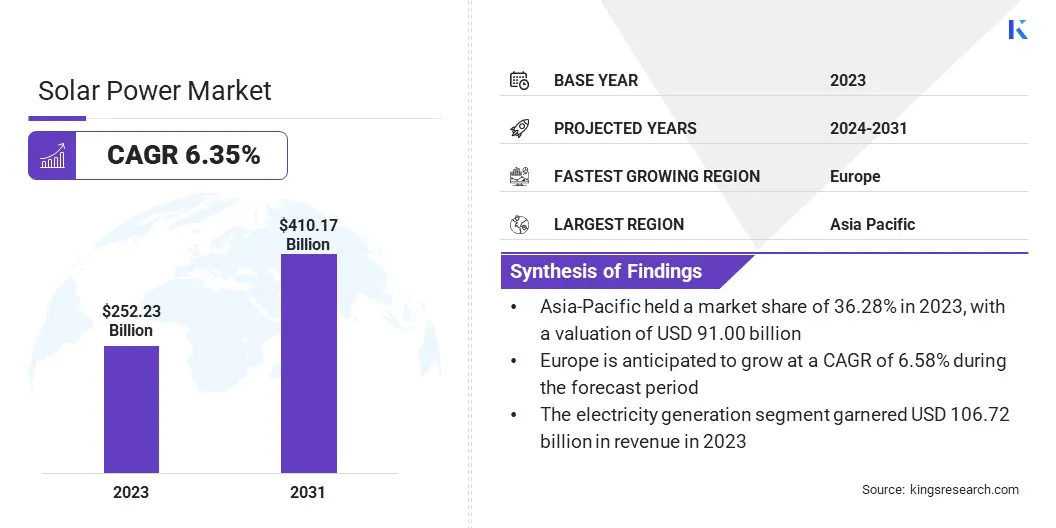

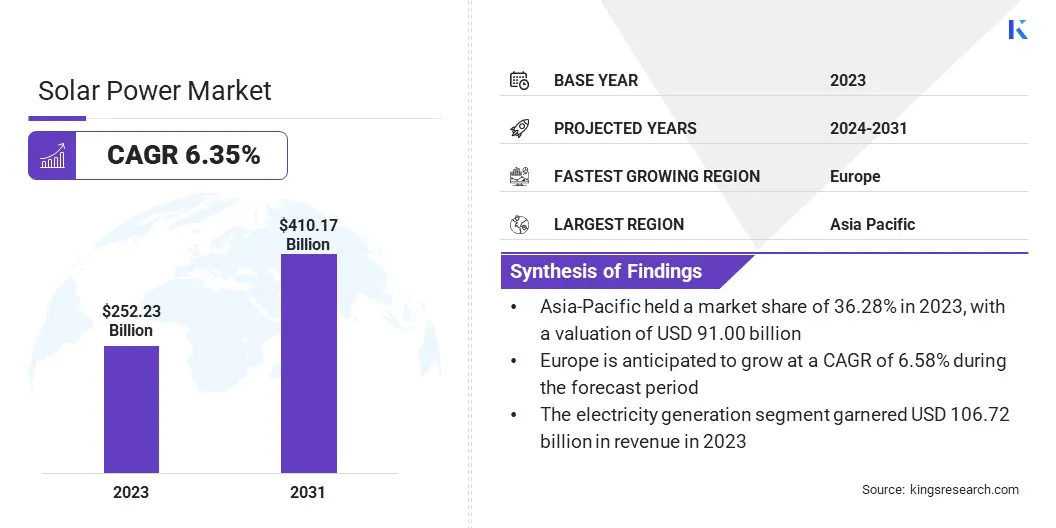

Solar Power Market Size

Global Solar Power Market size was valued at USD 252.23 billion in 2023 and is projected to grow from USD 266.57 billion in 2024 to USD 410.17 billion by 2031, exhibiting a CAGR of 6.35% during the forecast period.

In the scope of work, the report includes services offered by companies such as First Solar Inc., JinkoSolar Holding Co. Ltd., Canadian Solar Inc., SunPower Corporation, Trina Solar Co. Ltd., Yingli Green Energy Holding Co. Ltd., SolarEdge Technologies Inc., SMA Solar Technology AG, Enphase Energy Inc., Hanwha Q Cells Co. Ltd. and others.

Government incentives and policies, along with the expansion of utility-scale solar projects, are facilitating market development. Hybrid renewable energy systems (HRES) represent a significant opportunity in the solar power market by integrating multiple renewable energy sources to create a more stable and efficient power generation solution.

By integrating solar power with other renewable sources such as wind, hydro, or biomass, HRES mitigate the intermittency issues inherent in single-source renewable systems.

For instance, solar power generation peaks during sunny periods, whereas wind power can be used at different times, often complementing the solar energy supply. This synergistic approach maximizes energy output and enhances the reliability and consistency of power supply.

