Market Definition

The market focuses on outsourcing production processes, including formulation, testing, and assembly, to third-party manufacturers. It covers industries, including pharmaceuticals, cosmetics, electronics, and industrial equipment.

Contract manufacturers handle raw material sourcing, blending, component integration, and final packaging. This model supports companies lacking in-house capabilities or seeking cost and time efficiency.

Applications range across healthcare, automotive, consumer goods, and aerospace sectors. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Contract Manufacturing Market Overview

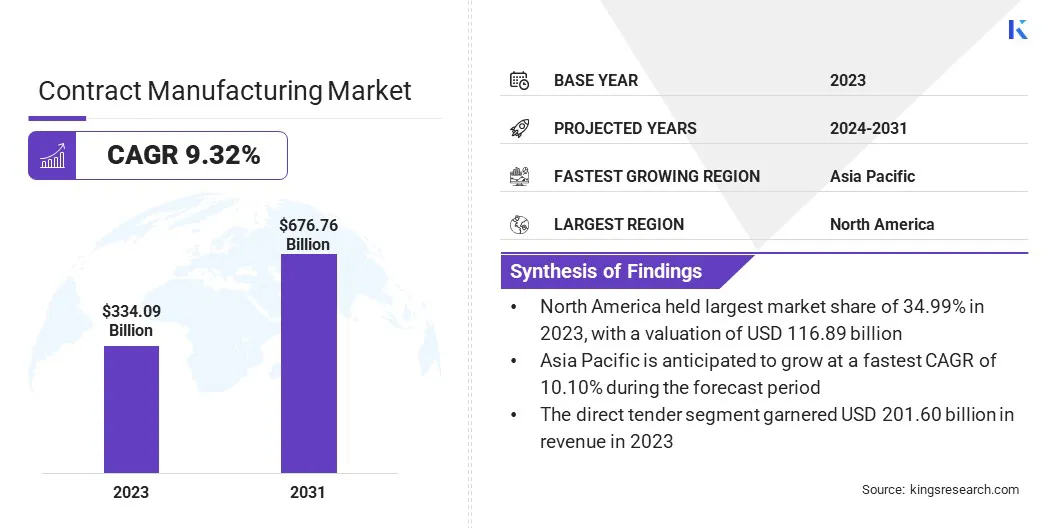

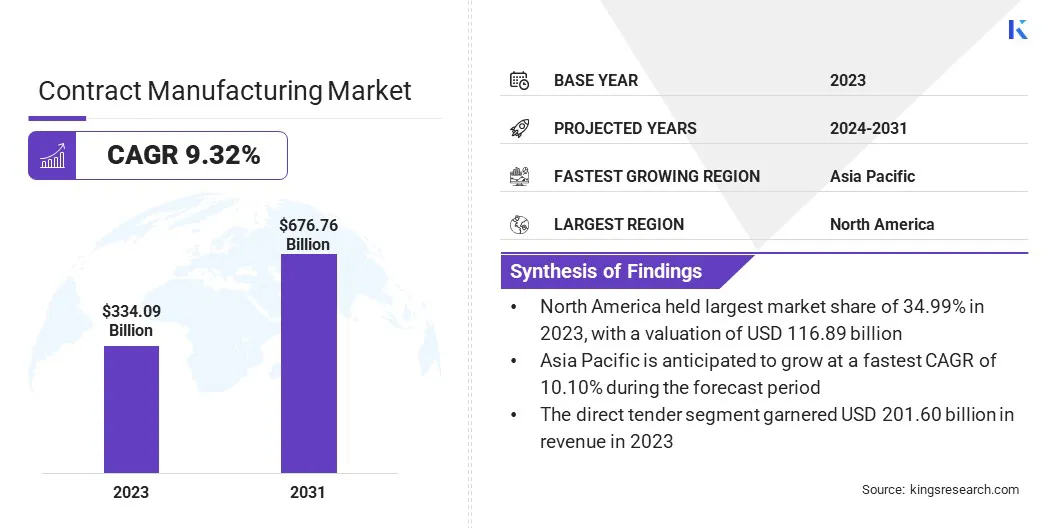

The global contract manufacturing market size was valued at USD 334.09 billion in 2023 and is projected to grow from USD 362.71 billion in 2024 to USD 676.76 billion by 2031, exhibiting a CAGR of 9.32% during the forecast period.

