Market Definition

Chromatography reagents are chemicals used to separate, identify, and quantify compounds during analytical and preparative chromatography processes. They include solvents, buffers, ion-pairing agents, and derivatization compounds that enable precise detection of target molecules.

The scope of the market includes applications such as pharmaceutical quality testing, environmental monitoring, food safety analysis, and biotechnology research. Laboratories, pharmaceutical manufacturers, and research organizations use chromatography reagents to improve analytical accuracy and ensure compliance with safety and quality standards.

Chromatography Reagents Market Overview

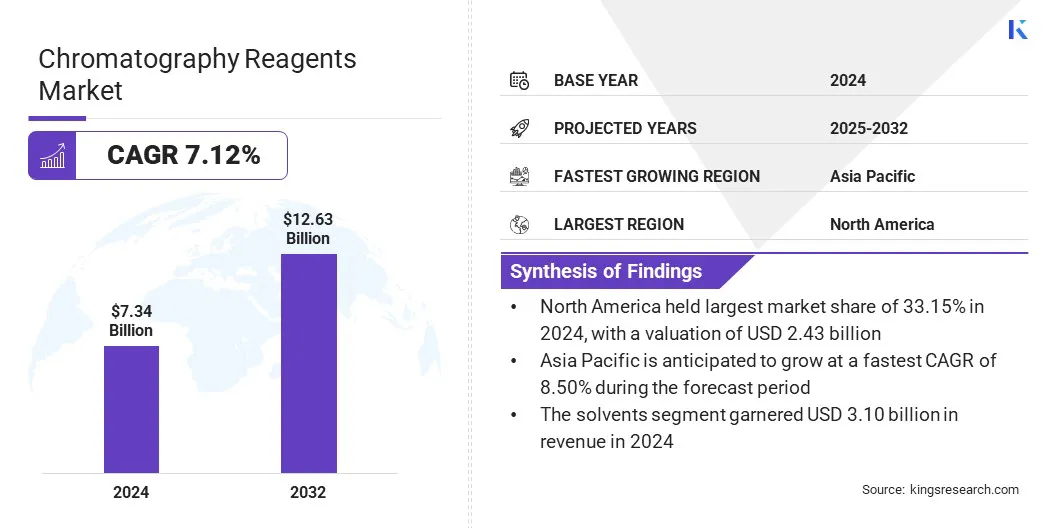

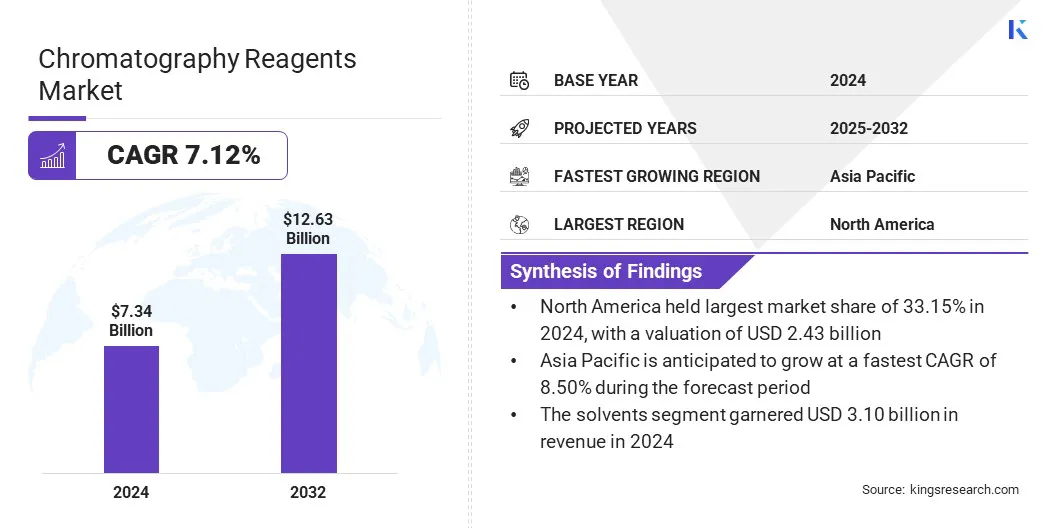

The global chromatography reagents market size was valued at USD 7.34 billion in 2024 and is projected to grow from USD 7.80 billion in 2025 to USD 12.63 billion by 2032, exhibiting a CAGR of 7.12% over the forecast period.

