Market Definition

The market involves the development and implementation of devices designed to monitor electrical systems and detect irregular conditions such as short circuits, phase imbalances, and equipment malfunctions. These devices operate through integrated sensing and logic mechanisms that trigger circuit breakers to isolate faults and protect infrastructure.

The market covers a wide range of relay types, including electromechanical, solid-state, and advanced digital relays, each suited to specific voltage levels and system complexities. The report provides insights into the key factors driving market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Protective Relay Market Overview

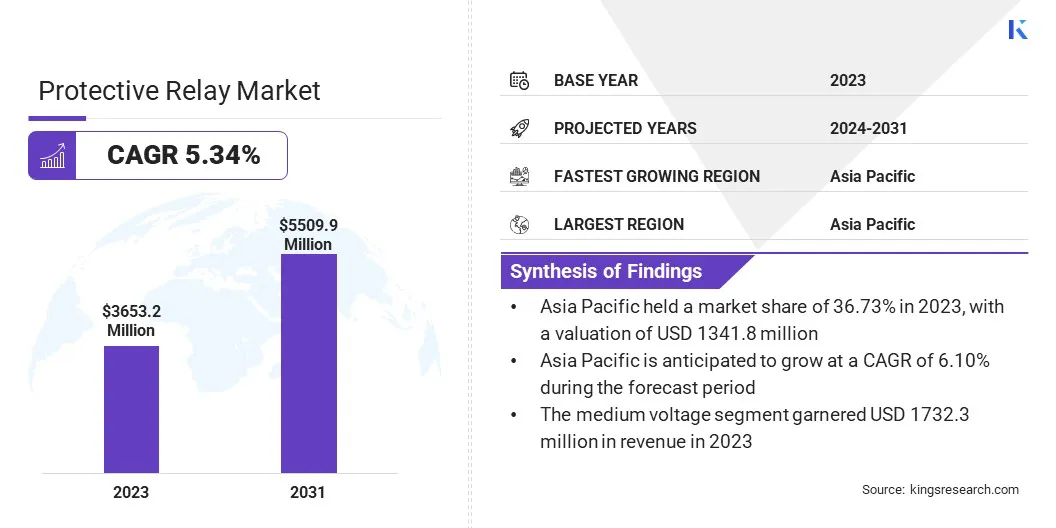

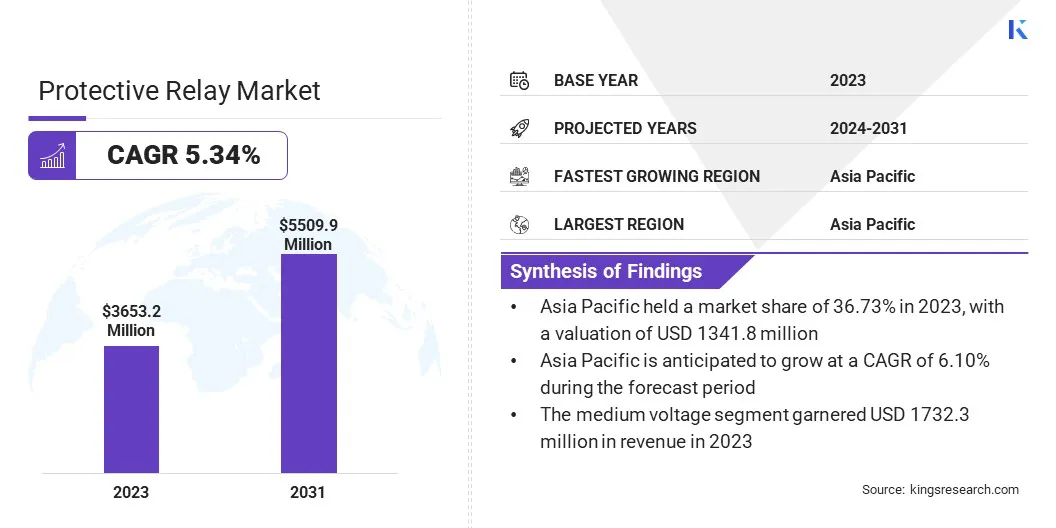

The global protective relay market size was valued at USD 3,653.2 million in 2023 and is projected to grow from USD 3,828.2 million in 2024 to USD 5,509.9 million by 2031, exhibiting a CAGR of 5.34% during the forecast period.

Market growth is driven by the rising deployment of smart grids and digital substations, which demand advanced protection and monitoring solutions. Additionally, the ongoing expansion of high-voltage transmission networks to support increased energy demand and renewable integration is accelerating the adoption of reliable protective relay systems.

Major companies operating in the protective relay industry are ABB Ltd., Siemens, Schneider Electric, General Electric Company, Eaton, Mitsubishi Electric Corporation, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Schweitzer Engineering Laboratories, Inc., Rockwell Automation, LARSEN & TOUBRO LIMITED, Wabtec Corporation, OMICRON, Basler Electric, NR Electric Co., Ltd., and Fuji Electric.

