Market Definition

Substation automation systems are digital platforms that manage, control, and protect electrical substations using intelligent electronic devices, communication networks, and advanced software. These systems enable real-time monitoring, remote operation, and data-driven decision-making, improving the efficiency and safety of power grid operations.

The market focuses on the formulation of digital substations, advanced protection schemes, and cybersecurity measures. Substation automation is widely used in power transmission networks, industrial plants, and renewable energy integration, ensuring operational efficiency, reduced downtime, and enhanced grid resilience through automation, remote operation, and predictive maintenance solutions.

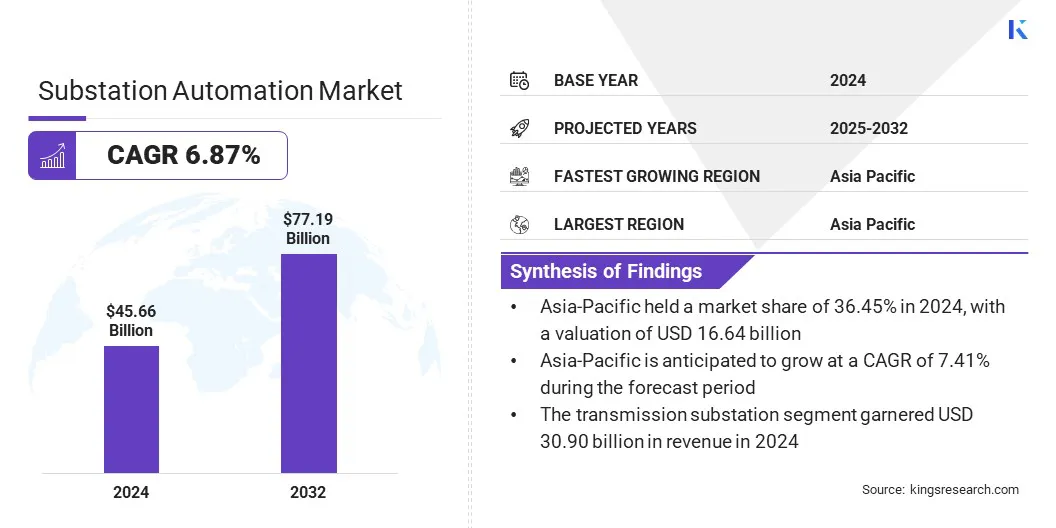

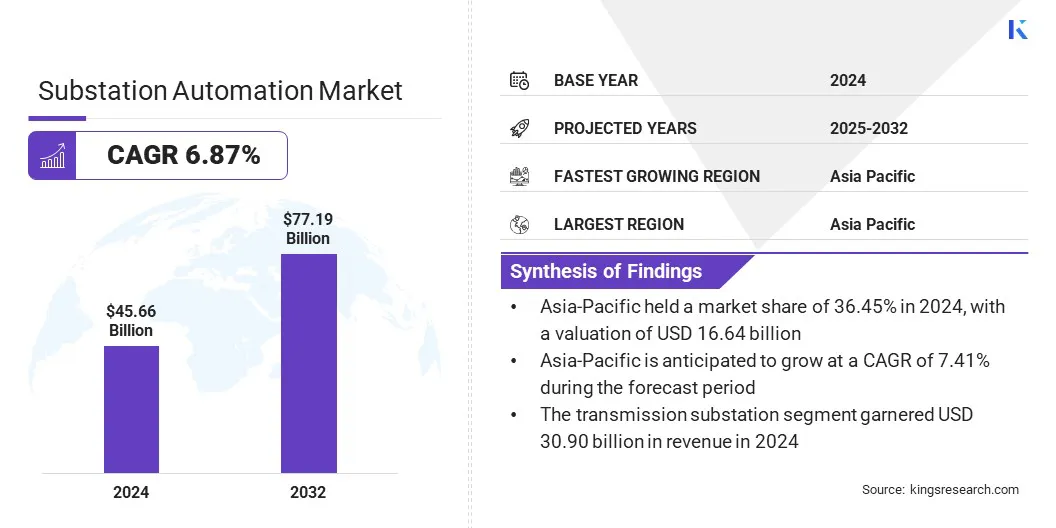

The global substation automation market size was valued at USD 45.66 billion in 2024 and is projected to grow from USD 48.47 billion in 2025 to USD 77.19 billion by 2032, exhibiting a CAGR of 6.87% during the forecast period.

