Market Definition

The market focuses on the production, distribution, and utilization of naturally derived antioxidant compounds that inhibit oxidation and protect cells from damage caused by free radicals.

These plant-based antioxidants are widely used in food, pharmaceuticals, cosmetics, and animal feed to extend shelf life, boost health benefits, and meet the demand for clean-label and sustainable products. The report identifies principal factors that contribute to market expansion, along with an analysis of the competitive landscape influencing its growth.

Natural Antioxidants Market Overview

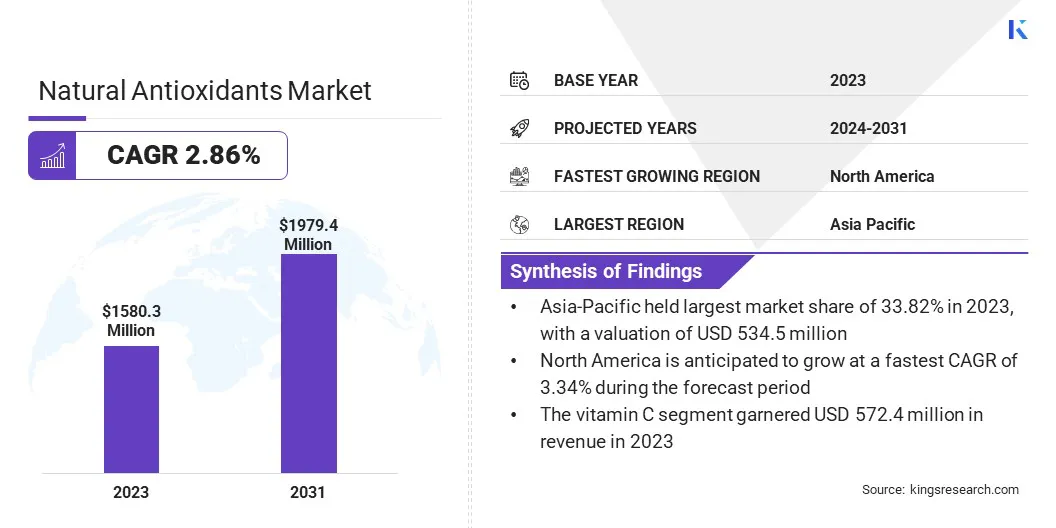

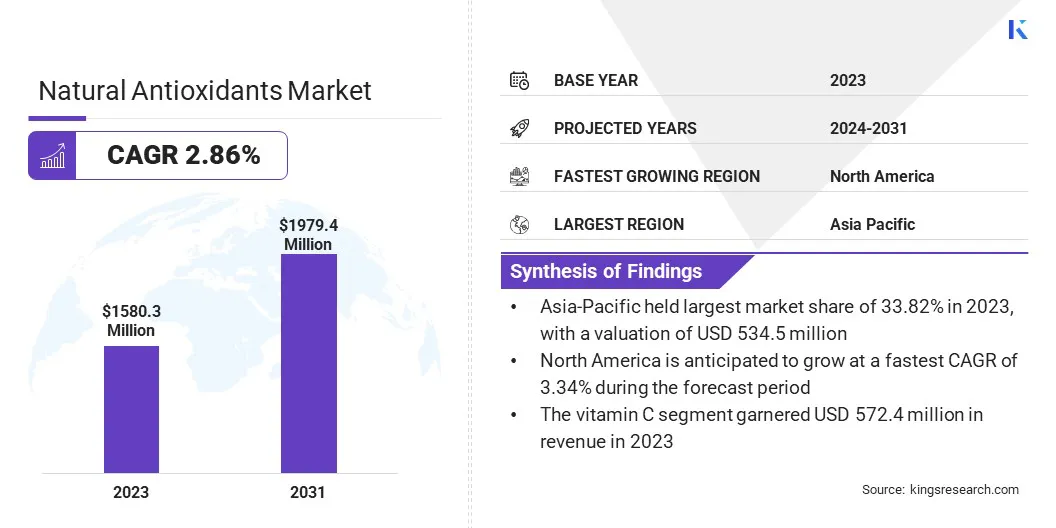

The global natural antioxidants market size was valued at USD 1580.3 million in 2023 and is projected to grow from USD 1624.5 million in 2024 to USD 1979.4 million by 2031, exhibiting a CAGR of 2.86% during the forecast period.

This growth is attributed to the rising consumer preferences for clean-label, natural, and health-promoting ingredients across end-use sectors such as food & beverages, pharmaceuticals, cosmetics, and animal nutrition.

Increasing awareness of the adverse health effects associated with synthetic additives is driving the demand for plant-based antioxidants, creating significant opportunities for manufacturers and suppliers of natural extracts.

