Cosmetic Antioxidants Market Overview

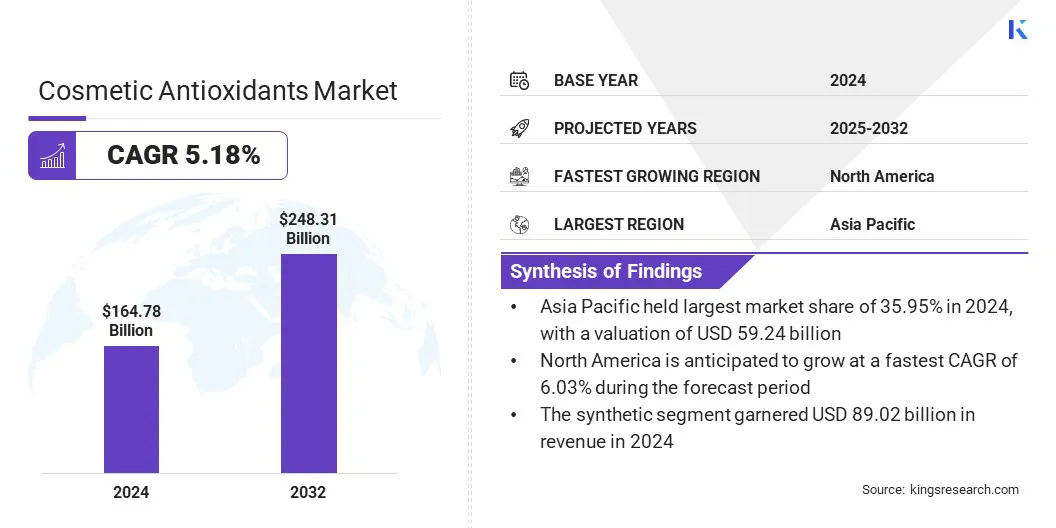

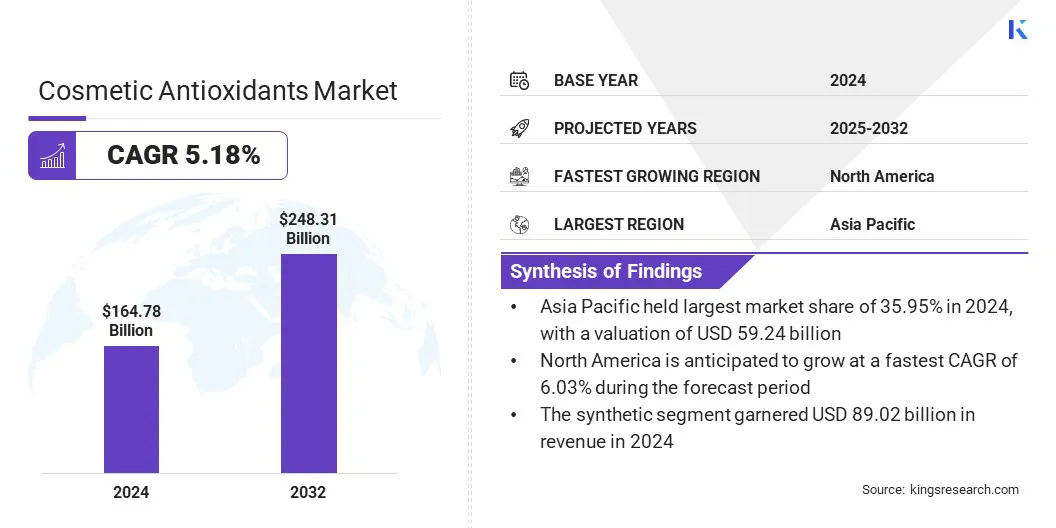

According to Kings Research, the global cosmetic antioxidants market size was valued at USD 164.78 billion in 2024 and is projected to grow from USD 172.76 billion in 2025 to USD 248.31 billion by 2032, exhibiting a CAGR of 5.18% during the forecast period.

This growth is driven by the growing adoption of encapsulation technologies, which protects sensitive ingredients from degradation and enable controlled release in skincare applications.

Consumers are increasingly prioritizing anti-aging solutions, mainly due to rising interest in products addressing wrinkles, fine lines, and age-related skin concerns. Skin rejuvenation is gaining traction, with consumers actively seeking formulations that restore elasticity, enhance skin texture, and support barrier repair.

