Enquire Now

Circuit Monitoring Market Size, Share, Growth & Industry Analysis, By Type (Modular Circuit Monitoring, Branch & Multi Circuit Monitoring,), By End User (Data Centers & IT Facilities, Industrial & Manufacturing, Commercial Buildings, Utilities & Energy Providers, Healthcare Facilities), and Regional Analysis, 2025-2032

Pages: 150 | Base Year: 2024 | Release: October 2025 | Author: Sunanda G.

Key strategic points

Circuit monitoring is the continuous observation and measurement of electrical circuits. It is used to assess performance and detect anomalies by tracking voltage, current, and load fluctuations.

Circuit monitoring is used in utility networks, industrial operations, commercial buildings, and renewable energy installations where consistent electrical performance is critical. The report includes a deep-dive into the market based on key trends, drivers, and innovations in this landscape.

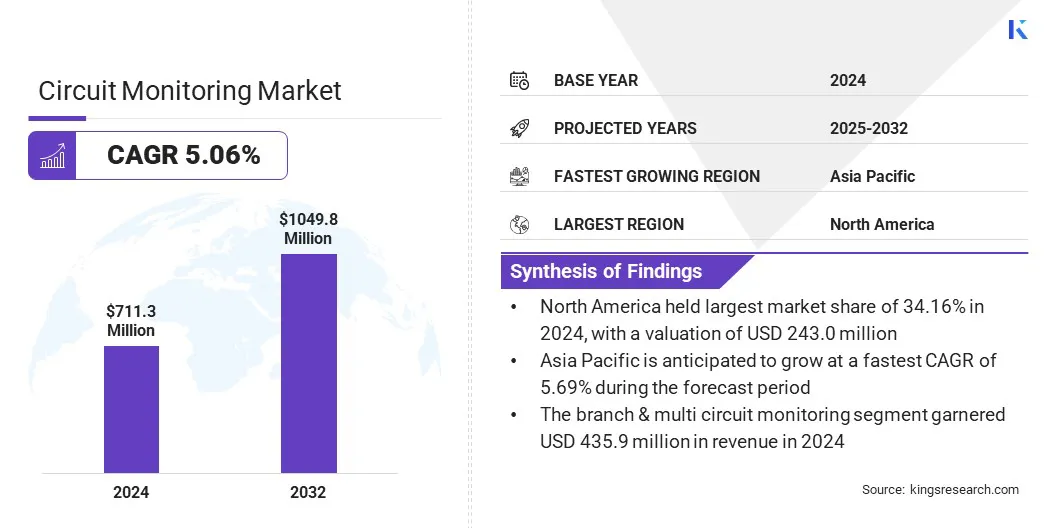

The global circuit monitoring market size was valued at USD 711.34 million in 2024 and is projected to grow from USD 743.16 million in 2025 to USD 1,049.79 million by 2032, exhibiting a CAGR of 5.06% during the forecast period.

The market is driven by rising industrial electrification and the resultant advent of wireless and cloud-enabled monitoring solutions that allow real-time management and predictive maintenance across facilities. Companies use these solutions to enhance their operational reliability and efficiency.

Major companies operating in the circuit monitoring market are ABB, Schneider Electric, Eaton Corporation, Siemens, General Electric Company, Legrand, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation, Schweitzer Engineering Laboratories, Inc., Littelfuse, Inc., Honeywell International Inc., Panasonic Corporation, TE Connectivity, and Texas Instruments.

The market is experiencing growth due to rising investments to modernize aging power grids and a shift toward smart grid infrastructure. Government authorities as well as private entities have allocated specialized funds to improve grid reliability.

The Department of Energy oversees investments in energy infrastructure totaling more than $62 billion. This includes providing $14 billion in financial assistance to States, Indian Tribes, utilities, and other entities that offer products and services to improve the electric grid's reliability, resilience, and efficiency. The integration of circuit monitoring systems is supporting real-time visibility into power distribution, reducing downtime and minimizing losses.

