Market Definition

The market involves the production of electricity from solar power systems that are located close to the point of use, rather than centralized power plants. These systems are typically smaller-scale, decentralized, and can be installed on rooftops, residential homes, commercial buildings, or small community-based installations.

The report outlines major factors driving the market, along with key drivers, regional analysis, and regulatory frameworks that are set to influence the growth trajectory over the forecast period.

Distributed Solar Power Generation Market Overview

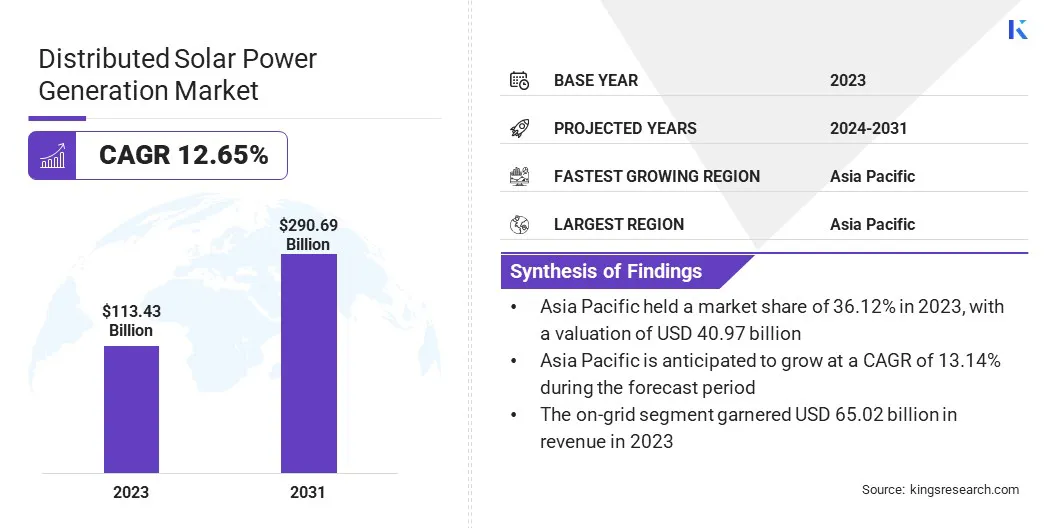

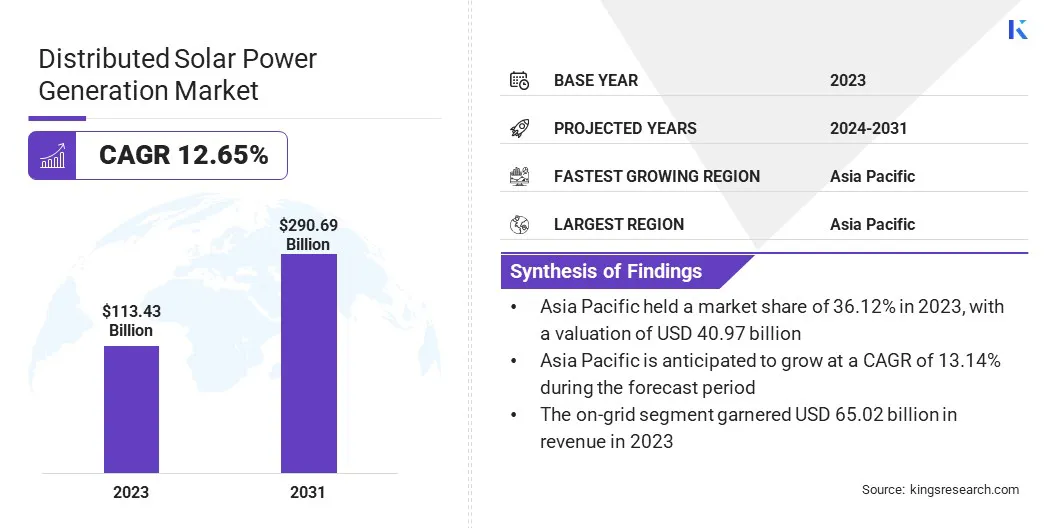

The global distributed solar power generation market size was valued at USD 113.43 billion in 2023, which is estimated to be USD 126.26 billion in 2024 and reach USD 290.69 billion by 2031, growing at a CAGR of 12.65% from 2024 to 2031.