Key Market Highlights:

- The cosmetic antioxidants industry was recorded at USD 164.78 billion in 2024.

- The market is projected to grow at a CAGR of 5.18% from 2025 to 2032.

- Asia Pacific held a share of 35.95% in 2024, valued at USD 59.24 billion.

- The synthetic segment garnered USD 89.02 billion in revenue in 2024.

- The vitamins segment is expected to reach USD 68.22 billion by 2032.

- The uv-protection segment is anticipated to witness the fastest CAGR of 5.70% over the forecast period.

- The skin care segment is projected to hold a share of 32.93% by 2032.

- North America is anticipated to grow at a CAGR of 6.03% through the projection period.

Major companies operating in the cosmetic antioxidants market are BASF SE, Wacker Chemie AG, Evonik Industries AG, Jan Dekker, Nexira, Croda International Plc, Provital, Symrise AG, Corbion NV, Barentz International BV, Eastman Chemical Company, Ashland, Btsa, The Estee Lauder Companies, and SEPPIC.

Antioxidants are being integrated into advanced skincare products to enhance renewal, firmness, and a youthful appearance, underscoring their importance in cosmetic innovation.

- In January 2025, Bonerge initiated a clinical trial to evaluate the oral effects on skin aging indicators, including elasticity, firmness, wrinkles, hydration loss, pigmentation, and inflammation.

Rising Demand for Premium Skincare and Personal Care Products

A key factor propelling the progress of the cosmetic antioxidants market is the rising demand for premium skincare and personal care products. Companies are continuously introducing advanced antioxidant-based solutions that target anti-aging concerns, environmental damage, and skin rejuvenation.

Consumer preference for safe, clinically validated, and high performance products is boosting the adoption of antioxidants in serums, creams, and specialized treatments, supporting premiumization in the global skincare and personal care industry.

- In January 2025, HUL announced plans to fully acquire Minimalist within two years. The acquisition aims to strengthen its beauty & wellbeing portfolio, expand in the high-growth in beauty segment, and address rising demand for premium care products.

Rapid Proliferation of Counterfeit Cosmetic Products

A major challenge hindering the expansion of the cosmetic antioxidants market is the proliferation of counterfeit cosmetic products. They often contain unsafe ingredients and lack efficacy, undermining consumer trust and brand credibility. This affects established companies that are investing heavily in innovation, as counterfeit versions erode sales and reputation.

In response, regulatory authorities are increasing oversight, while companies are adopting authentication measures to safeguard product integrity and ensure consumer safety.

To address this challenge, companies are implementing track-and-trace technologies such as QR codes, barcodes, and RFID, enhancing supply chain transparency, and strengthening collaborations with regulators to reduce counterfeit circulation and maintain consumer confidence in authentic cosmetic products.

Rising Adoption of Plant-Derived and Natural Antioxidants

A notable trend influencing the cosmetic antioxidants market is the rising adoption of plant-derived and natural antioxidants, supported by rising consumer preference for clean-label and sustainable skincare. Manufacturers are increasingly utilizing botanical extracts such as polyphenols, carotenoids, and flavonoids to offer effective, natural solutions.

Growing awareness of ingredient sourcing, safety, and regulatory compliance is further fueling this trend. Companies are expanding portfolios with standardized natural extracts to ensure consistent efficacy and quality, boosting market expansion.

- In April 2025, BASF expanded its natural-based ingredient portfolio with Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA, responding to rising sustainability demands in the personal care sector.

Cosmetic Antioxidants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Source

|

Synthetic, Natural

|

|

By Type

|

Vitamins, Carotenoids, Polyphenols, Enzymes, Others

|

|

By Function

|

Anti-aging, UV-Protection, Cleansing & Conditioning, Moisturizing, Others

|

|

By Application

|

Skin care, Hair care, Make-up, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Source (Synthetic and Natural): The synthetic segment earned USD 89.02 billion in 2024, primarily due to its cost efficiency, consistent availability, and suitability for large-scale cosmetic formulations requiring stable and uniform antioxidant properties.