The market is driven by increasing investments in grid modernization and the integration of renewable energy sources. Utilities are adopting advanced digital solutions to enhance grid reliability, efficiency, and security. Additionally, the rising focus on cybersecurity in energy infrastructure is accelerating the deployment of automation technologies, ensuring secure and resilient power distribution systems in response to evolving threats and regulatory requirements.

Key Highlights

- The substation automation industry size was recorded at USD 45.66 billion in 2024.

- The market is projected to grow at a CAGR of 6.87% from 2025 to 2032.

- Asia-Pacific held a market share of 36.45% in 2024, with a valuation of USD 16.64 billion.

- The hardware segment garnered USD 20.85 billion in revenue in 2024.

- The transmission substation segment is expected to reach USD 53.81 billion by 2032.

- The new segment is anticipated to witness the fastest CAGR of 7.45% over the forecast period.

- The utilities segment garnered USD 15.68 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 7.41% during the forecast period.

Major companies operating in the substation automation market are ABB, Schneider Electric SE, Siemens, General Electric, Hitachi Energy Ltd., Yokogawa Electric Corporation, Rockwell Automation, Inc., Cisco, Schweitzer Engineering Laboratories, Inc., Eaton, Mitsubishi Electric Corporation, Honeywell International Inc., Trilliant Holdings Inc., Alstom SA, and S&C Electric Company.

Substation Automation Market Report Scope

Substation Automation Market Report Scope

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, and Service

|

|

By Type

|

Transmission Substation, and Distribution Substation

|

|

By Technology

|

New, and Retrofit

|

|

By End-use Industry

|

Utilities, Data Centers & Cloud Campuses, Oil & Gas, Mining, Transportation, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Substation Automation Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted substation automation market share stood around 36.45% in 2023, with a valuation of USD 16.64 billion. The market in the region is registering rapid growth, due to large-scale investments in power infrastructure by governments in China, India, Indonesia, Vietnam, and the Philippines.

Expanding industrial zones, urban developments, and electrification of rural areas require modernized substations with automation, remote monitoring, and real-time data analytics. National initiatives such as China’s Belt and Road Initiative (BRI) and India’s Revamped Distribution Sector Scheme (RDSS) are accelerating the deployment of automated substations to ensure efficient and reliable power transmission.

Furthermore, countries like Japan, South Korea, China, and Singapore are leading in smart manufacturing and Industry 4.0, driving the demand for automated power substations. With manufacturing hubs integrating AI, IoT, and cloud computing, automated substations help optimize power usage, reduce downtime, and enhance operational resilience.

The substation automation industry in North America is poised for significant growth at a robust CAGR of 7.03% over the forecast period. The market is fueled by the demand for cyber-secure digital substations that enhance grid reliability and data security in the region.

The substation automation industry in North America is poised for significant growth at a robust CAGR of 7.03% over the forecast period. The market is fueled by the demand for cyber-secure digital substations that enhance grid reliability and data security in the region.

North America’s critical power infrastructure is increasingly vulnerable to cyberattacks, prompting utilities to integrate secure substation automation technologies. Additionally, the increasing adoption of IoT, AI, and cloud-based analytics is reshaping the market in North America.

Smart grid initiatives encourage the deployment of digital substations equipped with intelligent sensors, automated switching systems, and remote diagnostics. 5G connectivity and edge computing are further improving real-time grid monitoring, predictive maintenance, and fault detection, driving substantial investments in automated substation solutions.

- In April 2024, U.S.-based LF Energy announced new open-source initiatives to accelerate substation automation, including the launch of OpenSCD, a project focused on digital substation configuration. The initiative supports grid modernization by enhancing interoperability, flexibility, and real-time data exchange across substation systems.