Rising energy consumption, particularly in urban areas, is fueling the need for decentralized energy production. Distributed solar power systems provide a sustainable solution, enabling localized electricity generation to meet increasing demand.

Major companies operating in the distributed solar power generation industry are Wuxi Suntech Power Co., Ltd, Trinasolar, Canadian Solar, Yingli Solar, JA SOLAR Technology Co.,Ltd., Tata Sons Private Limited, SolarSquare Energy Private Limited, LEONICS CO., LTD, SHARP CORPORATION, Jain Irrigation Systems Ltd., Epoxy House, Suniva Inc., SunPower Corporation, First Solar, Inc, and Distributed Solar Development, LLC.

The market has registered a notable shift as consumers and businesses prioritize energy independence. Rooftop solar systems have emerged as a key solution, enabling localized power generation and reducing reliance on traditional grid electricity.

This growing demand is fueled by increasing energy prices, heightened environmental awareness, and a desire for self-sufficiency. The market continues to expand as solar technology advances and becomes more affordable, offering a sustainable and cost-effective way for users to generate clean energy on-site.

- In February 2024, Nextracker announced surpassing 600 distributed generation (DG) solar projects, highlighting the increasing adoption of solar trackers in commercial and industrial sectors. This growth supports energy independence, cost reduction, and reliable clean energy, aligning with the market trends.

Key Highlights:

- The distributed solar power generation industry size was valued at USD 113.43 billion in 2023.

- The market is projected to grow at a CAGR of 12.65% from 2024 to 2031.