Major companies operating in the natural antioxidants industry are dsm-firmenich, ADM, Kemin Industries, Inc., Barentz, Camlin Fine Sciences Ltd., Cargill, Prinova Group LLC, Ashland, DuPont, Indena S.p.A, Kalsec Inc., Vitablend Nederland B.V., Blue California, Naturex and Adisseo.

The growing emphasis on preventive healthcare and wellness, combined with shifting dietary patterns and regulatory support for natural ingredients, has further accelerated the market development.

- In January 2023, the National Center for Biotechnology Information (NCBI), published the article titled "Natural antioxidants from some fruits, seeds, foods, natural products, and associated health benefits". The article offers a comprehensive review of antioxidants derived from natural sources and their pharmacological relevance, emphasizing their role in combating oxidative stress and chronic diseases.

Additionally, continuous advancements in extraction and formulation technologies, along with the rising demand for sustainable and functional products, are driving the market by improving the bioavailability, stability, and efficacy of natural antioxidant compounds.

Key Highlights

- The natural antioxidants market size was valued at USD 1580.3 million in 2023.

- The market is projected to grow at a CAGR of 2.86% from 2024 to 2031.

- Asia-Pacific held a market share of 33.82% in 2023, with a valuation of USD 534.5 million.

- The vitamin C segment garnered USD 572.4 million in revenue in 2023.

- The food segment is expected to reach USD 543.8 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 3.34% during the forecast period.

Market Driver

Rising Health Consciousness and Demand for Clean-label Products

The market is propelled by the rising health consciousness and a strong consumer shift toward clean-label products. With growing awareness of the adverse effects of synthetic additives, consumers are increasingly seeking natural and recognizable ingredients in food, beverages, and supplements.

This is compelling leading manufacturers to replace artificial antioxidants with plant-derived alternatives such as tocopherols, polyphenols, and carotenoids.

- In September 2024, Syensqo launched Riza, a new range of 100% plant-based antioxidants and flavors derived from rosemary. This initiative follows its acquisition of the Moroccan rosemary extraction company Azerys in July 2024. Riza aims to replace artificial preservatives in food, offering natural alternatives to preserve omega-3 fatty acids, stabilize flavor, and extend shelf life. The products, which are available in powder and liquid forms, are non-GMO and ethically sourced from wild rosemary in Morocco's Atlas Mountains.

This trend is further supported by the expanding interest in holistic wellness, preventive healthcare, and dietary transparency, particularly among health-focused demographics such as millennials and aging populations. As a result, product reformulations with natural ingredients are gaining momentum across functional food, nutraceutical, and personal care sectors.

The increasing demand for clean-label products is compelling brands to invest in transparent sourcing, natural preservation methods, and scientifically backed antioxidant ingredients, thereby accelerating the growth of the natural antioxidants market globally.

Market Challenge

Stability and Shelf Life Concerns

The stability and shelf life of natural antioxidants present a critical challenge to the growth and adoption of these ingredients, particularly in industries such as food, beverages, and personal care.

Many natural antioxidants are prone to degradation when exposed to heat, light, oxygen, and moisture, reducing their effectiveness over time and limiting their ability to extend product shelf life. These issues can lead to inconsistent product quality and consumer dissatisfaction, particularly in sectors where product freshness and efficacy are paramount.

Moreover, maintaining the potency of natural antioxidants often requires costly preservation techniques, specialized packaging, and refrigeration, which can increase production costs and complexity.

Manufacturers are exploring advanced technologies such as encapsulation and controlled-release systems to protect antioxidants from environmental degradation. Specialized packaging designed to block light and oxygen, along with the development of more stable natural sources, are also being implemented to improve antioxidant longevity.

Additionally, research into antioxidant blends that enhance stability and synergistic effectiveness is gaining traction. These strategies aim to ensure that natural antioxidants can maintain their functionality and meet consumer expectations, paving the way for wider adoption and greater market growth.

- In August 2023, the National Center for Biotechnology Information (NCBI) published the article titled "Harnessing Natural Antioxidants for Enhancing Food Shelf Life: Exploring Sources and Applications in the Food Industry" in Foods by MDPI (Multidisciplinary Digital Publishing Institute) . The article provides a detailed review of natural antioxidants, focusing on their role in food preservation and their potential to extend shelf life while preserving nutritional quality and safety.

Market Trend

Integration into Functional Foods and Nutraceuticals

Technological advancements play a pivotal role in enhancing the integration of natural antioxidants into functional foods and nutraceuticals, driving the market. New extraction techniques, such as supercritical fluid extraction and enzymatic methods, have improved the efficiency and sustainability of obtaining high-quality natural antioxidants from plant-based sources, making them more accessible for use in functional food products and dietary supplements.

Additionally, advancements in formulation technologies are enhancing the bioavailability and stability of natural antioxidants, ensuring that they remain effective in diverse product formats. These innovations help preserve the potency of antioxidants, allowing for their inclusion in products with extended shelf life, such as fortified beverages, snack bars, and nutraceutical capsules.

