Market Definition

The beauty and personal care products industry includes products for grooming, hygiene, and enhancing appearance, such as skincare, haircare, makeup, fragrances, and personal care items.

Driven by growing interest in self-care, social media influence, and demand for natural ingredients, the market offers products across various price points, from mass-market to luxury. It continues to evolve with trends like eco-friendly packaging and innovative formulations.

Beauty and Personal Care Products Market Overview

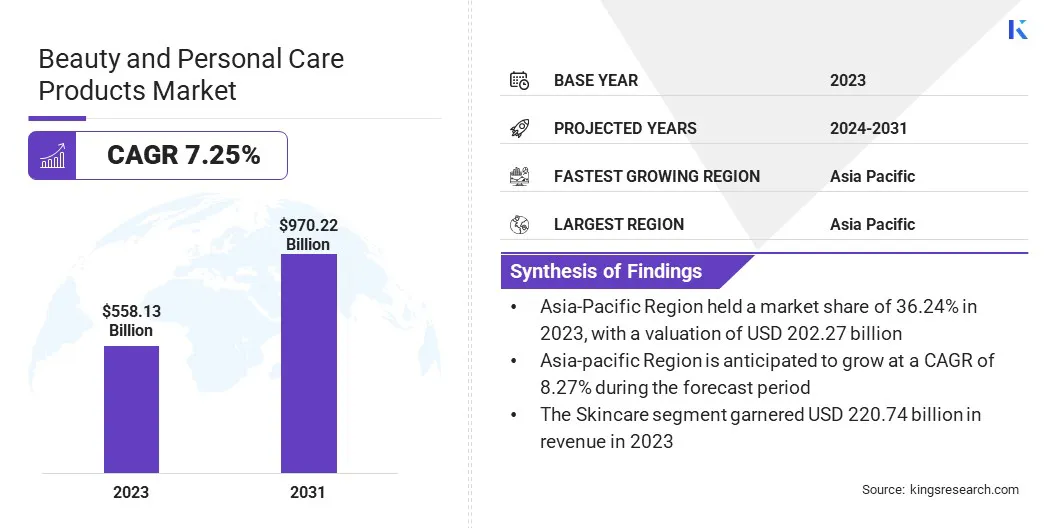

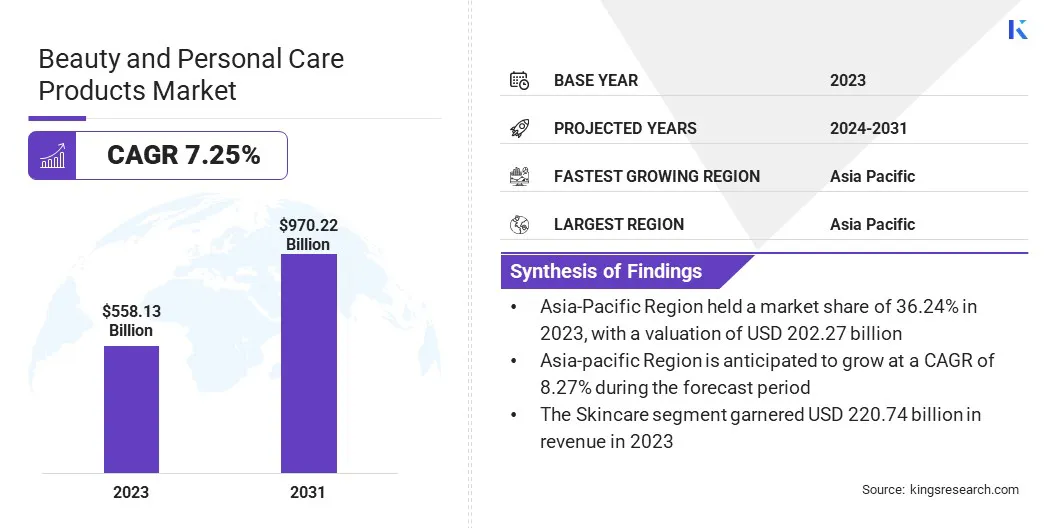

The beauty and personal care products market size was valued at USD 558.13 billion in 2023 and is projected to grow from USD 594.43 billion in 2024 to USD 970.22 billion by 2031, exhibiting a CAGR of 7.25% during the forecast period.