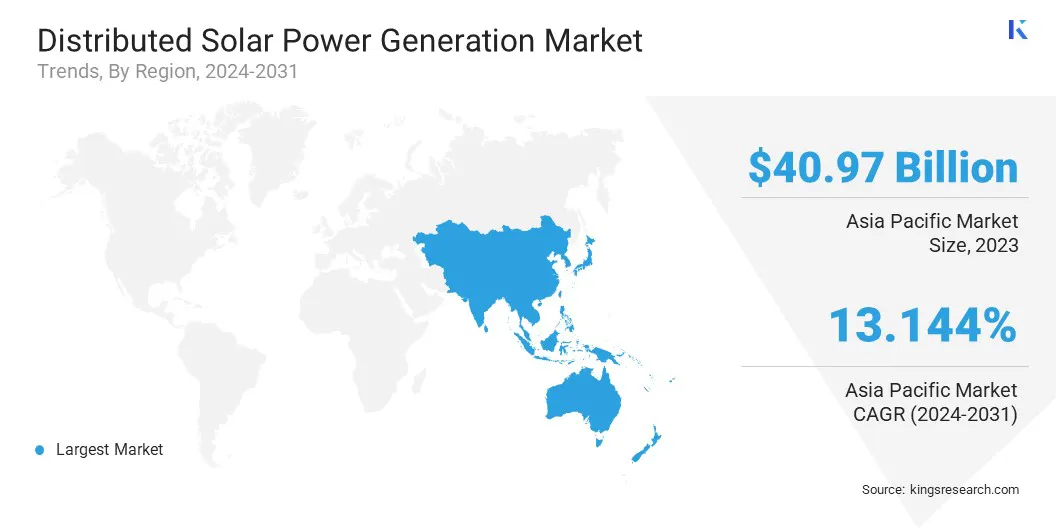

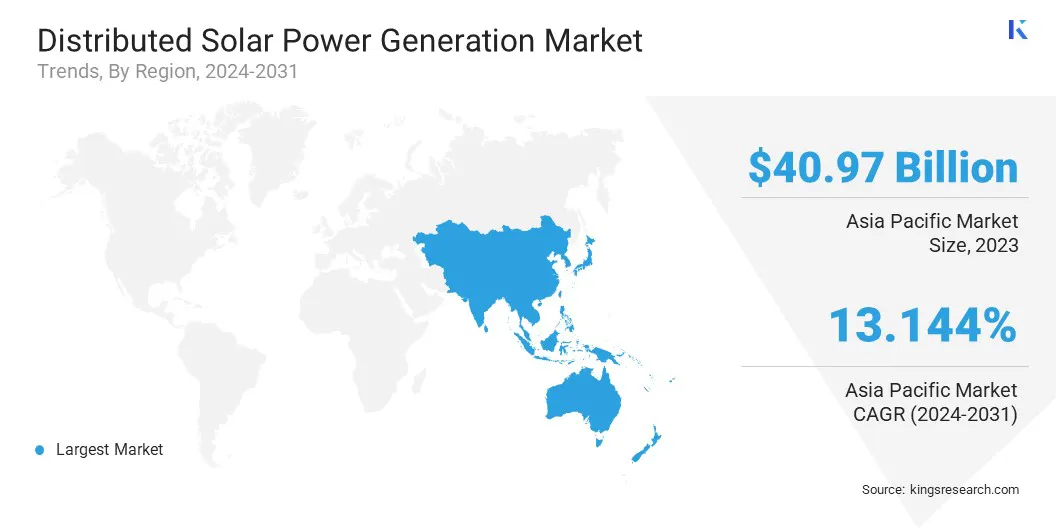

- Asia Pacific held a market share of 36.12% in 2023, with a valuation of USD 40.97 billion.

- The monocrystalline segment garnered USD 51.18 billion in revenue in 2023.

- The on-grid segment is expected to reach USD 172.41 billion by 2031.

- The Commercial and Industrial (C&I) segment is anticipated to register the fastest CAGR of 13.38% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 12.80% during the forecast period.

Market Driver

Increased Energy Demand

Increased energy demand, especially in rapidly growing urban areas, is a significant driver of the market. According to the World Bank Group, approximately 56% of the global population resides in cities. This urbanization trend is expected to persist, with the urban population more than doubling by 2050.

By that time, nearly 70% of the global population will be living in urban areas. Traditional grid systems struggle to meet the rising consumption as cities expand, creating a greater reliance on decentralized energy sources.

Distributed solar solutions, such as rooftop solar systems, offer an efficient way to address this demand by generating electricity on-site. This localized power production not only reduces strain on the grid but also provides an eco-friendly, cost-effective solution to energy needs.

- In October 2024, New York reached 6 gigawatts of distributed solar installations, one year ahead of schedule. Reported by the Solar Energy Industries Association (SEIA), this milestone, supported by the Governor of New York and the New York State Energy Research and Development Authority (NYSERDA), highlights the growing demand for clean, decentralized energy.

Market Challenge

Competition with Other Energy Sources

A key challenge for the distributed solar power generation market is the competition from other renewable sources like wind and traditional energy sources such as natural gas. These alternatives often offer different cost structures, efficiency levels, and scalability, which can impact the adoption rates of solar energy.

Improving solar panel efficiency, integrating energy storage solutions, and implementing favorable policies that incentivize solar adoption are essential. Additionally, hybrid systems combining solar with other renewables can provide reliable, cost-effective energy solutions, fostering greater market acceptance.

Market Trend

Technological Advancements in Solar Panels

The market has registered significant technological advancements, particularly with the rise of high-efficiency panels like bifacial and perovskite solar cells. These innovations enhance performance by capturing more sunlight, even in suboptimal conditions.

Bifacial panels can generate power from both sides, increasing energy output, while perovskite solar cells offer high efficiency at lower production costs. These breakthroughs are driving greater adoption of solar power in residential, commercial, and industrial sectors, making solar energy more accessible and viable across diverse environments.

- In January 2025, Hanwha Qcells achieved a world record in tandem solar cell efficiency, reaching 28.6% on a scalable full-area M10-sized cell, marking a significant advancement in solar power technology and driving progress in distributed solar power generation.

Distributed Solar Power Generation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Panel Type

|

Monocrystalline, Polycrystalline, Thin-film

|

|

By Grid Type

|

On-grid, Off-grid

|

|

By End Use

|

Residential, Commercial and Industrial (C&I), Utilities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Panel Type (Monocrystalline, Polycrystalline, Thin-film): The monocrystalline segment earned USD 51.18 billion in 2023, due to its higher efficiency and widespread adoption in distributed solar power generation.

- By Grid Type (On-Grid, Off-Grid): The on-grid segment held 57.32% share of the market in 2023, due to its ability to integrate with existing energy infrastructure for distributed solar systems.

- By End Use [Residential, Commercial and Industrial (C&I), Utilities]: The Commercial and Industrial (C&I) segment is projected to reach USD 145.81 billion by 2031, owing to the increased demand for sustainable, distributed energy solutions.

