Market Definition

A circuit breaker is a critical protective device that monitors electrical circuits and interrupts current flow during overloads or short circuits, preventing system and equipment damage.

The market encompasses low-, medium-, and high-voltage breakers for residential, commercial, and industrial applications, as well as related equipment such as switchgear, protection relays, and monitoring systems. Services, including installation, maintenance, and testing, further support efficient and secure power distribution networks.

Circuit Breaker Market Overview

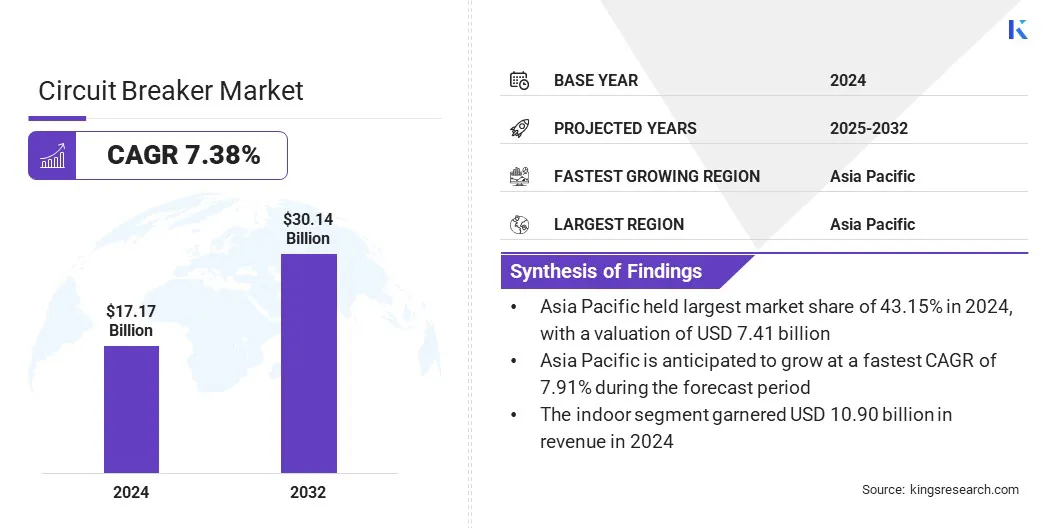

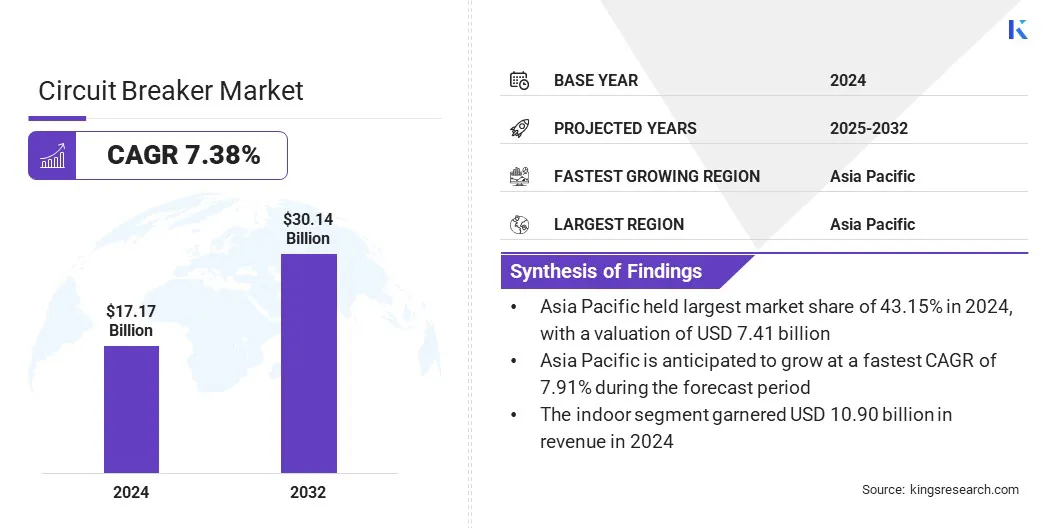

According to Kings Research, the global circuit breaker market size was valued at USD 17.17 billion in 2024 and is projected to grow from USD 18.31 billion in 2025 to USD 30.14 billion by 2032, exhibiting a CAGR of 7.38% during the forecast period. The market is witnessing significant growth, propelled by extensive investments in modern power infrastructure and the rising need for resilient and efficient electrical distribution across industrial, commercial, and residential sectors.