The market is growing due to ongoing upgrades in transmission and distribution networks. Aging electrical grids are being replaced with modern, automated systems that require reliable protection mechanisms. Integration of intelligent relays into these upgraded grids ensures improved fault detection, selective isolation, and reduced downtime.

Utilities and private operators are prioritizing digital protection solutions to enhance system resilience and performance, supporting market expansion across various economies.

Key Highlights:

- The protective relay industry size was recorded at USD 3,653.2 million in 2023.

- The market is projected to grow at a CAGR of 5.34% from 2024 to 2031.

- Asia Pacific held a market share of 36.73% in 2023, with a valuation of USD 1,341.8 million.

- The medium voltage segment garnered USD 1,732.3 million in revenue in 2023.

- The transmission line protection segment is expected to reach USD 2,030.6 million by 2031.

- The utilities segment secured the largest revenue share of 46.12% in 2023.

- Europe is anticipated to grow at a CAGR of 5.59% over the forecast period.

Market Driver

Deployment of Smart Grids and Digital Substations

The expansion of smart grid infrastructure is contributing significantly to the growth of the market. Smart grids rely on digital substations equipped with intelligent electronic devices, including multifunction protective relays that support automated control, remote diagnostics, and predictive maintenance.

These systems enhance the reliability and flexibility of the power network. The integration of digital relays supports utility goals for grid modernization and increased system transparency, fueling long-term market expansion.

- In January 2023, China’s State Grid Corporation announced USD 77 billion investment in transmission infrastructure, as part of its broader USD 329 billion commitment under the 14th Five-Year Plan (2021–2025). Additionally, China Southern Power Grid pledged USD 99 billion. Including regional power companies, the total projected national investment amounts to USD 442 billion.

Market Challenge

Complexity of Integrating Protection Relays with Modern Grid Infrastructure

A major challenge limiting the growth of the protective relay market is the complexity of integrating advanced protection systems into evolving grid architectures, particularly with the growing adoption of renewable energy sources and digital substations. Interoperability issues with diverse communication protocols and legacy systems often create technical barriers, increasing installation and maintenance costs.

To address this, market players are investing in R&D to develop relays that support standardized communication protocols such as IEC 61850. Additionally, companies are offering comprehensive engineering services and modular relay solutions to simplify integration, reduce downtime, and ensure seamless compatibility with modern power systems.

Market Trend

Expansion of High-Voltage Transmission Networks

The ongoing development of high-voltage and ultra-high-voltage transmission lines, particularly in emerging economies, is boosting the growth of market.

These long-distance transmission systems are exposed to higher risks of electrical faults, making precise fault localization and fast system response crucial. Protective relays designed for high-voltage environments offer features such as distance protection, differential protection, and communication-assisted schemes, making them essential for grid stability and safety.

- In November 2024, the U.S. Department of Energy’s (DOE) Office of Electricity (OE) and Office of Energy Efficiency and Renewable Energy (EERE) announced the selection of four pioneering research and development projects focused on high-voltage direct current (HVDC) transmission. These initiatives aim to enhance the cost-effective integration of renewable energy into the national grid through HVDC lines. Under the USD 11 million program, Innovative DEsigns for high-performAnce Low-cost HVDC Converters (IDEAL HVDC), the selected projects are expected to lower transmission system costs by 35% by 2035 and accelerate the adoption of advanced HVDC technologies across the power sector.

Protective Relay Market Report Snapshot

|

Segmentation

|

Details

|

|

By Voltage

|

Low Voltage, Medium Voltage, High Voltage

|

|

By Application

|

Transmission Line Protection, Transformer Protection, Feeder Protection, Generator Protection, Other

|

|

By End User

|

Utilities, Industrial, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Voltage (Low Voltage, Medium Voltage, and High Voltage): The medium voltage segment earned USD 1,732.3 million in 2023 due to its widespread use across industrial, commercial, and utility-scale distribution networks.

- By Application (Transmission Line Protection, Transformer Protection, Feeder Protection, and Generator Protection, and Others): The transmission line protection segment held a share of 36.01% in 2023, fueled by the increasing deployment of high-voltage transmission infrastructure and the critical need to ensure uninterrupted power flow and fault isolation across expansive grid networks.

- By End User (Utilities, Industrial, Government, and Others): The utilities segment is projected to reach USD 2,649.1 million by 2031, attributed to the increasing demand for grid reliability and fault detection across expanding transmission and distribution infrastructure.

Protective Relay Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific protective relay market share stood at around 36.73% in 2023, valued at USD 1,341.8 million. The expansion of energy-intensive industrial zones and smart manufacturing parks in the region is accelerating the demand for resilient electrical protection systems.

These facilities require stable, high-capacity electrical infrastructure with robust protection mechanisms. Protective relays are widely deployed to safeguard critical assets in sectors such as heavy engineering, chemicals, and materials processing, contributing to regional market expansion.