The market is booming, fueled by a surge in personal grooming, social media trends, popularity of natural ingredients, revolutionary products, and a growing focus on self-care. Considerably increased product availability across a wide range of prices, combined with the expansion of online shopping, considerably fuels the market.

Major companies operating in the beauty and personal care products market are L'Oréal, Procter & Gamble, Unilever, Johnson & Johnson Services, Inc., Revlon., Avon India, Kao Corporation, Coty Inc., Shiseido Co., Ltd., Colgate-Palmolive Company., and Amorepacific.

The market is driven by the growing consumer interest in self-care, influence of social media, and an increasing demand for natural and organic ingredients.

It serves a diverse consumer base, with products available at various price points, from mass-market to luxury brands, and continues to evolve with trends like eco-friendly packaging and innovations in skincare and beauty formulations.

Key Highlights:

- The global beauty and personal care products market size was valued at USD 558.13 billion in 2023.

- The market is projected to grow at a CAGR of 7.25% from 2024 to 2031.

- Asia Pacific held a market share of 36.24% in 2023, with a valuation of USD 202.27 billion.

- The specialty stores segment garnered USD 196.10 billion in revenue in 2023.

- The skincare segment is expected to reach USD 407.75 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.27% during the forecast period.

Market Driver

"Rising Consumer Preference for Natural and Organic Ingredients"

Consumers are increasingly turning to natural and organic ingredients in beauty and personal care items, due to the growing demand for health-conscious and eco-friendly products. Concerned about the risks of synthetic chemicals, many individuals seek safer, gentler alternatives.

The focus on sustainability, including biodegradable and cruelty-free options, along with the rise of the clean beauty movement driven by influencers and wellness trends, has further boosted this demand. As a result, natural and organic beauty products are becoming a major market segment.

- Tata Harper Skincare emphasizes using 100% natural and non-toxic ingredients in its products, sourced from its farm. It focuses on creating luxurious, effective formulations that deliver visible results without compromising on purity or sustainability. Every product is made with high-quality, plant-based ingredients, and the brand is committed to eco-friendly practices, from packaging to production. Its formulas are designed to promote healthy, radiant skin while supporting a cleaner, greener beauty industry.

The shift toward natural and organic beauty products is reshaping the market, with more brands adopting sustainable, plant-based formulations to meet consumer demand. The market for natural and organic products is set to expand further as consumers increasingly prioritize transparency, ethical sourcing, and eco-friendly practices.

This growing preference is driving innovation, with brands developing new products that offer both efficacy and environmental responsibility, signaling a long-term change in the beauty and personal care landscape.

Market Challenge

"Ensuring Global Regulatory Compliance and Quality"

The beauty and personal care products market encounters significant challenges, due to the complexities of navigating international regulations. These regulations are constantly evolving, and failing to meet them can result in substantial penalties and long-lasting damage to a brand's reputation.

Global product launches are further complicated by the need to manage numerous variations in products, packaging, and claims to ensure compliance. Many companies still rely on outdated, manual systems for this process, leading to inefficiencies, version control issues, and missed opportunities for content reuse.

This resource-intensive approach increases compliance risks and significantly hinders a company's ability to adapt to changing regulations and market demands. Companies can adopt automated compliance management tools and centralized data systems to streamline product tracking and ensure consistency across markets.

Digitalizing packaging and labeling processes helps companies easily adapt to varying regional requirements, reducing compliance risks and improving efficiency.

Market Trend

"Shift toward clean, natural, and sustainable beauty"

Consumers are increasingly favoring products with natural ingredients, free from harmful chemicals, and eco-friendly packaging. Driven by concerns about health, wellness, and sustainability, they demand greater transparency from brands.

In response, companies are reformulating products, adopting sustainable practices, and prioritizing ethical sourcing, making clean beauty a dominant industry force.

