) utilizing Schneider Electric’s advanced RM AirSeT SF6-Free technology. These RMUs are part of a new generation of MV/LV substation equipment, offering an alternative to traditional SF6 (sulphur hexafluoride) gas.

List of Key Companies in Electric Power Substation Automation Integration Market:

- Hitachi Energy Ltd.

- Siemens

- Schneider Electric

- General Electric

- Eaton

- Schweitzer Engineering Laboratories, Inc.

- Emerson

- Rockwell Automation

- Cisco Systems

- Honeywell International Inc.

- NovaTech, LLC

- NIDEC CORPORATION

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions Corporation

- Larsen & Toubro Limited (L&T)

Recent Developments (Agreements/Product Launch)

- In March 2025, Schneider Electric introduced its One Digital Grid Platform, an integrated, AI-driven solution aimed at improving grid resiliency, reliability, and operational efficiency. The platform features the PowerLogic T500, which functions as a primary substation RTU, data concentrator, and communications processor. It offers a modular, unified platform that streamlines the integration of operational technology systems within substations.

- In March 2024, Larsen & Toubro’s Power Transmission & Distribution (PT&D) division secured orders for the development of a 380kV Gas Insulated Substation (GIS). The contract scope includes the supply of associated reactors and the installation of hybrid GIS bays as part of the project.

Key Highlights

Key Highlights The North America electric power substation automation integration market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 2.67 billion. North America is rapidly expanding its solar and wind capacity, especially in remote and rural areas.

The North America electric power substation automation integration market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 2.67 billion. North America is rapidly expanding its solar and wind capacity, especially in remote and rural areas.