- In June 2024, China successfully connected the world’s largest solar power facility to the grid in the northwestern region of Xinjiang. Spanning approximately 33,000 acres (equivalent to 200,000 mu), the plant is expected to generate around 6.09 billion kilowatt-hours annually. Located near Ürümqi, the regional capital, this marks a major achievement in China’s renewable energy expansion. In September 2024, China began transforming the Kubuqi Desert into a major solar hub, integrating photovoltaic systems with ecological restoration and agricultural development. This initiative is part of a long-term plan to create a 400-kilometer "solar Great Wall" with a 100 gigawatts by 2030, enough to power Beijing.

Europe protective relay industry is projected to grow at a CAGR of 5.59% over the forecast period. The rapid expansion of offshore wind farms and their integration with mainland grids via subsea HVDC cables necessitate highly specialized protective relay technologies tailored for marine environments and hybrid AC/DC configurations.

These projects demand fast, distance-sensitive protection systems to secure both generation assets and long-distance transmission infrastructure, boosting regional market expansion.

Moreover, Europe's transition to decarbonized energy systems is intensifying pressure on grid stability, as variable renewable sources such as wind and solar replace centralized generation. The need to ensure dynamic grid resilience while phasing out conventional baseload plants is further contributing to this expansion.

Regulatory Frameworks

- In the U.S., the North American Electric Reliability Corporation (NERC) sets standards for bulk power system reliability, particularly focusing on protective relays with its PRC series (PRC-001 to PRC-027). Additionally, the IEEE C37 series provides comprehensive specifications for protective relays and related equipment, ensuring robust system protection and coordination nationwide.

- The European Union focuses on grid reliability and interoperability through standards developed by the International Electrotechnical Commission (IEC), particularly the IEC 60255 series, which is vital for protective relays and protection equipment. CENELEC, the European body for electrotechnical standardization, adopts IEC standards, ensuring uniform implementation across EU member states, supporting seamless grid integration.

- China has developed comprehensive national standards for protective relays, with key guidelines such as GB/T 40096, GB/T 40599-2021, and DL/T 526-2012 aligning with international IEC standards. These standards focus on local relay protection devices, monitoring systems, and automatic equipment, facilitating reliable system protection and effective performance monitoring across the country’s vast power grid.

- Japan aligns with the IEC 60255 standards for protective relays to maintain compatibility with global standards. The Institute of Electrical Engineers of Japan (IEEJ) and the Japan Electric Association (JEA) jointly issue additional national standards. These standards complement international practices, ensuring the development of reliable and efficient protective relay systems within Japan’s power infrastructure.

Competitive Landscape

Prominent players operating in the protective relay market are focusing on technological advancements and expanding their product portfolios to gain a competitive edge. By introducing innovative solutions with enhanced protection features and solid-state designs, companies are enhancing the reliability and efficiency of their products.

This expansion strengthens their competitive positioning and meets the growing demand for high-performance relays in electrically challenging environments. These strategic moves enable players to cater to the evolving needs of industries requiring robust protection systems.

- In January 2024, Toshiba Electronics launched the TLP241BP, the first photorelay in a DIP4 package rated over 1.4A. It offers an 80V OFF-state output terminal voltage and includes over-temperature and over-voltage. Its solid-state device ensures compactness, energy efficiency, silent operation, and improved reliability in electrically demanding environments.

List of Key Companies in Protective Relay Market:

- ABB Ltd.

- Siemens

- Schneider Electric

- General Electric Company

- Eaton

- Mitsubishi Electric Corporation

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Schweitzer Engineering Laboratories, Inc.

- Rockwell Automation

- LARSEN & TOUBRO LIMITED

- Wabtec Corporation

- OMICRON

- Basler Electric

- NR Electric Co., Ltd.

- Fuji Electric

Recent Developments (M&A/Agreements/Product Launch)

- In January 2025, OMICRON unveiled CMC 500, establishing a new standard in protection testing. This modular, multi-phase test set facilitates highly efficient testing of protection relays and full validation of protection systems. With the ability to handle up to seven voltages or ten currents, the CMC 500 is versatile and well-suited for field use and commissioning in conventional, hybrid, and digital IEC 61850 substations.

- In November 2024, Wabtec Corporation acquired Fanox, a company renowned for its expertise in manufacturing protection relays and self-powered relays. This acquisition Wabtec’s capabilities, expands its product portfolio, and strengthens it position in specialized relays for on-board train operations and industrial applications, while increasing recurring revenue.

- In July 2024, ABB was selected by SDI Heartland to design, build, and install new switchgear doors, controls, and protection relays at its 18-breaker substation. ABB’s Relion 615 series relays were chosen for their compact design and multifunctionality, offering protection, control, monitoring, and supervision. These relays also feature arc flash protection through optical detection with fiber-optic sensors, enabling rapid fault response.