The market is driven by advances in chromatography techniques that improve precision and throughput for analytical and bioprocess applications. Advancements by manufacturers in developing green and biodegradable reagents are further promoting the adoption of chromatography reagents, aligning with regulatory goals, reducing waste, and driving market growth.

Key Highlights

- The chromatography reagents industry size was USD 7.34 billion in 2024.

- The market is projected to grow at a CAGR of 7.12% from 2025 to 2032.

- North America held a share of 33.15% in 2024, valued at USD 2.43 billion.

- The solvents segment garnered USD 3.10 billion in revenue in 2024.

- The liquid chromatography (LC) reagents segment is expected to reach USD 7.36 billion by 2032.

- The ion exchange chromatography segment secured the largest revenue share of 26.40% in 2024.

- The research & academic institutions segment is set to grow at a CAGR of 8.05% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.50% over the forecast period.

Major companies operating in the chromatography reagents market are Thermo Fisher Scientific Inc., Merck KGaA, Avantor Inc., Waters Corporation, Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Chromatographic Specialties Inc., Chiron AS, Loba Chemie Pvt. Ltd., GFS Chemicals Inc., Regis Technologies Inc., Tokyo Chemical Industry Co., Ltd., Honeywell International Inc., and Shimadzu Corporation.

Rising pharmaceutical and biopharmaceutical research and development activities are increasing the demand for chromatography reagents in separation and purification processes. Additionally, growing investments in drug discovery pipelines are encouraging laboratories to use high-quality solvents, buffers, and ion-pair reagents for reliable analytical results.

Increasing emphasis from pharmaceutical and biopharmaceutical companies, supported by regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), is encouraging the adoption of chromatography reagents that deliver consistent performance in critical testing and validation stages.

- In May 2024, the U.S. Food and Drug Administration (FDA) reported that its Generic Drug User Fee Amendments (GDUFA) Science and Research Program has been instrumental in developing advanced analytical methods to support the assessment of complex generic drug products. These methods facilitate efficient development and assessment of generic drugs, emphasizing the importance of consistent performance in testing and validation stages.

Market Driver

Advances in Chromatography Techniques

Innovations such as ultra-high-performance liquid chromatography (UHPLC) are increasing the need for specialized chromatography reagents that deliver high precision and reliability. Growing use of UHPLC and high-resolution gas chromatography is enabling researchers to obtain faster and more accurate analytical results in pharmaceutical, environmental, and food testing laboratories.

- In October 2024, Waters Corporation introduced a suite of LC-MS-grade reagents, enzymes, and software designed to enhance the analysis of large molecule RNA therapeutics. These tools aim to accelerate the development of mRNA vaccines, personalized cancer therapies, and CRISPR-based treatments by improving sequence and modification confirmation.

Rising investment by pharmaceutical companies, biopharmaceutical manufacturers, and government laboratories is creating opportunities for reagent suppliers offering high-purity solvents, buffers, and derivatization agents. Moreover, the adoption of advanced techniques in chemical and clinical laboratories is strengthening the requirement for reagents designed for consistent performance under demanding conditions.

Market Challenge

High Cost of Advanced Reagents

A key challenge impeding the chromatography reagents market is the high expense of premium products used in advanced techniques. Laboratories using ultra-high-performance liquid chromatography (UHPLC) or mass spectrometry-coupled systems face substantial reagent costs that increase operational budgets. These elevated expenses restrict smaller laboratories from adopting sophisticated analytical methods, limiting their testing capabilities.