Moreover, the development of controlled-release systems enables antioxidants to be gradually released over time, further improving their efficacy in supporting long-term health benefits.

Natural Antioxidants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Vitamin C, Vitamin E, Polyphenols, Carotenoids

|

|

By Application

|

Pharmaceuticals, Food, Animal Feed, Beverages, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Vitamin C, Vitamin E, Polyphenols and Carotenoids): The vitamin C segment earned USD 572.4 million in 2023, on account of its widespread use in food, beverages, and supplements for its antioxidant properties and immune-boosting benefits.

- By Application (Pharmaceuticals, Food, Animal Feed, Beverages and Others): The food segment held 27.44% share of the market in 2023, due to the growing demand for natural preservatives and health-enhancing ingredients in packaged and processed food products.

Natural Antioxidants Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 33.82% share of the natural antioxidants market in 2023, with a valuation of USD 534.5 million. This market dominance is attributed to the growing health awareness, rising disposable incomes, and strong demand for functional foods and dietary supplements in countries such as China, India, and Japan.

Furthermore, the widespread use of traditional herbal medicines and natural remedies, combined with an increasing preference for clean-label and plant-based products, continues to support the market growth.

Favorable government initiatives that promote the use of natural ingredients, along with advancements in extraction technologies and expanding nutraceutical production capabilities, further reinforce Asia Pacific’s position in the global market.

- In May 2024, the Mahatma Gandhi University Innovation Foundation (MGUIF) entered a Memorandum of Understanding (MOU) with Camlin Fine Sciences Ltd. to develop natural antioxidants for food preservation. The partnership, which involves using spray drying technology for Camlin’s proprietary products, is currently in its pilot phase at MGUIF’s facility, with plans for large-scale production in the future.

The natural antioxidants industry in North America is poised for significant growth at a robust CAGR of 3.34% over the forecast period. This growth is attributed to the increasing consumer focus on health and wellness, which is driving the demand for natural and plant-based ingredients in everyday food and supplement products.

The region’s well-developed retail and healthcare infrastructure, coupled with a strong presence of leading nutraceutical and functional food manufacturers, supports the widespread availability and adoption of antioxidant-rich offerings.

Moreover, a heightened awareness of oxidative stress and its link to chronic diseases is encouraging consumers to seek antioxidant-enriched diets. Continued investment in research, innovation, and strategic partnerships is further propelling the market in North America.

Regulatory Frameworks

- In the European Union (EU), the Novel Foods Regulation (EU) 2015/2283 regulates the approval of new ingredients used in food products. It ensures that antioxidants derived from novel sources or in novel forms are safe for consumption before being placed on the market.

- In the U.S., the Food, Drug, and Cosmetic Act (FDCA) by the FDA, governs the use of natural antioxidants in food and cosmetics. Antioxidants should be safe for consumption or topical use and must meet FDA approvals for labeling claims, particularly when marketed for health benefits.

- In India, the Food Safety and Standards Authority of India (FSSAI), regulates the use of food additives. The FSSAI ensures that antioxidants used in food products comply with safety standards and are properly labeled.

Competitive Landscape

The natural antioxidants market is characterized by a diverse mix of well-established global manufacturers and dynamic regional players, each focusing on expanding their product portfolios and global reach through innovation and strategic partnerships.

Leading companies are actively investing in research and development to create high-stability formulations and enhance the efficacy of antioxidant compounds derived from natural sources. Emphasis is placed on sustainable sourcing practices and the development of clean-label, plant-based ingredients to meet the growing consumer demands for health-conscious and environmentally friendly products.

Additionally, firms are forming alliances with food, nutraceutical, and cosmetic brands to integrate natural antioxidants into a wider range of applications. Innovation, regulatory compliance, and traceability remain central to maintaining competitiveness, as the global demand for functional, transparent, and high-quality natural ingredients continues to rise.

- In September 2024, Givaudan Active Beauty launched the [N.A.S.] Vibrant Collection, a line of five vegan botanical extracts designed to enhance hybrid makeup formulations with both color and skincare benefits. These 100% natural extracts, crafted through green fractionation, include Curcuma 7409 (soothing), Gardenia 2168 (anti-aging), Spirulina 2183 (brightening), Radish 1805 (skin protection), and Radish 2364 (anti-glycation).

List of Key Companies in Natural Antioxidants Market:

- dsm-firmenich

- ADM

- Kemin Industries, Inc.

- Barentz

- Camlin Fine Sciences Ltd.

- Cargill

- Prinova Group LLC

- Ashland

- DuPont

- Indena S.p.A

- Kalsec Inc.

- Vitablend Nederland B.V.

- Blue California

- Naturex

- Adisseo