- In May 2024, American Chemical Society announced that the beauty and personal care products industry is registering a significant shift as consumers prioritize clean, natural, and sustainable beauty. Driven by growing health and environmental concerns, consumers are seeking products made with natural ingredients and free from harmful chemicals, along with eco-friendly packaging. Innovations such as Natural Deep Eutectic Solvents (NaDES) are emerging as eco-friendly solutions, enhancing the extraction and formulation of natural compounds in cosmetics.

The growing use of clean, natural, and sustainable products is transforming the beauty and personal care industry. This shift is encouraging brands to invest in research and development to create high-performance, plant-based formulations.

As sustainability becomes a core focus, the industry is expected to see continued innovation in eco-conscious product development.

Beauty and Personal Care Products Market Report Snapshot

| Segmentation |

Details |

| By Distribution Channel |

Hypermarket/Supermarket, Specialty Stores, Drugstores/Pharmacy, Online Retailers, Others |

| By Product Type |

Skincare (Facial care (Cleansers, Toners, Moisturizers, Serums, Masks, Others)), Bodycare (Lotions, Creams, Oils, Scrubs, others)), Haircare (Shampoos, conditioner, oil, others), Color Cosmetics/Makeup (Foundation, Concealer, Eyeshadow, Lipstick, other), Fragrances (Perfumes, Colognes, Eau de Toilette, others), Others |

| By Consumer Orientation |

Men, Women, Children |

| By Nature |

Organic, Conventional |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Drugstores/Pharmacy, Online Retailers, Others): The specialty stores segment earned USD 178.37 billion in 2023, due to their curated selection of premium products, expert advice, and personalized shopping experiences. This trend is driven by consumers seeking high-quality and niche beauty solutions in a specialized setting.

- By Product Type (Skincare, Haircare, Color Cosmetics/Makeup, Fragrances, Others): The skincare segment held 39.55% share of the market in 2023, due to the growing consumer focus on health, wellness, and self-care. Increased awareness of skincare benefits, along with the rise of natural and clean beauty trends, has driven the demand for a wide range of skincare products, including moisturizers, serums, and anti-aging solutions.

- By Consumer Orientation (Men, Women, Children): The women segment earned USD 264.05 billion in 2023, driven by high demand for skincare, makeup, and clean beauty products. Increasing awareness of skincare routines and a focus on personalized, sustainable options contributed to the segment’s growth.

- By Nature, (Organic, Conventional): The conventional segment is expected to grow at a CAGR of 7.66%, driven by the continued demand for affordable and widely available beauty and personal care products. Conventional products often offer a broader range of options and are typically more accessible to consumers, maintaining their strong presence in the market despite the rise of organic alternatives.

Beauty and Personal Care Products Market Regional Analysis

Asia Pacific accounted for a significant market share of around 36.24% in 2023, valued at USD 202.27 billion. Asia Pacific region dominates the beauty and personal care products market, due to a large, diverse consumer base, growing urbanization, rising disposable incomes, and increasing awareness of skincare and beauty routines.

Countries like China, Japan, India, and South Korea are key drivers of this growth, with the large, diverse populations, rising disposable incomes, and increasing interest in beauty and personal care products. The demand for both traditional and innovative skincare solutions, along with the growing popularity of clean and natural beauty trends, further accelerates the market expansion.

Additionally, the strong presence of local and global beauty brands, along with the rapid growth of e-commerce, continues to fuel the region's dominance in the global market.

The market in North America is poised to grow at a CAGR of 6.53% through the projection period, driven by the increasing demand for natural, organic, and clean beauty products. Consumers are becoming more health-conscious and environmentally aware, leading to a shift toward sustainable and ethically sourced products.

This growing preference for non-toxic, cruelty-free, and eco-friendly beauty solutions is prompting brands to innovate and reformulate their offerings to meet consumer expectations.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Regulation (EC) No. 1223/2009 of the European Union (EU) governs the safety of cosmetics sold in the EU. It requires that all cosmetic products be safe for human health when used under normal or reasonably foreseeable conditions. Manufacturers must ensure that their products undergo safety assessments before being placed on the market, provide ingredient lists, and adhere to strict labeling standards. The regulation also includes a ban on animal testing and prohibits the use of more than 1,300 ingredients deemed unsafe. It ensures ongoing market surveillance and enforces compliance to protect consumers' health and well-being.