Adoption of advanced technologies, including smart breakers and intelligent monitoring systems, combined with the expansion of renewable energy and industrial automation, further supports market expansion.

Key Market Highlights:

- The circuit breaker industry size was USD 17.17 billion in 2024.

- The market is projected to grow at a CAGR of 7.38% from 2025 to 2032.

- Asia Pacific held a share of 43.15% in 2024, valued at USD 7.41 billion.

- The ≤ 1 kV segment garnered USD 7.60 billion in revenue in 2024.

- The vacuum segment is expected to reach USD 13.31 billion by 2032.

- The indoor segment is expected to reach USD 18.81 billion by 2032.

- The utilities segment is expected to reach USD 11.04 billion by 2032.

- North America is anticipated to grow at a CAGR of 7.02% over the forecast period.

Major companies operating in the circuit breaker market are ABB, Schneider Electric, Siemens AG, Eaton, Hitachi, Ltd., Mitsubishi Corporation, Toshiba International Corporation, LS ELECTRIC Co., Ltd., HD Hyundai Co., Ltd., CHINT Group Co., Ltd., Havells India Ltd., TGOOD Global Ltd., SOCOMEC, FURUKAWA CO.,LTD, and Hager Group.

The rapid global expansion of artificial intelligence (AI) data centers is influencing the market. These facilities require highly reliable and resilient power systems to support continuous operation and prevent downtime.

Advanced circuit breakers with real-time monitoring, predictive maintenance, and enhanced fault protection are increasingly deployed to manage high electrical loads, ensure grid stability, and safeguard critical infrastructure, thereby boosting market growth.

- In July 2025, ABB launched its next-generation SACE Emax 3 air circuit breaker, designed to enhance energy security and resilience in critical infrastructure, including data centers, hospitals, airports, and advanced manufacturing sites. The breaker features advanced sensors, predictive maintenance algorithms, and fully integrated arc flash detection, providing real-time system insights and improving reliability.

Market Driver

Expansion of Global Power Infrastructure

The progress of the market is significantly driven by the expansion of global power infrastructure. Increasing electricity consumption, fueled by industrialization, urbanization, and rising electrification, requires robust generation, transmission, and distribution systems.

This growth creates a strong demand for reliable circuit breakers capable of managing higher loads, ensuring operational safety, and maintaining grid stability. Advanced breakers with enhanced fault protection and higher capacity are increasingly adopted to support complex power networks and minimize outage risks.

The continued development and modernization of electrical infrastructure further reinforce the importance of circuit breakers, making them essential for efficient, secure, and resilient power system operations.

Market Challenge

Managing Complexity of Electrical Load Networks

A significant challenge impeding the expansion of the circuit breaker market is managing the increasing complexity and higher load demands of modern electrical networks.

The integration of renewable energy and rising industrial and commercial consumption intensifies these demands. Conventional breakers often struggle to handle elevated currents, detect faults effectively, and maintain stability under fluctuating load conditions.

Manufacturers are developing advanced circuit breakers with higher capacity, intelligent fault protection, and digital monitoring capabilities to tackle these issues. IoT-enabled smart breakers provide real-time diagnostics, predictive maintenance, and enhanced control, enabling efficient load management, reducing the risk of outages, and ensuring reliable and safe operation of electrical networks.