To address this challenge, market players are developing cost-efficient reagent formulations, offering bulk supply agreements, and optimizing production to reduce pricing. These efforts are helping laboratories access high-quality chromatography reagents while managing overall testing expenditures effectively.

- In August 2025, Zymo Research introduced bulk reagent offerings with volume pricing, aiming to provide cost-effective solutions for laboratories. These bulk reagents are designed to help laboratories manage expenses effectively while maintaining the quality required for advanced analytical techniques.

Market Trend

Advancing Sustainability through Green and Biodegradable Reagents

A key trend in the chromatography reagents market is the development of low-toxicity and biodegradable formulations that support safer laboratory practices. These reagents are reducing the generation of hazardous waste, helping laboratories comply with stricter environmental regulations. Using eco-friendly solvents and buffers is improving workplace safety while lowering the cost of waste disposal.

Pharmaceutical, food testing, and environmental laboratories are adopting sustainable reagents to maintain analytical quality without compromising sustainability goals. Growing focus on responsible chemical use is further encouraging suppliers to expand portfolios of biodegradable and recyclable products.

- In April 2024, Phenomenex introduced its new size exclusion chromatography product, Biozen dSEC-7, designed for the analysis of adeno-associated viral (AAV) vectors in gene therapy. The particle technology and surface chemistry for characterizing AAVs allow for a reduction in run times and sample consumption, contributing to more sustainable laboratory practices.

Chromatography Reagents Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Solvents, Buffers, Ion Pair Reagents, Derivatization Reagents, Others

|

|

By Technology

|

Liquid Chromatography (LC) Reagents, Gas Chromatography (GC) Reagents, Supercritical Fluid Chromatography (SFC) Reagents, Others

|

|

By Separation Mechanism

|

Adsorption Chromatography, Partition Chromatography, Ion Exchange Chromatography, Size Exclusion Chromatography, Others

|

|

By End User

|

Pharmaceutical & Biotech Companies, Research & Academic Institutions, Environmental Testing Laboratories, Food & Beverage Industry, Healthcare & Clinical Laboratories, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Solvents, Buffers, Ion Pair Reagents, Derivatization Reagents, and Others): The solvents segment earned USD 3.10 billion in 2024 due to their essential role as mobile phases in separation processes.

- By Technology (Liquid Chromatography (LC) Reagents, Gas Chromatography (GC) Reagents, Supercritical Fluid Chromatography (SFC) Reagents, and Others): The liquid chromatography (LC) reagents segment held 58.10% of the market in 2024, due to their widespread use in pharmaceutical quality testing, biopharmaceutical research, and environmental analysis.

- By Separation Mechanism (Adsorption Chromatography, Partition Chromatography, Ion Exchange Chromatography, Size Exclusion Chromatography, and Others): The ion exchange chromatography segment is projected to reach USD 3.49 billion by 2032, owing to its high efficiency in separating charged biomolecules, which supports large-scale purification processes.

- By End User (Pharmaceutical & Biotech Companies, Research & Academic Institutions, Environmental Testing Laboratories, Food & Beverage Industry, Healthcare & Clinical Laboratories, and Others): The research & academic institutions segment is poised for significant growth at a CAGR of 8.05% through the forecast period, attributed to rising investments in advanced analytical tools that support innovation in life sciences, pharmaceuticals, and environmental testing.