Additionally, the integration of energy storage technologies, such as batteries, into HRES, serves to mitigate supply fluctuations by storing excess energy generated during peak periods and releasing it during periods of low production.

- For instance, in February 2024, The Solar Energy Corporation of India Limited (SECI), under the Ministry of New and Renewable Energy, commissioned India's largest battery energy storage system (BESS) in Chhattisgarh, India. The 40 MW/120 MWh BESS, paired with a 152.325 MWh solar PV plant (100 MW AC dispatchable capacity), will help Chhattisgarh meet peak energy demand and fulfill renewable purchase obligations using green energy.

These systems are particularly advantageous in remote or off-grid areas where access to a stable energy supply is crucial. The development of HRES further introduces new business models and revenue streams for energy providers, fostering innovation and encouraging investment in the renewable energy sector.

Solar power is a form of renewable energy sourced from the sun's radiation using various technologies, primarily photovoltaic (PV) cells and solar thermal systems. Photovoltaic cells, typically made of silicon, convert sunlight directly into electricity through the photovoltaic effect, where light photons excite electrons, thereby generating a flow of electric current.

Solar thermal systems use mirrors or lenses to concentrate sunlight to heat a fluid, which then produces steam to drive turbines for electricity generation. These technologies have evolved significantly, market by advancements such as multi-junction cells that capture different wavelengths of light to improve efficiency, and perovskite cells, which offer the potential for higher efficiency at lower costs.

The applications of solar power are diverse and expanding rapidly. Residential and commercial rooftops host solar panels to generate electricity for on-site use, thereby reducing dependence on the grid and lowering utility bills.

Utility-scale solar farms produce substantial amounts of electricity, which are integrated into national grids and make a significant contribution to the energy mix. In addition, solar power is increasingly used in off-grid and remote areas, providing a reliable energy source where traditional infrastructure is lacking.

Innovations such as solar-powered irrigation systems and solar desalination plants highlight the versatility of solar energy in addressing critical global challenges, including food and water security.

Analyst’s Review

The landscape of the solar power market is shaped by strategic maneuvers and growth imperatives of key players, all of which are crucial in maintaining competitive advantage and fostering advancement.

Leading companies are focusing on vertical integration to streamline operations and reduce costs, spanning from the manufacturing of photovoltaic cells to the deployment of solar farms. This approach enhances efficiency and allows for greater control over supply chains and quality assurance.

Innovations such as bifacial solar panels, designed to capture sunlight on both sides, along with advancements in energy storage solutions, are at the forefront of these efforts, aimed at increasing energy yield and reliability.

Moreover, key solar power market players are expanding their global footprint through strategic partnerships and acquisitions, targeting emerging markets in Asia, Africa, and Latin America, where solar potential remains untapped.

- For instance, in June 2024, Recheck, a verification platform for the residential solar industry, has launched an industry registry in partnership with SEIA and key solar finance, contractor, and technology partners. Recheck provides a registry of residential solar salespeople and installers to ensure top-tier customer experiences for families transitioning to cleaner, cheaper energy.

Moreover, sustainability initiatives play a significant role, with companies setting ambitious targets for carbon neutrality and promoting corporate social responsibility (CSR) projects to enhance their public image and stakeholder engagement.

The imperative for these companies lies in balancing rapid growth with operational sustainability, addressing regulatory challenges, and fostering public and private sector collaborations to increase the adoption of solar power worldwide.

Solar Power Market Growth Factors

Government incentives and policies are pivotal factors contributing to the proliferation of solar power globally, playing a crucial role in making solar energy more accessible and affordable. These incentives often include tax credits, rebates, feed-in tariffs, and grants designed to lower the financial barriers for both consumers and businesses looking to adopt solar technology.

For instance, the Investment Tax Credit (ITC) in the United States allows homeowners and businesses to deduct a significant percentage of their solar installation costs from their federal taxes, thereby reducing the overall investment burden.

- For instance, in May 2024, The Solar Energy Industries Association (SEIA) reports that the U.S. has surpassed 5 million solar installations, a major milestone in the nation’s clean energy transition. Notably, over half were installed since 2020, with more than 25% added since the Inflation Reduction Act became law 20 months ago, spanning homes, businesses, and large ground-mounted arrays.

Additionally, numerous governments implement net metering policies, which enable solar panel owners to sell excess electricity back to the grid, providing a financial return on their investment. Renewable portfolio standards (RPS) mandate that a certain percentage of energy must come from renewable sources, prompting utilities to increase their solar capacity.

These policies stimulate the solar power market growth and foster technological innovation as companies strive to meet the increasing demand for efficient and cost-effective solar solutions.

Moreover, government support for research and development in solar technology fosters advancements, thereby reduce costs and enhance performance. By creating a favorable regulatory environment, governments significantly accelerate the transition to a sustainable energy future, promoting economic growth, job creation, and environmental benefits.

