Market Definition

The market encompasses the design, construction, and operation of buildings that prioritize environmental sustainability, resource efficiency, and reduced environmental impact throughout their lifecycle.

Green buildings incorporate environmentally friendly technologies, such as energy-efficient systems, sustainable materials, and renewable energy sources, to minimize energy consumption, water use, and carbon emissions. The report explores the key drivers of the market, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping the market.

Green Building Market Overview

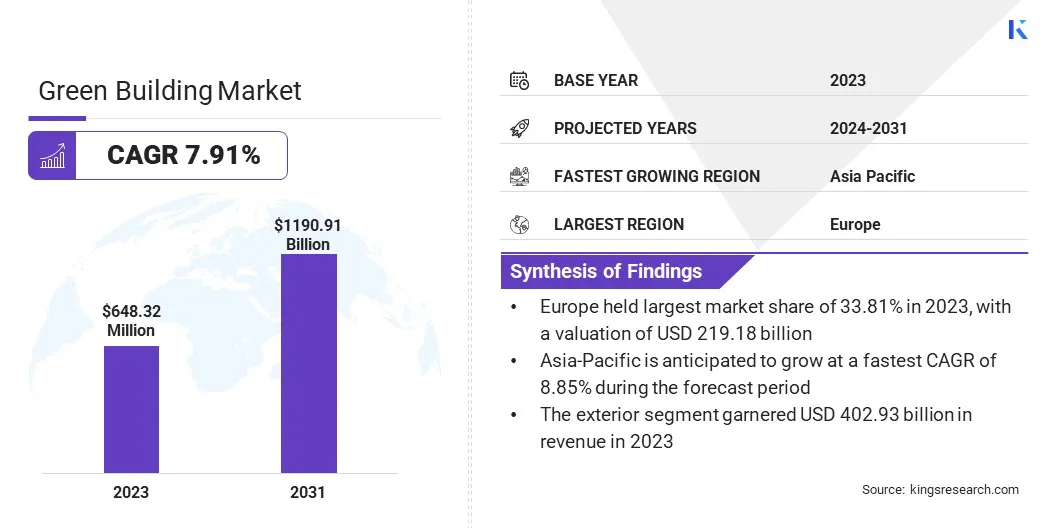

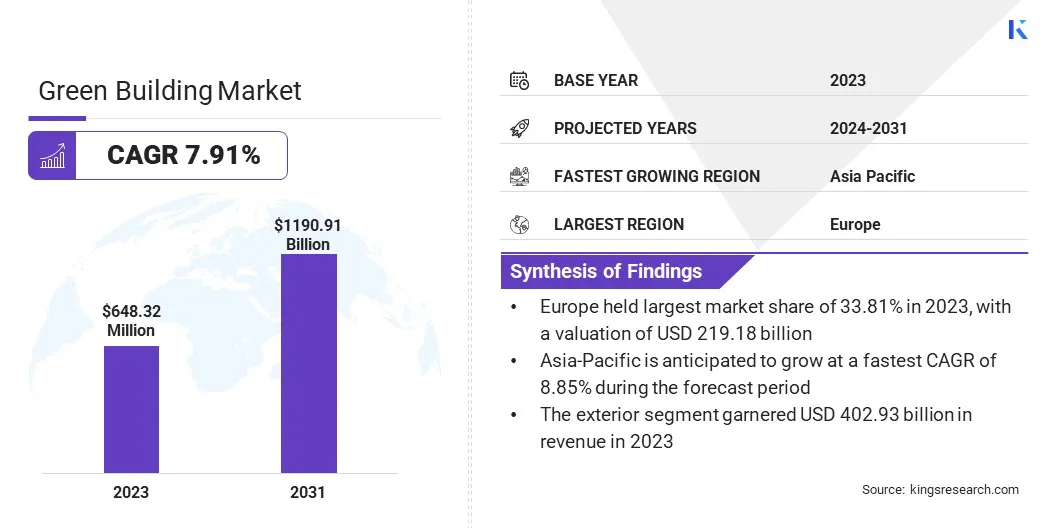

The global green building market size was valued at USD 648.32 billion in 2023 and is projected to grow from USD 699.02 billion in 2024 to USD 1190.91 billion by 2031, exhibiting a CAGR of 7.91% during the forecast period.

The market is driven by the rising demand for sustainable, energy-efficient, and cost-effective building solutions. Green buildings reduce environmental impact, improve indoor air quality, and offer long-term savings through efficient resource use and advanced technologies.

Key Market Highlights

- The green building industry size was valued at USD 648.32 billion in 2023.

- The market is projected to grow at a CAGR of 7.91% from 2024 to 2031.

- Europe held a market share of 33.81% in 2023, with a valuation of USD 219.18 billion.