- By Type (Vitamins, Carotenoids, Polyphenols, Enzymes, and Others): The vitamins segment held a share of 27.44% in 2024, owing to the extensive use of vitamin C and E in skincare products targeting oxidative stress, skin rejuvenation, and anti-aging concerns.

- By Function (Anti-aging, UV-Protection, Cleansing & Conditioning, Moisturizing, and Others): The anti-aging segment is projected to reach USD 69.80 billion by 2032, propelled by rising consumer demand for products that address wrinkles, fine lines, and age-related skin concerns through targeted antioxidant formulations.

- By Application (Skin care, Hair care, Make-up, and Others): The hair care segment is anticipated to witness the fastest CAGR of 5.48% over the forecast period, fueled by growing demand for antioxidants that promote scalp health, hair damage repair, and environmental protection.

Cosmetic Antioxidants Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific cosmetic antioxidants market share stood at 35.95% in 2024, valued at USD 59.24 billion. This dominance is reinforced by the rising consumer demand for premium skincare formulations that address anti-aging and pollution-related concerns.

Expanding urban populations are increasing awareness of skincare benefits, while regional manufacturers focus on incorporating plant-derived antioxidants into their product portfolios.

- In September 2024, Evonik introduced two products to address demand for sustainable, natural actives in beauty and personal care. CapilAcid, derived from Maqui fruit, provides antioxidant protection for hair, while Oleobiota, sourced from the Misiones rainforest, supports sebum-regulating skincare formulations.

North America is estimated to grow at a robust CAGR of 6.03% over the forecast period. This expansion is attributed to the strong consumer preference for dermatologically tested and clinically validated skincare solutions.

In particular, the increasing popularity of premium anti-aging formulations is boosting the adoption of antioxidant-based creams, serums, and specialized treatments. Additionally, the presence of established skincare brands focused on innovation in antioxidant formulations reinforces product availability and supports consumer adoption.

Regulatory Frameworks

- In the EU, the Cosmetics Regulation (EC) No 1223/2009 controls cosmetic product safety. It ensures that antioxidants used in formulations are safe, properly labeled, and compliant with restricted substance lists.

- In the U.S., the Federal Food, Drug, and Cosmetic Act (FD&C Act) governs cosmetic ingredients. It requires that antioxidants incorporated into cosmetics are not adulterated or misbranded, ensuring consumer protection and product integrity.

- In Japan, the Pharmaceutical and Medical Device Act enforces cosmetic ingredients. It defines permitted and restricted substances, requiring safety evaluation of antioxidants before use in cosmetic formulations distributed in the domestic market.

- In China, the Cosmetic Supervision and Administration Regulation (CSAR) directs cosmetic products. It mandates registration or filing of new ingredients, including antioxidants, and requires safety assessment to ensure compliance with national standards.

- In India, the Drugs and Cosmetics Act and Rules monitors cosmetic formulations. It oversees the safety and labeling of ingredients, including antioxidants, ensuring adherence to quality standards and prevention of harmful ingredient usage.

Competitive Landscape

Key players in the cosmetic antioxidants industry are focusing on expanding product portfolios through the development of stabilized and plant-derived antioxidant formulations. To support this, companies are advancing research initiatives to enhance ingredient efficacy and extend product shelf life.

Furthermore, strategic collaborations with biotechnology firms and raw material suppliers are being established to secure consistent access to high-quality extracts. In line with these efforts, market participants are also broadening their regional presence by strengthening distribution networks.

- In August 2025, Clinique, part of Estée Lauder Companies, launched on the Amazon.com.mx Premium Beauty store, aimed at expanding consumer access to its allergy-tested, fragrance-free skincare and makeup products.

Key Companies in Cosmetic Antioxidants Market:

- BASF SE

- Wacker Chemie AG

- Evonik Industries AG

- Jan Dekker

- Nexira

- Croda International Plc

- Provital

- Symrise AG

- Corbion NV

- Barentz International BV

- Eastman Chemical Company

- Ashland

- Btsa

- The Estee Lauder Companies

- SEPPIC

Recent Developments (Collaboration)

- In February 2025, The Estee Lauder Companies (ELC) collaborated with Serpin Pharma to leverage its anti-inflammatory research in cosmetics. The partnership strengthens ELC’s product innovation by integrating Serpin Pharma’s to advance global skin longevity solutions.