Market growth is driven by the rapid expansion of the pharmaceutical and biotech sectors, which increasingly rely on third-party manufacturers to scale production efficiently.

Additionally, advancements in manufacturing technology are enabling higher precision, automation, and cost-efficiency, making contract services more attractive to global clients seeking operational flexibility.

Major companies operating in the contract manufacturing industry are Lonza Group Ltd., Thermo Fisher Scientific Inc., Novo Holdings A/S, Samsung Biologics, WuXi Biologics Inc., Hon Hai Precision Industry Co., Ltd., Jabil Inc., Sanmina Corporation, Celestica Inc., Wistron Corporation, Benchmark Electronics, Inc., Altasciences, Hankscraft Inc., American Precision Electronics, and Aveka CCE Technologies, Inc.

Companies across sectors are increasingly outsourcing production to reduce capital investment and lower operating expenses. This shift enables them to avoid the high cost of in-house manufacturing infrastructure, labor, and regulatory compliance.

The demand for contract services from small and mid-sized enterprises is growing steadily. These cost advantages are accelerating the growth of market, making third-party manufacturers an essential part of modern supply chains.

- In February 2024, Samsung Biologics partnered with LegoChem Biosciences, a biotechnology firm leading advancements in antibody-drug conjugate (ADC) research. As part of the agreement, Samsung Biologics will support LegoChem Biosciences’ ADC program for solid tumor treatment by delivering antibody development and drug substance manufacturing services.

Key Highlights

- The contract manufacturing industry size was valued at USD 334.09 billion in 2023.

- The market is projected to grow at a CAGR of 9.32% from 2024 to 2031.

- North America held a market share of 34.99% in 2023, with a valuation of USD 116.89 billion.

- The end-to-end manufacturing segment garnered USD 141.17 billion in revenue in 2023.

- The pharmaceuticals & biopharmaceuticals segment is expected to reach USD 225.24 billion by 2031.

- The direct tender segment secured the largest revenue share of 60.34% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 10.10% over the forecast period.

Market Driver

"Expansion of the Pharmaceutical and Biotech Sectors"

The expansion of the pharmaceutical and biotech sectors is fueling the growth of the contract manufacturing market rapidly expanding, propelled by aging population, chronic disease prevalence, and innovation in biologics. These developments require scalable production capacities and strict compliance standards.

Contract manufacturing organizations (CMOs) play a key role by offering compliant facilities and production expertise. Their ability to meet regulatory demands and produce at scale is accelerating demand for contract manufacturing in the life sciences domain.

- In May 2025, Gilead Sciences announced an additional USD 11 billion investment to expand its domestic manufacturing and research capabilities in the United States, raising its total planned investment to USD 32 billion through 2030. The funding will support the adoption of new technologies, construction three new facilities, and upgrades to three existing sites, in response to U.S. policy shifts promoting domestic pharmaceutical production.

Market Challenge

"Supply Chain Disruptions"

A significant challenge hampering the growth of the contract manufacturing market is the ongoing supply chain disruptions. These disruptions, driven by factors such as global logistical bottlenecks, material shortages, and geopolitical tensions, can delay production timelines and increase costs.

Key players are addressing this challenge by diversifying supply chains, building local manufacturing capacities, and investing in advanced technologies such as automation and AI to streamline processes.

Additionally, firms are enhancing communication with suppliers and clients to better manage risks and ensure more reliable delivery schedules, mitigating the impact on production efficiency.