- The exterior segment garnered USD 402.93 billion in revenue in 2023.

- The residential segment is expected to reach USD 496.90 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.85% during the forecast period.

Major companies operating in the green building market are BASF, DuPont, Binderholz GmbH, Kingspan Group., Bauder Ltd, CertainTeed, LLC, Forbo Flooring India Private Limited, Interface, Inc., Owens Corning, LAFARGE, PPG Industries, Inc., RedBuilt, Amvic Inc, Bosch Sicherheitssysteme GmbH, and ABB.

The market growth is further supported by strict environmental regulations, global carbon neutrality goals, and government incentives. Innovations in sustainable materials and green certifications are accelerating adoption across residential, commercial, and industrial sectors.

- In September 2023, The Indian Institute of Technology Madras (IIT Madras) earned the prestigious Indian Green Building Council (IGBC) Platinum certification for its commitment to sustainability. This recognition highlights the institute's efforts in adopting green building practices across its campus, focusing on reducing its environmental impact and promoting eco-friendly infrastructure and operations.

Growing Awareness of Climate Change

The green building market is fueled by the rising awareness of climate change and the urgent need to reduce carbon emissions from the built environment. Sustainable construction practices and energy-efficient designs are increasingly prioritized to mitigate environmental impact and align with global climate goals.

Green buildings also support long-term environmental strategies by reducing energy consumption, improving resource efficiency, and lowering Greenhouse Gas (GHG) emissions. Demand continues to grow across residential, commercial, and industrial sectors as climate concerns influence policy and investment decisions.

- In April 2025, the International Finance Corporation (IFC) and Banco Santander Chile initiated a USD 100 million loan to finance green building projects in Chile. This partnership aims to promote sustainable construction practices by providing financial support for projects that meet environmental standards, thereby contributing to the reduction of carbon emissions and the advancement of green infrastructure in the region.

Maintenance Complexity and Operational Challenges

Maintenance complexity in green buildings remains a key challenge, particularly in managing advanced systems and materials designed for sustainability. These buildings often feature specialized technologies such as energy-efficient HVAC systems, solar panels, and smart building management systems, which require regular and skilled maintenance to operate at peak efficiency.

The need for specialized training and knowledge to maintain these systems is crucial, as improper upkeep can lead to performance degradation and higher operating costs. Moreover, the integration of complex systems may demand advanced monitoring tools to ensure smooth operations and early issue detection, preventing downtime.

Building owners and managers are investing in smart monitoring systems, long-term service contracts with manufacturers, and staff training programs. Additionally, incorporating maintenance needs into the design phase and adopting standardized protocols help reduce complexity, enhance performance, and ensure long-term sustainability.

Collaboration with specialized service providers who offer comprehensive maintenance solutions tailored to green technologies can also help ensure that systems remain efficient and cost-effective over time.

Net-zero Energy Buildings

A prominent trend in the green building market is the rapid adoption of net-zero energy buildings (NZEBs), driven by the global push for decarbonization and the increasing demand for energy efficiency. Innovations in building materials, such as high-performance insulation, energy-efficient windows, and sustainable construction techniques, are significantly reducing energy consumption and making NZEBs more viable.

The integration of renewable energy technologies, including solar panels and energy storage systems, allows buildings to generate as much energy as they consume, achieving net-zero energy usage.

Moreover, advancements in smart building technologies, such as energy management systems and automation, are optimizing energy use in real time, improving the overall performance of these buildings. These innovations are accelerating the adoption of NZEBs as a standard for sustainable construction, contributing to global carbon reduction goals and promoting healthier living environments.

- In June 2024, the Global Green Building Alliance (GGBA) launched an industry-first guide designed to help mobilize the $35 trillion needed to achieve net-zero emissions in buildings. This comprehensive resource outlines practical strategies for governments, financial institutions, and real estate developers to accelerate the decarbonization of buildings, in line with global climate objectives.

Green Building Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Exterior, Interior

|

|

By Application

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Exterior, Interior): The exterior segment earned USD 402.93 billion in 2023, due to the growing demand for energy-efficient and sustainable building facades, windows, and roofing materials.

- By Application (Residential, Commercial, Industrial): The residential segment held 42.17% share of the market in 2023, due to the increasing consumer demand for energy-efficient homes and sustainable living solutions.