Advanced solutions incorporating smart sensors, supervisory control and data acquisition (SCADA) systems, remote terminal units (RTUs), and digital protective relays are improving monitoring accuracy. Growing demand for renewable energy integration and distributed generation is further encouraging deployment of these technologies to manage complex grid networks.

Rising Industrial Electrification

Rising electrification across manufacturing, data center, and processing industries is a primary growth driver for the circuit monitoring market. Expansion of advanced manufacturing operations requires continuous monitoring of power distribution so that disruptions and equipment failures can be avoided. Further, cloud service providers and technology companies are increasing investments in data centers for accurate tracking of energy consumption to optimize efficiency and reduce operational costs.

In December 2024, the U.S. Department of Energy reported that data center electricity usage in the United States increased from 58 terawatt-hours (TWh) in 2014 to 176 TWh in 2023. The report projects that by 2028, data centers will consume between 325 and 580 TWh of energy, accounting for approximately 6.7% to 12% of the total U.S. demand.

Moreover, growth in industrial automation and robotics is creating a need for precise monitoring of electrical loads to ensure uninterrupted performance. Rising focus from industries on minimizing downtime and improving worker safety is further supporting the adoption of circuit monitoring systems.

Data Security Concerns

A key challenge impeding the expansion of circuit monitoring market is managing cybersecurity risks arising from increased connectivity and IoT integration. Unauthorized access, malware, and data breaches can compromise operational safety of networked monitoring systems. These risks are critical for utilities, manufacturing, and data center industries where continuous power reliability is essential.

Therefore, market players are deploying advanced encryption methods, multi-factor authentication, and real-time threat detection tools to strengthen security and ensure safe adoption of circuit monitoring solutions across critical sectors.

Wireless and Cloud-Enabled Monitoring for Real-Time Management

A key trend in the circuit monitoring market is the integration of wireless sensors into cloud-based platforms for enhanced electrical system management. Circuit monitoring equipment and solutions manufacturers and service providers are deploying wireless-enabled sensors to reduce installation complexity and minimize infrastructure costs.

Cloud-based platforms are enabling remote access to real-time circuit performance data, allowing faster detection and anomaly response. These platforms use predictive maintenance to improve the overall operational efficiency for data center providers, manufacturing facilities, and utility providers.

|

Segmentation |

Details |

|

By Type |

Modular Circuit Monitoring, Branch & Multi Circuit Monitoring |

|

By End User |

Data Centers & IT Facilities, Industrial & Manufacturing, Commercial Buildings, Utilities & Energy Providers, Healthcare Facilities, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America circuit monitoring market share stood around 34.16% in 2024, with a valuation of USD 242.99 million in the global market, driven by the rising adoption of smart building initiatives across commercial and industrial sectors.

Commercial organizations are implementing intelligent energy management systems to optimize consumption and reduce electricity costs. Increasing focus of private companies on adhering to sustainability and efficiency targets is accelerating the deployment of these systems.

Additionally, the rapid expansion of hyperscale and enterprise data centers due to the increasing cloud adoption and digital transformation initiatives is boosting the adoption of circuit monitoring systems. Reliable circuit monitoring enables efficient energy management and reduces operational risks in these facilities.

The circuit monitoring industry in Asia Pacific is set to grow at a CAGR of 5.69% over the forecast period, due to the rapid expansion of industrial and manufacturing sectors. Rising demand for electronics, automotive components, and heavy machinery is driving the modernization of electrical infrastructure.

Manufacturers are integrating monitoring systems with energy management and automation platforms to optimize performance. Moreover, governments and private developers are investing in modern monitoring systems for commercial complexes, hospitals, and transport facilities. This push for smart urban infrastructure is supporting the adoption of circuit monitoring technologies.

Major players in the circuit monitoring industry are adopting strategies such as research and development, technological advancements, and strategic partnerships to remain competitive in the market.

Companies are focusing on enhancing product capabilities with digital integration and real-time monitoring features. Investment in innovation allows firms to offer predictive maintenance solutions and improve operational efficiency. Collaboration with technology providers and system integrators helps expand market reach and application areas.

Frequently Asked Questions