- The Federal Food, Drug, and Cosmetic Act (FDCA) empowers the FDA to regulate the production, sale, and distribution of food, drugs, medical devices, and cosmetics in the U.S., aiming to protect the public from adulterated or misbranded products. It was introduced after the deadly sulfanilamide poisoning incident, which highlighted the need for stricter safety standards. The FDCA requires manufacturers to prove the safety and efficacy of new drugs before marketing and mandates quality standards for food, drugs, and cosmetics. The FDA enforces these regulations, conducts inspections, recalls unsafe products, and regulates advertising, labeling, and health claims.

- The National Medical Products Administration (NMPA) is responsible for regulating cosmetics in China. It ensures product safety by overseeing the registration and approval process for cosmetic products, including both domestic and imported items. The NMPA requires detailed product information, including ingredients, labeling, and safety data. It also enforces regulations to protect consumers from harmful substances, mandates animal testing for most imported cosmetics, and monitors the market for compliance. The NMPA plays a critical role in ensuring the safety, quality, and efficacy of cosmetics sold in China.

- Under the Drugs and Cosmetics Act, cosmetics manufacturing in India is regulated through state-level inspections and licensing, while the importation of cosmetics is overseen by the Drugs Controller General of India (DCGI) under a registration system. All imported cosmetics must be registered with the Central Licensing Authority and comply with safety and quality standards, including those specified in the Ninth Schedule or the country of origin.

Competitive Landscape

The beauty and personal care products industry is characterized by a large number of participants, including both established corporations and rising organizations.

To achieve a competitive landscape, key players in the beauty and personal care products market must focus on innovation, strategic partnerships, and expanding their distribution channels. They invest in research and development (R&D) to offer new, high-quality, and sustainable products that cater to evolving consumer demands.

- L'Oréal invests significantly in R&D to drive innovation across skincare, haircare, and cosmetics. Through a global network of research centers, the company develops advanced products, focusing on sustainability, eco-friendly formulations, and packaging. Additionally, L'Oréal integrates digital technologies, such as Artificial Intelligence (AI), to enhance product personalization and accelerate innovation, maintaining its leadership in the beauty industry.

List of Key Companies in Beauty and Personal Care Products Market:

- L’Oréal

- Procter & Gamble

- Unilever

- Johnson & Johnson Services, Inc

- Revlon

- Avon India

- The Estée Lauder Companies

- Kao Corporation

- Coty Inc.

- Shiseido Co.,Ltd

- Colgate-Palmolive Company

- Amorepacific

- Henkel AG & Co. KGaA

Recent Developments

- In April 2023, L'Oréal signed an agreement with Natura &Co to acquire Aesop, a premium skincare brand. This acquisition aims to enhance L'Oréal’s portfolio by adding Aesop’s unique, high-quality products focused on sustainability and luxury. The deal allows L'Oréal to further expand its presence in the premium skincare segment while benefiting from Aesop’s strong brand reputation and global growth potential. The transaction is expected to strengthen L'Oréal’s position in the fast-growing global skincare market.

- In March 2023, Sephora partnered with TikTok to launch a new program aimed at supporting rising beauty brands and content creators. The initiative focuses on helping emerging beauty brands gain visibility and connect with TikTok’s vibrant beauty community. Through this collaboration, Sephora will provide resources, guidance, and opportunities for these brands to engage with a broader audience. The program leverages TikTok’s platform to amplify trends, showcase product launches, and create interactive experiences, fostering growth and innovation in the beauty industry.

- In August 2024, L'Oréal acquired a significant stake in Galderma, a global leader in dermatology. This strategic move allows L'Oréal to strengthen its position in the dermatology and esthetic medicine market, enhancing its offerings in both skincare and medical esthetics. Galderma’s expertise in dermatological treatments complements L'Oréal's beauty portfolio, marking an expansion into the growing market of skin health solutions. The partnership also allows for innovative product development, leveraging both companies’ strengths in science and research to address evolving consumer needs.