Green Building Market Regional Analysis

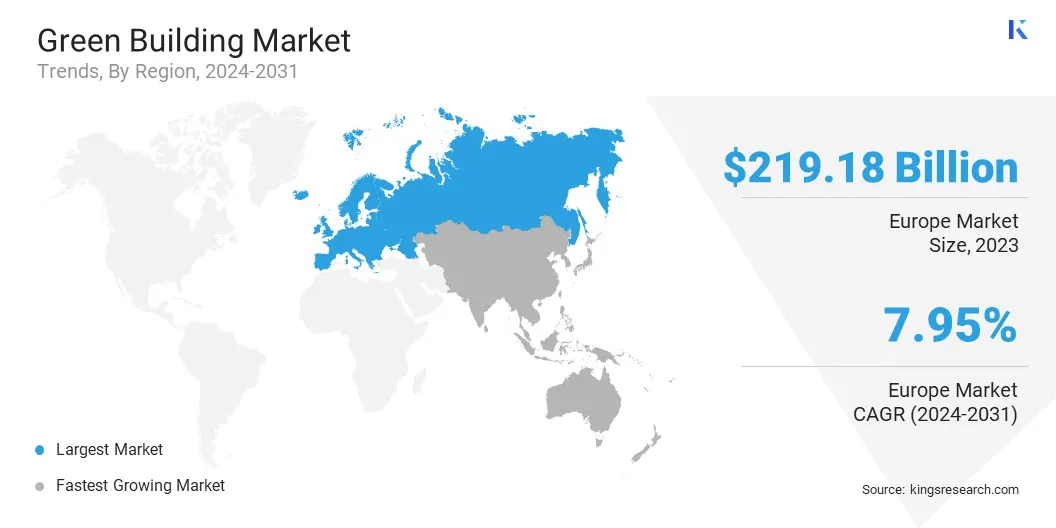

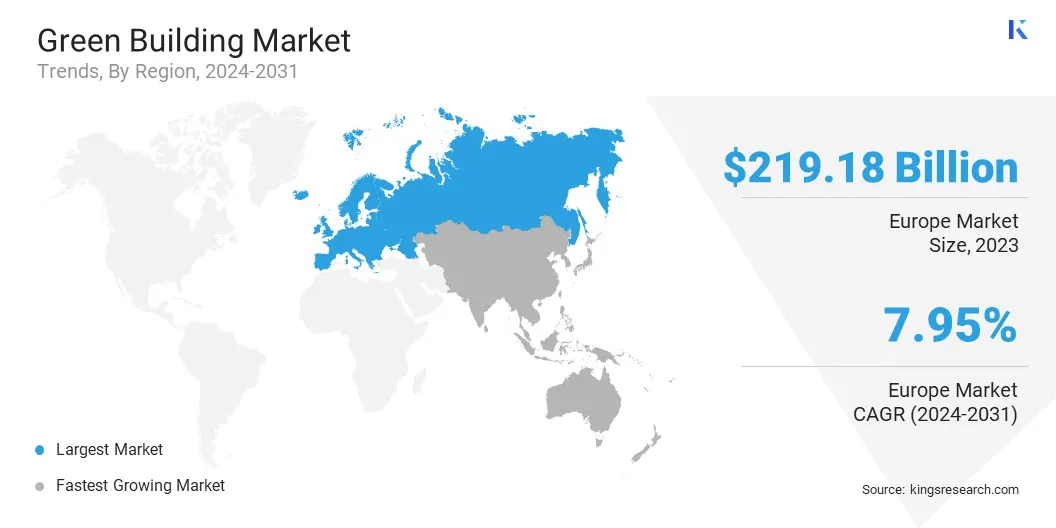

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Europe green building market share stood at around 33.81% in 2023, with a valuation of USD 219.18 billion. This market dominance is attributed to the region’s robust regulatory framework, strong commitment to sustainability, and the widespread adoption of green building certifications like BREEAM (Building Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design).

Europe green building market share stood at around 33.81% in 2023, with a valuation of USD 219.18 billion. This market dominance is attributed to the region’s robust regulatory framework, strong commitment to sustainability, and the widespread adoption of green building certifications like BREEAM (Building Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design).

Moreover, the increasing focus on reducing carbon footprints, coupled with government incentives for energy-efficient construction, is driving the market. Europe’s leadership in green building innovation, along with significant investments in sustainable infrastructure projects, solidifies its position as a major player in the market.

- In September 2024, the European Environment Agency (EEA) released a report emphasizing that renovating existing buildings with sustainable materials can significantly contribute to Europe’s green transition. The report highlights that the use of buildings accounts for 42% of total energy consumption and 35% of GHG emissions, while decommissioning buildings generates the largest waste stream in the EU by weight.

The green building industry in Asia-Pacific is poised for significant growth at a robust CAGR of 8.85% over the forecast period. The market is propelled by the increasing demand for energy-efficient buildings, particularly in rapidly developing countries where urbanization and infrastructure development are accelerating.

The region’s growing focus on sustainability, coupled with government initiatives promoting green building certifications and eco-friendly construction methods, is further accelerating adoption. Additionally, the expansion of renewable energy integration in buildings and advancements in sustainable materials are supporting the market expansion in the region.