High initial investment costs remain a significant challenge to the widespread adoption of solar power, despite the long-term financial and environmental benefits. The upfront costs associated with purchasing and installing solar panels, inverters, mounting hardware, and other necessary components are prohibitive for many homeowners and small businesses.

Despite the declining cost of solar technology, the initial financial outlay remains substantial, often ranging from several thousand to tens of thousands of dollars, depending on the system size and complexity.

Additionally, the costs associated with acquiring necessary permits and inspections, as well as potential modifications to existing infrastructure, elevate the initial investment.

Financing options such as loans, leases, and power purchase agreements (PPAs) help mitigate these costs, but they may not be accessible to all potential customers, particularly those with lower credit scores or limited financial resources. This financial barrier impedes the rate of adoption, especially in developing regions where capital availability is a significant constraint.

To overcome this challenge, innovative financing solutions, government subsidies, and incentive programs are essential. Moreover, increasing public and private investment in research and development continue to reduce the costs of solar technology, which makes it more affordable and accessible to a broader audience.

Solar Power Market Trends

The rapid growth in residential solar installations is a notable trend in the solar power market, mainly due to decreasing costs, enhanced awareness of environmental issues, and supportive government policies. Homeowners are increasingly turning to solar power as a viable alternative to traditional energy sources, fostered by the aim to reduce energy bills and contribute to environmental sustainability.

Additionally, various financing options, such as solar loans, leases, and power purchase agreements (PPAs), have made it easier for homeowners to afford solar installations without significant upfront costs. Government incentives, including tax credits, rebates, and net metering policies, have further played a crucial role in boosting residential solar adoption by making it more economically attractive.

The residential solar market is experiencing robust growth, with more households installing solar panels on their rooftops each year. This trend contributes to the overall growth of the solar power industry by promoting energy independence and resilience, as homeowners generate their own electricity, thereby reducing reliance on the grid.

Furthermore, the increasing prevalence of residential solar installations is fostering the development of smart home technologies and energy management systems, thus enhancing the efficiency and sustainability of household energy use.

Segmentation Analysis

The global market is segmented based on technology, application, end use, and geography.

By Technology

Based on technology, the market is categorized into photovoltaic systems and concentrated solar power systems. The photovoltaic (PV) systems segment captured the largest share of 56.21% in 2023. The significant decline in the cost of PV technology over the past decade has made solar power more affordable and accessible to a broader range of consumers and businesses.

This cost reduction is primarily due to advancements in manufacturing processes, economies of scale, and technological innovations that have improved the efficiency and reliability of PV panels.

Additionally, increasing government support in the form of tax credits, subsidies, and favorable regulatory frameworks has incentivized the adoption of PV systems. These policies have lowered the financial barriers associated with installation and operation, thereby fostering greater participation in residential, commercial, and utility-scale projects.

Furthermore, the growing awareness regarding environmental issues and the urgent need to reduce carbon emissions have spurred demand for clean energy solutions, with PV systems emerging as a preferred choice due to their scalability and versatility.

The integration of PV systems with energy storage solutions and smart grid technologies has further enhanced their attractiveness, thereby providing more consistent and reliable power supply.

By Application

Based on application, the solar power market is classified into electricity generation, charging, lighting, and heating. The electricity generation segment garnered the highest revenue of USD 106.72 billion in 2023.

One of the main factors fueling this growth is the substantial increase in demand for renewable energy sources as countries worldwide strive to reduce their reliance on fossil fuels and mitigate the impacts of climate change. Solar power, in particular, has emerged as a leading source of clean energy due to its abundant availability and decreasing costs.

The expansion of large-scale solar farms and utility-scale projects has significantly contributed to revenue growth, as these installations generate substantial amounts of electricity to meet the needs of both urban and rural areas.

Additionally, advancements in solar technology, such as higher efficiency photovoltaic panels and improved energy storage systems, have enhanced the viability and attractiveness of solar power for electricity generation.

Government policies and incentives, including feed-in tariffs, tax credits, and renewable energy mandates, have increased the adoption of solar power, leading to substantial investment and development in the sector. Additionally, the integration of solar power into existing grids and the growing trend of decentralized energy systems have played a crucial role in boosting revenue, as they offer more reliable and resilient electricity supply options.

By End Use

Based on end use, the solar power market is divided into commercial, residential, and industrial. The industrial segment is poised to record a staggering CAGR of 7.51% through the forecast period. This considerable expansion is largely attributed to the increasing emphasis on sustainability and energy efficiency within industrial operations.

Solar energy provides a cost-effective alternative to traditional fossil fuels, allowing industrial facilities to stabilize and lower their energy expenses in the long run.

Additionally, advancements in solar technology, including improved efficiency and durability of solar panels, have made them suitable for diverse industrial applications, where large-scale energy consumption is common.