Chromatography Reagents Market Regional Analysis

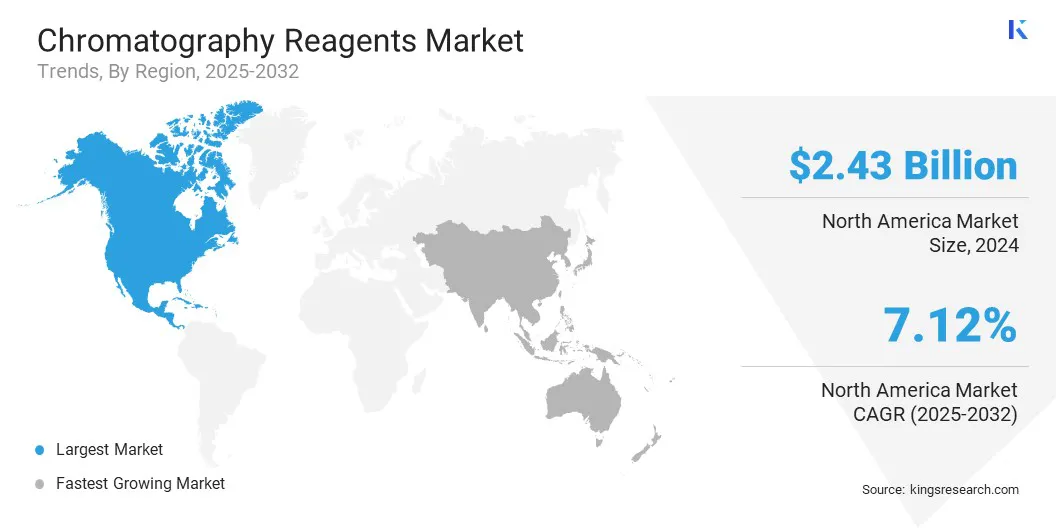

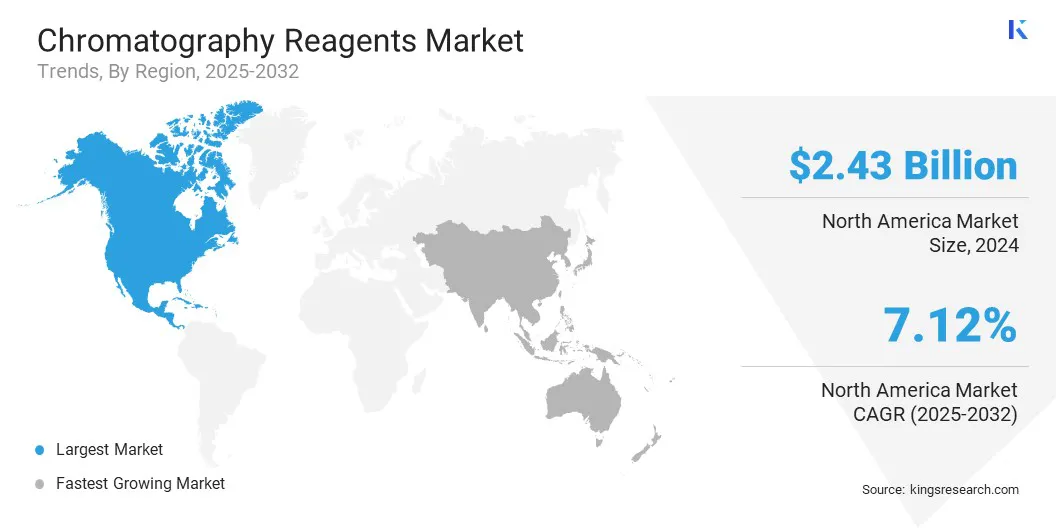

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America chromatography reagents market share stood at 33.15% in 2024 in the global market, with a valuation of USD 2.43 billion, driven by the robust investments in pharmaceutical and biotechnology research. The increasing focus of pharmaceutical companies and research institutions on drug discovery, quality control, and biosimilar development necessitates high-precision analytical techniques.

- In May 2025, Agilent Technologies launched the InfinityLab Pro iQ Series, a new line of liquid chromatography-mass spectrometry (LC-MS) systems. These systems are designed to meet the increasing demand for high-precision analytical techniques in pharmaceutical and biotechnology research.

Regulatory agencies such as the FDA mandate rigorous quality control and validation, further fueling demand for chromatography reagents. The surge in biopharmaceuticals, monoclonal antibodies, and gene therapy research is further contributing to greater adoption of chromatography techniques.