Market Trend

"Advancements in Manufacturing Technology"

Modern contract manufacturers are investing in automation, data analytics, robotics, and continuous manufacturing. These technologies improve efficiency, reduce waste, and enhance product quality. Advanced capabilities attract clients looking for precision, speed, and regulatory compliance.

This technological evolution is expanding the service offerings and capabilities of contract manufacturers. These improvements are fueling the growth of contract manufacturing market by making outsourced production more reliable and scalable.

- At Collaborate INDIA 2024, Universal Robots unveiled its next-generation collaborative robots (cobots), the UR20 and UR30 models. Featuring AI integration, vision systems, and advanced safety mechanisms, these cobots demonstrate enhanced performance and flexibility for diverse manufacturing applications.

Contract Manufacturing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

End-to-End Manufacturing, Component Manufacturing, Labor or Service Subcontracting, Private Label Manufacturing, Custom Formulation, Packaging, Research & Development

|

|

By End-use Industry

|

Pharmaceuticals & Biopharmaceuticals, Medical Devices, Electronics & Consumer Goods, Automotive, Aerospace & Defense, Semiconductors

|

|

By Distribution Channel

|

Direct Tender, Retail Sales, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (End-to-End Manufacturing, Component Manufacturing, Labor or Service Subcontracting, Private Label Manufacturing, Custom Formulation, Packaging, and Research & Development): The end-to-end manufacturing segment earned USD 141.17 billion in 2023 due to its ability to offer integrated solutions that streamline development, reduce transfer-related risks, and accelerate time-to-market for complex products.

- By End-use Industry (Pharmaceuticals & Biopharmaceuticals, Medical Devices, Electronics & Consumer Goods, Automotive, Aerospace & Defense, and Semiconductors): The pharmaceuticals & biopharmaceuticals segment held a share of 32.35% in 2023, fueled by the rising demand for cost-effective, large-scale production of complex drugs and biologics, supported by stringent quality requirements and increasing outsourcing by global drug developers.

- By Distribution Channel (Direct Tender, Retail Sales, and Others): The direct tender segment is projected to reach USD 412.01 billion by 2031, owing to its ability to secure large-volume contracts with institutional buyers, ensuring consistent demand and long-term revenue for manufacturers.

Contract Manufacturing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America contract manufacturing market share stood at around 34.99% in 2023, valued at USD 116.89 billion. North America’s growing pharmaceutical and biotech sectors are contributing significantly to this notable growth.

With an increase in drug development activities and demand for biologics, many companies prefer to outsource manufacturing to specialized contract manufacturers. This allows businesses to focus on R&D while leveraging local, high-quality manufacturing capabilities.

Additionally, the region has been at the forefront of adopting cutting-edge manufacturing technologies, such as automation, advanced robotics, and digitalization. These advancements improve production efficiency, reduce costs, and enhance product quality. As businesses increasingly focus on cost-effectiveness and speed, demand for contract manufacturing services continues to rise.

The Asia Pacific contract manufacturing industry is set to grow at a robust CAGR of 10.10% over the forecast period. This growth is largely attributed to the growing middle-class population, creating a strong demand for electronics, pharmaceuticals, personal care, and packaged food.

Contract manufacturers are scaling up to meet this rising regional consumption. Localized production helps global brands offer faster delivery and better pricing, contributing to regional market expansion. Moreover, Asia Pacific has emerged as a key hub for biopharmaceutical manufacturing, supported by GMP-certified facilities and a growing base of scientific talent.

Regional contract manufacturers are increasingly involved in formulation, sterile production, and scale-up for biologics. This is strengthening the region's position in global drug development pipelines, bolstering its growth.

- In January 2025, Akums Drugs and Pharmaceuticals, India's largest contract manufacturer, announced the development of a new facility dedicated to lyophilized and sterile dosage manufacturing, focusing on injectables and biologics. This expansion aims to meet the growing demand for complex biologics and specialty pharmaceuticals, reflecting the broader industry shift toward outsourcing to contract manufacturing organizations (CMOs) for efficiency and expertise.