The ability to integrate solar power with existing energy systems, along with the availability of energy storage solutions, enhances energy reliability and supports uninterrupted industrial operations. Furthermore, government incentives and policies promoting renewable energy adoption in the industrial sector have spurred investments in solar projects, thereby supporting the growth of the segment.

Solar Power Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific solar power market accounted for a share of 36.08% and was valued at USD 91.00 billion in 2023. This substantial growth is augmented by several factors, including strong government support, rapid industrialization, and increasing energy demands.

Countries such as China, India, Japan, and Australia have been at the forefront of solar power adoption, implementing ambitious renewable energy targets and offering substantial incentives and subsidies to stimulate domestic industry growth.

China's substantial advancement in clean energy, supported by large-scale solar farm developments and a robust domestic manufacturing sector, has made a notable impact. India’s National Solar Mission and various state-level policies have further fueled significant investments in solar infrastructure.

- For instance, in April 2024, Tata Power Solar Systems Limited partnered with Indian Bank to promote solar rooftop adoption among residential consumers. This collaboration will provide financing solutions under the Pradhan Mantri Surya Ghar Muft Bijli Yojana for installations up to 3 KW and support installations from 3 to 10 KW under the regular scheme.

Additionally, Japan's increased focus on energy security following the Fukushima incident, coupled with Australia's favorable solar conditions and supportive policies, have strengthened their respective markets.

- For instance, in June 2024, Proterial, Ltd. inaugurated a captive-use photovoltaic power generation facility at the Toyoura Plant of Ibaraki Works in Hitachi City, Ibaraki Prefecture, to support its decarbonization efforts. Commencing full-scale operation in March 2024, the facility will generate 1.95 million kWh annually, covering approximately 3.8% of the plant's electricity consumption and reducing carbon dioxide emissions by 900 tons per year.

The Asia-Pacific region benefits from abundant sunlight, which enhances the efficiency and output of solar installations. Furthermore, declining costs of solar technologies and advancements in photovoltaic systems have made solar power economically viable, leading to the widespread adoption in residential, commercial, and utility-scale sectors.

Europe is poised to grow at a staggering CAGR of 6.58% in the forthcoming years, majorly due to progressive energy policies, ongoing technological advancements, and strong public and private sector commitment to renewable energy.

The European Union's ambitious climate goals, including the European Green Deal and the target to achieve carbon neutrality by 2050, are contributing significantly to this growth. These initiatives have led to substantial investments in renewable energy infrastructure, with a major focus on solar power.

Countries such as Germany, Spain, Italy, and the Netherlands are at the forefront of solar capacity expansion, supported by substantial additions and favorable regulatory frameworks.

- For instance, in 2023, Europe installed 70.1 GW of new solar capacity, powering nearly 21 million additional homes. The European solar market has more than doubled in two years, growing from 32.0 GW in 2021 to over 300 GW in total operational capacity, marking a significant milestone in the continent’s energy transition.

Technological innovations, such as improved photovoltaic cell efficiency and advanced energy storage solutions, are enhancing the feasibility and attractiveness of solar power. Moreover, Europe’s well-developed grid infrastructure and interconnection capabilities facilitate the integration of solar energy, ensuring a reliable supply and distribution.

The increasing adoption of decentralized energy systems and the rise of prosumers, who both produce and consume solar energy, are contributing to market growth. Additionally, there is a high level of public awareness and support for renewable energy, which is surging consumer demand for residential and community solar projects.

Competitive Landscape

The solar power market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Solar Power Market

- First Solar Inc.

- JinkoSolar Holding Co. Ltd.

- Canadian Solar Inc.

- SunPower Corporation

- Trina Solar Co. Ltd.

- Yingli Green Energy Holding Co. Ltd.

- SolarEdge Technologies Inc.

- SMA Solar Technology AG

- Enphase Energy Inc.

- Hanwha Q Cells Co. Ltd.

Key Industry Developments

- June 2024 (Launch): Tata Power Solar Systems Limited launched the national campaign ‘#GharGharSolar’ and ‘Tata Power ke Sangh’. This initiative aims to expand the company’s reach across India, promoting a sustainable future through the widespread adoption of solar energy solutions.

- January 2024 (Partnership): First Solar secured a 15-year captive Power Purchase Agreement (PPA) with Cleantech Solar. Cleantech Solar aims to build 150 MW of PV solar and 16.8 MW of wind assets in Tamil Nadu, India, providing 7.3 GWh of clean electricity to First Solar's new 3.3 GW manufacturing facility.

The global solar power market is segmented as:

By Technology

- Photovoltaic Systems

- Concentrated Solar Power Systems

By Application

- Electricity Generation

- Charging

- Lighting

- Heating

By End Use

- Commercial

- Residential

- Industrial

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America