Substation Automation Market Overview

The growing shift toward smart grids is driving the market. Utilities are adopting automation technologies to enable real-time monitoring, data-driven decision-making, and improved operational efficiency. Smart grids require advanced automation solutions to enhance power distribution, optimize load management, and ensure uninterrupted electricity supply.

Governments and regulatory bodies are investing in smart grid projects, further accelerating the deployment of substation automation solutions to modernize energy infrastructure and enhance overall grid performance.

Market Driver

Adoption of Digital Substations

The shift from traditional substations to digital substations is accelerating the growth of the substation automation market. Digital substations replace conventional copper wiring with fiber-optic communication, enhancing reliability and reducing operational costs. Digital substations improve real-time monitoring, asset management, and fault detection, enhancing power system efficiency.

Utilities and industrial operators are increasingly adopting digital solutions to improve operational resilience, minimize maintenance costs, and enhance the flexibility of energy networks in response to evolving power demands.

- In February 2024, GE Vernova’s Grid Solutions business introduced GridBeats, a suite of software-defined automation solutions designed to accelerate grid digitalization and improve grid resilience. GridBeats offers functionalities for substation digitalization, autonomous grid zone management, and remote monitoring of devices and communication networks.

Market Challenge

Cybersecurity Risks in Substation Automation

A significant challenge in the growth of the substation automation market is the increasing risk of cyber threats targeting critical power infrastructure. Such vulnerabilities to cyberattacks pose a serious threat to grid stability and security as substations become more digitalized and interconnected.

Companies are implementing advanced cybersecurity solutions, including encryption, multi-layered authentication, and intrusion detection systems. Compliance with regulatory cybersecurity frameworks such as NERC CIP and IEC 62443 is also being prioritized. Additionally, organizations are investing in AI-driven threat detection and real-time monitoring to enhance resilience against evolving cyber threats.

Market Trend

Modernization of Aging Power Infrastructure

Modernization of aging power infrastructure is accelerating the adoption of substation automation systems by replacing outdated equipment with intelligent, digital solutions. Utilities are upgrading legacy substations to improve grid reliability, enable predictive maintenance, and integrate renewable energy sources. These upgrades enhance operational efficiency and support the transition to smarter, more resilient energy networks.

The trend also aligns with global efforts to future-proof power infrastructure against rising demand and evolving grid challenges. Automated substations play a critical role in ensuring a stable electricity supply, supporting economic growth and meeting the increasing demand for efficient power distribution.

- In March 2025, the parliament of Germany approved a USD 544 billion special fund to support infrastructure modernization, defense, and climate action. This fund, to be deployed over 12 years, aims to upgrade critical systems, including energy grids and transport networks, while reducing industrial and structural emissions.

Market Segmentation

- By Component (Hardware, Software, and Service): The hardware segment earned USD 20.85 billion in 2024 due to the high demand for intelligent electronic devices (IEDs), process interface units, and communication hardware, which are essential for real-time data processing, grid reliability, and seamless automation integration.

- By Type (Transmission Substation, and Distribution Substation): The transmission substation held 67.67% of the market in 2024, due to the increasing demand for grid modernization, higher voltage handling capacity, and the critical role of automation in ensuring efficient long-distance power transmission and integration of renewable energy sources.

- By Technology (New, and Retrofit): The new segment is projected to reach USD 47.42 billion by 2032, owing to its ability to enhance grid efficiency, interoperability, and real-time monitoring, aligning with increasing investments in smart grid infrastructure and the growing demand for advanced digital solutions.

- By End-use Industry (Utilities, Data Centers & Cloud Campuses, Oil & Gas, Mining, Transportation, and Others): The data centers & cloud campuses segment is anticipated to witness the fastest CAGR of 7.90% over the forecast period, attributed to rising demand for uninterrupted power, energy efficiency, and intelligent grid infrastructure.