- In September 2024, Eaton launched the AbleEdge home energy management system, integrating smart breakers, a microgrid interconnect device, and flexible panels. The system enables real-time load management, seamless transitions between grid and energy storage, and interoperability with residential solar and storage systems.

Market Trend

Increasing Adoption of High-Power Switchgear

The market is witnessing a notable shift toward the adoption of advanced switchgear and high-power breakers to address rising power demands in modern electrical networks. These innovative solutions provide efficient management of higher current loads while enhancing overall system reliability and operational safety.

They also support improved grid stability by minimizing disruptions and enabling precise fault protection. Growing emphasis on energy efficiency and optimized power distribution prompts utilities and industrial sectors to implement high-capacity breakers.

Additionally, the integration of such technologies facilitates better performance under varying load conditions, reduces maintenance requirements, and strengthens the resilience of electrical infrastructure.

- In April 2025, ABB launched a complete switchgear solution for wind turbines, integrating a 7200A Emax 2 air circuit breaker and a 3200A AF Contactor. The solution supports larger turbines with higher yields, enhances grid stability, and offers high reliability, advanced fault protection, and efficient high-power switching. ABB aims to maximize wind energy output and reduce maintenance costs.

Circuit Breaker Market Report Snapshot

|

Segmentation

|

Details

|

|

By Voltage

|

≤ 1 kV, 1–50 kV, 50–300 kV, 300–800 kV, Above 800 kV

|

|

By Insulation Type

|

Vacuum, Air, Gas, Oil

|

|

By Installation

|

Indoor, Outdoor

|

|

By End User

|

Residential, Commercial, Industrial, Utilities, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Voltage (≤ 1 kV, 1–50 kV, 50–300 kV, 300–800 kV, and Above 800 kV): The ≤ 1 kV segment earned USD 7.60 billion in 2024, mainly due to widespread integration in low-voltage distribution systems across residential and commercial infrastructure.

- By Insulation Type (Vacuum, Air, Gas, and Oil): The vacuum segment held a share of 42.12% in 2024, due to its high reliability, minimal maintenance needs, and enhanced performance in compact installations.

- By Installation (Indoor, Outdoor): The indoor segment is projected to reach USD 18.81 billion by 2032, owing to increased urbanization and rising demand for space-efficient, secure power distribution solutions.

- By End User (Residential, Commercial, Industrial, Utilities, and Others): The utilities segment is estimated to reach USD 11.04 billion by 2032, fueled by large-scale grid modernization, expansion of transmission networks, and adoption of advanced breaker technologies.

Circuit Breaker Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific circuit breaker market accounted for a substantial share of 43.15% in 2024, valued at USD 7.41 billion. The region’s dominance is driven by rapid economic growth, industrialization, and urbanization in countries like China, India, and Southeast Asia.

According to the International Energy Agency (IEA), Southeast Asia alone is projected to contribute 25% of global energy demand growth by 2035, with electricity demand rising at 4% annually.

Increasing renewable energy adoption and modernization of power grids necessitate advanced circuit breakers, while investments in clean energy, grid infrastructure, and battery and solar component manufacturing accelerate deployment, supporting grid stability and efficiency.

The North America circuit breaker industry is expected to register the fastest CAGR of 7.02% over the forecast period. This growth is fueled by increasing investments in modern power infrastructure, including transmission, distribution, and renewable energy integration projects.

Rising industrialization, urbanization, and electrification across the region are boosting demand for reliable and high-capacity breakers. Additionally, utilities and commercial sectors are upgrading aging electrical networks to enhance grid stability, operational efficiency, and safety.

Adoption of smart and digital breakers with real-time monitoring and fault protection further supports regional market expansion, while continuous investments in energy modernization reinforce sustained growth.

- In December 2024, the U.S. Department of Energy’s Office of Electricity and Wind Energy Technologies Office announced a USD 8 million funding opportunity for R&D on high-voltage direct current (HVDC) power circuit breakers. The initiative aims to develop technical standards, improve efficiency, and reduce the costs of HVDC breakers, supporting long-distance renewable energy transmission and enhanced grid integration.