The chromatography reagents industry in Asia Pacific is set to grow at a significant CAGR of 8.50% over the forecast period. This growth is attributed to substantial government investments in research and development. Governments are funding initiatives in life sciences, environmental monitoring, and food safety, which require advanced analytical techniques.

Policies promoting innovation and technological advancement are encouraging the adoption of chromatography methods. The establishment of research centers and laboratories is further increasing the demand for chromatography reagents.

- In August 2025, Agilent Technologies inaugurated a biopharma experience center in Hyderabad, India. This new facility aims to offer advanced laboratory technologies, including chromatography, mass spectrometry, cell analysis, and lab informatics, to accelerate the development of life-saving medicines.

Regulatory Frameworks

- In the U.S., the FDA regulates chromatography reagents under the Federal Food, Drug, and Cosmetic Act. The FDA's guidance on analytical procedures and methods validation emphasizes the importance of chromatography in ensuring the identity, strength, quality, and purity of drug substances and products. Manufacturers must comply with Good Manufacturing Practices (GMP) and validate analytical methods to meet regulatory requirements.

- In the European Union (EU), the European Medicines Agency (EMA) oversees the regulation of chromatography reagents used in pharmaceutical applications. The European Pharmacopoeia (Ph. Eur.) sets quality standards for medicines and their components, including reagents used in chromatographic analyses. Compliance with these standards is mandatory for pharmaceutical manufacturers in Europe.

- In China, the National Medical Products Administration (NMPA) monitors in-vitro diagnostic (IVD) reagents, which include certain chromatography reagents. Manufacturers must adhere to the Provisions for the Registration and Filing of In-Vitro Diagnostic Reagents, ensuring compliance with safety and performance standards.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) sets standards for the use of chromatography reagents in pharmaceutical and medical applications. The Pharmaceutical and Medical Device Act (PMD Act) governs the regulation of pharmaceuticals and medical devices, ensuring the safety and efficacy of products. Chromatography reagents used in pharmaceutical applications must comply with the standards set forth in this act.

- In India, the Central Drugs Standard Control Organization (CDSCO) administers the import, manufacture, sale, and distribution of drugs under the Drugs and Cosmetics Act, 1940, and the Drugs and Cosmetics Rules, 1945. The Medical Devices Rules, 2017, govern the regulation of medical devices, including in-vitro diagnostic reagents, which encompass certain chromatography reagents.

Competitive Landscape

Major players in the chromatography reagents industry are adopting strategies such as research and development, strategic partnerships, and technological advancements to remain competitive. Companies are focusing on developing innovative products, enhancing efficiency, and improving performance to meet the growing demand for high-purity reagents.

- In March 2025, Axcend introduced the world's smallest full-stack high-performance liquid chromatography (HPLC) system. This compact system enables scientists to perform high-precision analyses in environments where space is limited, such as pharmaceutical and biotechnology laboratories.

Key Companies in Chromatography Reagents Market:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantor Inc.

- Waters Corporation

- Agilent Technologies Inc.

- Bio-Rad Laboratories, Inc

- Danaher Corporation

- Chromatographic Specialties Inc.

- Chiron AS

- Loba Chemie Pvt. Ltd.

- GFS Chemicals Inc.

- Regis Technologies Inc.

- Tokyo Chemical Industry Co., Ltd.

- Honeywell International Inc.

- Shimadzu Corporation

Recent Developments (M&A/Product Launch)

- In December 2024, Repligen Corporation launched the AVIPure dsRNA Clear OPUS columns, a novel chromatography reagent solution for purifying mRNA therapeutics. This innovation improves dsRNA removal efficiency, reduces costs, and supports the growing demand for high-purity reagents in biopharmaceutical production.

- In August 2024, Calibre Scientific acquired Greyhound Chromatography and Allied Chemicals Ltd., a UK-based provider of chromatography consumables and analytical standards. This acquisition enhances Calibre Scientific's chromatography portfolio and expands its distribution operations in the UK and Ireland.