Regulatory Frameworks

- In the U.S., The market is regulated by multiple authorities ensuring grid reliability, safety, and cybersecurity. The National Electrical Safety Code (NESC) sets installation and operational safety standards for substations, while the Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC) establish and enforce bulk power system reliability standards. NERC’s Critical Infrastructure Protection (CIP) standards play a crucial role in securing substation automation systems against cyber threats.

- The EU's regulatory framework for substation automation is based on IEC 61850, ensuring interoperability and communication standardization across member states. The European Network of Transmission System Operators for Electricity (ENTSO-E) sets grid operation standards, including those for digital substations. Additionally, IEC 60364 governs electrical installations, providing consistency in safety measures. EU initiatives such as Digitalisation of Energy Action Plan aim to enhance automation and smart grid deployment across Europe.

- Japan regulates substation automation through the Japan Electric Association (JEA) Standards, ensuring safe and efficient electrical installations. The government’s Energy Conservation Act promotes the modernization of substations as part of its smart grid strategy. Utilities such as Tokyo Electric Power Company (TEPCO) invest in substation digitalization to enhance grid resilience, particularly in disaster-prone areas. Automation and remote monitoring are key components of Japan’s initiative to improve power stability.

Competitive Landscape

The substation automation industry is characterized by market players that are actively adopting strategies focused on advancements in digital substation technology to enhance grid efficiency, reliability, and automation.

By integrating next-generation process interface units and modular digital solutions, companies are streamlining substation operations, reducing infrastructure complexity, and improving interoperability. These innovations are accelerating the shift toward fully digital substations, reinforcing their role in modern grid infrastructure. As a result, such strategic advancements are significantly contributing to the growth of the market.

- In January 2024, Hitachi Energy enhanced its cutting-edge digital substation technology with the introduction of SAM600 3.0, an advanced process interface unit (PIU) designed to accelerate the transition to digital substations for transmission utilities. The newly developed, modular SAM600 integrates three functionalities into a single device, allowing it to function as a merging unit, a switchgear control unit, or a hybrid of both. This versatile design supports multiple installation configurations, enhancing flexibility and efficiency in substation automation.

Key Companies in Substation Automation Market:

- ABB

- Schneider Electric SE

- Siemens

- General Electric

- Hitachi Energy Ltd.

- Yokogawa Electric Corporation

- Rockwell Automation, Inc.

- Cisco

- Schweitzer Engineering Laboratories, Inc.

- Eaton

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Trilliant Holdings Inc.

- Alstom SA

- S&C Electric Company

Recent Developments (Expansion/Product Launch)

- In February 2025, LF Energy introduced SEAPATH v1.0, an open-source real-time hypervisor built to support the virtualization of protection, automation, and control functions in IEC 61850-based digital substations. The release strengthens reliability, security, and scalability across grid systems, with its vendor-agnostic design enabling flexible deployments and advancing the digitalization of both primary and secondary substations.

- In July 2024, GE Vernova announced plans to provide GE Algeria Turbines (GEAT) with high-voltage equipment, components, and grid automation solutions for 134 substations by 2028 to strengthen Algeria’s grid infrastructure. The supplied technology is set to play a key role in integrating renewable energy sources while ensuring a stable and reliable power supply to support the country’s expanding population and economic growth.

- In March 2023, Honeywell launched its Versatilis Transmitters for condition-based monitoring of rotating equipment, including pumps, motors, compressors, fans, blowers, and gearboxes. These transmitters offer critical measurements that enhance safety, availability, and reliability across various industries. It extends to applications such as improving heat exchange efficiency and ensuring the reliability of substations, further optimizing industrial operations.

Substation Automation Market Report Scope

Substation Automation Market Report Scope The substation automation industry in North America is poised for significant growth at a robust CAGR of 7.03% over the forecast period. The market is fueled by the demand for cyber-secure digital substations that enhance grid reliability and data security in the region.

The substation automation industry in North America is poised for significant growth at a robust CAGR of 7.03% over the forecast period. The market is fueled by the demand for cyber-secure digital substations that enhance grid reliability and data security in the region.