Ongoing investments in research, development, and the adoption of smart building technologies are also playing a key role in driving the market and making green buildings more cost-effective and accessible.

- In November 2023, Rushil Décor's MDF manufacturing facility in Visakhapatnam was awarded the IGBC Green Building certification, recognizing its sustainable practices, including a notable decrease in energy & water usage and effective wastewater management. The plant boasts 32% green cover, half of which consists of drought-resistant plants, and is eligible for a 50% capital expenditure reimbursement under the industrial development policy of Andhra Pradesh.

Regulatory Frameworks

- In the U.S., the Leadership in Energy and Environmental Design (LEED) Green Building Rating System, developed by the U.S. Green Building Council (USGBC), regulates sustainable building practices. It sets standards for the design, construction, operation, and maintenance of green buildings.

- In the European Union (EU), the Energy Performance of Buildings Directive (EPBD) (2010/31/EU) regulates the energy efficiency of buildings. It mandates energy performance certificates for new and existing buildings, promoting the adoption of energy-saving measures such as better insulation and efficient heating systems.

- In the UK, the Building Regulations Part L (Conservation of Fuel and Power) governs the energy efficiency standards of buildings in the UK. It focuses on reducing carbon emissions by enhancing the energy efficiency of buildings through measures such as high-performance insulation, efficient heating systems, and low-carbon technologies.

- In Australia, the National Construction Code (NCC) 2019 Volume Two Amendment 1, specifically Part 2.6 – Energy Efficiency, regulates the energy performance of residential buildings. This regulation aims to reduce GHG emissions by ensuring that buildings are capable of energy efficiency.

- In China, the Green Building Evaluation Standard (GB/T 50378-2019) provides a framework for assessing the environmental performance of buildings. It focuses on energy efficiency, water conservation, waste management, and indoor environmental quality, promoting sustainable practices in building design, construction, and operation, and supporting the growth of the market.

Competitive Landscape

The green building industry is characterized by a moderately fragmented competitive landscape, comprising both established multinational corporations and specialized regional players. Companies are focusing on technological innovation, strategic partnerships, and market expansions to strengthen their position in the market.

Leading players are investing heavily in research and development to enhance sustainable construction technologies, energy-efficient materials, and green building solutions, particularly in sectors such as residential, commercial, and industrial construction. Additionally, mergers and acquisitions are enabling market leaders to expand their product offerings and geographical footprint.

- In March 2025, Sintali Limited entered into a strategic partnership with the Mexican Chamber of the Construction Industry (CMIC) to promote sustainable building practices. This collaboration aims to combine the expertise of both companies to foster environmentally responsible construction and operational strategies, further advancing their shared commitment to sustainability in the built environment.

Key Companies in Green Building Market:

- BASF

- DuPont

- Binderholz GmbH

- Kingspan Group.

- Bauder Ltd

- CertainTeed, LLC

- Forbo Flooring India Private Limited

- Interface, Inc.

- Owens Corning

- LAFARGE

- PPG Industries, Inc.

- RedBuilt

- Amvic Inc

- Bosch Sicherheitssysteme GmbH

- ABB

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In April 2025, the U.S. Green Building Council (USGBC) unveiled LEED v5, a more comprehensive version of its green building certification system. The new system emphasizes decarbonization, human health, and resilience, with half of its points allocated to emissions reductions and climate resilience assessments for all projects.

- In December 2024, ABB’s Smart Buildings Division partnered with the World Green Building Council’s European Regional Network to promote low-carbon, energy-efficient buildings across Europe. As a Regional Knowledge Partner, ABB will leverage its expertise in electrical and automation technologies to support the decarbonization of the built environment and influence regional building policies.

- In December 2024, CFP Green Buildings partnered with Piraeus Bank to introduce an online tool aimed at improving the energy efficiency of buildings in Greece. Set to launch in 2025, the service will provide property owners with tailored recommendations for energy upgrades and offer financing options to support sustainable renovations.

- In August 2024, One Click LCA, a leading provider of lifecycle assessment software for construction, entered into a strategic partnership with the U.S. Green Building Council (USGBC). This collaboration aims to provide USGBC members with discounted access to One Click LCA software, offer educational resources, and enhance efforts to drive decarbonization in the U.S. construction sector.

Europe green building market share stood at around 33.81% in 2023, with a valuation of USD 219.18 billion. This market dominance is attributed to the region’s robust regulatory framework, strong commitment to sustainability, and the widespread adoption of green building certifications like BREEAM (Building Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design).

Europe green building market share stood at around 33.81% in 2023, with a valuation of USD 219.18 billion. This market dominance is attributed to the region’s robust regulatory framework, strong commitment to sustainability, and the widespread adoption of green building certifications like BREEAM (Building Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design).