Distributed Solar Power Generation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a market share of around 36.12% in 2023, with a valuation of USD 40.97 billion. Asia Pacific is a dominant region in the distributed solar power generation market, due to its vast solar potential, increasing demand for renewable energy, and government support for green energy initiatives.

The region benefits from abundant sunlight, significant investments in solar infrastructure, and rapid industrialization, driving the adoption of distributed solar solutions. Additionally, favorable policies, such as tax incentives and renewable energy targets, coupled with a growing awareness of environmental sustainability, position Asia Pacific as a leader in the global solar energy transition.

- In January 2024, Huasun Energy powered Northern Vietnam's largest distributed solar project, a 20.048 MWp rooftop initiative, enhancing sustainability with its high-efficiency Himalaya G12-132 HJT modules. This milestone contributes significantly to Vietnam's green energy goals and carbon reduction efforts.

The market in Europe is poised for significant growth at a robust CAGR of 12.80% over the forecast period. Europe is rapidly emerging as the fast-growing region for distributed solar power generation, driven by strong policy support, increasing demand for clean energy, and substantial investments in renewable technologies.

Several European countries are focusing on expanding their solar capacity, especially through decentralized systems like rooftop installations and microgrids. This shift is fueled by the region's ambitious climate goals, favorable regulatory frameworks, and the growing need for energy independence. These factors are propelling Europe’s leadership in the global transition to sustainable energy.

- In February 2024, Suntech signed a 200MW contract with a Polish energy company at ENEX 2024, marking a significant expansion into the growing market in Poland. This partnership highlights Suntech's continued contribution to the renewable energy development in Europe.

Regulatory Frameworks

- In the U.S., solar manufacturers can benefit from two federal tax credits: the 45X MPTC, for domestic clean energy component production, and the 48C ITC, for investing in clean energy manufacturing facilities.

- In India, the PM Surya Ghar Muft Bijli Yojana aims to provide free electricity to one crore households by 2027, offering subsidies for rooftop solar installations and promoting energy independence across the nation.

- In the EU, the Renewable Energy Directive establishes renewable energy targets, promoting cooperation among member states and emphasizing energy storage systems, including solar, wind, and battery storage, to aid energy transitions.

Competitive Landscape:

Companies in the distributed solar power generation industry are focusing on enhancing solar module efficiency, integrating energy storage solutions, and expanding installation capabilities.

They are also developing innovative technologies, such as bifacial panels and advanced inverters, to improve system performance and reduce costs. Additionally, partnerships are being forged to increase market penetration, expand product offerings, and promote sustainability.

- In September 2023, JinkoSolar signed a Memorandum of Understanding (MoU) with Failte Solar to provide 200MW of high-efficiency N-Type Tiger Neo modules for the Irish distributed solar generation market. This collaboration aims to strengthen sustainable energy growth and enhance solar energy adoption in Europe.

List of Key Companies in Distributed Solar Power Generation Market:

- Wuxi Suntech Power Co., Ltd

- Trinasolar

- Canadian Solar

- Yingli Solar

- JA SOLAR Technology Co.,Ltd.

- Tata Sons Private Limited

- SolarSquare Energy Private Limited

- LEONICS CO., LTD

- SHARP CORPORATION

- Jain Irrigation Systems Ltd.

- Epoxy House

- Suniva Inc.

- SunPower Corporation

- First Solar, Inc

- Distributed Solar Development, LLC.

Recent Developments (Partnerships)

- In March 2025, Servotech Renewable Power System secured its first solar rooftop order from North Eastern Railway, marking a significant step in expanding its renewable energy solutions. This 2 MW project emphasizes the company's commitment to sustainable infrastructure development.

- In December 2024, Tata Power Renewable Energy partnered with Canara Bank to promote the PM Surya Ghar Scheme, offering affordable financing options for rooftop solar installations. This collaboration aims to increase solar energy adoption among Indian households, enhancing the country's sustainability efforts.

- In October 2024, Peak Energy partnered with INUPS to develop rooftop solar projects across South Korea. This collaboration aims to support South Korea's net-zero target by utilizing available rooftop spaces, targeting 30MW initially with plans for over 200MW.