Regulatory Frameworks

- In the U.S., the circuit breaker is governed by the National Electrical Code (NEC) and oversight from the Occupational Safety and Health Administration (OSHA) to ensure electrical safety, system reliability, and workplace compliance.

- In Europe, regulatory compliance is enforced through IEC (International Electrotechnical Commission) standards, EN standards, and CE marking, which certify that circuit breakers meet safety, performance, and environmental requirements across EU countries.

- In China, circuit breakers are regulated under the China Compulsory Certification (CCC) system and GB standards, ensuring product quality, safety, and environmental compliance.

- In Japan, the Electrical Appliance and Material Safety Law (DENAN) defines technical requirements and certification procedures for the safe operation of electrical protective devices.

- In India, circuit breakers must meet the Bureau of Indian Standards (BIS) specifications, the Indian Electricity Rules, and safety regulations enforced by the Central Electricity Authority (CEA) to ensure grid reliability, performance, and public safety.

Competitive Landscape

Key players operating in the circuit breaker market are emphasizing product innovation and strategic mergers and acquisitions to expand their global presence. They are investing in developing advanced circuit breakers with enhanced digital intelligence, predictive maintenance capabilities, improved fault protection, and higher capacity to meet growing demands from industrial, commercial, and residential sectors.

Companies are also focusing on mergers and acquisitions to access cutting-edge technologies, diversify product portfolios, and strengthen their positions in key regional markets.

These strategies allow companies to address evolving customer requirements, integrate innovative solutions efficiently, and consolidate market share, while ensuring their offerings remain aligned with the increasing complexity and modernization of electrical infrastructure worldwide.

- In April 2025, Sécheron acquired the LoPro high-voltage circuit breaker technology from TE Connectivity. The acquisition strengthens Sécheron’s global position in electrical protection and switching solutions, enabling integration and further development of LoPro technology.

Top Companies in Circuit Breaker Market:

- ABB

- Schneider Electric

- Siemens AG

- Eaton

- Hitachi, Ltd.

- Mitsubishi Corporation

- Toshiba International Corporation

- LS ELECTRIC Co., Ltd.

- HD Hyundai Co., Ltd.

- CHINT Group Co., Ltd.

- Havells India Ltd.

- TGOOD Global Ltd.

- SOCOMEC

- FURUKAWA CO.,LTD

- Hager Group

Recent Developments (Product Launch/Partnerships/Investment)

- In June 2025, Schneider Electric launched the MasterPacT MTZ Active circuit breaker in East Africa, designed to enhance multi-industry power safety, efficiency, and sustainability. The breaker features real-time power monitoring, an industry-first QR code for rapid fault response, built-in Energy Reduction Maintenance Setting (ERMS), and a smart control unit, enabling proactive energy management, faster fault clearance, improved safety, and extended equipment lifespan.

- In June 2025, Schneider Electric and LATI formed a strategic partnership to develop sustainable RESI9 DPN XE miniature circuit breakers using LATIECO compounds. The collaboration focuses on reducing environmental impact while maintaining performance, achieving a 25% lower carbon footprint for MCB casings, and ensuring mechanical strength, thermal stability, flame retardancy, and compliance with electrical safety standards.

- In April 2025, Sensata Technologies launched the STPS500 Series PyroFuse, a pyrotechnic circuit breaker designed for high-voltage applications up to 1000V. The device provides rapid disconnect in less than 1 millisecond, high breaking capacity, excellent post-isolation resistance, and a compact design, enhancing safety and reliability in automotive, charging, aerospace, and industrial systems.

- In September 2024, Hitachi Energy announced an investment exceeding USD 155 million in North America, focusing on expanding high-voltage switchgear and breaker facilities in Pennsylvania, and transformer plants in Virginia and Mexico. The projects aim to meet growing demand, double production capacity, and advance eco-efficient technologies, with a major focus on sustainable energy infrastructure.