Regulatory Frameworks

- Contract manufacturing in the U.S. is regulated by the Food and Drug Administration (FDA) under the Current Good Manufacturing Practice (CGMP) regulations, codified in Title 21 of the Code of Federal Regulations (CFR) Parts 210 and 211. These regulations ensure that products are consistently produced and controlled according to quality standards. Additionally, the FDA's Quality System Regulation (QSR) under 21 CFR Part 820 applies to medical devices, requiring manufacturers to establish and maintain a quality system.

- The European Medicines Agency (EMA) oversees contract manufacturing within the EU, enforcing compliance with Good Manufacturing Practice (GMP) guidelines. These guidelines are harmonized with international standards to ensure product quality and safety. For medical devices, the EU Medical Device Regulation (MDR) (Regulation (EU) 2017/745) mandates stringent requirements for manufacturers, including those outsourcing production.

- China regulates contract manufacturing through the National Medical Products Administration (NMPA). Key regulatory tools include the 2022 “Provisions for Supervision and Administration of Medical Device Manufacturing” and “Guidance for Preparation of Contract Production Quality Agreement.” These require registrants to retain full responsibility for outsourced products.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees contract manufacturing through the Pharmaceutical and Medical Device Act (PMD Act). Contract manufacturers must follow Good Manufacturing Practice (GMP) regulations and are subject to PMDA inspections. The agency verifies that companies have the infrastructure and systems to ensure safety, traceability, and compliance.

Competitive Landscape

Major players operating in the contract manufacturing industry are adopting strategies such as expanding their business platforms to strengthen capabilities and meet growing demand.

This includes enhancing manufacturing infrastructure, expanding specialized services, and securing long-term service agreements, allowing companies to support complex product pipelines and scale production efficiently. Such expansion efforts are enabling faster turnaround, improved service offerings, and stronger partnerships with global clients.

- In April 2025, Lonza implemented a new operating model under its “One Lonza” strategy, consolidating its CDMO operations into three integrated platforms, such as Integrated Biologics, Advanced Synthesis, and Specialized Modalities. This reorganization aims to enhance customer partnerships, execution excellence, and digital capabilities, positioning Lonza as a pure-play CDMO.

List of Key Companies in Contract Manufacturing Market:

- Lonza Group Ltd.

- Thermo Fisher Scientific Inc.

- Catalent, Inc.

- Samsung Biologics

- WuXi Biologics Inc.

- Hon Hai Precision Industry Co., Ltd.

- Jabil Inc.

- Sanmina Corporation

- Celestica Inc.

- Wistron Corporation

- Benchmark Electronics, Inc.

- Altasciences

- Hankscraft Inc.

- American Precision Electronics

- Aveka CCE Technologies, Inc.

Recent Developments (M&A/Expansion/Product Launch)

- In April 2025, Thermo Fisher Scientific Inc. announced plans to invest an additional USD 2 billion in the United States over the next four years. The investment aims to boost innovation, manufacturing, and economic competitiveness within the life sciences sector. By expanding its U.S. manufacturing capacity, the company intends to reinforce the resilience of the national healthcare supply chain and generate a significant multiplier effect across the broader American economy.

- In February 2025, Hankscraft showcased its contract manufacturing services at the 2025 AHR Expo in Orlando, Florida. The company specializes in value-added manufacturing and program management, offering a range of products including electronic actuators, molded enclosures, and PCBs.

- In February 2025, Benchmark commenced construction of its fifth facility in Penang, Malaysia, with an initial investment of USD 25 million. The new two-story building will add 215,000 square feet of manufacturing space to support growing demand for Wafer Fab Equipment manufacturing.

- In December 2024, Novo Holdings A/S acquired Catalent in an all-cash deal valued at approximately USD 16.5 billion. Catalent, known for supporting the development and delivery of advanced treatments globally, aligns with Novo Holdings’ strategy of fostering long-term value in the life sciences sector.